Past Week in Crypto: Stablecoin Buying Dries Up, Bitcoin Struggling with Resistance

In Brief

Bitcoin News & Macro

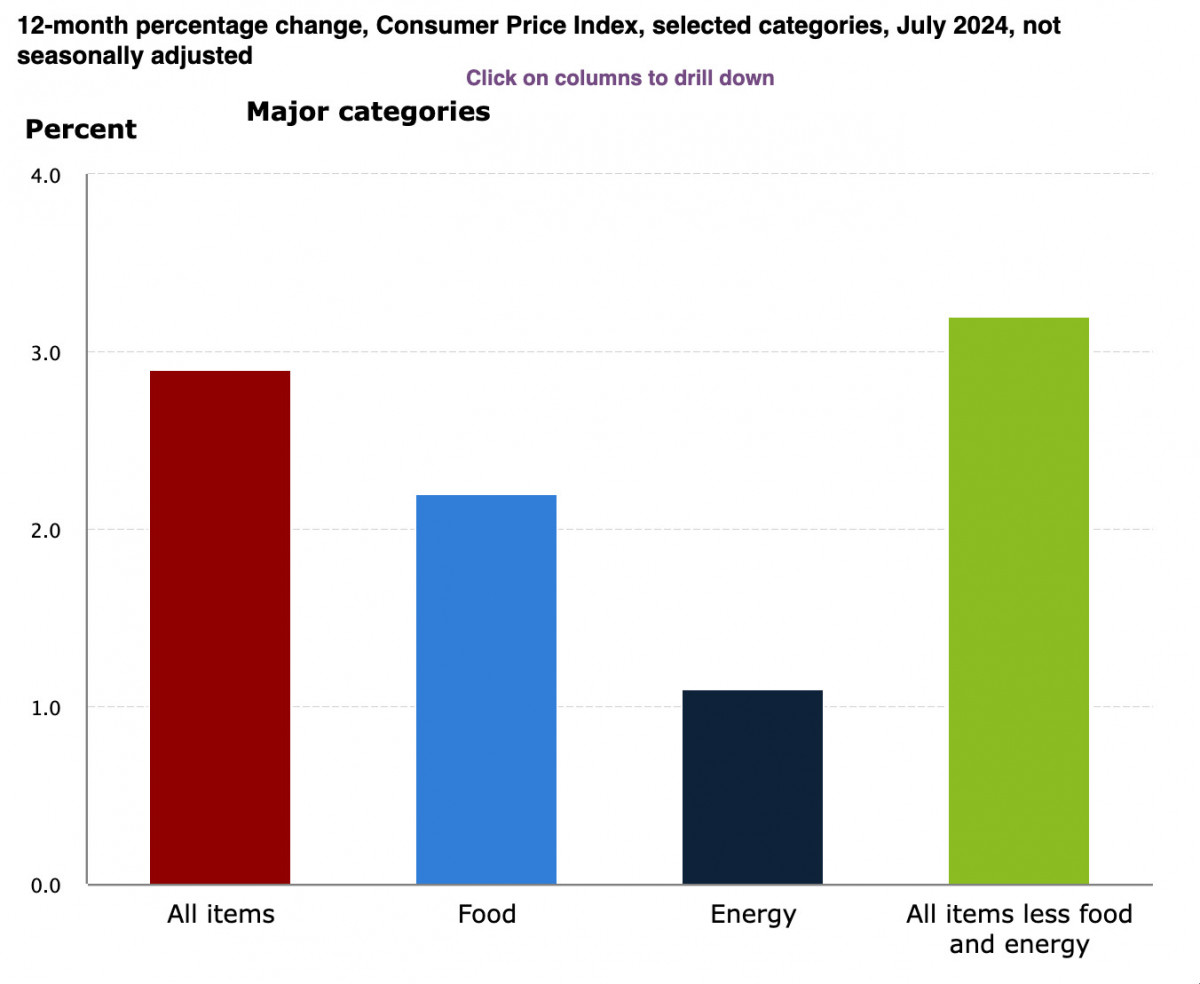

Let’s explore the key developments in Bitcoin over the last week. Early in the week, whispers about an upcoming CPI report stirred fears of a market correction. If the report shows cooling inflation, it could signal that the Fed might ease up on rate hikes or even cut rates, which would be bullish for Bitcoin. Conversely, if the report shows inflation is still running hot, the fear of more aggressive monetary tightening could trigger a selloff in the crypto market (investors would brace for reduced liquidity and higher borrowing costs).

Source: US Bureau of Labor Statistics

The pressure mounted as stablecoin buying dried up, dragging Bitcoin below the $59K mark.

