Crypto Accounting: Understanding the Financial Landscape of Cryptocurrencies

In Brief

Cryptocurrencies revolutionize financial systems with anonymous, decentralized transactions. Companies embrace cryptocurrencies for investments and salaries but must adhere to regulations, pay taxes, and be transparent.

Cryptocurrencies revolutionized the financial landscape. The idea of anonymous and decentralized transactions without a third party has certainly changed how we think about financial systems and transactions.

Their popularity is growing, and the different implementations of blockchain technology have led to changes in numerous industries. The result? Companies embrace cryptocurrencies in many new aspects, such as making investments or paying salaries.

However, finance and money are no joke. Companies must adhere to all local, state, and international regulations, pay taxes, and be transparent about using cryptocurrencies.

This article will break down some of the crucial aspects of crypto accounting and help businesses stay compliant.

Basics of Digital Assets

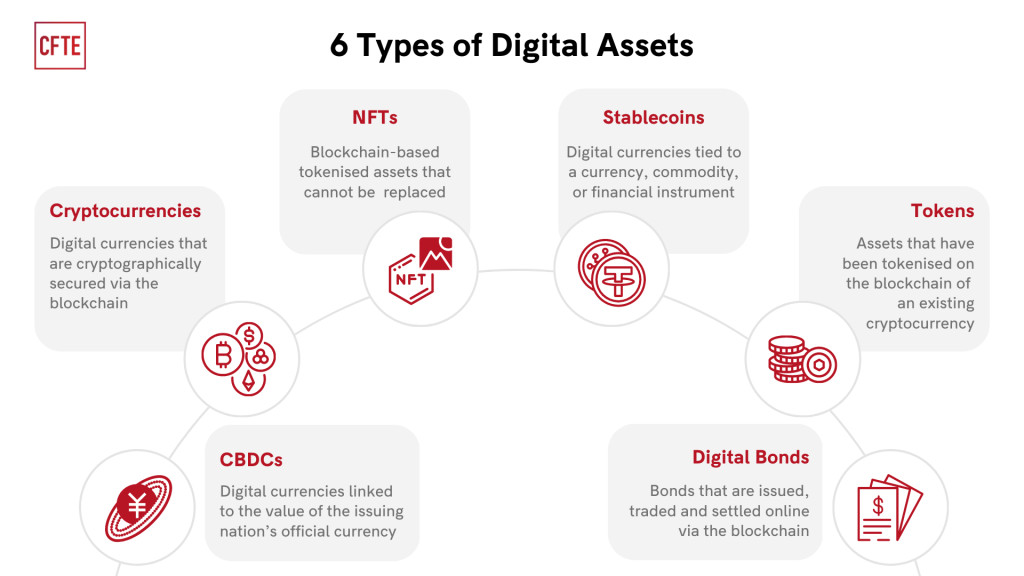

The difference between digital and physical assets is pretty apparent. You can’t touch or hold a digital asset. Yet, they are both considered opportunities for investing and earning. Digital assets include:

- Central Bank Digital Currency (CBDC)

- Non-fungible tokens (NFTs)

- Cryptocurrencies

- Digital bonds

- Stablecoins

- Tokens

Photo: CFTE

As innovations continue to enter the market, more digital asset types will likely occur. For example, cryptocurrencies were the only digital asset on the list for years. Now, the list has grown.

Since all transactions of cryptocurrencies, tokens, and NFTs are recorded on the blockchain, they are considered relatively secure.

We won’t go over the basics of cryptocurrencies, but the transparency of blockchain technology ensures that anyone can observe what cryptocurrency transactions occurred. Because of the critical characteristics of blockchain, digital assets are considered secure.

Furthermore, they aren’t tied to traditional financial services. You can leverage a web wallet to access and store your assets, in which case you only need an internet connection and a device, or you can store them on your physical wallets.

However, the potential risks of cryptocurrencies are high volatility and cyber threats. Yes, people can break into your house and steal something, but you can lose your entire savings if you don’t care for your digital currencies properly.

The volatility of cryptocurrencies is what deters many people from investing in them. Their volatility is also what makes accounting and tracking their value hard. Thankfully, many software and skilled accountants can help you keep track of your crypto finances.

Methods for Acquiring and Protecting Cryptocurrencies

You can obtain cryptocurrencies in several ways. You can choose from several centralized and decentralized crypto exchanges and purchase the amount of cryptocurrencies that you want.

