Crypto Markets Witness Abrupt Liquidation Spike, Triggers Speculation and Concerns

In Brief

In a startling development, cryptocurrency markets witnessed massive liquidations over a short span, amplifying concerns over market volatility.

In a startling development, cryptocurrency markets witnessed massive liquidations over a short span, amplifying concerns over market volatility.

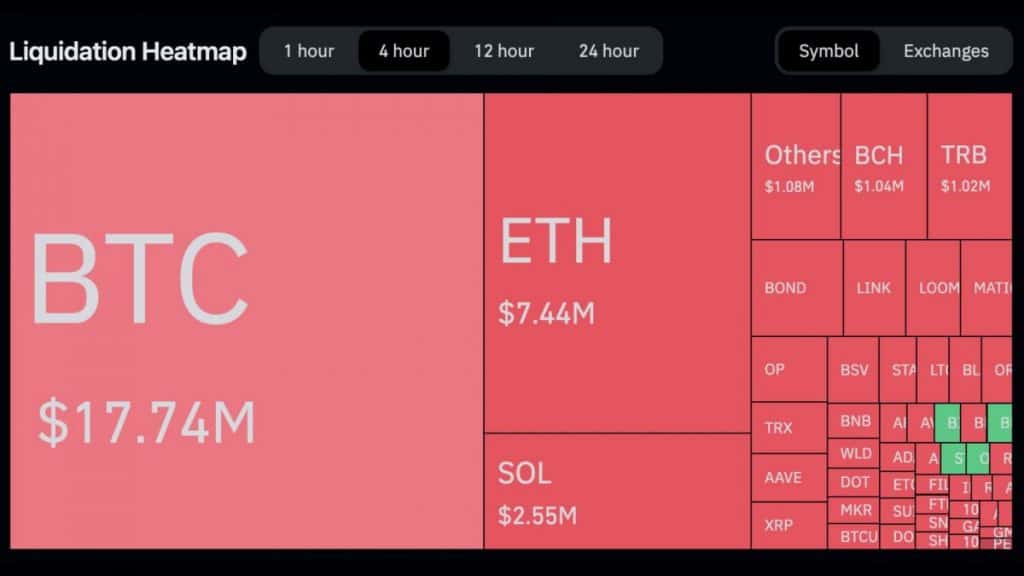

Recent data from Coinglass reveals a staggering sum of over $30 million liquidated across the network in just four hours. Breaking it down further:

- Bitcoin faced liquidations close to $18 million.

- Ethereum wasn’t far behind, with around $7.5 million.

- SOL saw liquidations amounting to approximately $2.6 million.

This abrupt spike aligns with an increasing trend in liquidations observed over varying timeframes. For instance, in the 1-hour period, $9.10 million was liquidated. While extending the time window to 24 hours reveals liquidations soaring past $100 million.

Examining Exchange-Specific Liquidations

Delving further into the data, it’s evident that specific exchanges bore a more considerable brunt of the liquidations. Binance took the forefront, seeing liquidations worth $13.49 million, with a remarkable 83.91% being short liquidations.

Following closely was OKX, enduring liquidations nearing $9 million, and a vast 91.79% of these were short positions. Lastly, Bybit grappled with liquidations amounting to $5.80 million, where short positions made up 72.06%.

A crucial point of note here is the overwhelming proportion of short liquidations across all platforms. This might suggest an overleveraged bearish sentiment among traders that eventually backfired.

Market Analytics & Implications

Such sudden and large-scale liquidations invariably raise questions about the stability of the crypto market. Traders, especially those heavily leveraged, should tread with caution.

Market sentiment can be fickle, and as observed, a bearish inclination dominated the recent trading patterns. However, as history suggests, crypto markets are resilient. Such events often serve as a reset, paving the way for more grounded and informed trading strategies.

The recurrent theme is the imperative need for traders to stay updated, diversify their portfolios, and ensure they’re not overexposed to undue risks. As the crypto domain continues to mature, market participants must evolve their strategies to navigate its inherent volatility effectively.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.