For the past few weeks, Bitcoin (BTC) has been languishing in a tight price range of approximately $23,400

The recent rejection from the $23,400 resistance level suggests that Bitcoin may not be ready to move above this price point yet. It is still too early to definitively say whether BTC will remain within this range in the near future or break out of it. The upcoming monthly close in a few days’ time could provide more clarity on where Bitcoin’s price is headed.

In the meantime, investors should monitor Bitcoin’s price movements closely to look for any signs of a breakout from its current range. They may also consider investing in other assets that are performing better than Bitcoin at this time and diversifying their portfolios. This could help protect them against any potential losses in case Bitcoin fails to break out from its current range. Ultimately, it is important for investors to remain aware of what is happening in the cryptocurrency markets and make informed decisions based on their own risk appetite.

Whatever the outcome, it is clear that Bitcoin’s price is in a period of consolidation, and investors should take this into account when deciding how to allocate their funds. As always, it is important to exercise caution and do your own research before making any investment decisions. This will help ensure you make the best possible decision for your financial future.

Ultimately, only time will tell where Bitcoin’s price is headed, but it is important to remain patient and informed throughout this period of market uncertainty. By monitoring the latest news and trends in the crypto world and making sound investment decisions, investors can ensure they are positioned well to take advantage of any potential opportunities that may arise in the near future.

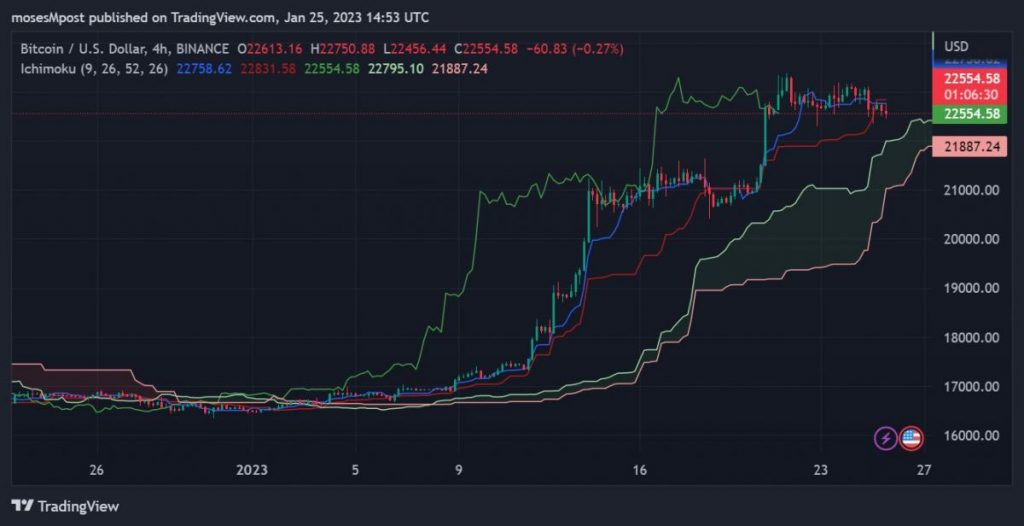

BTC technical outlook

In the medium term, traders should maintain a close eye on Bitcoin’s technical charts. Though the bearish rejection at $23,400 is certainly concerning, given BTC’s extended moves higher this week, it is important to consider that there is still nearly a week of January left. What happens then could be critical in determining the direction of BTC’s price heading into February.

On the daily chart, there is the formation of several flag patterns. The flag pattern is considered to be a bullish signal and suggests that Bitcoin could soon break above the $23,400 resistance level.

Whatever the case may be, it is essential for traders and investors to stay informed about the latest developments in the cryptocurrency markets and make decisions based on their own risk appetite. By taking these precautions, they can ensure that their investments are well-positioned to benefit from any potential upside in the near future.

In addition, traders should also pay attention to key levels, such as the 200-day moving average at $22,000 and the 50-day MA at $20,400. If Bitcoin fails to break above these key levels, it could indicate that a bearish move toward the $17,000 range is possible. On the other hand, if Bitcoin manages to break above these levels and hold its ground, then it could signal an extended bull run in the coming weeks.

Ultimately, traders should keep a close eye on Bitcoin’s price action and remain aware of key technical indicators for clues on Bitcoin’s short-term trajectory. By doing so, they will be better positioned to make informed trading decisions going forward.

Conclusion

It is clear that Bitcoin’s price has been stuck in a narrow range in the past few days, and there is still some uncertainty as to where it will head next. That said, traders should remain vigilant and monitor the latest news and trends in the cryptocurrency markets to take advantage of any potential opportunities that may arise.

Related articles

- Cardano gives early signals of a rally. Is this a good opportunity?

- Bitcoin markets: Nearly 100% of public bitcoin miners have been sold out

- For the first time ever, BTC’s Hash Ribbon model failed; What does this mean for Bitcoin’s future?

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Moses is an experienced freelance writer and analyst with a keen interest in how technology is disrupting the financial sector. He has written extensively on the subject of cryptocurrencies from an investment perspective, as well as from a technical standpoint. He has also been involved in trading cryptocurrencies for over two years.

More articlesMoses is an experienced freelance writer and analyst with a keen interest in how technology is disrupting the financial sector. He has written extensively on the subject of cryptocurrencies from an investment perspective, as well as from a technical standpoint. He has also been involved in trading cryptocurrencies for over two years.