U.S. IRS adds NFTs as digital assets for tax purposes

In Brief

IRS added instructions how taxpayers account for NFT-related taxes

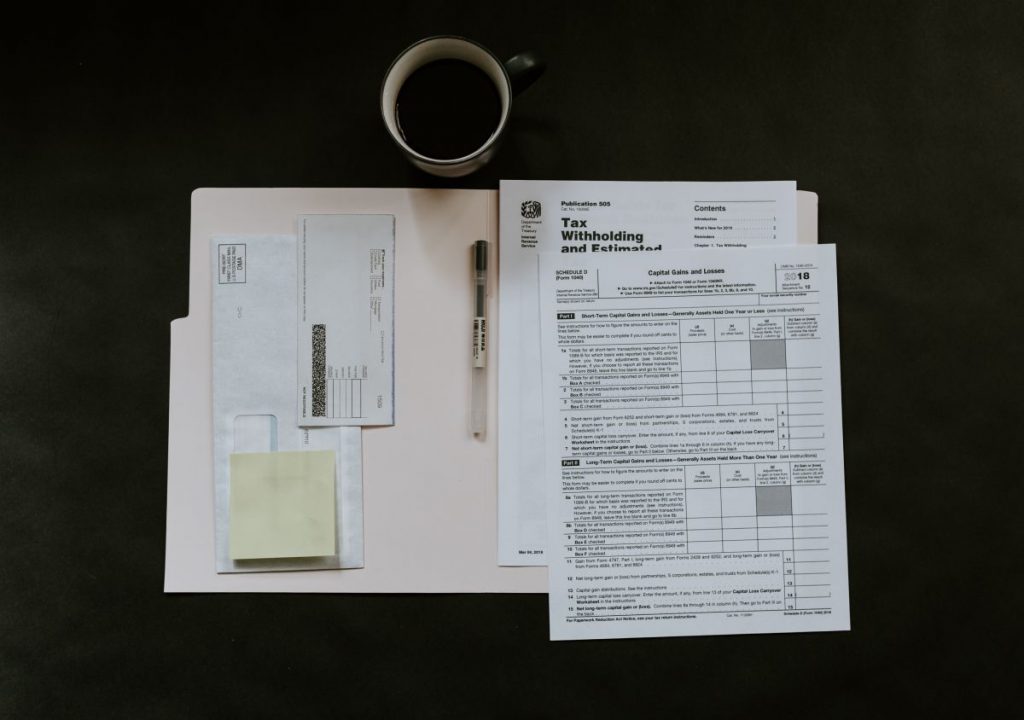

The draft document for the 2022 tax year changed the term from “virtual currency” to “digital assets”

According to the document, taxable income has to be reported: “if you disposed of any digital asset in 2022, that you held as a capital asset, through a sale, exchange, gift, or transfer”

The U.S. Internal Revenue Service (IRS) has added NFTs to its annual income tax instructions. The move is meant to facilitate the filing of crypto-related taxes—now, digital asset investors might receive some clarification on how to legally deal with NFT profits.

NFTs only emerged in 2021, when there wasn’t much information on how taxpayers should deal with their profits from NFT sales. Digital collectibles were also subject to a higher capital gains tax rate than stocks, bonds, crypto, or other assets.

On Monday, the Treasury Department’s tax division released a draft document classifying NFTs within the digital asset category. This means NFTs won’t be taxed as art or antiquities but will be categorized with cryptocurrencies.

The statement said: “Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology.” Digital assets include NFTs and virtual currencies, such as cryptocurrencies and stablecoins.

For the 2022 tax year, crypto investors must report taxable income on all NFT possessions: If they received digital assets as payments for property or services, as a reward or award, as a hard fork, if they minted or staked NFTs, disposed of digital assets in exchange for services or traded for other assets, transferred digital assets for profit, and more.

Last year’s U.S. tax-filing instructions defined virtual currencies “as a unit of account, a store of value, or a medium of exchange.”

With the new regulations, the U.S. joins several other countries, such as Singapore, Israel, and India, in taxing NFTs.

The latest larger-scale NFT investigation concerned Yuga Labs. The Securities and Exchange Commission (SEC) accused BAYC’s creators of violating federal law by selling unregistered NFTs.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Agne is a journalist who covers the latest trends and developments in the metaverse, AI, and Web3 industries for the Metaverse Post. Her passion for storytelling has led her to conduct numerous interviews with experts in these fields, always seeking to uncover exciting and engaging stories. Agne holds a Bachelor’s degree in literature and has an extensive background in writing about a wide range of topics including travel, art, and culture. She has also volunteered as an editor for the animal rights organization, where she helped raise awareness about animal welfare issues. Contact her on [email protected].

More articles

Agne is a journalist who covers the latest trends and developments in the metaverse, AI, and Web3 industries for the Metaverse Post. Her passion for storytelling has led her to conduct numerous interviews with experts in these fields, always seeking to uncover exciting and engaging stories. Agne holds a Bachelor’s degree in literature and has an extensive background in writing about a wide range of topics including travel, art, and culture. She has also volunteered as an editor for the animal rights organization, where she helped raise awareness about animal welfare issues. Contact her on [email protected].