Crypto Market Weekly Recap: Bitcoin Stuck Below $85K, Ethereum Fights for $2K, While Toncoin Rockets on Hype and News

In Brief

Bitcoin struggles below $85K, Ethereum wobbles under $2K, and Toncoin surges 40% on hype and big news.

The crypto market’s been all over the place this week — Bitcoin stuck in limbo, Ethereum looking shaky, and Toncoin ripping higher like none of that matters. Here’s what’s really driving the moves, what’s holding things back, and what could hit next.

Bitcoin: Grinding sideways below $85K

Bitcoin’s been stuck in a frustratingly tight range between $80K and $85K this past week, with bulls and bears in a kind of uneasy standoff. After that sharp bounce from $76K, you’d think BTC might have gathered enough steam to push higher – but no dice.

BTC/USD 4H Chart, Coinbase. Source: TradingView

Every attempt to break above $84K–$85K has been swatted down, leaving traders wondering if this is just a healthy “shakeout” like some analysts say, or something more ominous brewing.

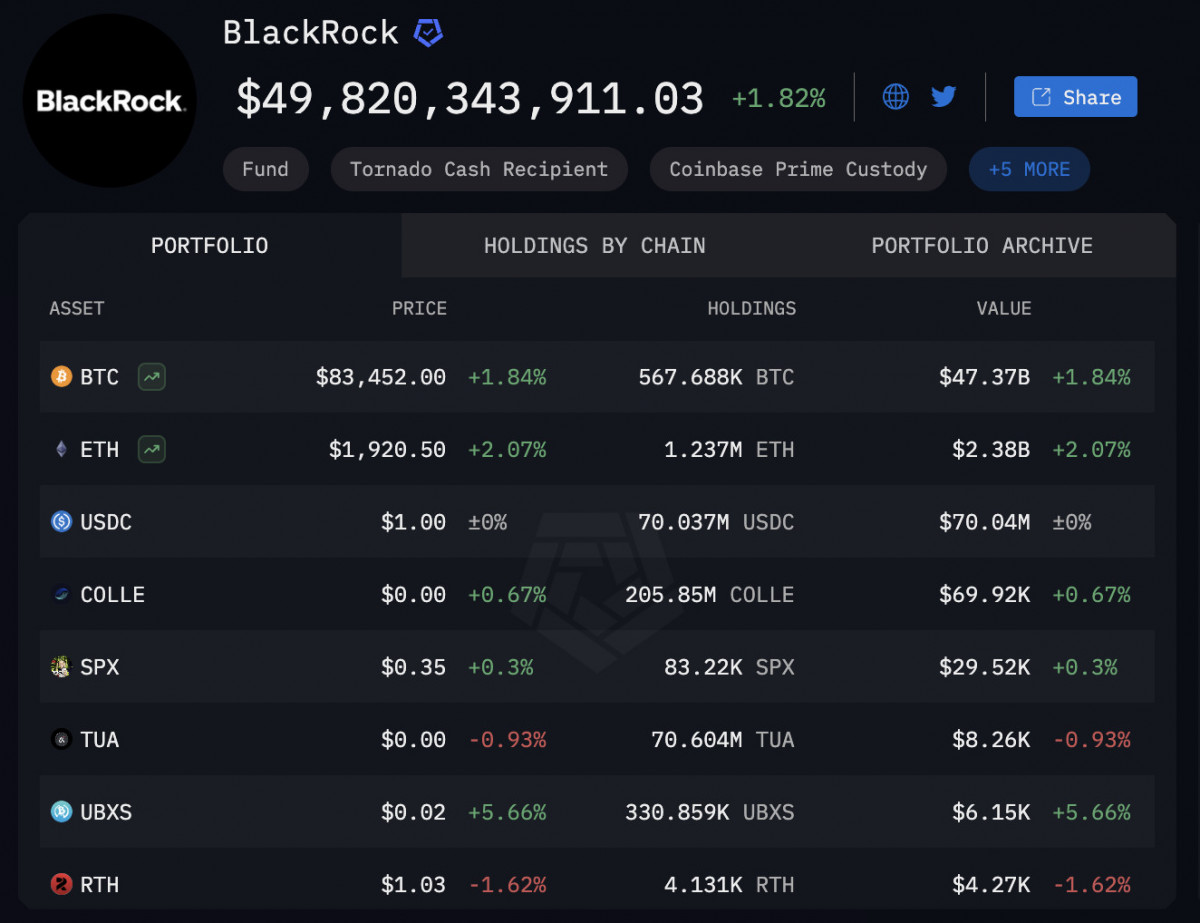

BlackRock’s crypto holdings. Source: Arkham Intelligence

Part of the hesitation is macro – and it’s a lot. The U.S. is cranking up tariffs on China and Canada, rattling risk markets. Everyone’s watching the Fed like hawks ahead of next week’s FOMC, waiting to see if rate cuts are even on the table or if we’re in for more hawkish surprises.

Texas state senator Charles Schwertner arguing for the merits of SB-21. Source: Bitcoin Laws

On the flip side, BlackRock’s now sitting on over $47 billion in BTC, and Texas moving ahead with its Bitcoin reserve plan gives some serious long-term credibility – but that hasn’t been enough to shift short-term sentiment.

