From $0.42 to $4,800: The Epic Journey of Ether and Its Market Evolution

In Brief

Ether, a blockchain startup founded in 2015, revolutionized the cryptocurrency industry with smart contracts and decentralized apps, becoming the second-largest digital asset by market capitalization.

Ether has had a remarkable journey since its introduction in 2015, changing the cryptocurrency landscape and rising to the position of the second-largest digital asset by market capitalization. Ether, a blockchain startup founded by visionary engineers led by Vitalik Buterin, pioneered the blockchain industry’s adoption of smart contracts and decentralized apps.

This development distinguished Ether from Bitcoin and other cryptocurrencies, turning it into a network for creating decentralized apps and giving rise to a whole network of blockchain-based businesses.

This in-depth article will look at the major occasions, technological innovations, and market dynamics that have influenced Ether’s price over time. It will give us a better understanding of the variables influencing its price fluctuations and possible future course.

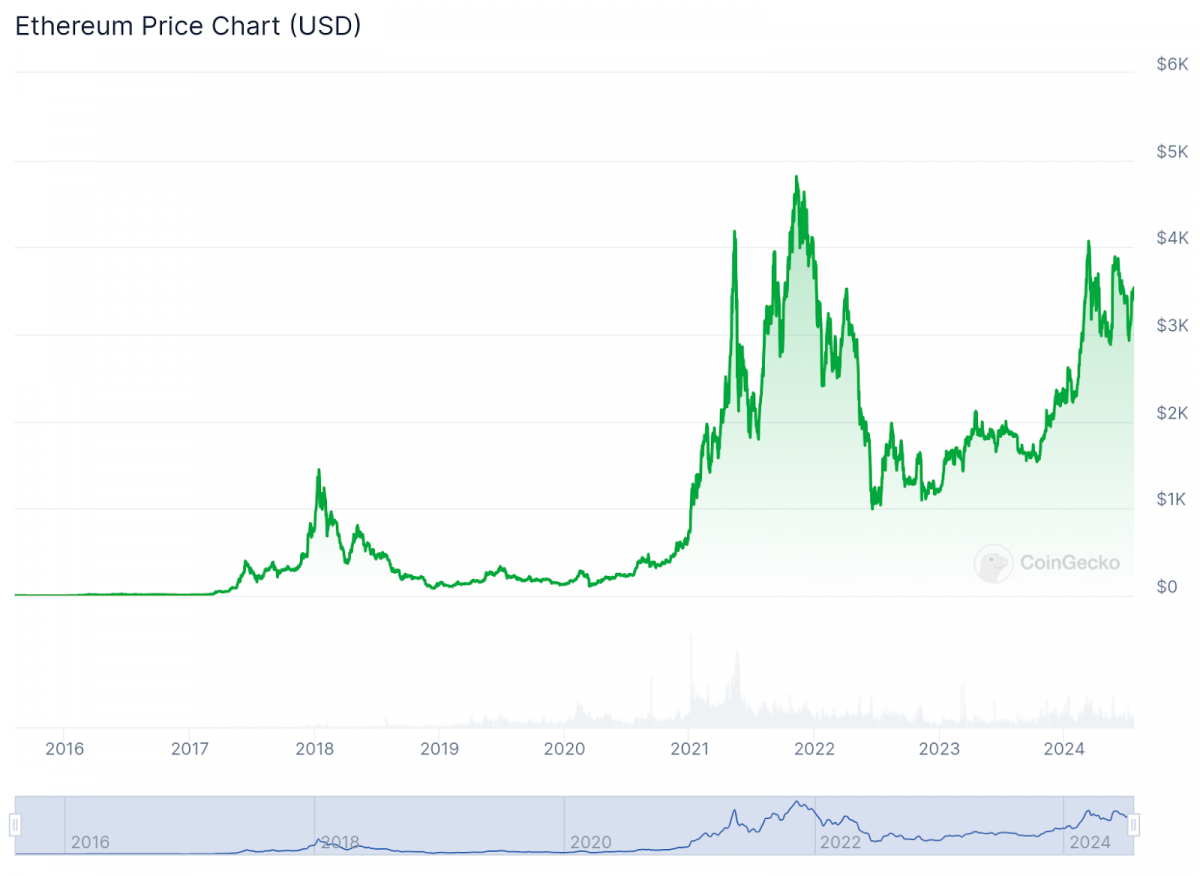

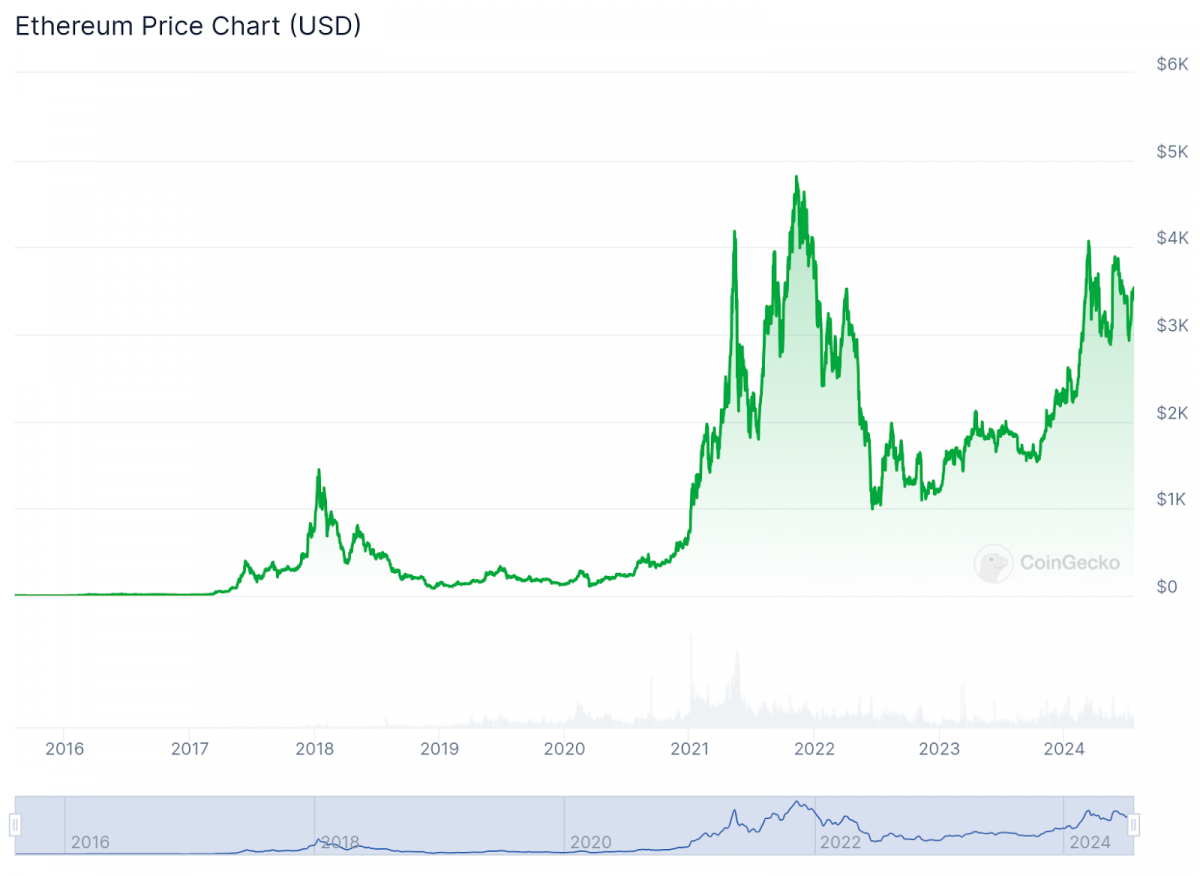

Photo: CoinGecko

The Early Days: 2013-2016

Conception and Launch

The inception of Ether dates back to late 2013 when Vitalik Buterin put out the idea of a blockchain platform capable of facilitating decentralized apps and smart contracts. The cryptocurrency community embraced this innovative concept right once, and in August 2014, a successful crowdfunding effort was launched.

