From Bytes to Barns: How Tokenized Real-World Assets Are Changing Sustainable Agriculture and Beyond

In Brief

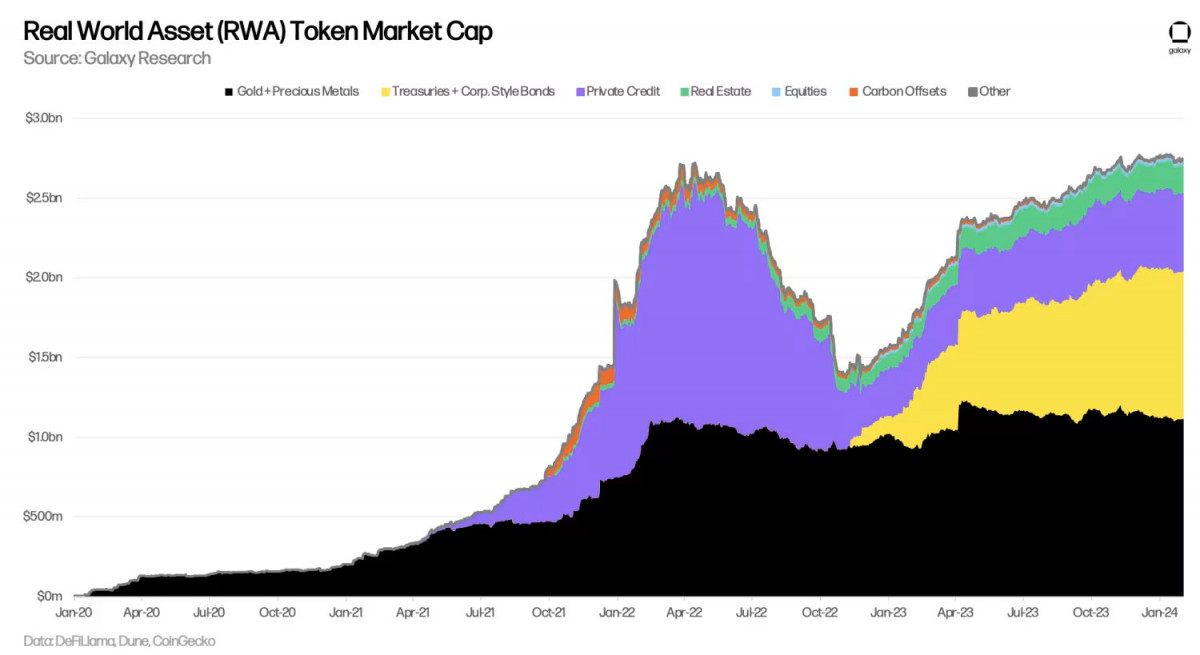

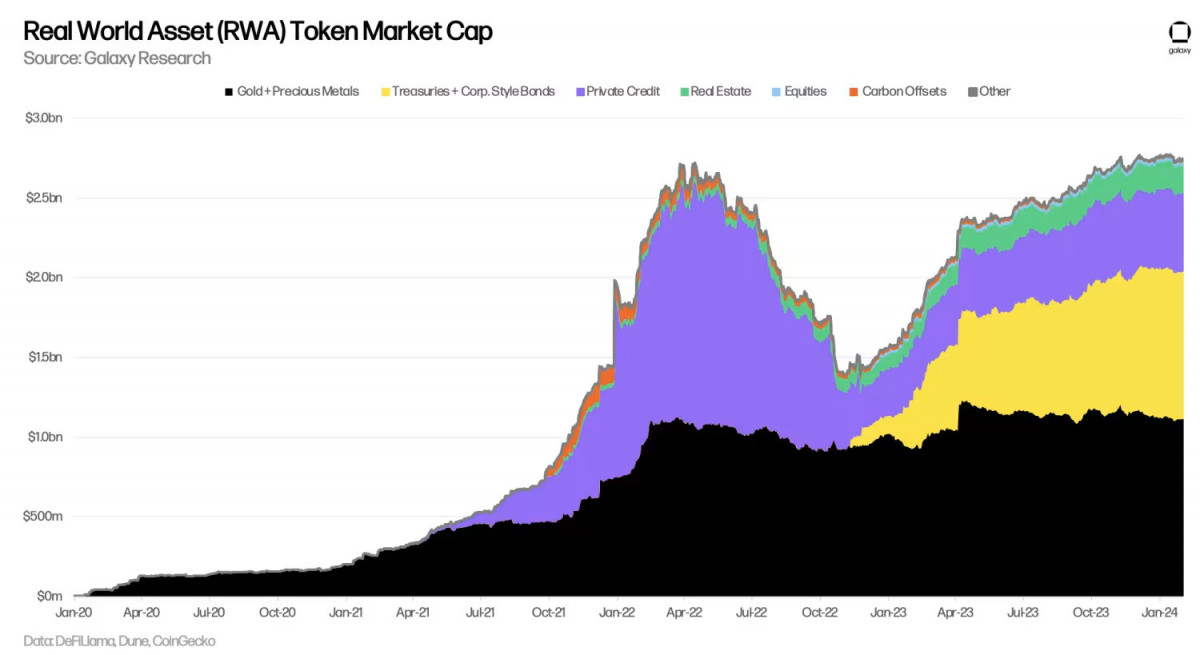

RWA tokenization, expected to reach $8 billion in 2024, digitizes tangible assets, aiding sustainability initiatives and providing transparent reporting for ESG finance options.

RWA tokenization has acquired a lot of popularity in recent years; according to blockchain analytics company Messari, the sector is expected to reach $8 billion in total value locked (TVL) in 2024 alone. This novel approach, which turns tangible assets into blockchain-tradable tokens, is currently being used to facilitate and advance sustainability initiatives in a number of industries.