Despite the jitters, optimistic undercurrents still run through the market, especially among institutional players.

Source: Glassnode

For one, Marathon Digital and other mining heavyweights announced hefty capital raises aimed at boosting their Bitcoin reserves and expanding operations.

To sum up, major institutions are quietly accumulating. The underlying belief is that institutional involvement will be a key driver for Bitcoin’s next leg up, even if the short-term remains rocky.

BTC Price Analysis

With that in mind, let’s talk technicals. Overall Bitcoin has been struggling to regain its footing after a sharp 27% drop from the week before last.

Source: TradingView

After the plunge to the 56,000 zone, BTC has stabilized but remains in a consolidation phase, with bulls and bears battling it out like there’s no tomorrow. Every rebound attempt stalls just below the 64,000 resistance (previously strong support) while the 20-EMA around 60,000 continues to cap upside moves. Without a clear breakout above these levels, sellers maintain control, and the market looks increasingly pressured.

Source: TradingView

On the 4-hour chart, Bitcoin is stuck in a sideways channel between 56,000 support and 62,000 resistance. Multiple rejections at the 50-EMA around 60,000 suggest the market is leaning bearish, and the formation of a potential descending triangle adds downside risk. The RSI, having rolled over near 40, signals fading momentum, and BTC seems to be running out of steam. If the 56,000 support gives way, another significant drop could be on the horizon – who knows, maybe into the low 50,000s?

The weekly open near 58,500 hinted at early strength, but each daily close has been lower, indicating buyers lack staying power. The battleground is between 56,000 support and 62,000-63,000 resistance. For now, the market remains trapped in a choppy, range-bound environment, waiting for a catalyst to break the deadlock.

Ethereum News & Macro

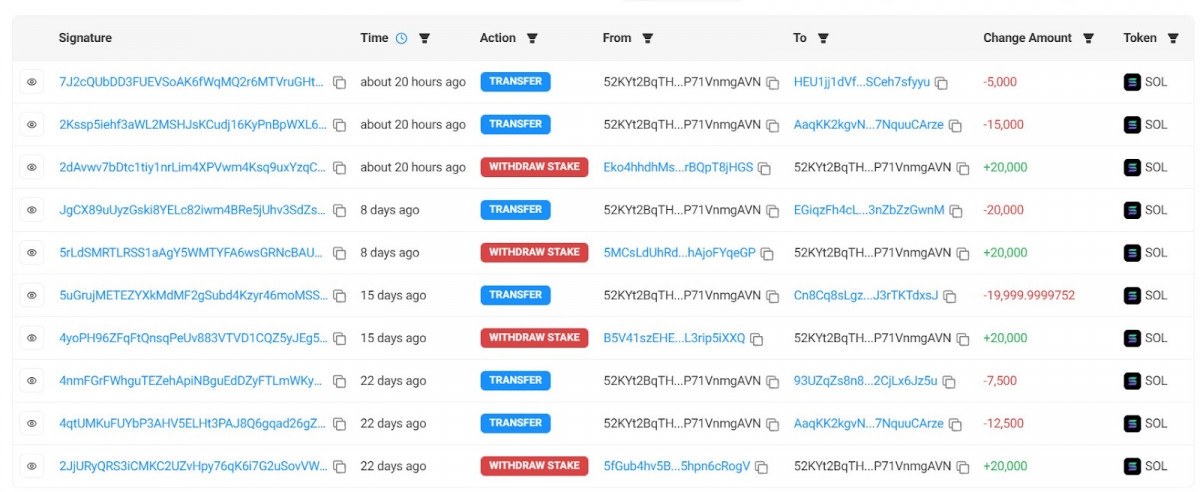

Now, let’s move over to the Ethereal side of things. Kicking off around August 12, Ether found itself under pressure, dipping to five-year lows in transaction costs. Over the weekend, median transaction fees hit rock bottom – as low as 1 gwei. This sparked concerns that the network’s activity is cooling off at an uncomfortable pace. And just to add some drama to the mix, a Solana whale decided to dump $84 million, intensifying the bearish vibes across the entire crypto space, Ethereum included.