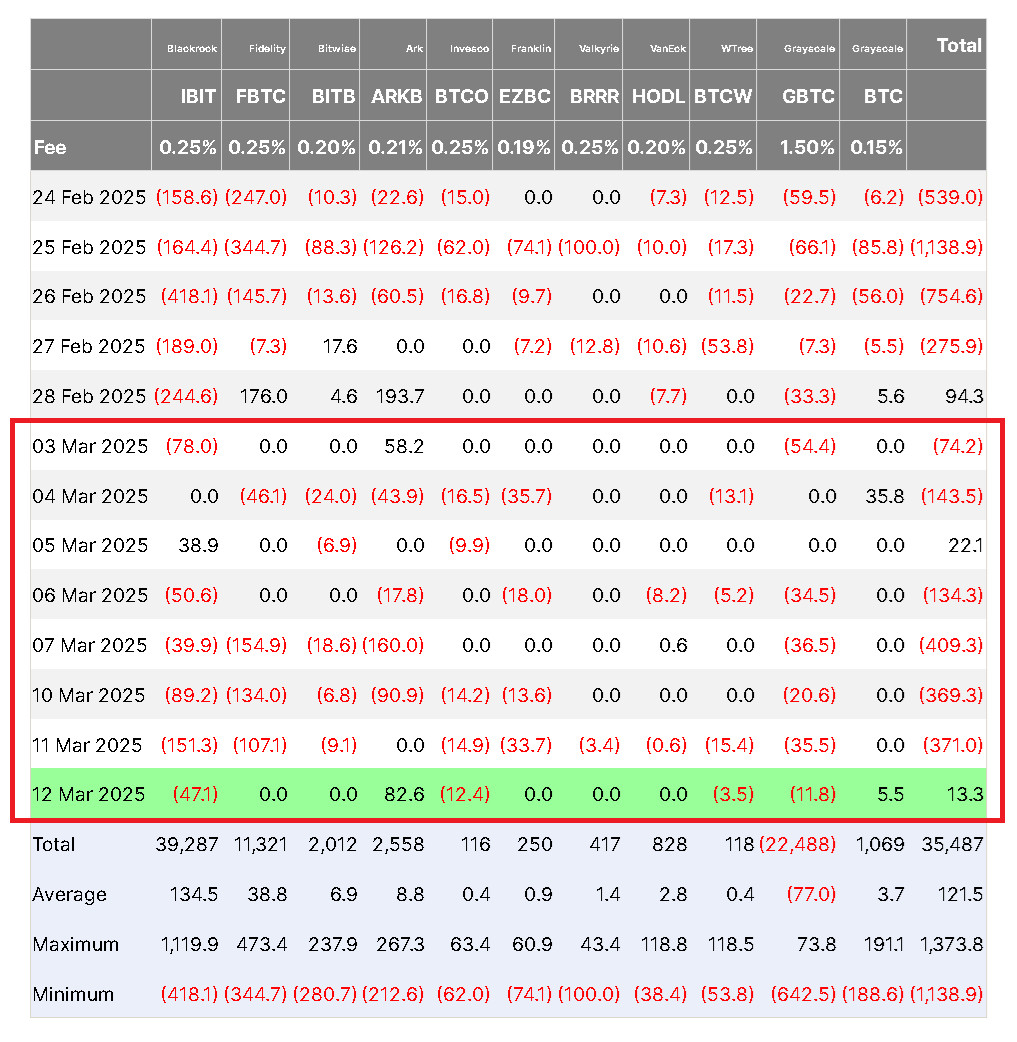

Spot Bitcoin ETF daily flow data. Source: Farside Investors

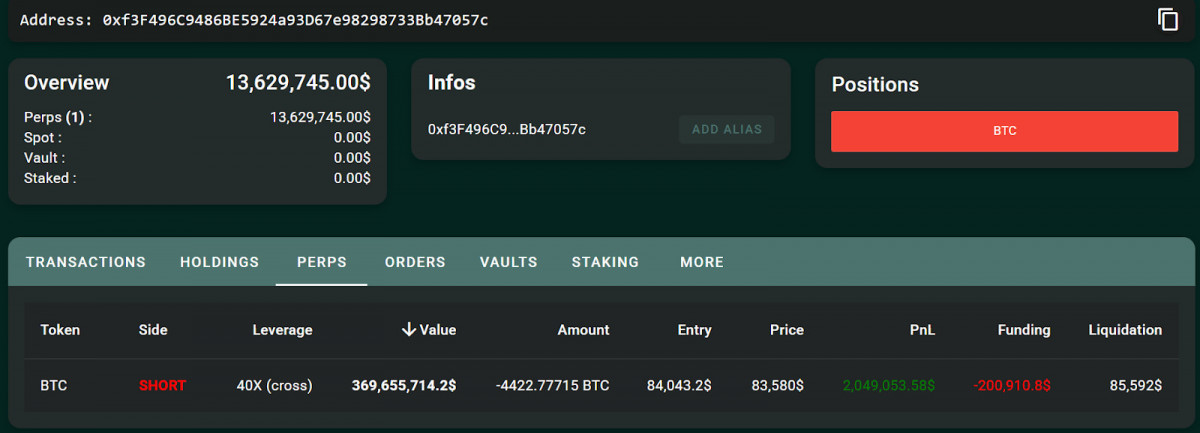

ETF flows haven’t helped either – funds keep bleeding, and whales are making big directional bets (one dropping $368M on a short, no less), so clearly not everyone’s expecting a breakout just yet.

Source: Hypurrscan

Bottom line? If BTC doesn’t close this week above $81K, there’s a real risk we see a retest of that $76K level. But if broader markets calm down and the Fed doesn’t spook everyone, a swift move back toward $90K is still possible. Right now, though, the market feels nervous and tired – like it’s waiting for the next big cue to decide which way to go.

Ethereum: Stuck below $2K and feeling the pressure

Ethereum just can’t seem to catch a break right now. It’s been hovering around $1,900 all week, even dipping close to $1,780 at one point – and any bounce it gets feels half-hearted. Compared to Bitcoin, ETH is really struggling; the ETH/BTC ratio is still sitting near 5-year lows, which pretty much screams that traders are rotating out of altcoins and piling into Bitcoin instead.

ETH/USD 4H Chart, Coinbase. Source: TradingView

Part of the reason is the SEC’s ongoing delays on all those ETH ETF applications – not exactly confidence-inspiring.

Tim Beiko’s latest announcement on the Pectra upgrade: Ethereum Magicians

Then there’s the Pectra upgrade, which was supposed to bring some much-needed scaling magic, but that’s been pushed back too. So now, Ethereum is in limbo, waiting for clarity that isn’t coming anytime soon.

