Carbon Credit Markets

“While we are facing a climate change, the carbon credit market stands as a beacon of hope, where environmental responsibility meets economic incentive, and where the fight against global warming takes root in the world of commerce.”

What is Carbon Credit Market?

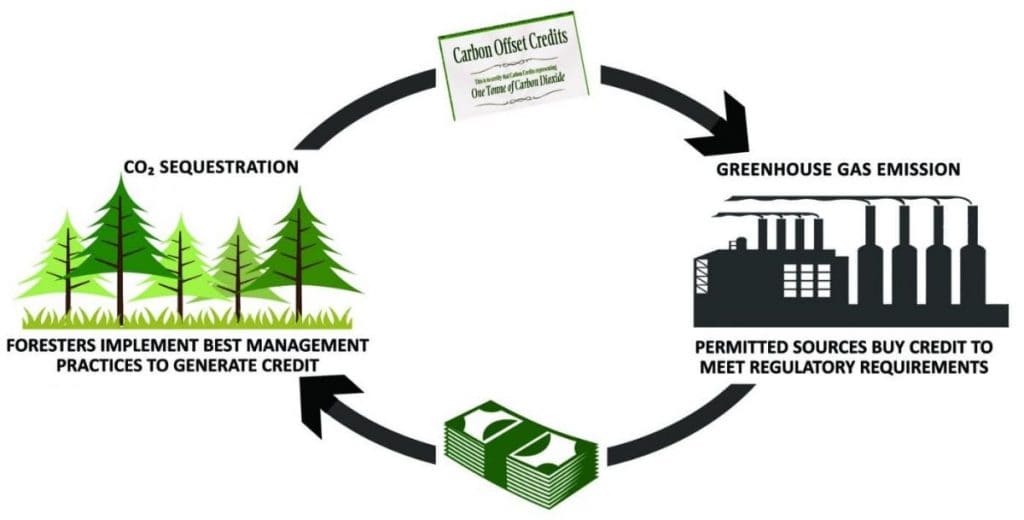

Carbon credit markets are basically platforms that were made for trading where you can buy and sell carbon credits. What is a carbon credit? Carbon credits, function similarly to emission permit slips. For example, a certain corporation is authorized to produce one ton of CO2 emissions only when it purchases carbon credits, which are often provided by the governments. Sometimes businesses that have extra credits at the end of the process can sell them to other businesses.

Businesses and people can use the carbon market to offset their carbon emissions by purchasing carbon credits from institutions and the government that completely or considerably reduce greenhouse gas emissions. The basic idea behind carbon credits is to put a price on carbon emissions and offer financial incentives for reducing them.

Understanding of Carbon Credit Markets

By lowering, absorbing, and storing emissions via various procedures, private entities and government institutions are able to produce and market carbon credits. Some businesses may need years before they can significantly reduce their emissions, even with advancements in technology. However, companies must continue to offer their products and services in order to make the money required to reduce their operational carbon footprint.

Talking about the size of the carbon markets, it’s really difficult to measure. Since the value of carbon credits is strongly correlated with the quality of the issuing organization so the cost of carbon credits vary. Although third-party validators provide an extra layer of oversight by ensuring that each carbon offset is indeed the result of real-world emissions reductions, variations exist across various kinds of carbon offsets.

What are the most popular ways for businesses and governments for producing carbon credits?

Almost all of the projects are related to the “greening” of the territory or reducing energy consumption, among them the are:

- Renewable Energy Projects: By replacing energy resources based on the fossil fuels, renewable projects can provide clean, energy from sources like solar, wind, hydroelectric, and geothermal power and lower emissions that way. For those countries with plenty of rivers, constructing a hydroelectric plant is an attractive and reasonably priced option for producing electricity.

- Improving energy efficiency: Efforts to increase energy efficiency like renovating buildings with the higher energy standards, and for example modernising transportation sector, raising of the electric vehicles usage may lower greenhouse gas emissions in a certain way.

- Transportation Emission Reductions: As it was mentioned earlier, even simple usage of electric vehicles like cars and buses can change the situation.

- Reforestation and Agroforestry: This kind of project usually includes trees planting on the degraded land or other cases like in Singapore, where the owners of the buildings have to compensate the amount of destroyed trees (during the construction) on the roofs of the buildings.

As an instrument for financing and promoting emission reduction initiatives, the carbon credit market is just a small drop for a plan to solve climate change problem. Even though there are critics and difficulties like the possibility of manipulating the market and transparency problems, all of us can agree that it’s better than nothing.

Latest news about Digital Property:

- The Bank of Korea and the Korea Exchange are partnering to explore the integration of Central Bank Digital Currency (CBDC) into the carbon credit market. The partnership aims to create a digital financial and asset infrastructure, leveraging distributed ledger technology to assess the feasibility of integrating CBDCs with carbon emissions trading. The initiative is expected to begin in November and will test in the latter half of next year.

- Ripple (XRP) has partnered with Thallo to create the first Web3 carbon credit marketplace. The project aims to combat climate change by creating a marketplace for carbon credits built on the XRP Ledger. Carbon credit is a global trading market for companies that emit too much CO2. The project aims to democratize the carbon credit market by simplifying the match between buyer and seller. Despite the ongoing bear market, XRP remains one of the top-performing cryptocurrencies.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.