The Price of Non-Compliance: Bybit’s $1 Million Fine in India

In Brief

Bybit’s financial penalty of ₹9.27 crore has sparked debate on compliance in the cryptocurrency market, highlighting regulatory issues faced by Indian exchanges and global implications.

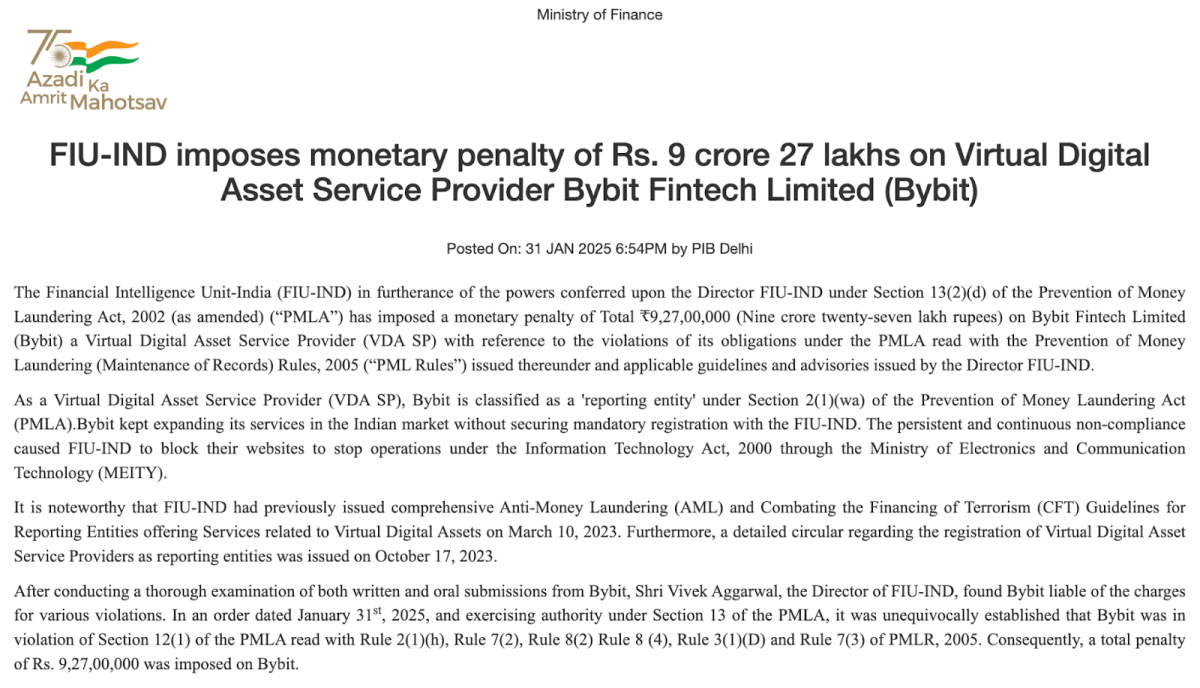

The recent financial penalty issued on Bybit by India’s Financial Intelligence Unit (FIU-IND) has prompted widespread debate about compliance in the fast-changing cryptocurrency market. Bybit received a penalty of ₹9.27 crore (roughly $1.06 million) for violating the Prevention of Money Laundering Act (PMLA) and related laws. This episode not only underscores the regulatory issues that cryptocurrency exchanges confront in India, but it also has far-reaching ramifications for the worldwide crypto sector.

Photo: Ministry of Finance

Overview of the Regulatory Framework

The PMLA, implemented in 2002, seeks to prevent money laundering and guarantee that financial institutions adhere to high compliance standards. Under this legislation, Virtual Digital Asset Service Providers (VDASPs) such as Bybit are defined as ‘reporting entities’ and must register with FIU-IND. The latest steps against Bybit demonstrate the Indian government’s determination to enforce compliance on cryptocurrency platforms.

