From Fear to Greed: Will September Be a Game-Changer for Cryptocurrencies?

In Brief

Bitcoin’s market value surged from $45,500 to $64,000, indicating resilience and optimism among traders and investors, with a 40% recovery expected until September.

In recent weeks, Bitcoin, the cryptocurrency with the greatest market value, has shown incredible resiliency, rising from a low of $45,500 to heights exceeding $64,000. Traders and investors are feeling more optimistic now that the market has recovered 40%, and many are looking forward to a strong rebound that might go until September.

Photo: CoinGecko

Macro Aspects at Work: The Fed’s Effect on Cryptocurrency Markets

The recent success of the cryptocurrency market is inextricably linked to more general macroeconomic variables, especially the US Federal Reserve’s evolving monetary policy position. Recent remarks made by Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium have paved the way for possible interest rate lowering, which may have major implications on volatile assets like crypto.

Powell remarks that the job market has substantially cooled and that inflation is on a sustainable road back to the 2% objective, which indicates a turning point in the US economy. Since March 2022, the Fed has maintained high interest rates as a defining feature of its policy. These measures were taken to counteract the effects of substantial monetary stimulus during the COVID-19 epidemic, which included soaring inflation and an overheated labor market.

Powell’s admission that “the negative hazards to employment have increased” and that “the positive risks to inflation have decreased” now appears to have laid the ground for a policy change that would benefit investors and maybe spark a Bitcoin bubble.

This change in monetary policy is part of a larger trend. The cryptocurrency industry has been facing a number of difficulties, including governmental scrutiny and worries about the impact on the environment. On the other hand, assets valued in dollars, like Bitcoin and Ethereum, can become more appealing to investors looking for alternative value stores due to the possibility of higher liquidity in traditional markets, which is usually linked to lower interest rates.

Institutional Trust and the Dynamics of the Market

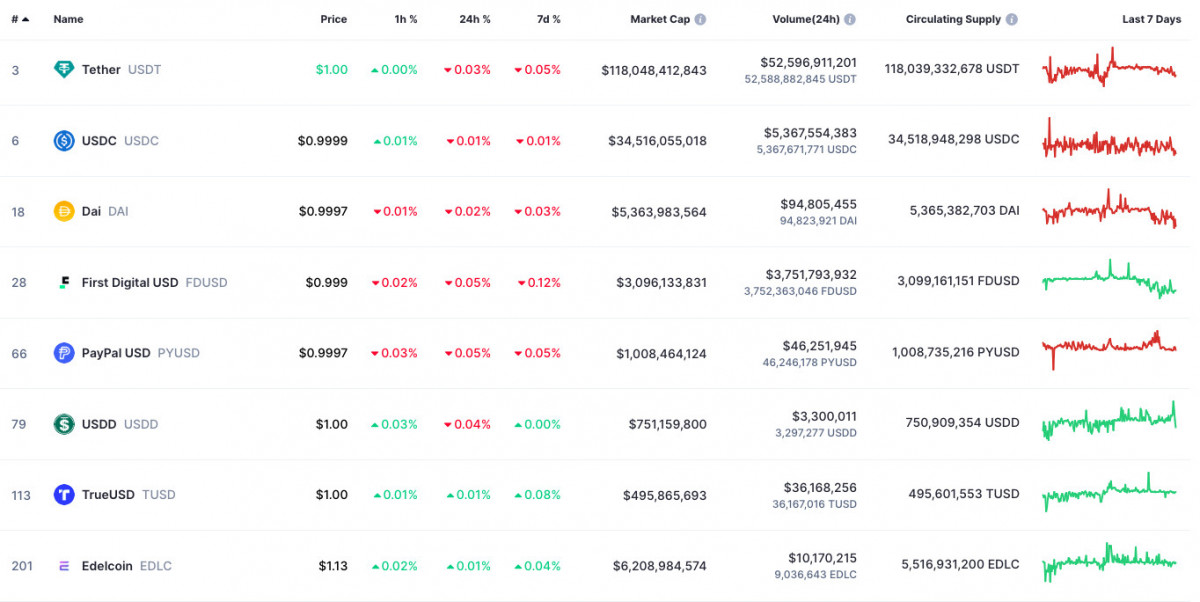

The increase in stablecoin market value provides more proof of the interaction between macroeconomic variables and cryptocurrency markets. Stablecoins’ overall market capitalization increased from $163.8 billion to $169.8 billion in August alone, indicating a robust $6 billion net issuance. This rise is more than just a figure; it’s a sign of consistent money entering the cryptocurrency field and strong market liquidity.