Source: Solscan

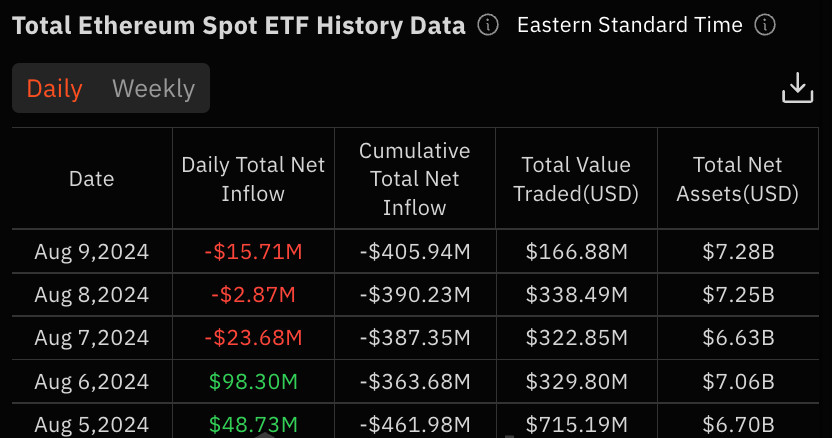

Yet, beneath the turbulence, institutional investors are far from throwing in the towel. Ether ETFs saw solid inflows in early August, with around $105 million pouring in.

Source: SoSoValue

It’s a clear signal that, despite the choppy waters, big players still see Ethereum as a cornerstone in their crypto portfolios. The recent launch of Ethereum-based ETFs further stokes that fire, proving that even in a down market, Ethereum retains its weight.

Source: Ultrasound.money

What’s more, Ethereum’s staking ecosystem quietly flexes its muscles, with over 120 million ETH now locked in. This reinforces the network’s security and gives long-term holders something to smile about.

ETH Price Analysis

In terms of pure price action, Ethereum has been mirroring Bitcoin – showing a cautious recovery after the recent crash.

Source: TradingView

On the daily chart, ETH has been fluctuating between $2,600 and $2,700 without a clear breakout in either direction. The $2,600 level serves as weak support, while the overhead 20-day and 50-day EMAs keep pressure on the price, signaling a broader bearish trend. Until ETH can reclaim $2,732, the market remains in limbo.

Source: TradingView

Zooming into the 4-hour chart, the consolidation is even clearer. After rebounding from the $2,100 low, ETH’s rally stalled at $2,700, leaving the price stuck in a range. The 50-EMA is currently acting as resistance around $2,635, preventing any upward momentum. The RSI at neutral 50 confirms the market’s indecision, as both buyers and sellers hesitate to take control.

The market feels tense, with a major move clearly on the horizon – but the direction remains uncertain. Like Bitcoin, Ether is stuck in a holding pattern, awaiting a trigger for the next big move. Reclaiming $2,800 could spark a rally toward $3,000 while losing the $2,600 support risks further downside.

Toncoin News & Macro

Meanwhile, Toncoin (TON) had a dynamic week, with big moves that boosted both its price and market perception.

The big highlight was a 10% price surge after its inclusion in Binance’s Launchpool, drawing in new investors eager to stake BNB and FDUSD for TON rewards. This instantly positioned TON as a rising star in DeFi. Adding to the momentum, TON partnered with Pyth Network by integrating real-time institutional price feeds, making it even more appealing to major players.

Michael Cahill, CEO of Douro Labs and core contributor to Pyth, commented on the partnership. He said:

“These measures are in place to give TON developers and all other supported ecosystems the confidence to build cutting-edge DeFi that will serve potentially millions of users.”

Meanwhile, TON’s user base saw explosive growth in 2024, with network addresses skyrocketing tenfold, a clear sign of its expanding influence.

On top of that, Turkey’s largest exchange, BtcTurk, listed TON, further boosting its accessibility and reach. So, are new highs on the horizon? Let’s wait and see.

TON Price Analysis

Apart from the news, TON’s price action has been pretty eventful as well. Like Bitcoin, TON has shown some serious resilience post-crash, bouncing back to previous key levels. Unlike Bitcoin, TON seems to have a lot of up-and-down momentum going on even within that consolidation.

Source: TradingView

While the price of TON managed to post higher lows since that August bottom, it’s been struggling to break cleanly through $7.00. For now, it has settled into a tight channel between $6.50 and $7.00.

Source: TradingView

Switching over to the 4H chart, we can see how TON’s been repeatedly teasing breakouts above $7.00, only to be slapped down by sellers each time. The rallies are there, but they lack the strength to follow through, leading to repeated pullbacks. Still, TON’s holding strong above $6.50, supported by the 50-EMA, while the RSI stays comfortably neutral. The market’s in a bit of a wait-and-see mode – neither overbought nor oversold, just cruising.

Supposing TON can finally clear that $7.00 resistance, we could see it take a run towards $7.50 and beyond. But if it keeps struggling at this level, another consolidation phase might be in the cards – or worse, a slip back to $6.50 or lower. So, traders, keep an eye on those levels.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.