Solus Partners Drops Landmark Report On Canton Network’s Institutional Breakthrough: What To Expect In 2026?

In Brief

Solus Partners’ new study provides a comprehensive analysis of Canton Network’s evolution from early pilots to emerging market infrastructure, detailing its institutional use cases, network traction, architectural design, and long‑term scalability outlook.

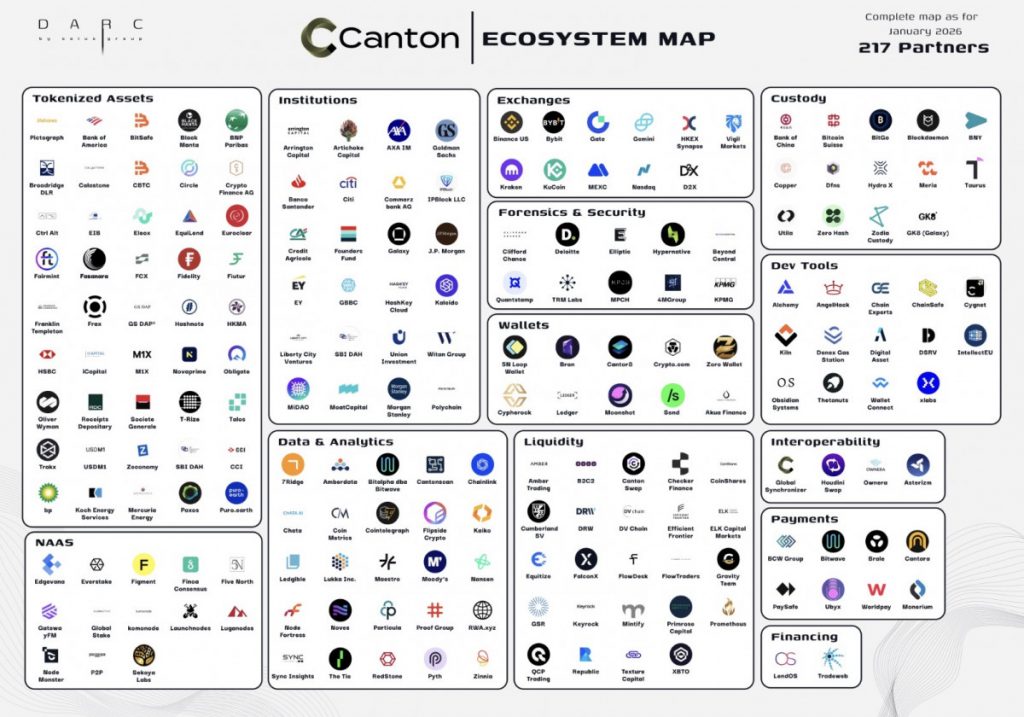

Research and advisory firm Solus Partners announced that it has released the “Canton Network 2026 Report” which examines Canton Network’s development across 2024–2026, tracing its evolution from early institutional pilots to its emerging position as market infrastructure.

The analysis draws on primary Canton Network documentation—including whitepapers, build materials, and tokenomics papers—alongside on‑chain data, partner announcements, and third‑party reporting on pilot outcomes.

The research explores the core institutional problems Canton Network is built to address, the traction visible across live platforms and pilots, the roles of key ecosystem participants, the influence of institutional use cases on adoption, and how architectural and economic design choices shape the network’s scalability and long‑term sustainability.

Let’s take a closer look at key findings:

Canton Network Overview And Traction

Canton Network operates as a public‑permissioned “network of networks” for smart‑contract‑based applications, designed for multi‑party workflows where privacy and access control are essential, particularly in regulated financial environments.

