MPost Markets: Cryptocurrency prices slump

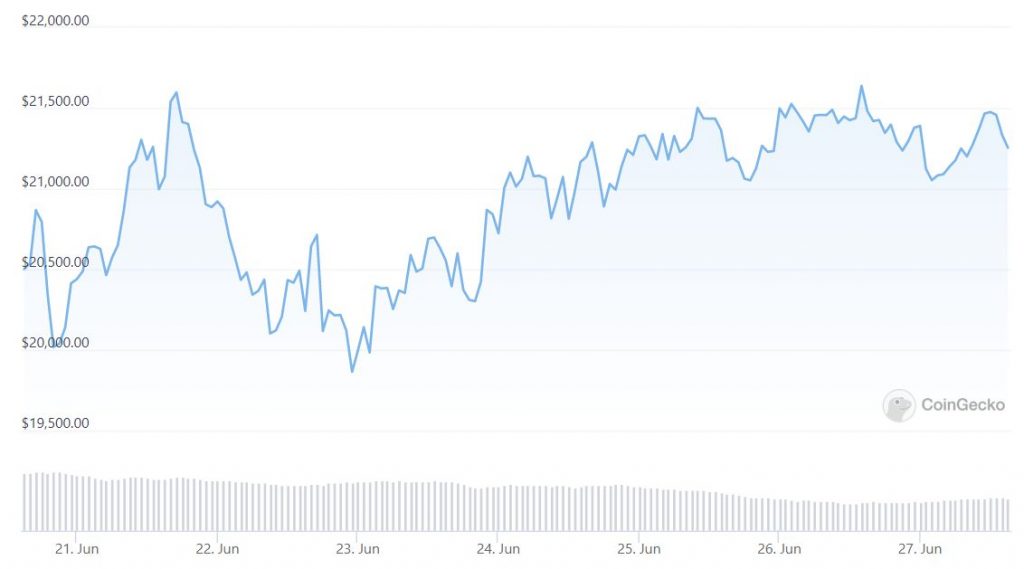

The bitcoin price still hasn’t gotten out of the slump over the weekend, similar to many other cryptocurrencies.

Bitcoin is down by 1.87% since yesterday, but the price has hardly changed over the weekend. While it traded at $21,284.90 on Friday, the price is now $21,291.59.

Ethereum’s ether has experienced a 3.92% fall since Sunday and is now trading at $1,220.00. The price has fallen just a bit over $12 since Friday. The price variation is low when it comes to other coins as well. True, the price of Binance’s BNB has slipped by 2.48%, XRP by 2.75%, and Cardano’s ADA by 3.87%. However, the prices are overall similar to what they were before the weekend.

While we probably shouldn’t hold much hope for TerraClassicUSD as the stablecoin has remained untethered to $1 for over a month, it has seen a massive price increase. Up by 282.63% over the last 24 hours and 425.26% over the seven-day period, the coin is now trading at $0.043.

The metaverse coins have seen a slightly bigger price slip since yesterday, but the prices are still higher than on Friday. Even though the price of Decentraland’s MANA has decreased by 4.72%, the coin has again taken over Flow as the first NFT cryptocurrency by the market cap. Flow, meanwhile, is down by 3.91%, The Sandbox’s SAND by 5.91%, and ApeCoin by 7.46%.

Some metaverse cryptos are seeing price hikes, however. SwftCoin SWFTC is up by 24.16% over the last 24 hours, and the price has jumped by 116.84% over the last week. Stacks ST is up by 15.47%, Handshake HNS by 5.51%, and Xeno Token by 5.38%.

The price of the Metaverse Index MVI has remained practically unchanged since Friday and is trading at $42.64.

Read related posts:

- MPost Markets: Cryptocurrencies are in the green

- DeeKay’s Animation NFT “Life and Death” Purchased for $1M by Snoop Dogg

- MPost Markets: Cryptocurrency prices rise

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Karolina is a writer and journalist with a background in literary studies. She loves exciting tech solutions and art, and NFTs are often a perfect amalgamation of the two. Outside of work, she’s a plant mom, a vintage fashion enthusiast, and a gamer.

More articles

Karolina is a writer and journalist with a background in literary studies. She loves exciting tech solutions and art, and NFTs are often a perfect amalgamation of the two. Outside of work, she’s a plant mom, a vintage fashion enthusiast, and a gamer.