DWF Labs Under Scrutiny Amid Suspicions of Market Manipulation

DWF Labs is creating a stir in the crypto community due to its global presence, extensive services, and assertive trading strategies. However, a burning question arises: Is there more to its story beneath the surface?

Moreover, delving further into their operations, a notable focal point arises – their accessible cryptocurrency wallet.

In this article, we’ll explore the truth behind this virtual treasury to reveal the intricacies of their assets and potential market impact.

Uncovering DWF Labs’ Digital Wallet & Market Movements

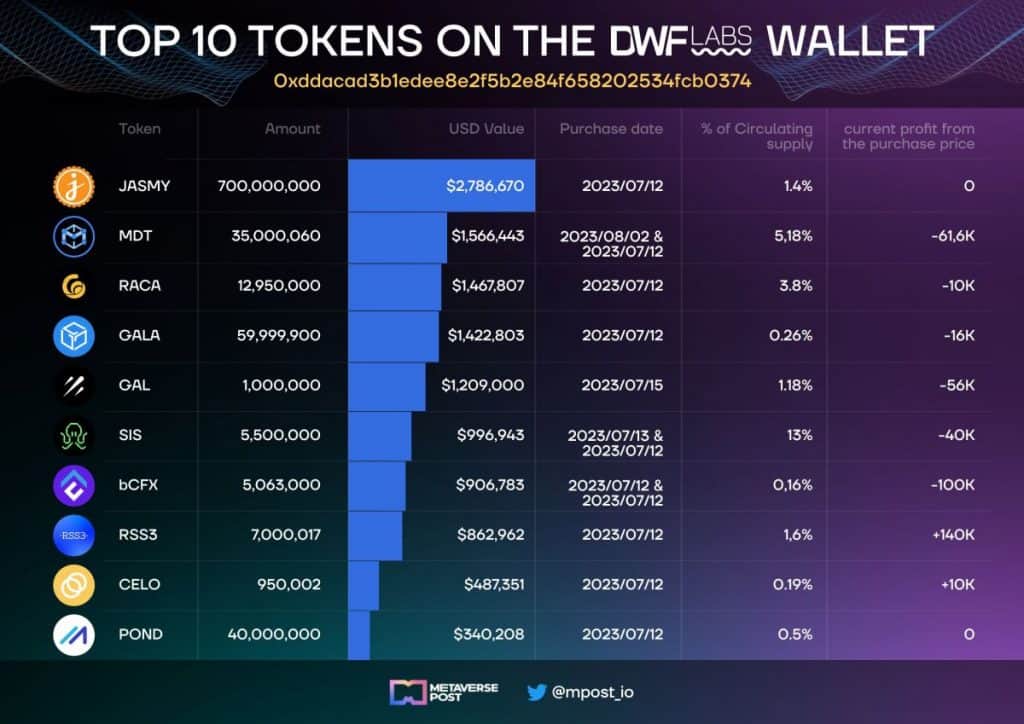

The public wallet of DWF Labs provides a panoramic view of its diversified portfolio:

- JASMY: Holding 700 million tokens (1.4% of the circulating supply).

- MDT: A stake of 35 million tokens (5.18% of the circulating supply).

- RACA: Holding close to 13 billion tokens (3.8% of the circulating supply).

- GALA: With nearly 60 million tokens, they hold 0.26% of the supply.

- GAL: Their 1 million tokens translate to 1.18% of the circulating supply.

- SIS: A significant 13% of the circulating supply is held by DWF Labs.

- bCFX: With over 5 million tokens, they possess 0.16% of the circulating supply.

- RSS3: 7 million tokens in their wallet, or 1.6% of the circulating supply.

- CELO: Their 950k tokens make up 0.19% of the circulating supply.

- POND: Holding a massive 40 million tokens, equating to 0.5% of the circulating supply.

But, there are substantial indications of potential market manipulation:

- The enormous $65M open interest against a $107M capitalization on Binance combined with a trading volume 13 times its cap hints at orchestrated market movements.

- The clear distinction in YGG‘s spot and futures at its peak further leads one to question if these disparities were natural or induced.

Furthermore, DWF Labs’ substantial $28 million investment in Conflux prompts inquiries. Does this signify authentic support for the Conflux ecosystem or a calculated effort to establish market influence in Asia and Hong Kong?

