Ethereum Price to Hit $4K Soon Despite Resistance at $3955

In Brief

Ethereum price is expected to push beyond the $4K threshold soon, given its consistent bullish momentum on the chart.

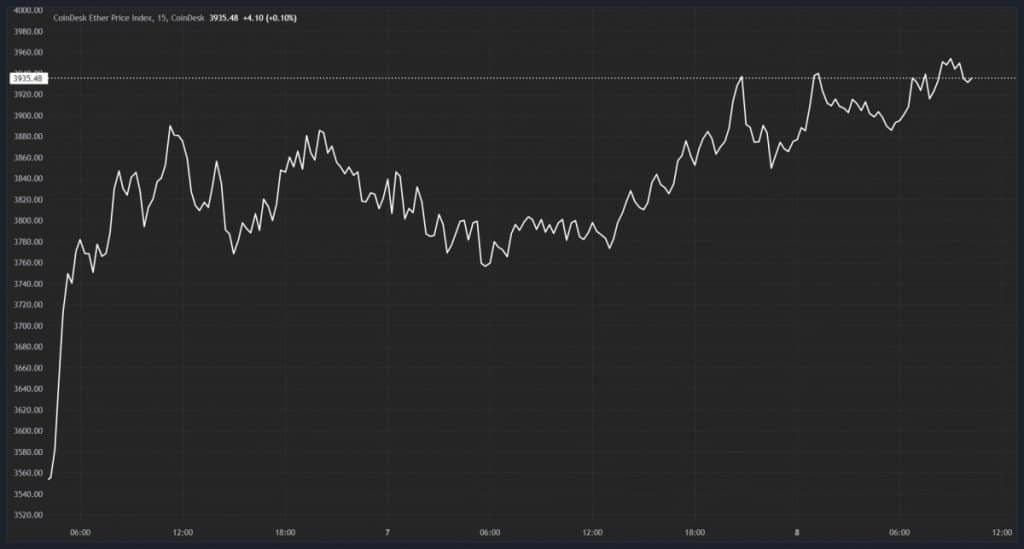

Price of the second largest cryptocurrency by market capitalization, Ethereum (ETH) is currently trading at a price of $3,954, reflecting growth of over 4% within the 24-hour timeframe. The crypto is expected to push beyond the $4,000 threshold soon, given its consistent bullish movement on the charts.

Following a noteworthy uptick in the price of Bitcoin (BTC), surpassing $69,000—its previous all-time 2021 high earlier this week, there is an anticipation that Ethereum will undergo a similar trend, aiming to reach $4,891—its all-time high of January 5, 2022. Presently, Ethereum is trading approximately 20% below its peak value.

Ethereum demonstrated strong performance at the beginning of the previous month, experiencing an increase from a lower value of $2,267, and is set to potentially reach $4,000. This is attributed to ETH recently surpassing the $3,800 mark and stabilizing at $3,894, accompanied by a notable trading volume of $40.13 billion observed two days ago, marking a rebound after 21 months of relative decline.

Factors Behind Potential Ethereum Surge

Analysts are forecasting a potential new increase in Ethereum price in March. However, analysis depends on various factors and can be influenced by market volatility and trends.

Two primary factors that could contribute to the rise of Ethereum to $4,000 are the forthcoming approval of spot Ethereum exchange-traded funds (ETFs) and the prevailing bullish market conditions. Several applications for spot Ethereum ETFs from asset management companies such as Franklin Templeton, Ark 21Shares, VanEck, and Grayscale are presently pending approval from the United States Securities and Exchange Commission (SEC), and there is growing anticipation that they might be granted shortly.

ETFs represent funds mirroring specific assets that are traded on exchanges with reduced potential for losses. The spot Bitcoin ETFs were introduced to the market earlier this year and quickly achieved substantial success. Recently, the spot Bitcoin ETFs reached a noteworthy daily trading volume of $1 billion, even amid market downturns. Furthermore, the success of Bitcoin’s recent surge to its all-time high is often credited to the activity associated with spot Bitcoin ETFs, and a similar outcome is expected for Ethereum upon the approval of spot Ethereum ETFs.

Another significant factor is the current bullish market condition, driven by a sense of greed in the cryptocurrency market, propelling cryptocurrencies upward. The fear and greed index currently stands at 81, indicating ‘extreme greed’.

Ethereum has exhibited a bullish trend for several months and is following an upward trajectory. If the market conditions persist, a favourable scenario might emerge for Ethereum, potentially driving it to the $4,000 mark.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.