This characteristic of crypto is convenient and easy for accounting, as you will only have to remember basic information about the purchase, such as the date, the price of digital currencies at that point, and the amount you’ve invested.

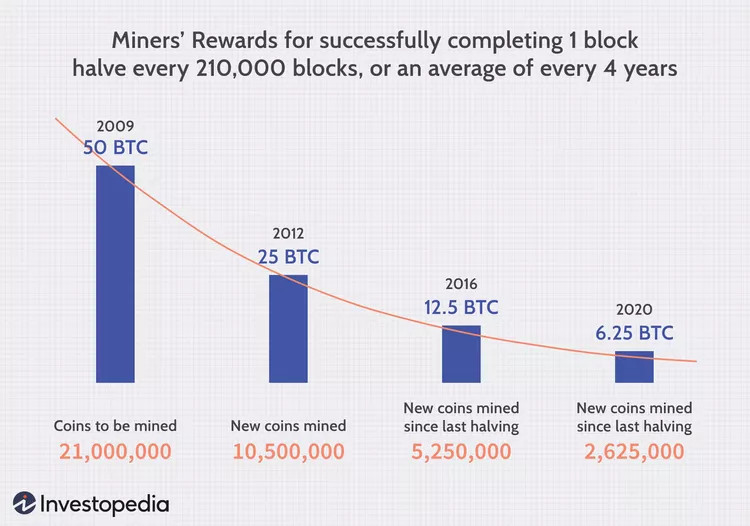

In the past, cryptocurrencies were commonly obtained through mining. While anyone can start mining today, it’s much harder to obtain cryptocurrencies such as Bitcoin without making large investments in equipment. Plus, the supply is running low due to the halving process.

Photo: Investopedia

If you’ve decided to mine cryptocurrencies, recognize the obtained crypto as an asset on the date you’ve obtained it. Similarly to mining, coins you receive through staking, which is the locking of your virtual currencies in a node, should also be adequately recorded.

You can also obtain tokens and coins through initial coin offerings or initial dex offerings. In both situations, you’re investing in tokens or coins, and you should accurately record these transactions.

Keep in mind that tokens and cryptocurrencies differ in their nature. Some countries recognize the difference between utility tokens and security tokens. Consider the regulations that apply to you and record these tokens as revenue or equity.

Cryptocurrencies are valuable but vulnerable to cyber threats. In the long run, it’s essential to implement crypto protection strategies.

Effective strategies include:

- Employing specialized services for enhanced security.

- Diversifying crypto holdings to reduce risk.

- Using cold wallets to store assets offline.

Aside from protecting crypto assets from cybersecurity threats, it’s important to consider strategies to safeguard them from legal risks. Forming an LLC to hold your cryptocurrency can provide a legal shield between your personal and business assets. Different states have varying requirements and LLC costs, so understanding these expenses is crucial. Typical costs include registration fees, annual report fees, and ongoing state compliance charges, which vary depending on where you establish your LLC.

Accounting for Cryptocurrencies

To understand how to conduct accounting for cryptocurrencies, you need to start with evaluating the prices of your crypto assets. The crypto markets fluctuate often, so pay special attention to purchase (or sale) prices.