@YieldGuild token $YGG listed on Binance Futures. Important step in the token’s development, which brings sustainability and power to it. Good job, guys, I’m really happy to see such nice progress! Short research > below👇 pic.twitter.com/sdk7tMEfRV

— Andrei Grachev (@ag_dwf) August 5, 2023

Do DWF’s Past Transactions Showcase Patterns of Influence?

Upon delving deeper into the organization’s historical transactions, certain potentially concerning patterns emerge:

- The movement of 3.65M #YGG to Binance coincided with a price ascent.

- Their notable acquisition of 29.2M YGG from the Yield Guild Treasury was complemented by additional token purchases across multiple exchanges in 2022.

- Binance’s statistics reveal substantial activity: $1.475B in futures turnover, a 36.5% increase at $C98, and a $45M open interest. The disparity between the $65M open interest and the $107M capitalization underscores potential market manipulation, as Binance’s trading volume surpasses its market cap by 13 times!

#C98 STRONG PUMP#Coin98 has received an investment of up to “7 digits” from #DWFLabs to accelerate the application of #Web3 globally.

— NTT (@NTT3k) August 9, 2023

DWF Labs is an investment company that provides liquidity services for #Web3 companies.#Crypto #CryptocurrencyNews #C98 #DWF pic.twitter.com/LwBg49T5WM

How Market Makers Influence Token Prices

Fundamentally, a market maker enhances market liquidity by maintaining sufficient buy and sell orders for traders. They derive profit from the spread between buying and selling prices. However, substantial holdings also grant them significant influence.

- Supply and Demand Manipulation:

- If a market maker holds a significant portion of a token, they can create artificial shortages by withholding it from the market. Conversely, flooding the market with the token can drive prices down.

- Setting the Bid-Ask Spread:

- Market makers can set wider bid-ask spreads, making it more expensive for traders to enter or exit positions. This can deter trading or make it more profitable for the market maker at the expense of regular traders.

- Price Anchoring:

- By placing large buy or sell orders, market makers can create psychological “anchors” that can influence the perceived value of a token. If other traders see a massive sell order at a particular price, they may believe that’s the token’s true value and adjust their trading strategies accordingly.

- Creating Momentum:

- By initiating a series of buy or sell orders, a market maker can create the appearance of momentum in a token’s price movement. Observing traders might jump on the bandwagon, further accelerating the intended price direction.

- Information Asymmetry Exploitation:

- Given their central position, market makers often have access to more comprehensive information than regular traders. By acting on this information before it becomes public, they can make strategic moves that benefit their positions.

- Order Book Visualization:

- Large orders placed by market makers can be visible on the order book, which can influence traders’ decisions. A significant buy order can create bullish sentiment, while a large sell order can do the opposite.

- Indirect Influence through Partnerships and Announcements:

- By publicizing partnerships, investments, or other significant moves related to a token they hold, market makers can create hype or concern around a token, influencing its demand and price.

In the case of DWF Labs, their ownership of 13% of all SIS seemingly empowers the company to manipulate the token’s availability, directly impacting its price. The strategic choices the company makes—or opt not to make— also seem to resonate across the token’s trading ecosystem.

Interplanetary news! Symbiosis just partnered with @DwfLabs, a leading global web 3.0 investment company 💪

— Symbiosis (@symbiosis_fi) January 27, 2023

Together, we will tirelessly strive to enhance the awesomeness of Symbiosis! 👾

Check out the article to learn more: https://t.co/36pZtMwoeK pic.twitter.com/zQyo5KUU3c

DWF Labs – Market Innovators or Manipulators?

Current circumstantial evidence and patterns strongly hint at potential market manipulation by DWF Labs. The company’s ability to influence specific tokens, coupled with strategic acquisitions, raises questions about its true intentions.

However, it is also important to note that these findings require careful consideration. Although certain patterns suggest market involvement, there is no direct evidence of malicious intent.

As the crypto realm expands, scrutiny will naturally fall upon major players like DWF Labs. Transparency, fairness, and ethics are essential to safeguard the lasting credibility of the Web3 universe.

Read more:

- The DWF Labs Market Strategy: Pump and Dump of Crypto Tokens

- Intense Week in Crypto – CPI, PPI, Huobi Rumors, CRV Loans

- One of the Top Profit Earners on Binance Burns 2,500 ETH

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.