Weekly Crypto Update: Bitcoin Struggles at $100K, Ethereum Battles ETF Uncertainty, TON’s BTC Teleport Gears Up

In Brief

Bitcoin (BTC)

Bitcoin just can’t seem to crack that $100K ceiling. Every attempt to push higher has been met with resistance, and this week was no different. Spot Bitcoin ETFs saw $430 million in outflows, throwing cold water on hopes of a sustained rally.

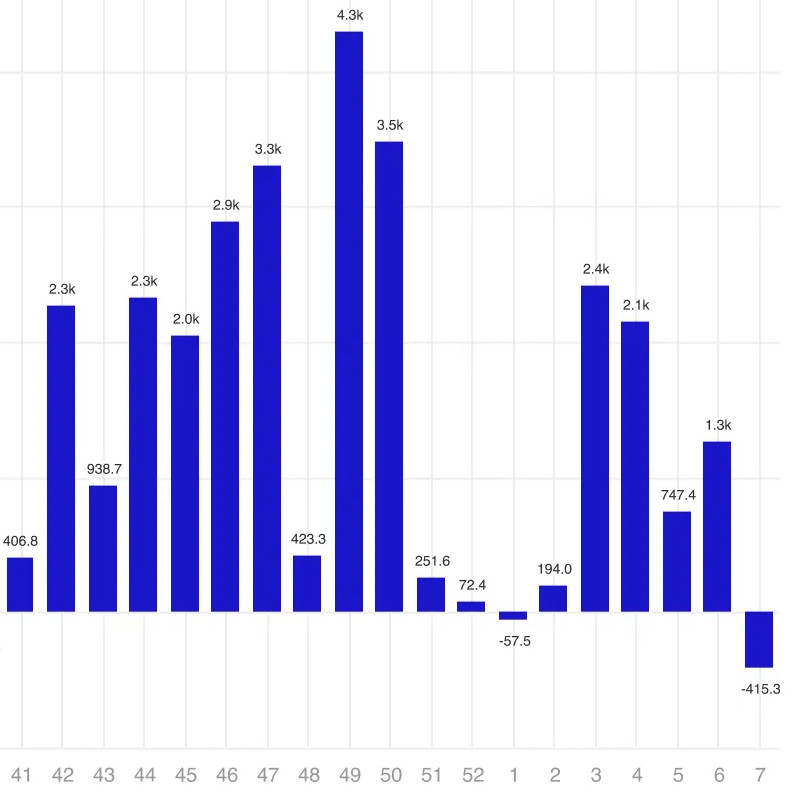

Weekly crypto asset inflows by the number of the week in late 2024 and early 2025 (in millions of US dollars). Source: CoinShares

Even BlackRock’s ETF, now controlling over 50% of the market, couldn’t turn the tide. But institutions haven’t stepped away – MicroStrategy is gearing up for another buying spree, raising $2 billion to scoop up more BTC.

Strategy’s Bitcoin purchases. Source: SaylorTracker

Meanwhile, the biggest shock of the week came from the Bybit hack, a staggering $1.4 billion exploit pulled off by the Lazarus Group.

Source: Ben Zhou

It’s the largest crypto heist ever, and while Bybit scrambled to recover, concerns over fund laundering and potential sell pressure weighed heavily on the market. At the same time, macro headwinds aren’t helping.

DXY Index (left) vs. Bitcoin/USD (right). Source: TradingView / Cointelegraph

The Federal Reserve remains hesitant on rate cuts, and a sell-off in long-dated US Treasuries suggests investors are pulling back from risk.

BTC/USD 4H Chart, Coinbase. Source: TradingView

Price-wise, we’re still chopping and ranging tight. After briefly pushing toward $99,200, BTC lost steam and tumbled back toward $95K, where it’s now hovering. The 50-day moving average at $96,423 has flipped into resistance, and with the RSI sitting around 45, momentum is looking weak. Buyers need to step in soon, or BTC risks slipping toward $92K-$93K before finding a solid base.

Ethereum (ETH)

Ethereum managed to claw its way back above $3K, but not without its own share of drama. Bybit’s hack put pressure on ETH, but the exchange’s emergency buyback of nearly $300 million in Ether helped stabilize things.

Source: Justin Bons

Then came the debate over a possible Ethereum rollback to recover the stolen funds. Alas, the idea quickly shut down by core developer Tim Beiko, who called it “technically intractable.” That put a stop to the panic, but not to the lingering concerns about centralized exchange security.

Still, there’s been some quiet bullishness under the surface. Whales have been pulling ETH off exchanges, suggesting a supply squeeze could be brewing.

ETH/USD 4H Chart, Coinbase. Source: TradingView

Ethereum has been stuck in a choppy range, bouncing between $2,600 and $2,850, with sellers capping upside moves. The 50-day moving average at $2,722 has become a key battleground, and right now, ETH is hovering right around it. RSI at 46 signals fading momentum, and if bulls don’t step up, another drop toward $2,600 is possible. On the flip side, if buyers regain control, ETH could push back toward $2,800-$2,850 in the short term.

Toncoin (TON)

Toncoin has been moving quietly, mostly flying under the radar. After a stretch of consolidation, TON’s price is starting to show some life, pushing back above its 50-day moving average. The RSI is hovering near 58 – not overheated, but showing a bit of bullish momentum. If Bitcoin and Ethereum can hold steady, TON might have room to run, especially with DeFi on the network picking up steam.

TON/USD 4H Chart, Coinbase. Source: TradingView

The biggest head-turner came from TON Teleport BTC. The testnet just launched, setting the stage for Bitcoin to start moving into TON’s ecosystem. That means BTC holders can now play around with yield farming, collateralized lending, and cross-chain transfers – all without needing a centralized exchange. If this takes off, it could pull in serious liquidity and give TON’s DeFi sector some real weight.

Right now, TON is still moving in sync with Bitcoin and Ethereum, but it’s stacking up fundamental catalysts that could push it into its own breakout. If Bitcoin shakes off its stagnation and risk appetite returns, TON could be primed for a run. It’s not quite there yet, but with growing DeFi traction and a Bitcoin bridge on the way, it’s shaping up to be one of the more interesting altcoins to watch.

Overall, the market feels like it’s stuck in limbo. The Bybit hack was a gut punch, ETF outflows aren’t helping, and macro uncertainty is keeping traders on edge. But institutions are still here, buying is still happening, and if Bitcoin can get back above $106K, things could heat up fast. Until then, it’s a waiting game, and the risk of another leg is down still looming.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.