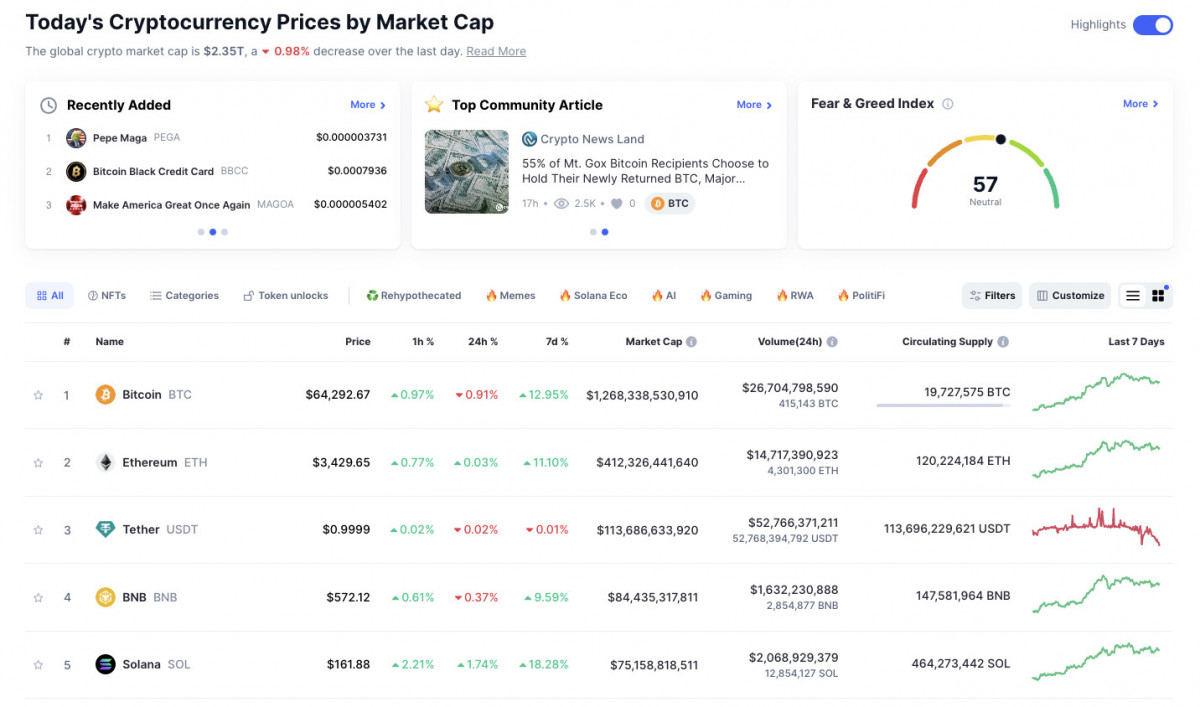

One method of proving your asset’s value is through fair value measurement. This process determines the value of a crypto asset based on the current market price. Information on major cryptocurrencies such as Bitcoin, Ethereum, and BNB is more easily obtained than altcoin information.

Photo: CoinMarketCap

Another important component is considering market value relevance. This way, you can understand the value of your assets by having data on the active market.

Besides fair value measurement, you also need to consider cost-based accounting, which refers to the price at which you’ve acquired your financial assets. The last method includes impairment accounting, which considers the value of cryptocurrencies when their market value drops below cost.

Although it’s unlikely that you’ll have to explain all the crypto transactions you’ve conducted, it’s crucial to record the information tied to your acquirement of the asset and the amount you’ve sold or exchanged it for.

Even financial transactions adhere to different laws and regulations between individuals and businesses, so you must consider how central authorities handle cryptocurrency transactions in your specific case.

Using Crypto for Home Loans

The crypto space has advanced so much in the past decade that private and public blockchains are sprouting up in industries such as healthcare and tech. Furthermore, cryptocurrencies are embraced even by traditional banking systems and financial institutions.

For example, you can now buy a house using your crypto. Some lenders accept crypto as collateral for mortgage loans. This lets you keep your digital money while getting a loan for a real home.

It’s a new option that turns your crypto into something you can live in. Just remember that crypto prices change quickly, which can impact your mortgage loan. Learn about the ups and downs before getting this new type of loan.

Stay Compliant With Crypto Accounting

Traditional financial institutions have been around for many generations. While they have some downsides, they are well-regulated and adhere to a defined set of protocols. Although cryptocurrencies are popular nowadays, they are still far from widespread adoption.

Governments worldwide are making slow progress in regulating cryptocurrencies and finding ways to help their adopters feel comfortable. This will take some time in the long run, and some countries are advancing faster than others.

The bottom line is that you should know how your government treats cryptocurrencies and how you record and report crypto gains and losses.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Jeremy Moser is the co-founder and CEO of uSERP, a leading digital PR and SEO agency. With a keen focus on driving organic growth and increasing online visibility, Jeremy has built a reputation for delivering impactful results in the digital marketing space. In addition to running uSERP, Jeremy is also an entrepreneur in the SaaS industry, where he buys and builds companies like Wordable.io. His deep expertise in SEO and content marketing is reflected in his work as a writer for notable publications, including Entrepreneur and Search Engine Journal, where he shares expertise on scaling businesses, growth strategies, and digital marketing trends.

More articles

Jeremy Moser is the co-founder and CEO of uSERP, a leading digital PR and SEO agency. With a keen focus on driving organic growth and increasing online visibility, Jeremy has built a reputation for delivering impactful results in the digital marketing space. In addition to running uSERP, Jeremy is also an entrepreneur in the SaaS industry, where he buys and builds companies like Wordable.io. His deep expertise in SEO and content marketing is reflected in his work as a writer for notable publications, including Entrepreneur and Search Engine Journal, where he shares expertise on scaling businesses, growth strategies, and digital marketing trends.