Final Week of March in Crypto: BTC Slides, ETH Struggles, TON Defies the Drift

In Brief

Bitcoin stumbles, Ethereum struggles, but Toncoin shines as markets chop sideways, with macro uncertainty keeping traders on edge ahead of April’s key events.

Alright, we’re wrapping up March with a market that feels… itchy. Like it wants to move, but doesn’t quite know where. Bitcoin’s taken a spill, Ethereum’s barely keeping it together, and Toncoin – weirdly – is just doing its own thing. There’s no clean trend, no euphoric top, no panic capitulation. Just chop, tariffs, and a lot of hot takes.

Let’s break it down.

Bitcoin (BTC): ~$81.9K and clinging on

BTC dropped from $88K to a low of $81.5K, and while it bounced a bit, it’s still hovering near the lows like a boxer hanging off the ropes. Not knocked out, but definitely winded.

BTC/USDT 4H Chart, Coinbase. Source: TradingView

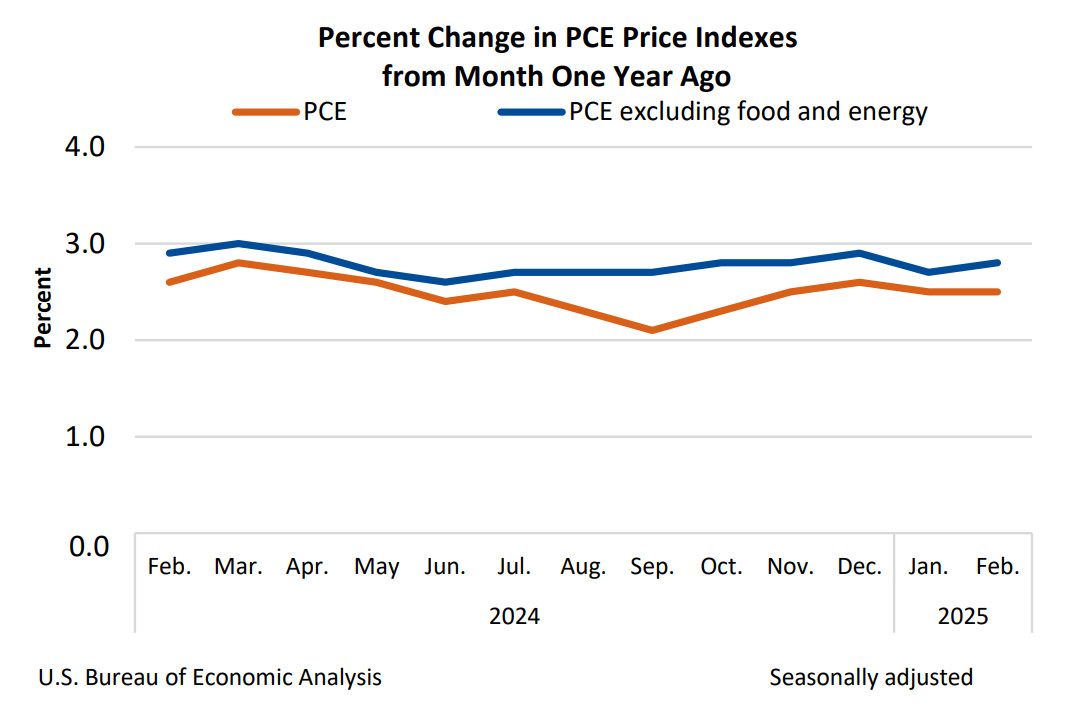

So what happened? Basically, macro threw a wrench into the works – again. Trump’s “Liberation Day” tariffs are now looming over April 2 like a big stormcloud. That’s got traders spooked across equities and crypto alike, especially with the PCE inflation data coming in hot. So much for early rate cuts, huh?

US PCE % change (screenshot). Source: Bureau of Economic Analysis

But here’s the trick: it looks like no one’s panicking. In fact, MARA’s gearing up to raise $2B to buy more BTC (because apparently we’re in the era of Bitcoin-powered treasury strategies).

