Market Update: BTC Coils Near $105K, Ethereum Fizzles, TON Waits on Sentiment

In Brief

Bitcoin holds steady near \$105K amid growing adoption but sideways trading, Ethereum dips after overextending, and Toncoin drifts as the ecosystem builds quietly, awaiting stronger market sentiment.

Bitcoin (BTC)

Let’s rewind to last week first. You may remember that Bitcoin was looking spicy – we pushed hard into $105K–$106K, and for a moment, it felt like the breakout was coming any day.

BTC/USDT 4H Chart, Coinbase. Source: TradingView

But this week is… Nada. No breakdown, no breakout. Just that same sideways range. And that’s where things get interesting, because while the price has stayed steady, the news around Bitcoin has been anything but quiet.

You’ve probably noticed what’s happening on the corporate front. Bitcoin treasury announcements have been dropping like confetti. First, there was AlAbraaj Group – a major Middle Eastern restaurant chain going full BTC treasury.

Then Basel Medical – yeah, a healthcare company – announced it was doing the same.

Source: GlobeNewswire

And right as you think that’s already unexpected, along comes Ukraine, signaling it’s in the final stages of drafting a Bitcoin reserve bill. So, it’s safe to say that the whole movement is no longer fringe. It seems to have turned full nation-state level accumulation.

Source: Incrypted

But here’s the fun bit: none of that actually moved the price. Not immediately, anyway. This market doesn’t seem surprised by adoption anymore – it’s already sort of… expected? So unless we get something game-changing – like a Fed pivot or a massive ETF shockwave – BTC might just stay coiled up here a little longer.

And speaking of ETFs, we did see a bit of cooling in inflows this week. Nothing dramatic, just a tapering – which could partly explain why we didn’t get the breakout.

Bitfinex BTC margin longs, BTC. Source: TradingView / Cointelegraph

At the same time, if you dig into Bitfinex margin data, there’s been a slight pullback from the leveraged longs. A softening in confidence, or so it seems. You could interpret it as healthy (no overextension) or you could see it as a sign that the big players are waiting too.

BTC/USDT 4H Chart, Coinbase. Source: TradingView

Now, if you’re watching the chart closely, you’ll notice price action has been hugging the 20-period moving average while repeatedly rejecting the 50-SMA – a sign of pressure building, but no directional dominance yet. And, finally, the RSI is hovering in the low 50s – right around 51.6 – so the market looks pretty balanced. Not overbought, and not oversold either.

Now, this kind of tight, clean range is often the prelude to a big move. Whether that’s going to be a rip through $106K or a quick shakeout down to $99K first, is still TBD.

Ethereum (ETH)

Speaking of the ‘followers’, ETH was the early mover – ran hard last week, and then this week got hit with reality. Right after BTC hit resistance, ETH decided to front-run. It pushed through $2,500, then climbed into the $2,700s. People were dusting off the old $3K targets and prepping for ETH to lead the next leg.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

ETH loves to break out just before the market’s ready, and this time was no different. It ran hot, hit overbought RSI, and then fell straight back to $2,300. Now, part of that is tied to ETH’s fundamentals. The Pectra upgrade sure looks super promising, but its midterm impact is yet to be seen. L2 activity is still holding strong. But, let’s be honest, none of that was ‘new’ this week. So, you shouldn’t be surprised that ETH just couldn’t sustain the move.

And there’s a deeper story here about ETH’s current role. It’s still the backbone of DeFi, still the platform of choice for devs, still scaling beautifully – but from a market psychology perspective, ETH clearly isn’t leading right now. It wants BTC to set the tone – then it’ll reprice quickly. That’s probably why you saw it dive when BTC just paused.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

Technically, ETH now sits below both its 20- and 50-period SMAs, which points to a clear shift from last week’s strength. Meanwhile, the RSI has dropped sharply to around 36 – not quite oversold, but close. That’s telling us the momentum’s gone for now, but there’s room to recover if sentiment shifts.

So where does that leave us? To get back into bullish form, ETH needs to reclaim $2,500. But, even more realistically, it needs a narrative push – and that probably won’t come without BTC doing something dramatic first.

Toncoin (TON)

Meanwhile, TON had its moment last week – popped up to $3.55… and now it’s drifting again.