With Ether’s official launch on July 30, 2015, a new chapter in blockchain history began. Ether (ETH), the native coin of Ether, was only worth $0.42 at inception. This first valuation reflected the project’s early stage and the limited awareness of its potential.

First Year of Trading

For the most part of its first year of existence, ETH started at about $0.75 and traded below $1. The project was still in its early stages, so this was a time of low awareness and limited adoption. However, the roots of future development were being sown as developers and early adopters began to explore the platform’s potential.

2016: Growing Popularity and the DAO Hack

In 2016, Ether started to acquire substantial traction. From less than $1 at the start of the year to more than $20 by the middle of the year, the price of ETH started to grow. The growing interest in the platform’s potential and the introduction of the first sizable Ether-based Decentralized Autonomous Organization (DAO) were the main drivers of this upsurge.

Yet, the bliss did not last long. A major setback happened in June 2016 when the DAO was breached, allowing about $50 million worth of Ether to be stolen. This incident shocked the Ether community and the larger cryptocurrency market, which resulted in a precipitous drop in the price of ETH.

The DAO attack sparked a divisive hard fork in the Ether network that gave rise to Ether Classic (ETC) and brought to light the difficulties associated with security and governance in decentralized systems. Ether proved resilient and maintained faith in the project’s potential by ending the year with a price hovering around $8 despite this setback.