In March 2023, the FIU-IND announced complete recommendations for reporting businesses dealing with virtual digital assets, highlighting the importance of strong anti-money laundering (AML) and counter-terrorist financing (CFT) procedures. These principles were strengthened by a circular issued in October 2023, which mandated VDASP registration. Bybit’s ongoing activities without gaining this registration resulted in the implementation of the punishment and subsequent shutdown of its websites under the Information Technology Act.

Bybit Operations in India

Bybit, one of the world’s largest cryptocurrency exchanges, has been actively growing its services in India despite a lack of governmental license. This development includes providing a diverse choice of trading alternatives and financial goods, which drew a large user base. However, as regulatory pressure grew, Bybit found itself at a crossroads.

The FIU-IND’s investigation indicated that Bybit failed to comply with numerous important requirements of the PMLA and its accompanying guidelines. Specifically, infractions were found in many areas of the PMLA and the Prevention of Money Laundering (Maintenance of Records) Rules, 2005. The results prompted FIU-IND to take quick action against Bybit, which resulted in a huge fine.

Implications of Non-Compliance

The implications of noncompliance are severe for crypto exchanges operating in India. The suspension of Bybit’s websites essentially terminated its activities in the country, affecting both the platform and its users. Existing customers were allowed to withdraw cash, but they could not engage in new transactions or utilize other services. This interruption demonstrates how regulatory frameworks may directly impact operational capabilities in the cryptocurrency economy.

Furthermore, Bybit’s problem is not unique; other prominent exchanges, like Binance and KuCoin, have faced similar regulatory procedures for noncompliance with Indian legislation. This trend indicates a greater crackdown on crypto platforms that do not comply with local legislation.

Bybit Response and Future Prospects

In light of these changes, Bybit has made initiatives to improve its compliance record. The exchange has legally registered with FIU-IND and is now seeking a Virtual Digital Asset Service Provider (VDASP) license. This application procedure began on June 26, 2024, reflecting Bybit’s proactive attempt to comply with regulatory standards.

Vikas Gupta, Bybit’s national manager for India, expressed confidence in acquiring full operational licensing in the near future. This remark shows a desire to collaborate closely with Indian officials to fix compliance issues and restart regular operations.

Despite substantial hurdles, including service suspensions and public doubt about its compliance status, Bybit is committed to negotiating India’s complicated regulatory framework. The exchange’s attempts to interact with regulatory organizations reflect a recognition of the value of compliance in establishing confidence in the crypto ecosystem.

India’s Regulatory Landscape

India has always taken a cautious approach to cryptocurrency regulation, with strong procedures in place to prevent criminal activity using digital assets. Financial regulators have increased their surveillance of cryptocurrencies due to their perceived use in money laundering and terrorism funding.

However, there are indications that India’s attitude on cryptocurrencies may shift in reaction to global trends and internal economic factors. Recent conversations among politicians indicate a readiness to reconsider existing restrictions and perhaps create a more conducive climate for cryptocurrency innovation.

As countries throughout the world embrace more inclusive policies regarding cryptocurrencies, India may find itself caught between stringent regulatory control and developing an atmosphere conducive to technological progress.

The $1 million fine issued on Bybit is reminder of the significance of compliance in the cryptocurrency business. As authorities globally tighten their grip on digital asset platforms, exchanges must prioritize compliance with local laws to risk harsh penalties and operational interruptions.

Bybit’s experience demonstrates both the hurdles that VDASPs confront when negotiating complicated regulatory regimes and the opportunity for good change via proactive interaction with authorities. Since India refines its approach to cryptocurrency regulation, exchanges such as Bybit will need to adjust quickly while remaining compliant with growing requirements.

This event highlights a watershed moment for Bybit and India’s cryptocurrency market, as players seek clarification despite ongoing legislative changes. The future success of crypto exchanges will be heavily reliant on their ability to comply with regulatory obligations while preserving user confidence in an increasingly regulated landscape.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.