Block Scholes and Bybit Trace Crypto’s Shift from FOMO to Fear

In Brief

After October’s $6 billion liquidation, Bybit and Block Scholes’ latest report shows a newly cautious crypto market, with traders hedging positions and waiting for clarity amid subdued optimism.

The crypto market has experienced many phases over the past decade: euphoric, chaotic, unstoppable. However, it has rarely been cautious. This cautious tone is evident in Bybit and Block Scholes’ latest Crypto Derivatives Analytics Report, which provides a sober analysis of digital asset trading following October’s record-breaking $6 billion liquidation. Despite the buzz about a modest price rebound, data indicate traders are retreating behind hedges, healing their wounds, and awaiting clarity that might not arrive soon.

The report states that the trigger was another geopolitical incident. U.S.–China trade tensions escalated when President Trump unexpectedly announced a 100% tariff increase on Chinese goods. Within hours, massive liquidations wiped out billions in open interest, eliminating one of the largest leveraged buildups in crypto history.

Even though the two countries later agreed on a new trade framework, the damage was already done. Bitcoin has since traded within a narrow range of $105,000 to $115,000, where it remains stubbornly confined. In a market that once thrived on momentum, such stagnation seems almost unfamiliar.

Perpetuals Stuck in Neutral

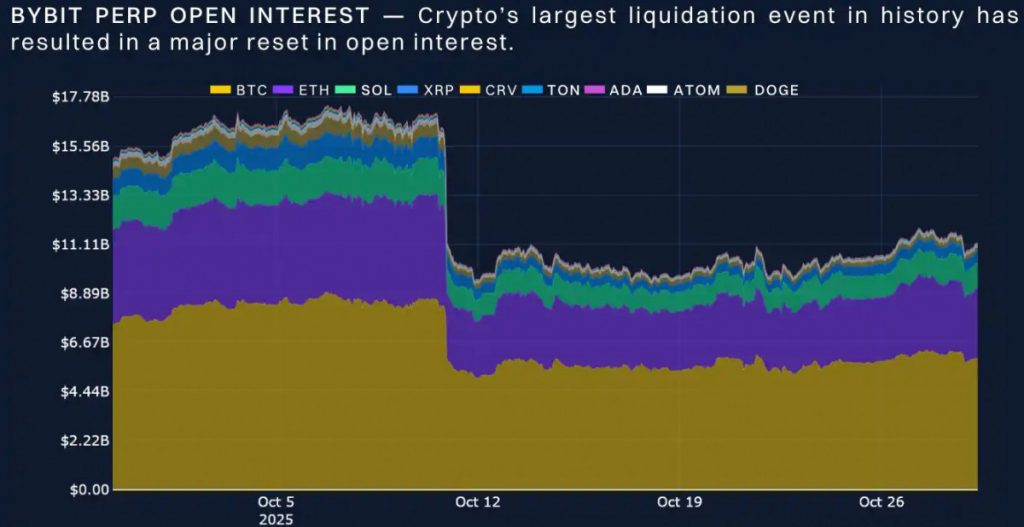

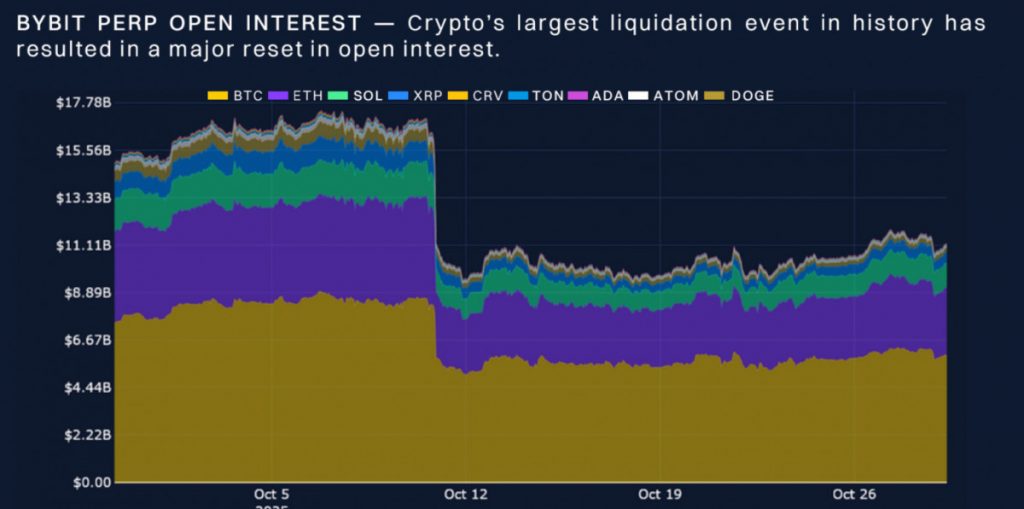

Bybit’s data indicates that perpetual futures, which are central to crypto derivatives, remain below $10 billion in notional open interest, a level not seen since early 2023. Although record highs in U.S. equities should have boosted risk appetite, the report reveals a growing disconnect between digital assets and traditional markets.

Traders appear hesitant to re-enter with significant positions, still affected by the rapid and large-scale decline in October. What was once a market driven by leverage now seems to be in a survival mode.