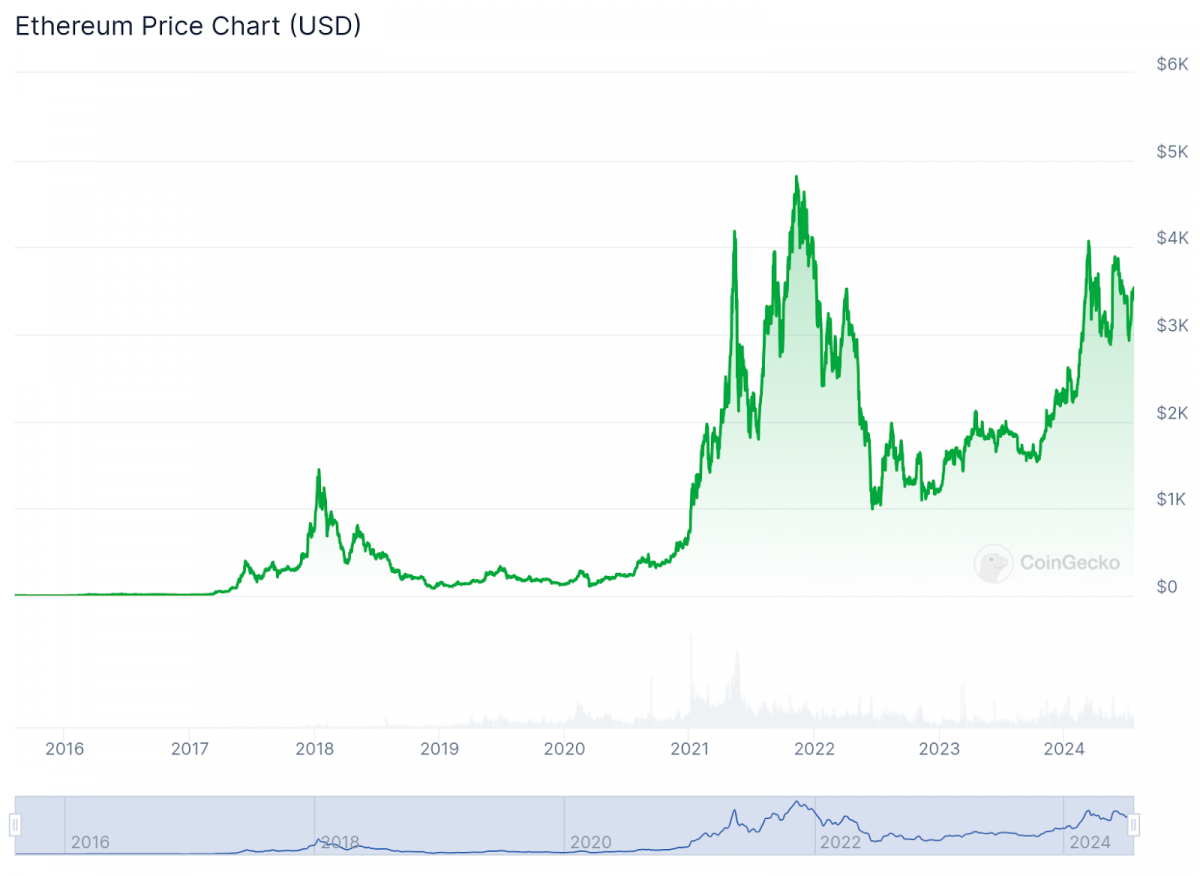

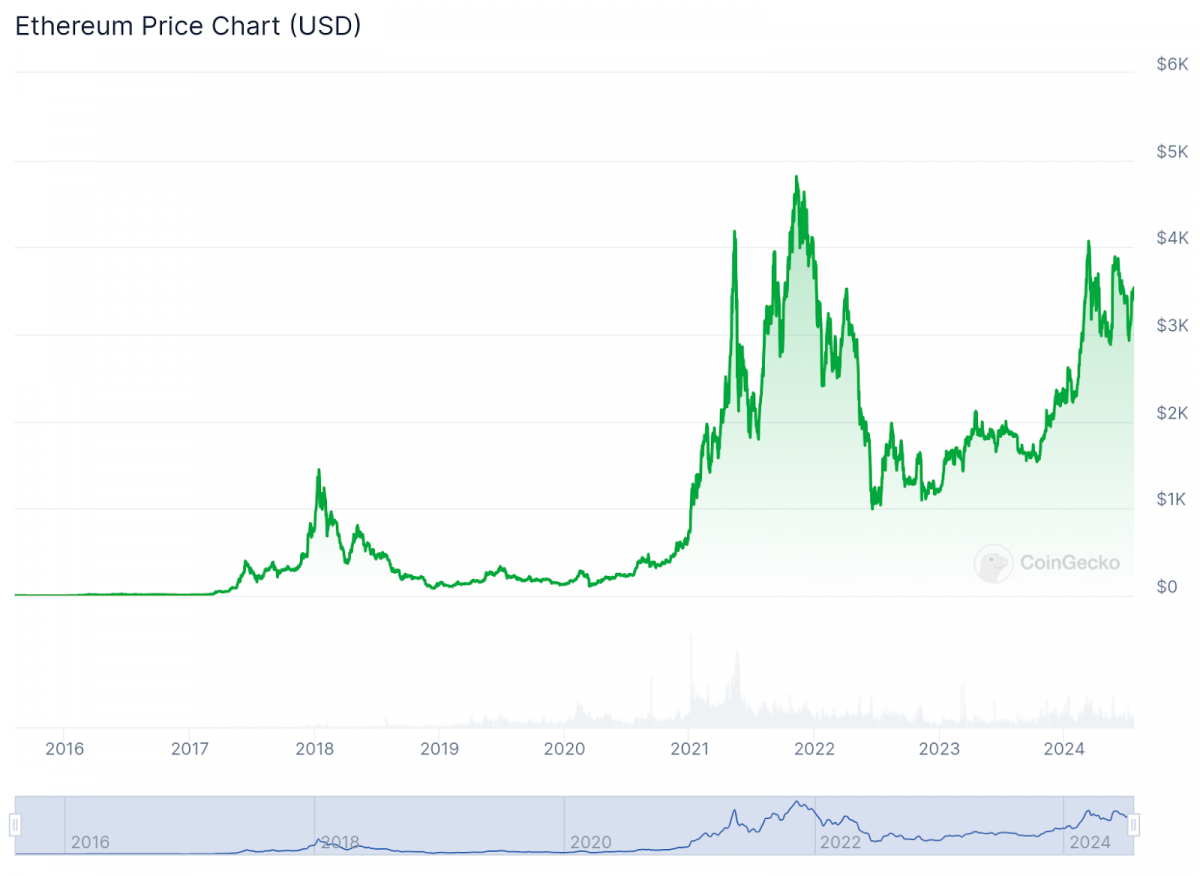

Photo: CoinGecko

The Bull Run of 2017: Ether Goes Mainstream

The year 2017 was historic for Ether and the cryptocurrency sector as a whole. Ether’s value skyrocketed as digital currencies attracted a lot of attention.