TON/USDT 4H Chart. Source: TradingView

But let us zoom out a bit. You’ll see that TON had one of the cleaner vertical runs earlier this month, and honestly, last week’s high near $3.55 looked like it could’ve been the start of something bigger. But, as we may see, it did not follow through. Along with the price itself, RSI dipped, momentum faded, and now we’re bouncing between $3.00 and $3.15 with barely any volume to speak of.

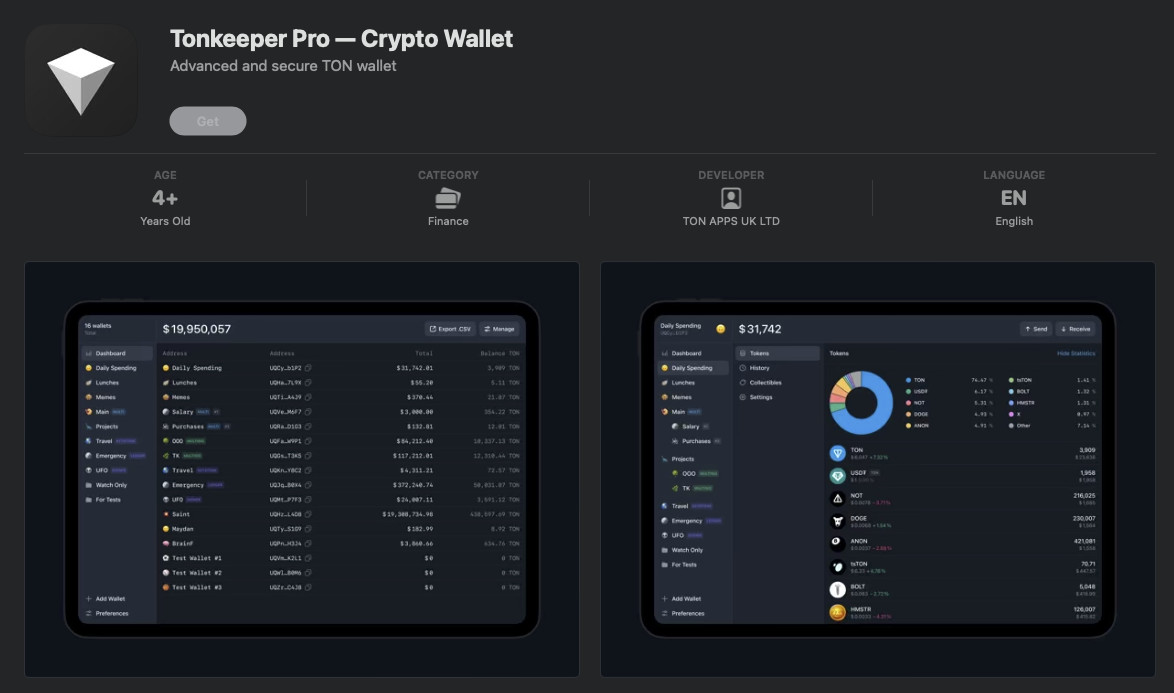

Under the hood, though, there have been some developments. For one, Tonkeeper Pro launched on iOS. That’s a meaningful infrastructure upgrade – users can now send USDT on TON without needing to hold any TRX or TON for gas, plus there’s multisig and on-chain 2FA. But again – no price reaction, or at least not yet.

Source: AppStore

We’ve also seen TON’s NFT marketplace activity surge, particularly on Telegram-native platforms like Tonnel Marketplace. That’s encouraging in terms of ecosystem traction, especially as Telegram continues to blur the lines between messaging app and crypto wallet. But NFT volume is a sentiment signal, not a driver – it needs to translate into sustained user growth and token demand to really move price.

Souce: TON – LIVE

But again – all this is still early innings. These are more like seeds being planted, not full-on catalysts popping off.

TON/USDT 4H Chart. Source: TradingView

Technically, TON’s chart confirms the drift. Price has slipped below both the 20- and 50-period SMAs, and RSI is hanging out around 41.7 – not oversold, but definitely soft. Without a reclaim of $3.15 with strong volume, it’s hard to make the bull case in the short term.

So what’s the read here? The fundamentals are still quietly improving, the ecosystem is maturing, and user activity is bubbling up – but the market doesn’t seem to care yet. And that tells us TON is still a macro follower. Until Bitcoin breaks out and risk appetite returns, TON will likely stay rangebound, no matter how clean the updates are.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.