Photo: CoinMarketCap

There is still a lot of institutional interest in cryptocurrencies, especially Bitcoin. As of the end of August, there has been a net inflow of $17.86 billion into Bitcoin ETFs, demonstrating the conventional financial sectors’ ongoing faith in the feasibility and growth potential of cryptocurrencies. Wall Street’s endorsement of cryptocurrencies as an alternative investment might act as a cushion against future market downturns and increase their attractiveness.

Yet, there are challenges to success. The market for cryptocurrencies is still scarred from August’s volatility, which serves as a clear warning of the hazards associated with this asset class. In addition, possible headwinds are approaching. Market volatility might be caused by the unquantifiable danger posed by the U.S. government’s asset movements. Comparably, the recent transfer of 35,000 ETH by the Ethereum Foundation to Kraken for possible sale has sparked worries of widespread sell-offs by other investors who are apprehensive about future price declines.

Will History Repeat or Be Rewritten in September?

September frequently saw market declines as a result of profit-taking following summer advances. This month, there is a tendency for the general volatility of Bitcoin, which is impacted by regulatory changes and macroeconomic situations, to intensify these negative pressures.

However, especially in a market as volatile as cryptocurrencies, previous success does not always predict future outcomes. September Bitcoin prices may find support from the present macroeconomic climate, which is marked by possible interest rate reductions and more liquidity, defying past patterns.

According to Bitget Research Chief Analyst Ryan Lee, prices for Bitcoin may be as high as $54,000 to $72,000 in September, while prices for Ethereum could be as low as $2,250 to $3,350. Even while these estimates are positive, it should be noted that the market is still vulnerable to unanticipated developments, especially if there is a major drop in the US dollar index.

Further evidence for a September surge comes from on-chain data. According to Glassnode, Bitcoin now controls a “staggering” 56% of the whole cryptocurrency market valuation. A portion of this tendency may be ascribed to long-term holders who, despite market pressure, kept their strong convictions throughout this cycle and kept adding Bitcoin. Due to its tendency to decrease the amount of Bitcoin that is available for purchase, this behavior frequently comes before notable price changes.

Managing Uncertainty: Crucial Elements to Pay Attention to

It’s important to remember, though, that the cryptocurrency market is infamously erratic, and a number of things might affect how it develops over the next several weeks. Regulatory actions, geopolitical events, and changes in investor mood may all influence whether September will witness a return to volatility or a continuation of the recent price rebound.

The increasing use of cryptocurrencies by companies and institutional investors introduces an additional level of complexity to the dynamics of the market. The link between traditional financial markets and cryptocurrency markets may increase as more established financial institutions include Bitcoin and other digital assets in their portfolios. Long-term stability may result from this, but in the short run, cryptocurrencies may be more vulnerable to larger market pressures.

The attitude of the market is still influenced by the environmental issues around Bitcoin mining, which have been a source of debate in recent months. However, the industry’s drive for more ecologically friendly mining methods and the rising usage of renewable energy sources should allay some of these worries and perhaps draw in eco-aware investors.

The Crypto Fear & Greed Index indicates a notable improvement in market mood. After only a few days, the index’s scores more than quadrupled, going from “extreme fear” to bordering on “greed.” This change implies that the typical crypto investor’s perspective has quickly changed, which may be paving the way for more optimistic market behavior.

Photo: Alternative

After a period of difficult conditions, the mining industry—a vital part of the Bitcoin ecosystem—is beginning to revive. According to the most recent predictions, mining difficulty is expected to improve by 2.8% this week after falling by 4.2% during its most recent automatic adjustments.

As a result, the measure will be very near to its all-time high, negating the impact of the early August decline in BTC prices below $50,000. The raw hash rate measurements point to an increase in the amount of processing power used for mining; on August 23, a new all-time high spike of 774 exahashes per second was observed.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.