First Half of 2017

ETH started the year trading at roughly $8 but swiftly gained momentum. The cost had quickly increased to about $400 by June. This phenomenal expansion was driven by multiple factors:

- Rising adoption of the Ether platform across various sectors;

- The surge in Initial Coin Offerings (ICOs) leveraging Ether’s infrastructure;

- Broad-based bullish trend in the cryptocurrency market.

Second Half of 2017

The latter half of 2017 saw even more remarkable progress. Ether, along with the broader cryptocurrency market, entered a period of euphoria. By the end of the year, ETH had surged to an all-time high of around $1,400, representing a staggering increase of over 17,000% from the beginning of the year.

This period of exuberance attracted significant media attention and drew in a wave of new investors, further fueling price speculation. The dramatic rise of Ether during this time solidified its position as a major player in the cryptocurrency space and demonstrated the growing interest in blockchain technology and decentralized applications.

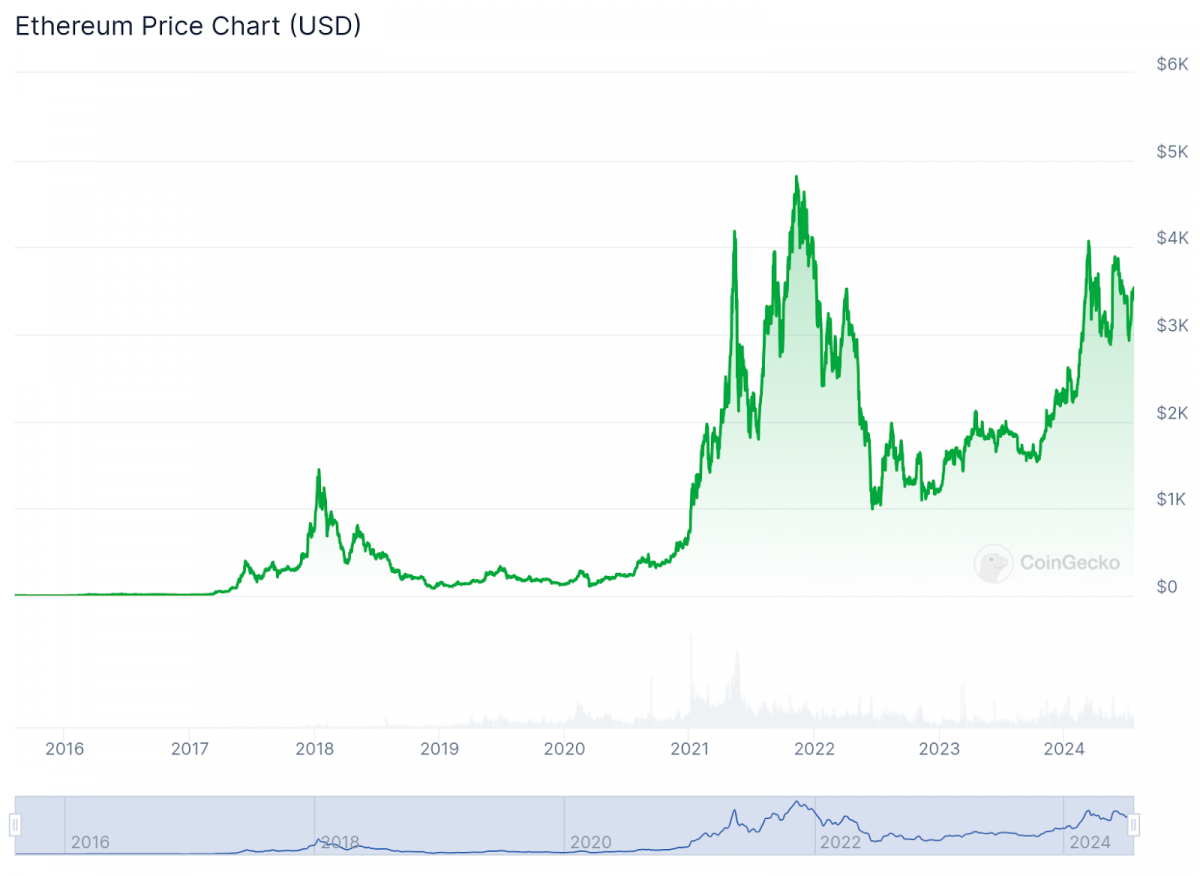

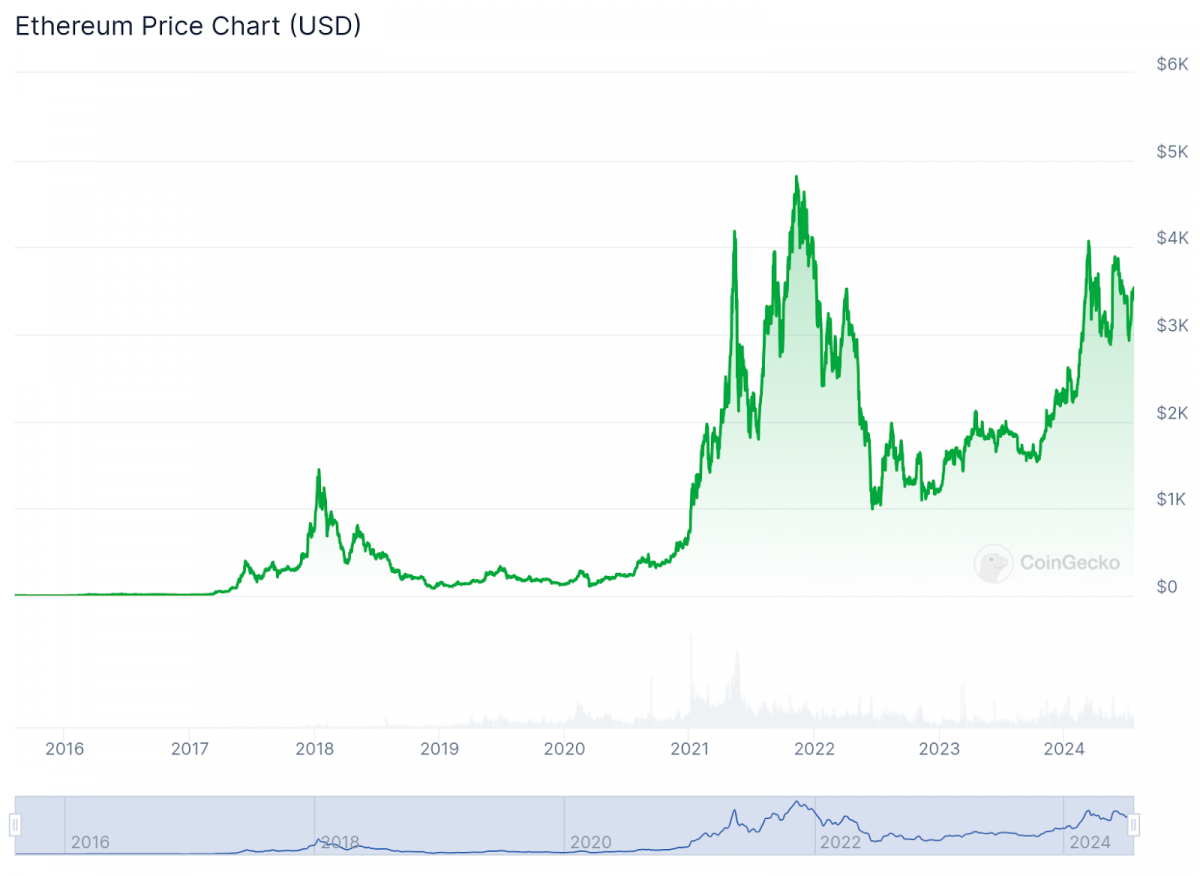

Photo: CoinGecko

The Crypto Winter: 2018-2019

The euphoria of 2017 gave way to a sobering reality check in 2018, ushering in a period known as the “crypto winter.”

2018: The Great Decline

Several factors contributed to this dramatic fall:

- Regulatory concerns in various countries;

- The bursting of the ICO bubble;

- A general loss of confidence in the cryptocurrency market;

- Many projects have raised funds through Ether-based ICOs selling their ETH holdings.