Still, not everything looks bad under the hood. Some sharp-eyed traders have noticed that ETH just had its biggest exchange outflows since 2022 – a potential sign that whales are quietly scooping it up and pulling it off exchanges.

But even if that’s true, Ethereum’s fate is still tightly chained to Bitcoin right now. If BTC can’t get its act together and move higher, ETH isn’t going anywhere fast. Some analysts are even eyeing $1,600–$1,650 as a possible “final flush” zone if the broader market stays shaky. So for now, Ethereum is in a holding pattern, waiting for Bitcoin – and regulators – to give it a reason to move.

Toncoin: Rocketing on news & hype

Meanwhile, Toncoin has been on an absolute tear this week, flying from $2.50 to $3.60 in just a few days – that’s a cool 40% gain while most of the market is just dragging sideways.

TON/USD 4H Chart, Coinbase. Source: TradingView

It’s one of the few coins that seems to have broken free from Bitcoin’s gravity, and a lot of that momentum is tied to some pretty big headlines.

The TON Society celebrates the return of Durov’s passport by French law enforcement officials. Source: TON Society

First off, Pavel Durov’s exit from France – a massive story in itself – lit a fire under TON as traders started speculating on what this means for Telegram and the whole Toncoin ecosystem.

Source: TON Core

Add to that TON Core’s barrage of bullish announcements: slashing network fees by 4x, speeding up block production with the new Accelerator update, and throwing in some fresh liquidity tools on DeDust.

Source: DeDust

All that gave the market plenty to chew on. Bitso also added support for TON in Latin America, giving the coin a solid use case beyond just hype.

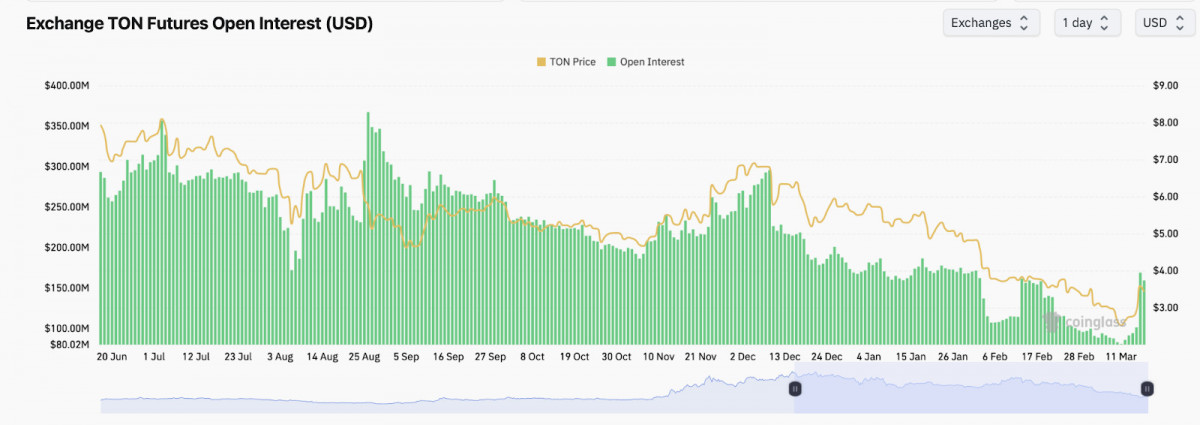

Toncoin open interest surged 67% on March 15. Source: CoinGlass

And, sure enough, traders are lleaning into it hard – open interest shot up 67% after Durov’s news, signaling that big money is betting this run has legs.

But here’s the thing – as much as TON is riding its own wave, it’s still an altcoin swimming in a Bitcoin-dominated ocean. If BTC takes a dive below $80K, don’t be surprised if TON gives back some of these gains fast. On the flip side, if Bitcoin holds steady, there’s a chance TON keeps pushing toward that $4.50–$5.00 range. Right now, though, it’s a classic case of “hot narrative meets shaky market” – thrilling to watch, but not without risks.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.