CryptoQuant: Coinbase Premium Index Indicates Potential For Short-Term BTC Increase

In Brief

CryptoQuant noted in its latest analysis that Coinbase Premium Index rose above weekly moving average, suggesting a short-term price increase.

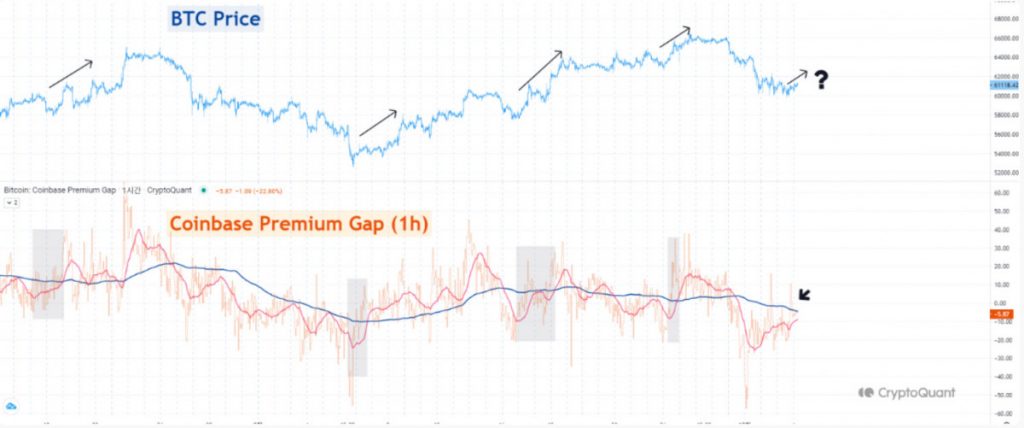

Company specializing in cryptocurrency market data analytics, CryptoQuant released a new analysis highlighting that it has analyzed the Coinbase Premium Index on a one-hour timeframe to assess short-term momentum, while also utilizing daily and weekly moving averages for additional context. The firm noted that historically, considerable price movements have followed instances when the daily moving average crosses above the weekly moving average, forming a golden cross accompanied by strong momentum.

Currently, the Coinbase Premium Index has temporarily risen above the weekly moving average once again, and the gap between the daily and weekly averages is gradually narrowing. Analyzing past Bitcoin price movements alongside this indicator reveals that prices typically see short-term increases when a golden cross occurs, as indicated by the shaded gray region.

For instance, despite a recent price correction from $66,000 to around $61,000 around October 1st, the sustained increase in demand from US-based investors indicates a potential for renewed upward pressure on Bitcoin. This ongoing demand, as reflected in the Coinbase Premium, may signal a possible short-term recovery in Bitcoin’s price.

Bitcoin Trades Above $61,000 Amid Increased Whale Activity And Spot ETF Outflows

As of the current writing, Bitcoin is trading at $61,302, reflecting an increase of over 1.00% in the past 24 hours. The cryptocurrency reached an intraday low of $60,083 and a high of $61,593. Bitcoin’s market dominance has slightly declined by 0.05% over the past day, bringing it to 56.91%.

This decrease in price aligns with reported outflows of $54.13 million from spot Bitcoin exchange-traded funds (ETFs) as of October 3rd. Additionally, data from Whale Alert indicates a rise in whale activity involving Bitcoin over the last day, leading to further speculation among market observers.

In the broader market, the global cryptocurrency market capitalization has increased by 1.20%, now valued at $2.13 trillion. However, the total market volume has dropped by 20.34%, currently standing at $75.54 billion, according to CoinMarketCap data.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.