2019: Modest Recovery and Consolidation

2019 saw a modest improvement in Ether’s fortunes, with the price ranging between $100 and $300. While this represented an increase from the 2018 lows, it was still far below the heights of the previous bull run.

This period was characterized by development and consolidation within the Ether community. The focus shifted towards enhancing the platform’s scalability and preparing for the transition to Ether 2.0, a major upgrade aimed at improving the network’s efficiency and capacity.

Photo: CoinGecko

The DeFi Boom and COVID-19 Impact: 2020

2020 presented both new opportunities and challenges for Ether:

COVID-19 Market Crash

The outbreak of the COVID-19 pandemic initially sent cryptocurrency values plummeting, with Ether briefly falling below $100 in March. However, this downturn proved to be short-lived.

Recovery and DeFi Boom

As central banks worldwide implemented monetary easing policies in response to the economic crisis, interest in cryptocurrencies as a hedge against inflation grew. Additionally, the Ether-based Decentralized Finance ecosystem began to take off, driving demand for ETH.

These factors led to a significant recovery, with ETH closing the year above $700. The DeFi boom particularly benefited Ether, as it increased demand for ETH to be used in various DeFi protocols. This period also saw growing interest from institutional investors, further supporting the price.

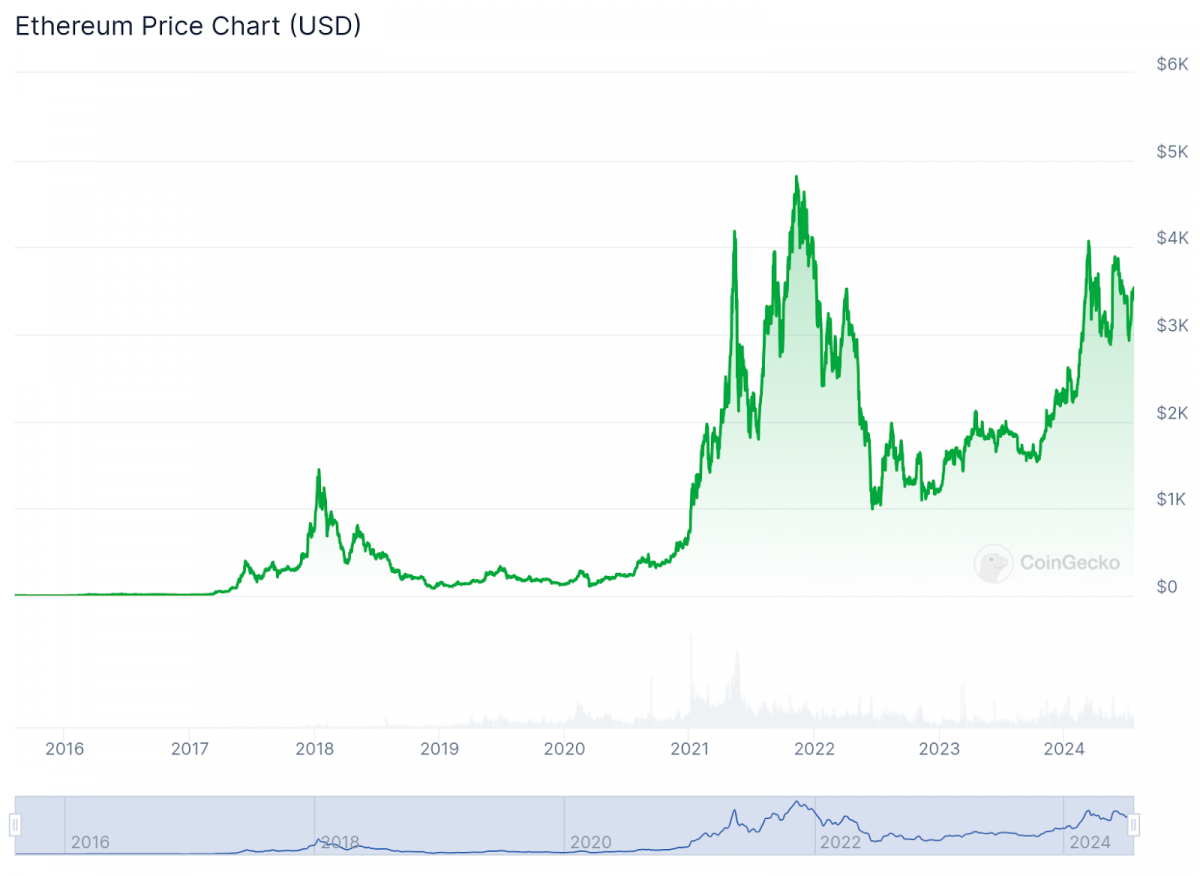

Photo: CoinGecko

The All-Time High and Volatility: 2021

New All-Time High

Fueled by the ongoing DeFi boom, increasing institutional adoption, and the growing popularity of Non-Fungible Tokens (NFTs) – many of which were minted on the Ether blockchain – ETH reached a new all-time high of over $4,800 in November 2021.

Market Volatility

The second half of 2021 was marked by increased volatility. Factors contributing to price fluctuations included:

- Regulatory crackdowns in China;

- Normal market cycles;

- Concerns about the environmental impact of proof-of-work mining.

Despite these challenges, Ether retained much of its value, closing the year at approximately $3,700.

Photo: CoinGecko

The Merge and Market Challenges: 2022-2023

2022: A Challenging Year

The cryptocurrency market, including Ether, faced severe challenges in 2022. Rising interest rates, inflation concerns, and the collapse of major crypto projects led to a broad market downturn. Ether’s price fell significantly, dropping below $1,000 at points during the year.

The Merge

A major technological milestone was achieved in September 2022 with “The Merge,” Ether’s transition from a proof-of-work to a proof-of-stake consensus mechanism. This upgrade was seen as a critical step for Ether’s future, reducing its energy consumption by over 99%. However, it did not immediately impact the price as many had hoped.