Source: MARA Holdings

Meanwhile, Arthur Hayes is out here saying $110K is next once the liquidity is back. So yeah, short-term pain, but structurally? Still bullish.

So, what now? It looks like if $80K holds, cool – we chop sideways, maybe bounce. If it breaks, $78K or $72K are in play, but honestly… that kind of flush would probably get bought faster than Taylor Swift tickets.

Ethereum (ETH): $1,796 and tripping

Meanwhile, ETH is having a much tougher time. Down from $2,115 to sub-$1,800, underperforming BTC by a landslide. RSI’s in oversold territory (around 21), and ETH/BTC just hit a five-year low – yep, five years. That’s a whole halving cycle ago.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

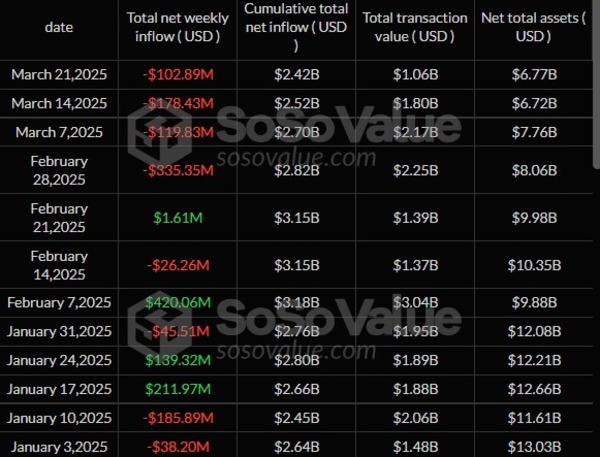

But the pain isn’t about jus one thing – there are several reasons at play. For one, ETH funds are bleeding out – feels almost normal at this point, doesn’t it?

Ethereum ETF net inflows continue slumping. Source: SoSoValue

Post-Dencun, we had the SIR.trading hack, which doesn’t help with trust.