Hedging Over Hype

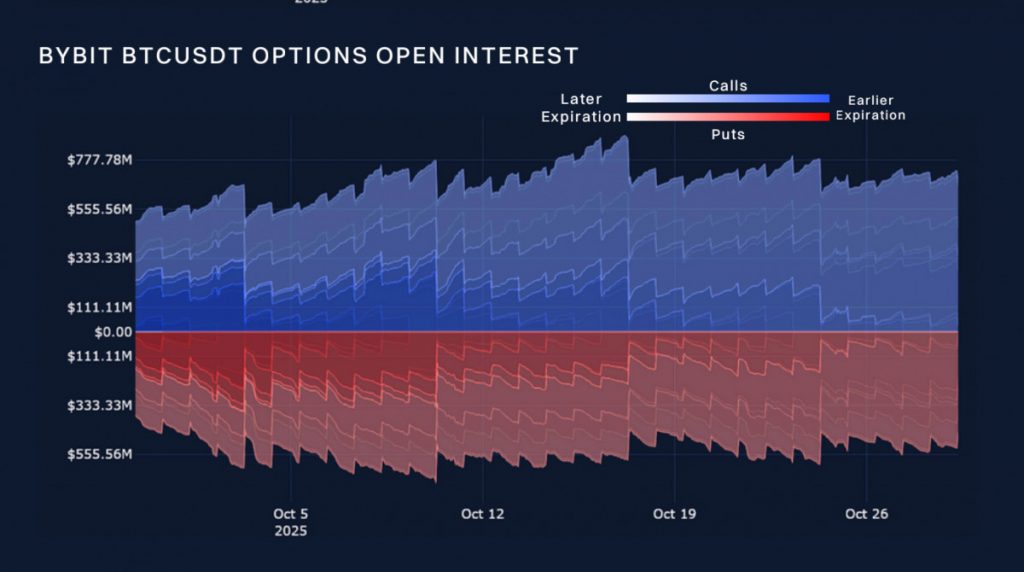

The story is actually more nuanced. Although perpetual markets have stalled, options trading presents a different picture. Bybit and Block Scholes note that Bitcoin options open interest has been steadily increasing, indicating that professional traders are adopting defensive positions rather than completely withdrawing.

The demand for short-term puts remains strong, and at-the-money implied volatility, an important indicator of risk perception, remains high across different maturities. This subtle shift from leverage to options highlights that crypto’s most sophisticated investors aren’t leaving, but rather buying time.

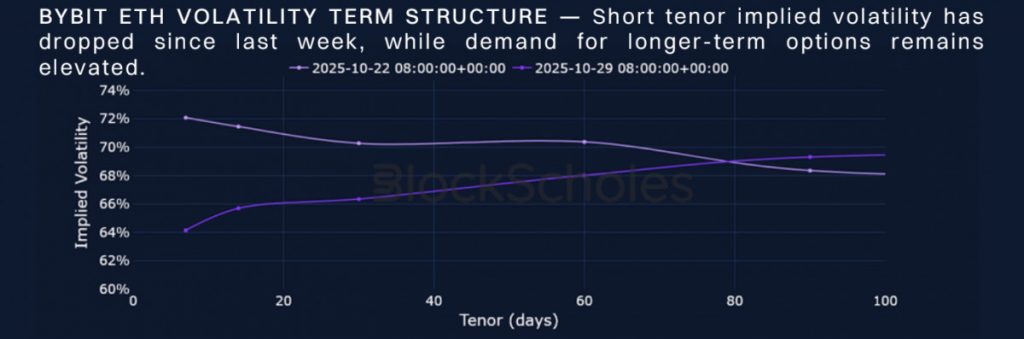

That hesitation is reflected across Ethereum markets, where volatility temporarily shifted to a bullish trend before reverting to a cautious stance. Despite declining realized volatility, traders still pay premiums for insurance.

Block Scholes’ analysts note that the market struggles to forget October’s shock, with a collective post-traumatic reflex keeping option prices elevated even when spot markets are calm. Historically, these phases of low price movement and costly hedging have often preceded sudden large moves. The challenge is that no one can predict which direction this time will favor.

Macro Headwinds and Micro Sparks

Macro forces offer little reassurance. Federal Reserve Chair Jerome Powell’s repeated statement that future rate cuts are unlikely has subdued the cautious optimism after the October policy meeting. With manufacturing data in the U.S. and Asia weakening and Europe nearing stagnation, the long-held belief that crypto would decouple from global finance seems more myth than fact once again. When stocks hit new highs and Bitcoin remains almost static, it’s not resilience; it’s disengagement.

Certain areas, especially in DeFi, still show signs of activity. The World Liberty Financial protocol, a Trump-supported project with the governance token WLFI, experienced a 25% rebound in its token value after an 8.4 million-token airdrop and a buyback-and-burn vote aimed at boosting prices. This temporarily reignited speculation about politically affiliated DeFi ecosystems.

However, even in these cases, perpetual funding rates remain volatile, indicating that traders are still hesitant to view the bear market as over. While the WLFI rally is a notable headline, it highlights how divided sentiment has become: confidence is localized rather than widespread.

Waiting for Conviction

The main insight from Bybit and Block Scholes’ analysis is that crypto no longer moves as a unified entity. The synchronized rallies of 2021 have been replaced by fragmented liquidity and a focus on defensive capital rotation. Traders now prioritize hedging over speculation and monitor macro events, such as tariffs and Fed speeches, more carefully than ever.

This doesn’t mean optimism has disappeared. It is simply overshadowed by caution. Markets that undergo tough periods like October’s often emerge stronger and more streamlined. In derivatives, stability following deleveraging can signal growth, but only if traders regain trust that liquidity won’t disappear suddenly. The current pause might be the calm before crypto’s next major narrative shift, be it institutional inflows, monetary easing, or renewed retail speculation.

Currently, Bybit’s charts and Block Scholes’ sentiment indexes both indicate a similar situation: a market that is active yet cautious, moving but alert, awaiting the next signal. After ten years of fluctuating extremes, maybe restraint itself is the strongest bullish indicator.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.