How RWA Tokens Are Driving the Latest Crypto Market Surge

In Brief

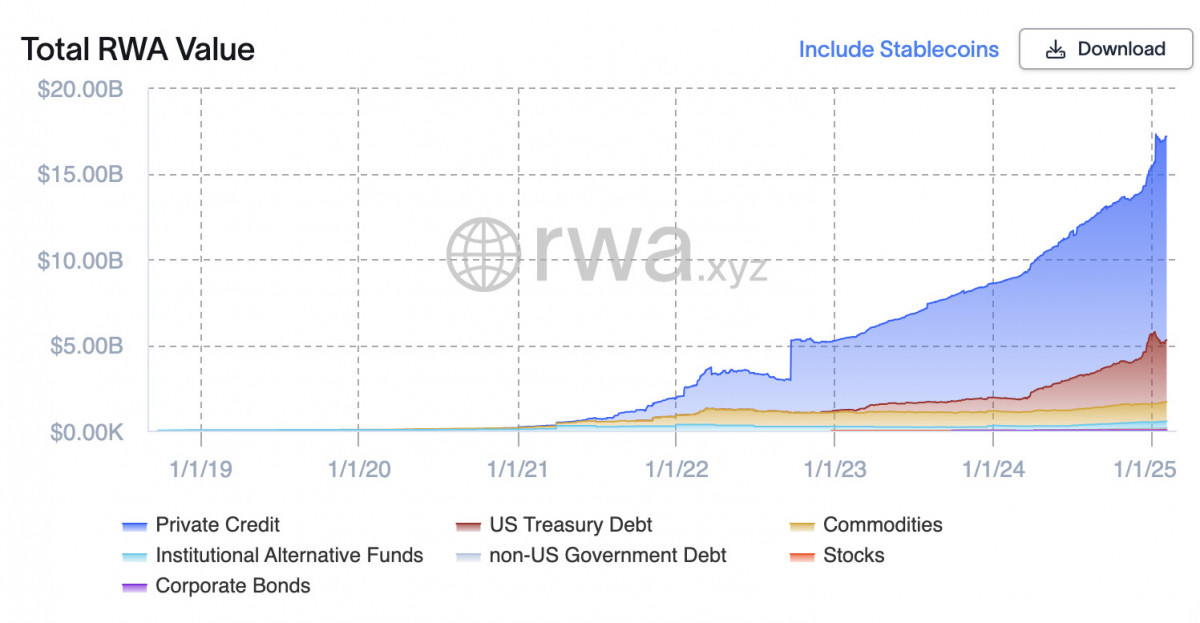

The cryptocurrency ecosystem is witnessing a significant shift with the resurgence of real-world asset tokenization marketplaces, with total value locked on-chain now at $17.1 billion.

The revival of real-world asset tokenization marketplaces indicates an important change in the cryptocurrency ecosystem. The industry has regained its prominence, with total value locked on-chain now standing at $17.1 billion. This rise, which has almost doubled in the last 12 months, demonstrates how tokenized assets are becoming important forces behind the larger recovery of digital assets.

Photo: RWA.xyz

Leading Market Gains for RWA Tokens

RWA-related tokens outperformed the sector as a whole in the February 3 crypto market recovery. Notably, after falling to $17, Chainlink (LINK) recovered the $21 level with a 22% increase. Similar rises of 23% and 27% were seen by Mantra (OM) and Ondo Finance (ONDO), respectively, indicating a resurgence of interest in blockchain-based asset tokenization. Singapore’s Monetary Authority-regulated Chintai (CHEX) saw a 38% increase, indicating a demand for legal tokenized financial products throughout the world.

This result is consistent with macroeconomic trends. Investor fears have eased as a result of the temporary suspension of U.S. tariffs on Canada and Mexico, creating a situation that is favorable to risky assets like cryptocurrencies. Digital assets, especially RWAs, are gaining from capital rotation as traditional markets respond to regulatory changes.

