India Soars to Become the World’s Second-Largest Crypto Market

In Brief

India soars to become the world’s second-largest crypto market, handling $268.9 billion in transactions from July 2022 to July 2023, despite high tax rates.

Central & Southern Asia and Oceania (CSAO) have emerged as major players in the global cryptocurrency landscape. Recent reports highlight India as the second-largest market, with estimated transactions worth $268.9 billion.

But beyond the raw numbers, the region is leading in grassroots adoption. While regulatory complexities in Hong Kong and high tax rates in India have posed challenges, the sector continues to flourish.

The Indian Paradox: High Taxes, Higher Adoption

Contrary to global trends, high tax rates have not deterred India’s massive demand for cryptocurrencies. The Indian government imposes a 30% tax on crypto gains and a 1% tax on all transactions.

But India is not just about sheer volume; the country also ranks high in decentralized exchanges, centralized exchanges, lending protocols, and NFT protocols. Uneven implementation of transaction taxes has led to challenges for local exchanges, but that hasn’t quashed the market’s enthusiasm.

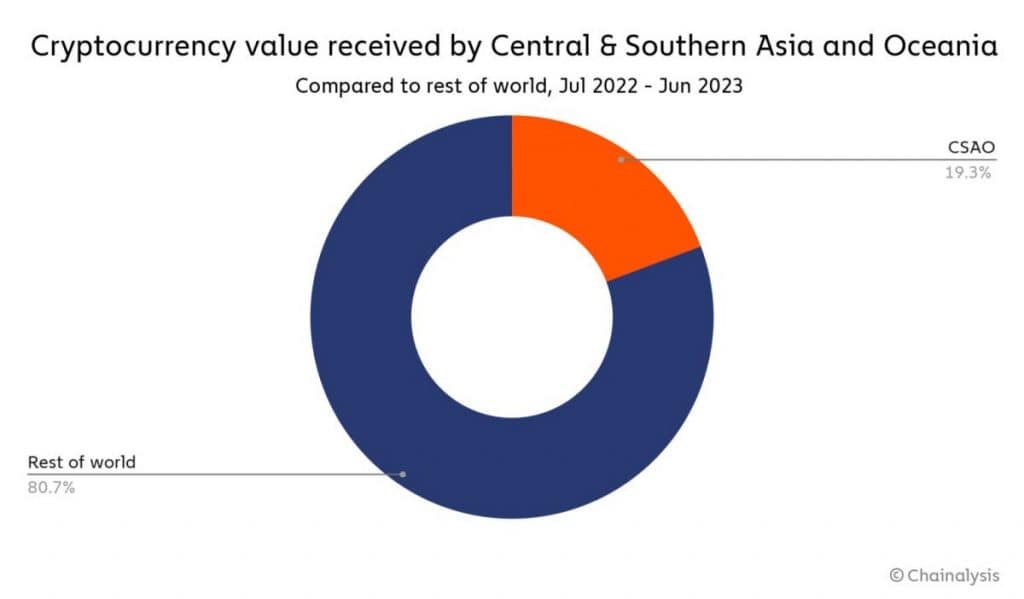

Chainalysis’ 2023 Geography of Cryptocurrency Report shows that CSAO accounts for almost 20% of global crypto activities. The region features six countries in the Global Crypto Adoption Index, including India, Vietnam, the Philippines, Indonesia, Pakistan, and Thailand. A noticeable spike in DeFi activities and institutional adoption suggests a maturing market.

The Philippine Phenomenon: Play-to-Earn

The Philippines has made headlines for its receptivity to play-to-earn games like Axie Infinity, particularly during the COVID-19 pandemic. The craze for these games has led to broader cryptocurrency adoption, setting the stage for more advanced uses of digital assets.

The country is also benefiting from regulatory sandboxes and private sector initiatives, paving the way for what some believe could become the “blockchain capital of Asia.”

While the Philippines leans towards gaming and speculative trading, Pakistan’s crypto adoption is primarily driven by necessity. With inflation rates soaring, many Pakistanis are turning to cryptocurrencies, especially stablecoins, as a hedge against economic instability. Although trading is currently banned, there are signs that the government is beginning to consider regulatory frameworks that could further legitimize the use of crypto.

Regulatory Hurdles and Future Prospects

The JPEX rugpull incident in Hong Kong has led to calls for more robust regulation and investor education. Authorities across CSAO are grappling with the need for balanced regulations that promote innovation while protecting investors.

CSAO is not a monolithic block; it’s a complex tapestry of varying rates of adoption and regulatory landscapes. Yet, the region offers crucial insights into how different economic and social factors drive cryptocurrency usage.

Whether it’s the gaming fervor in the Philippines or the economic necessities in Pakistan, CSAO exemplifies the diverse ways in which cryptocurrency can adapt to local needs and conditions, thereby solidifying its role in future financial ecosystems.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.