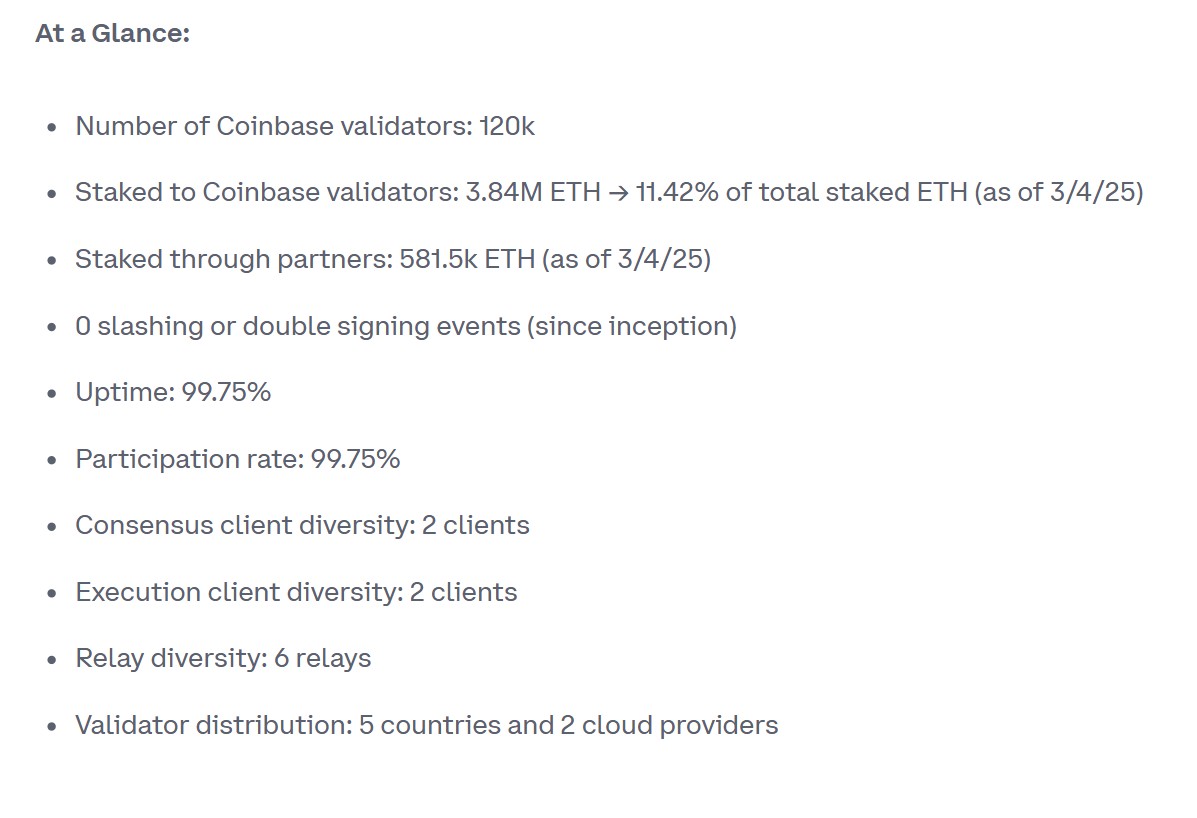

Also, it’s come to the surface that Coinbase is holding 11%+ of staked ETH, currently being its largest node operator. This expectedly has some folks yelling about centralization again.

Coinbase is the largest Ethereum node operator. Source: Coinbase

Some VCs are calling ETH “a dead investment.” Overdramatic, sure – but it tells you just where the sentiment is heading.

Right now, ETH’s basically waiting on BTC to stop bleeding. If Bitcoin finds a floor, maybe we get a relief bounce. If not, ETH could break below $1,750 and start knocking on $1,700’s door. But at this point, it’s less about TA and more about who still believes in the long-term thesis – which, let’s be honest, is kinda shaky if the only bullish narrative is “BlackRock might file an ETH ETF.”

Toncoin (TON): $3.89 and doing its own thing

While Bitcoin stumbled and Ethereum faceplanted, TON somehow managed to dance to its own rhythm. It climbed from $3.55 to over $4 early in the week, held above key levels even as the majors bled out, and is now coasting near $3.89 – still above its 50-SMA, still looking sturdy.

TON/USD 4H Chart. Source: TradingView

But this wasn’t just another altcoin defying gravity – TON actually had reasons to move.

First came Elon. Musk confirmed that his Grok AI bot is now live inside Telegram, instantly tying TON to the hottest narrative in tech. And now the comedy: the bot crashed under the weight of users within hours. But hey, the roof is on fire, right?

Then, in a very on-brand flex, TON’s official account claimed a Tesla Cybertruck in a promo photo could be bought with TON. Whether it’s symbolic or a real test of utility doesn’t even matter – it got attention.

So yeah, TON’s strength wasn’t just technical – it had narrative fuel. If BTC can stay above $80K, TON could easily retest the $4.10–$4.20 zone. But if the market takes another dive, even TON’s solid week won’t save it from gravity. Still, it’s been one of the few bright spots – and that counts.

So… what’s the mood?

On edge. The market feels like it’s stuck in a waiting room. Everyone’s watching macro headlines seeking out clues and spoilers for the next Fed meeting. Nobody wants to be the first to buy the dip – or the last.

There’s no real conviction right now. Volume’s thinning, volatility’s up, and traders are split between “we’re going to $65K” and “this is just a fakeout before ATH.” Feels like we’re one narrative away from either scenario.

But here’s the silver lining: institutionals haven’t flinched. Whales are nibbling. And historically, these kinds of fake-outs and chop zones have ended in explosive moves – usually up, especially when the broader financial system is leaking weirdness from every seam.

April’s going to be spicy. If the market likes what it hears from the Fed or if Trump softens the tariff tone, we could see risk-on come roaring back. If not? Well, buckle up. Either way, its lookes like the boring days are over.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.