Speculative trading is not the only factor contributing to the increase of RWA tokenization. Major financial organizations and institutional players are progressively establishing themselves in this market. RWA.xyz reports that U.S. Treasury debts account for 21% of the sector’s TVL, while private credit accounts for approximately 70% of the on-chain value of tokenized assets. The rest consists of commodities, stocks, and tokenized real estate.

The increasing involvement of Wall Street demonstrates a shift in the way that blockchain is seen by traditional finance. Financial giants like BlackRock and Franklin Templeton are aggressively investigating blockchain-based assets, and analysts point to the estimated $30 trillion market potential of asset tokenization. According to Andrey Kuznetsov, co-founder of Haqq Network, conventional banking executives are getting ready for a future in which tokenized RWAs will be crucial.

Market Rotation and the Rise of Alternative Assets

The most recent cryptocurrency comeback has shown changing investing trends. RWAs are becoming more and more popular as a more reliable and utility-driven substitute for DeFi and NFTs. Pav Hundal, head analyst at Swyftx, called the increase as a “speculative rotation,” implying that investors are rediscovering the importance of tokenization initiatives that combine blockchain and traditional financial markets.

This change is most seen in the rising demand for tokenized US Treasuries. Ondo Finance has introduced Nexus, a solution that enables the immediate minting and redemption of tokenized Treasury issues. Institutional investors seeking blockchain-based exposure to fixed-income markets have shown an interest in the platform. Such trends suggest that RWAs are generating speculative returns and emerging into functioning investment products.

Regulatory Developments and Global Expansion

Regulation is an important aspect in the growth of RWA markets. Recent policy moves in the United States indicate a more permissive approach to tokenized assets. Centrifuge’s general counsel, Eli Cohen, anticipates the Trump administration to loosen regulations on digital asset tokenization, promoting further growth in the field.

Simultaneously, legislative certainty in places such as Singapore and the Middle East encourages new projects. MANTRA, a layer-1 blockchain designed specifically for RWA applications, has announced a billion-dollar asset tokenization cooperation with Dubai’s DAMAC Group. Such agreements highlight the growing integration of blockchain into established businesses ranging from real estate to institutional finance.

Bitcoin’s Influence and Overall Market Impact

Bitcoin’s comeback has set the ground for renewed optimistic enthusiasm in the cryptocurrency market. While BTC’s 4% increase looks tiny in comparison to the double-digit gains of RWA tokens, it represents an additional sign of rising investor confidence. The CoinDesk 20 Index, which measures large-cap crypto assets, rose 2%, adding to the notion of a long-term recovery.

Photo: CoinGecko

RWA assets are profiting from the increased optimism, with trading firms like Wintermute reporting a 200% gain in TVL last year. The tokenization of government securities, in particular, has spurred this growth, indicating a greater institutional embrace of blockchain-based financial instruments.

The trend of tokenized RWAs points to a fundamental change in financial markets. The sector’s fast growth, aided by legislative changes and institutional support, is altering investing strategies. Tokenization’s transformational potential has been stressed by leading financial voices such as BlackRock CEO Larry Fink and Robinhood’s Vlad Tenev. Their requests for regulatory clarification reflect the broader recognition of blockchain as a credible financial infrastructure.

Tokenized RWAs might become one of the most important blockchain applications. The potential to connect traditional assets with decentralized finance makes a strong argument for long-term adoption. While volatility remains a problem, the growing engagement of global banks, asset managers, and governments suggests that the emergence of RWAs is not a passing trend.

The return of RWA tokenization markets is indicative of a bigger shift in digital asset investing. As the sector achieves fresh all-time highs, its influence goes beyond speculative profits, providing a look into the future of blockchain-based banking. With institutional investors understanding the benefits of tokenization, RWAs might become a key component of global financial markets in the coming years. The continuing growth of legislative frameworks and technology breakthroughs will decide the rate of adoption, but the momentum behind tokenized assets is evident.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.