Tokenized RWAs are beneficial in achieving a number of sustainability objectives. These tokens establish an open and comprehensible system for reporting and fulfilling regulatory requirements by digitizing sustainable assets, including the results they have, waste reduction, and quantifiable real-world consequences. This is especially important for businesses looking for finance options related to ESG.

Photo: Galaxy

Studies reveal that a considerable proportion of businesses acknowledge engaging in greenwashing, indicating that transparency is still a top priority in sustainability initiatives. By offering an unchangeable record of operations and data about assets on a public ledger, tokenized RWAs solve this problem by boosting accountability and lowering the possibility of making false claims regarding environmental effects.

Empowering Smallholder Farmers Through Tokenization

Dimitra is an initiative that assists smallholder farmers and demonstrates one noteworthy use of tokenized RWAs in sustainable agriculture. Dimitra makes it possible to partially own assets like cocoa plantations and avocado trees by tokenizing crop farms. This system gives farmers access to modern tools for quality evaluation, production optimization, and surveillance of crops.

Through the creation of “digital twins” of farmed assets, Dimitra’s method enables blockchain-based asset tracking and information access for farmers and other stakeholders. The benefits of this transparency are felt by farmers, vendors of inputs, authorities, carbon credit auditors, and crop exporters along the whole value chain. In order to give local farmers access to enterprise-grade tech solutions and improve production transparency, Dimitra and OMA collaborated to digitize 10,000 avocado trees on the Polygon in Kenya.

Due to its effectiveness, the Amazon Cacao Project has been expanded to other areas, including Roraima in Brazil. The objective of this effort is to enhance productivity and diversify agricultural processes for local farmers by extending the regions under cocoa production and using contemporary agricultural techniques.

Additionally, tokenized RWAs are being used to solve global issues like water shortage. Through a decentralized network, LAKE, a firm offering a “New Water Economy,” connects water providers to customers, companies, and communities directly using a tokenized method. Water is not tokenized by LAKE, but it is made accessible through the usage of its ecosystem and LAK3 token, which enables token holders to purchase, sell, secure, give, and invest in water sources.

Challenges and Future Prospects of Tokenized RWAs in Sustainability

The use of tokenized RWAs for sustainability confronts a number of obstacles despite the possible advantages. It is still challenging to verify that the underlying assets of tokenized RWAs actually satisfy certain sustainability standards; this calls for third-party audits and certification procedures. Inconsistencies and distrust may result from the industry’s lack of consistency in measuring and reporting.

The legal frameworks governing tokenized RWAs are sometimes ambiguous and differ between nations. To maintain safe and legal operations, this calls for close adherence to national legislation. Additionally, growers and farmers who may not be familiar with these technologies may become confused due to the intricacy of blockchain principles and terminology.

Tokenized RWA proponents, however, think that its implementation will soon be required due to the need for more sustainable techniques in the agricultural industry and other areas. As the worldwide focus on sustainability develops, the built-in mechanisms of RWAs decrease risks within supply chains by offering a permanent record of operations.

There is plenty of room for development in the tokenized asset market; estimates indicate that the market might reach $16 trillion by 2030. The potential for tokenization to open up new investment options across a variety of asset classes, including U.S. Treasuries, fiat currencies, equities, and commodities, as well as growing interest from traditional financial businesses, are the main drivers of this expansion.

Photo: mezen

GRWAs, or sustainable and green real-world assets, are particularly attractive for tokenization. These resources, which include waste management, carbon offsetting, and renewable energy initiatives, are all centered on environmental sustainability. Tokenization allows a wider variety of investors to engage in initiatives that were previously only available to large institutions or affluent people by facilitating fractional ownership and trade of these assets.

The potential of GRWAs is demonstrated by creative efforts like the TREE Token. With the help of this crypto-impact fund for forestry and climate, 100 million trees and plants will be planted in agroforestry climate initiatives over the course of five years, possibly producing 33 million tons of CO2 equivalent. The TREE Token facilitates public co-investment in climate-positive agroforestry initiatives, offering possible financial rewards in addition to environmental advantages.

Rebalance Earth is another example; it is creating a token to encourage the preservation of priority species that are essential for ecological resilience and carbon capture. This project serves as an example of how tokenization may stimulate conservation efforts and open up new marketplaces for environmentally friendly products.

Asset tokenization has environmental advantages that go beyond particular initiatives. Tokenization lessens the need for physical documentation and distribution by digitizing assets and facilitating their transfer and ownership using blockchain. This lowers energy usage and greenhouse gas emissions. This digital strategy also reduces the amount of resources used, especially paper, which helps to lower pollution and deforestation.

Are GRWAs Even Beneficial?

Eco-friendly tokenization is already showing clear advantages in real-world applications. One initiative that encourages the use of energy-efficient washing machines and lowers water and energy usage is the EcoWash token project. Asset tokenization has been used in supply chain management by organizations such as IBM to improve transportation routes and lower fuel and greenhouse gas emissions.

The promise of blockchain in environmental preservation is exemplified by the tokenization of carbon credits, as exemplified by platforms such as Climate Trade. These platforms provide the efficient and transparent trade of carbon credits, assisting companies in more efficiently offsetting their carbon footprints and aiding in the worldwide fight against climate change.

Other noteworthy examples are Plastic Bank, which employs tokenization to combat plastic pollution and encourage recycling, and Power Ledger, which facilitates peer-to-peer trade of renewable energy. To boost funding for clean energy projects, WePower tokenizes the generation of green energy, while Veridium Labs tokenizes natural resources and carbon offsets to promote conservation and sustainable land management.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.