Gemini Clarifies $282M Withdrawal Before Genesis Bankruptcy, Dispelling Speculations

In Brief

Gemini took to X (formerly Twitter) to clear the air about allegations of its $282 million withdrawal from Genesis.

The crypto exchange said it withdrew $282 million of Earn users’ funds from Genesis on August 9, 2022 and held those funds in the liquidity reserve for their benefit.

Gemini today took to X (formerly Twitter) to debunk a New York Post story which alleged that the crypto exchange “secretly withdrew $282M before Genesis collapse.”

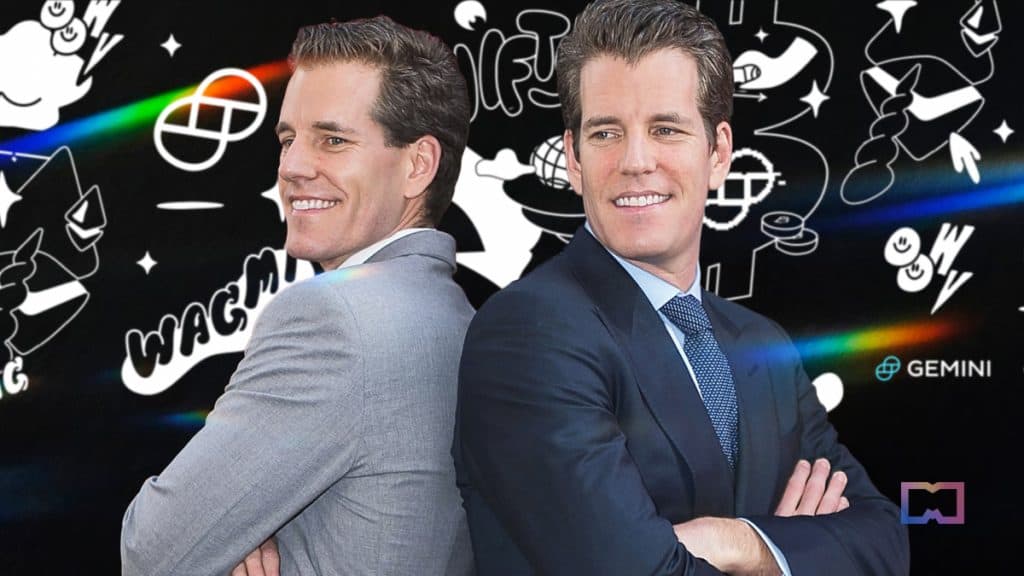

According to an undisclosed source, The New York Post claimed that the Winklevoss Twins, co-founders of Gemini, withdrew their personal funds from the crypto lender.

Today, Bloomberg also reported that Gemini withdrew millions from Genesis months before the crypto lender’s bankruptcy filing, citing two people familiar with the matter. Digital Currency Group’s Genesis was the lender for Gemini’s Earn program.

Setting the record straight, Gemini stated on X that “the $282 million that was withdrawn from Genesis in August 2022 was in fact Earn users’ money.” It also clarified that the assets were neither Gemini corporate funds nor the personal funds of the exchange’s founders and their investment firm, Winklevoss Capital.

We are disappointed that the @nypost has chosen to recklessly publish a completely misleading story about the Gemini Earn program. Everything the Post alleges in its story is the exact opposite. The $282 million that was withdrawn from Genesis in August 2022 was in fact Earn…

— GeminiTrustCo (@GeminiTrustCo) September 28, 2023

The exchange said that the terms of the Earn Program allowed Gemini to create a “liquidity reserve” aimed at benefiting Earn users by retaining a portion of the funds they deposited into the program.

On August 9, 2022, Gemini withdrew $282 million from Genesis and allocated it to the liquidity reserve amidst the market downturn.

“In hindsight, this proved to be a wise and prudent decision,” Gemini stated. “As a result of our risk management, Earn users had $282 million less exposure to Genesis when Genesis halted redemptions on November 16, 2022.”

The Feud Between Gemini and Genesis

The conflict between Gemini and Genesis began in the aftermath of FTX’s collapse last November. As the FTX contagion spread, Genesis froze customer withdrawals and subsequently filed for bankruptcy. Genesis revealed that its derivatives trading arm had approximately $175 million locked up in FTX at the time.

in January, the SEC brought charges against both Gemini and Genesis related to an alleged unregistered securities offering associated with the Earn program.

Genesis, Digital Currency Group (DGC), Gemini, and other creditors reached an initial agreement in February to recover assets amidst the bankruptcy. However, the agreement fell through.

In July, Gemini sued DCG and its CEO Barry Silbert as it tried to recover $1.1 billion from Genesis. The crypto exchange alleged that DCG and Silbert committed “fraud and deception,” according to the filing.

In today’s post on X, Gemini called the New York Post’s story “pure fantasy” and claimed that Silbert had prearranged the New York Post article to influence public opinion.

“But of course, the Post is a tabloid — not a serious financial publication — and clearly willing to launder the lies of Barry Silbert and DCG in exchange for clicks, even if it means deceiving their readership,” Gemini said.

In response to Gemini’s post, users said that funds in the Earn program have been locked up for over a year and questioned why the exchange has not returned their funds.

“As a user who has had their coins locked for nearly a year- we’re frustrated, angry and have lost trust in you. I’m to the point of saying “just give me my coins back and you can keep the interest it was earning.” Just give me an option…,” one user stated.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.