QCP Capital: Bitcoin Volatility Shifts In Favor Of Put Options Amid Lack Of Upside Catalysts

In Brief

QCP Capital’s latest market analysis highlights how recent tariff announcements by Donald Trump, coupled with potential sanctions on Japan, are fueling market uncertainty and volatility.

Singapore-based cryptocurrency trading firm QCP Capital published a market analysis noting that this Monday has set the tone for the week, following the effects of DeepSeek’s actions two weeks ago and the volatility driven by tariffs last week. This time, Donald Trump’s announcement of a 25% levy on steel and aluminum briefly unsettled markets in anticipation of Jerome Powell’s testimony and the release of Consumer Price Index (CPI) data.

QCP Capital highlights that with Mexico and Canada being among the top three suppliers of steel and aluminum to the US, the tariffs have raised questions about the recent temporary delay and could reignite trade tensions. Furthermore, Donald Trump’s remarks about potential sanctions on Japan, a key US ally, come after the White House’s decision to block Nippon Steel’s attempt to take over US Steel, adding another layer of uncertainty.

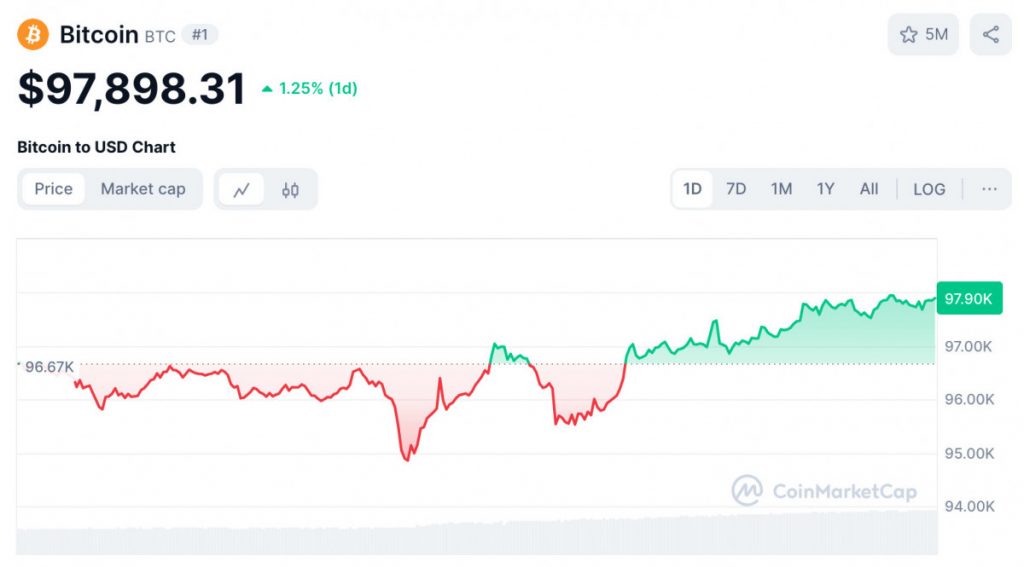

While commodities remained largely unchanged, Asian equities saw a slight dip, and Bitcoin briefly dropped to $95,000 before recovering, the firm noted. This suggests that the movement was sentiment-driven rather than indicative of a fundamental shift in risk appetite. BTC volatility currently favors puts until April, reflecting a lack of catalysts for upward movement.

A feedback loop seems to be forming, as President Donald Trump, who is highly sensitive to market reactions, is now facing a market that appears to be questioning his moves. This could further embolden him, contributing to increased market volatility.

Bitcoin Trades Above $97,000, Amid Market Volatility

As of the latest update, Bitcoin is trading at $97,898, reflecting an increase of over 1.25%. The coin’s intraday range was between a low of $94,855 and a high of $97,948. Additionally, Bitcoin’s market dominance rose by 0.42% from the previous day, reaching 60.77%, indicating that altcoins are still facing pressure amid ongoing market volatility.

In parallel, the global cryptocurrency market capitalization saw a 0.20% rise over the past 24 hours, reaching $3.19 trillion at the time of writing. Moreover, total market volume increased by 39.32% from the previous day, reaching $104.9 billion, according to data from CoinMarketCap.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.