2023: Signs of Recovery

The crypto market began to show signs of recovery in 2023, with Ether’s price gradually climbing. Factors contributing to renewed optimism included:

- Anticipation of potential Ether ETFs;

- Continued development of layer-2 scaling solutions;

- Growing adoption of Ether in various sectors.

By the end of 2023, Ether had regained some ground, trading above $2,000.

Photo: CoinGecko

2024 with Ether Spot ETFs and Beyond

Early 2024 Developments

The approval of Bitcoin spot ETFs in January 2024 set the stage for increased institutional involvement in the cryptocurrency market. This development, coupled with the anticipation of similar Ether ETFs, contributed to positive price momentum for ETH in early 2024.

Ether Spot ETFs

A major milestone was reached in late May 2024 with the SEC’s approval of Ether spot ETFs. This decision paved the way for ETH to be traded on major stock exchanges, potentially opening the door to a new wave of institutional and retail investors.

Photo: CoinGecko

Factors Influencing Ether Prices

Throughout its history, Ether’s price has been influenced by several key factors. The increasing adoption of Ether for transactions and its integration into various industries have significantly driven demand and, consequently, contributed to price increases.

Investor sentiment and demand play crucial roles as well. Fluctuations in investor confidence and overall market sentiment can lead to notable price movements for Ether. Positive news, endorsements, and market trends often generate enthusiasm among investors, driving prices up, while negative sentiment or market corrections can have the opposite effect.

Ether also faces competition from numerous other digital assets and blockchain platforms. Innovations and advancements by rival cryptocurrencies can impact Ether’s market share and influence its price, as investors may shift their focus to perceived superior alternatives.

Technological developments and upgrades, such as the transition to Ether 2.0 and the implementation of EIP-1559, have had profound effects on Ether’s price and market dynamics.

The regulatory environment is another significant factor. The evolving regulatory landscape for cryptocurrencies across different countries plays a crucial role in shaping Ether’s market trends. Regulatory developments can influence investor behavior, with changes in laws and regulations potentially impacting Ether’s accessibility, legality, and overall market performance.

Macroeconomic factors, including global economic conditions, inflation rates, and monetary policies, also affect Ether’s perceived value.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.