Crypto Exchange KuCoin Registers Approximately 20% Decrease In User Assets and 50% Market Share Decline Following DOJ Charges

In Brief

KuCoin unveiled nearly 20% decrease in user assets on the platform after the DOJ announced charges last week.

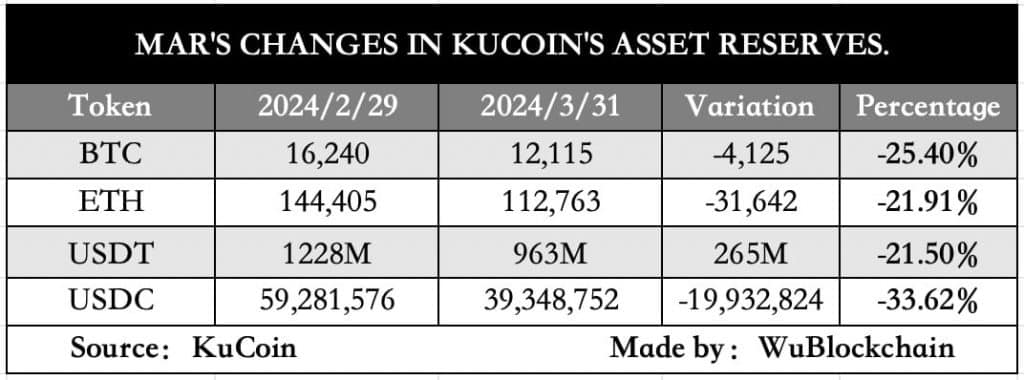

Cryptocurrency exchange KuCoin released its latest asset reserve certificate, unveiling nearly 20% decrease in user assets on the platform after the charges from the United States Department of Justice (DOJ) announced last week.

As per the document, the user’s Bitcoin (BTC) assets amounted to 12,114, decreasing 25.4% from February. Similarly, the user’s Ethereum (ETH) assets totaled 112,000, showing a decline of 21.91%. Furthermore, the users’ USDT assets amounted to 963 million, indicating a decrease of 21.5%.

Furthermore, outflows from KuCoin-labeled wallets reached $600 million on March 26 alone, notably surpassing inflows, according to blockchain research and analytics firm Kaiko. These outflows primarily consisted of ETH and USDT. KuCoin users have been transferring funds to competing cryptocurrency exchanges and their self-custodial wallets. Some of the outflows could be attributed to market makers departing the platform.

Meanwhile, KuCoin’s market share by daily trading volume decreased by half. The daily volume saw a decline of approximately 75% from $2 billion to $520 million.

Keep track of cryptocurrency distributions in our Airdrops Calendar.

DOJ Accuses KuCoin of Anti-Money Laundering Laws Violations, CFTC Initiates Parallel Civil Action To Get Disgorgement

The DOJ levied allegations against the exchange and two of its founders, Chun Gan and Ke Tang, accusing them of violating anti-money laundering (AML) laws. The allegations implicated KuCoin in facilitating money laundering of over $9 billion. The indictment asserted that KuCoin intentionally evaded United States AML and know-your-customer (KYC) regulations by falsely claiming it lacked United States customers despite having a substantial United States customer base.

Simultaneously, the Commodity Futures Trading Commission (CFTC) initiated a parallel civil action against KuCoin, accusing it of unlawfully operating a digital asset derivatives exchange, seeking disgorgement, civil monetary penalties, permanent bans on trading and registration, as well as a permanent injunction to prevent future violations.

KuCoin responded to the events on social media platform X, stating that its operations are functioning smoothly and reassured users that their assets are secure. The exchange acknowledged the reports and indicated that legal counsel examines the specifics.

However, following the announcements, the number of users seeking to withdraw their tokens from the platform increased. This led to delays in withdrawal processing times.

Recently, the platform initiated an $8.95 million airdrop program for users affected by the withdrawal congestion. Additionally, a larger airdrop was planned for users who did not withdraw any assets during this period.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.