Reported Traction

• 153.92M total transactions

• 278,045 recorded parties

• 18.09M transactions over 14 days (1.01M average per day)

• 13.37B CC distributed as rewards

Validator participation includes 819 validators in total, with 737 active and 80 inactive, resulting in an active share of 89.9 percent. The network dashboard indicates that public activity represents the majority of usage and has trended upward over the past month. Public updates have ranged between 6,000 and 7,500 per day, with a noticeable increase around mid‑January. Private updates peaked between 2,000 and 2,400 per day before moderating to approximately 1,800–2,500 per day, representing around 20 percent of activity.

Additional metrics include 37.89B CC in total circulation, 1.39M transfers recorded in a 24‑hour period, and 66,330 active addresses within the same timeframe, indicating a high concentration of transfers among a relatively focused set of active participants. The report also covers tokenomics, product design, architectural considerations, and the burn‑and‑mint equilibrium model.

The report further offers an in‑depth examination of Canton Network’s product design and technical architecture, detailing how its modular components support regulated, multi‑party workflows. It also provides a comprehensive look at Polyglot, the network’s EVM‑compatibility layer that enables Solidity‑based applications to operate within Canton’s privacy‑preserving environment. In addition, the analysis covers the network’s tokenomics framework, the mechanics of its burn‑and‑mint equilibrium, and other operational data points that illustrate how the system is structured for long‑term sustainability and institutional‑grade performance.

Roadmap And Development Priorities

According to the study, the network roadmap’s near‑term priorities include transitioning DTCC tokenization from pilot to production. The minimum viable product for Treasury tokenization is targeted for the first half of 2026, with broader deployment planned for the second half. Expansion to additional DTC‑ and Fed‑eligible assets will follow based on client demand.

JPMorgan has announced phased JPM Coin deployment throughout 2026, with potential integration of blockchain‑based deposit accounts. Technical upgrades scheduled for early 2026 include enhancements to dynamic price feeds, streamlined incentive structures, and expanded institutional‑grade validator onboarding. A recent halving event reduced emissions and significantly lowered the share allocated to Super Validators.

Expansion Initiatives

• Finalizing Polyglot for EVM compatibility

• Deepening institutional real‑world‑asset markets

• Onboarding additional validators

• Enabling cross‑chain interoperability

• Optimizing token economics toward sustainable equilibrium

• Extending platform support to tokenized equities and commodities

Market Impact And Observations

Regulated Interoperability

The report highlights that Canton’s model enables multi‑party workflows without requiring a single global public ledger, allowing institutions to maintain permissions and privacy while still achieving atomic settlement.

Measurable Traction

Network activity is already at scale, with high validator participation supporting production‑oriented experimentation.

Production‑Aligned Deployments

Canton Network has secured participation from major financial market infrastructure providers, including DTCC and Euroclear, marking a shift from exploratory pilots to production‑aligned deployments.

Institutional Ecosystem Growth

Global tier‑one institutions referenced in the ecosystem include Nasdaq, NYS, BNP Paribas, Bank of China, HSBC, Goldman Sachs, HKFMI, and Moody’s Ratings.

Remaining Uncertainties

• The burn‑and‑mint equilibrium remains untested at scale

• Certain network metrics are difficult to independently verify due to privacy architecture

• The Daml developer ecosystem is smaller compared to Solidity.

Polyglot as a Catalyst for Adoption

According to the study, Polyglot is positioned as a key accelerator, aiming to reduce migration costs by introducing EVM/Solidity compatibility—whether through Solidity‑to‑Wasm, EVM‑in‑Wasm, or a parallel EVM virtual machine—while preserving Canton’s privacy and multi‑party workflow model. This approach is intended to allow existing DeFi and enterprise Solidity teams to port systems rather than rebuild them.

Strategic Positioning

Analysts conclude that Canton is not attempting to replace public blockchains. Instead, it is building the layer where regulated capital can move without friction. If that foundational layer succeeds, the structure of activity built above it may shift accordingly.

Please find the full report here: https://docsend.com/view/ggkscdmmq3sst9im

Among authors and contributors are Canton, Tradias. Everstake, mufettis, AltCryptoGems, YashasEdu, DeFi Warhol, and Ronin.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.