QCP Capital: Today’s Bitcoin Rally Sparks Hope For October Market As US Election Approaches

In Brief

QCP Capital’s latest analysis notes that several factors may explain BTC’s movement, but historical price trends are also noteworthy.

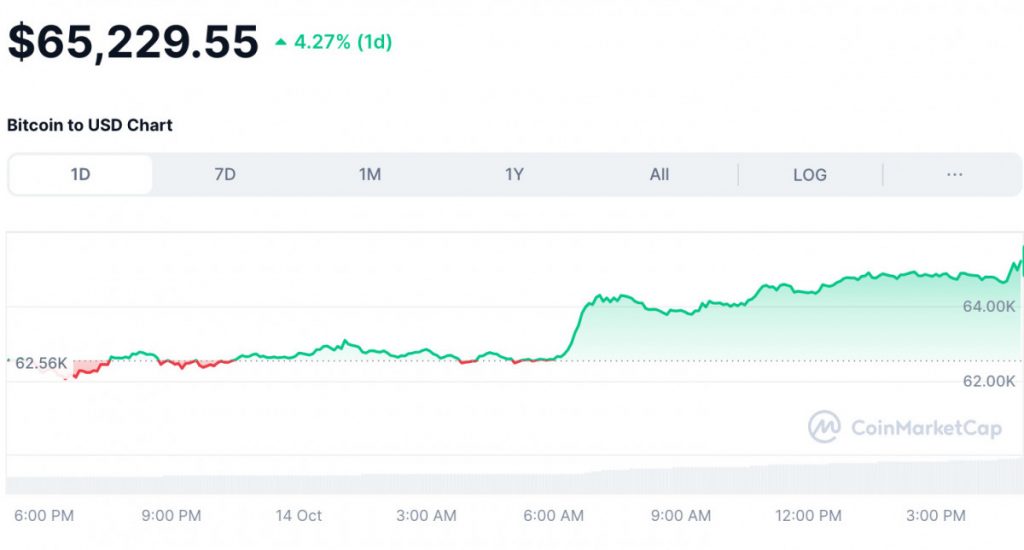

Singapore-based cryptocurrency trading firm QCP Capital published its latest market analysis, indicating that Bitcoin surged from $62,000 to $65,000 today, while about $80 million in leveraged short positions for BTC and ETH were liquidated. While some may link this rally to the news that Mt. Gox has postponed its repayment deadline to October 2025, this information was already available as of Friday.

The firm further noted that while several factors could account for today’s movement, it is a noteworthy moment when considering historical price trends. It is currently mid-October and only three weeks away from the US elections. Looking back to 2016, Bitcoin traded within a tight range for over three months before the elections. It was only three weeks prior to Election Day that Bitcoin began its ascent from $600, ultimately doubling in price by the first week of January.

Similarly, in 2020, Bitcoin remained stagnant for about six months, only starting to climb from $11,000 just three weeks before the US elections, reaching a peak of $42,000 by January.

So far, “Uptober” has been somewhat disappointing, with Bitcoin increasing by only 1.2%, compared to an average rise of 21%, the firm observed. After several months of range-bound trading, one might wonder if history will repeat itself. Today’s rally has certainly sparked some optimism in the market as enthusiasm for October began to wane.

With the spot price on the rise, the market is now focusing on profit targets for the upcoming fourth quarter, the firm concluded.

Bitcoin Surges Above $65,000 Amid Strong ETF Inflows

As of the current writing, Bitcoin is trading at $65,229, reflecting an increase of over 4.27% in the past 24 hours. The lowest price recorded during this period was $62,045. Notably, a surge in Bitcoin’s price today coincided with a nearly 96.50% rise in its 24-hour trading volume. Additionally, the US spot Bitcoin exchange-traded funds (ETFs) experienced inflows of approximately $308.76 million in the week ending October 11th.

Meanwhile, ETH is trading at $2,574, marking a 4.63% increase over the last 24 hours. The lowest price for the asset during this timeframe was $2,437, and its price movement aligns with the overall market trend. Interestingly, this increase occurred despite reported outflows of $5.22 million from spot Ethereum ETFs, according to data from SoSoValue.

The global cryptocurrency market capitalization has risen by 2.94%, reaching a total of $2.94 trillion. Furthermore, total market volume surged by 62.09%, climbing to $72.28 billion, based on information from CoinMarketCap.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.