Bitcoin vs Ethereum in 2024: an ongoing battle for NFT dominance

In Brief

As the NFT market continues to regain its erstwhile popularity and expand, the competition between the two blockchain giants Ethereum and Bitcoin to assert dominance in this space becomes increasingly intense.

NFTs are regaining their erstwhile popularity in 2024, and as the market continues to expand, welcoming new promising players, the competition between the two blockchain giants Ethereum and Bitcoin to assert dominance in this space becomes increasingly intense. With Ethereum being the pioneer in implementing NFTs and Bitcoin’s newfound Ordinals protocol both platforms have distinct advantages as they strategize to capture the lion’s share of the NFT market today.

What’s the Fuss About?

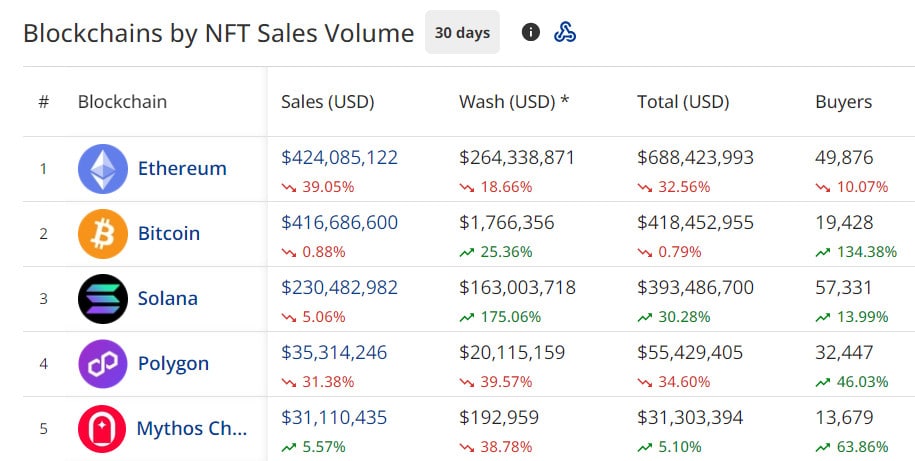

Bitcoin’s recent surge in NFT sales during early March marked a historic moment as it surpassed Ethereum in market leadership for the first time. The remarkable 80% week-over-week increase in Bitcoin NFT transactions has garnered global attention from investors and enthusiasts. During the last month, the community has seen an ever-changing shift within the NFT space dominance from Ethereum to Bitcoin. Remarkably, while four of the top five all-time best-selling NFT collections are based on Ethereum, top two NFT collections of the last 24 hours are Bitcoin-based ordinals.

CryptoSlam.io

The Rise (and Fall) of Ethereum NFT

Ethereum, the second-largest cryptocurrency by market capitalization, has been at the forefront of the NFT revolution since the introduction of its ERC-721 standard in 2017. This protocol became a game-changer, promoting the creation and trading of unique digital assets on the blockchain.

Ethereum accounts for a significant portion of the NFT market volume, with an all-time total trade volume of $76,842,565,571 according to CryptoSlam (current as of April 3, 2024). The platform has lately seen a surge in daily active users, indicating a recovering interest in NFTs since the decay in the aftermath of 2021’s NFT boom. As of April 3, at 9:30 PM (UTC), according to CryptoSlam, the daily total sales volume for Ethereum NFTs reached $13,255,474, and $690,544,425 in the last 30 days.

Until recently, Ethereum’s dominance in the NFT space was evident, with popular projects like BAYC, Pudgy Penguins, and CryptoPunks, all built on the Ethereum blockchain.

Bitcoin Ordinals Enter the Game

While Ethereum has been leading the NFT charge, Bitcoin, the world’s most valuable cryptocurrency, is unwilling to be left behind. Cryptoslam shows that Bitcoin’s entry into the NFT space has gained traction largely due to the increase in buyers. This month alone, the number of Bitcoin NFT buyers grew by 134.38%. The total trade volume for Bitcoin-based NFTs in the last month reached $419,585,739, demonstrating an emerging demand for Bitcoin’s presence in this sector.

CryptoSlam.io

Its newfangled Ordinals protocol has the community’s heated interest, forcing Bitcoin NFTs to fly up.

Ordinals? Who is She?

Introduced in January 2023, Bitcoin Ordinals represent a unique aspect of the Bitcoin blockchain, functioning akin to NFTs. Each satoshi, the smallest unit of Bitcoin, is assigned a distinct serial number based on its mining sequence. These serial numbers, referred to as ordinals, are integral for maintaining a comprehensive ledger of satoshi ownership and whereabouts. Furthermore, ordinals can be enhanced with supplementary data through inscriptions, facilitating the creation of exclusive and limited digital assets. By capitalizing on the security and decentralized structure of the Bitcoin blockchain, the Ordinal protocol facilitates the development of NFT-like assets. This recent addition to the Bitcoin ecosystem has sparked contentious debates among users with diverse perspectives on the advantages of Ordinals for the network.

For and Against Ordinals

The introduction of Ordinals sparked a contentious debate extending beyond the confines of the Bitcoin community. Opinions arose between those who see Ordinals as an innovative step towards bolstering the blockchain’s sustainability and ecosystem and those who view them as critical in amplifying demand for block space. Proponents argue that Ordinals will serve as a vital asset for miners as block rewards diminish over time, leaving transaction fees as their primary source of income. They contend that Bitcoin’s security, decentralization, and resistance to censorship render it an ideal blockchain for the NFT market.

Conversely, critics perceive Ordinals as a misapplication of Bitcoin and a squandering of the network’s finite resources. They highlight concerns about potential fee hikes and network congestion stemming from Ordinals. Furthermore, some critics posit that Ordinals deviate from Bitcoin’s original vision and design, initially aiming to establish a peer-to-peer electronic cash system.

Diverse Perspectives

On the one hand, Ethereum’s established infrastructure, smart contract capabilities, and existing network effect give it a considerable edge over Bitcoin. Ethereum’s robust ecosystem of developers and projects could further drive the NFT market’s continued growth.

Additionally, some arguments from Ordinals’ critics favor Ethereum: Bitcoin best declares itself specifically for financial transactions; by Bitcoin’s throughput, NFTs may not take root on the blockchain.

However, Bitcoin’s brand recognition and security features may play a significant role in attracting artists and collectors who prioritize the network’s stability and proven track record. Bitcoin’s entry into the NFT market could prompt a new wave of interest in digital ownership from a broader audience.

As the NFT market revives and expands, Ethereum and Bitcoin are poised for a fierce battle for dominance in 2024. With Ethereum’s established position and Bitcoin’s entry into the NFT space, both platforms possess unique advantages that will shape their respective positions in this evolving landscape. While Ethereum’s early mover advantage and strong developer community may contribute to its continued dominance, Bitcoin’s brand recognition cannot be underestimated. Ultimately, the outcome of this battle will be determined by how each platform innovates and addresses the community’s evolving needs in the NFT ecosystem.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Zhauhazyn is a copywriter and sociology major. Fascinated by the intricate dynamics of Science and Technology Studies, she delves deep into the realm of Web3 with a fervent passion for blockchain.

More articles

Zhauhazyn is a copywriter and sociology major. Fascinated by the intricate dynamics of Science and Technology Studies, she delves deep into the realm of Web3 with a fervent passion for blockchain.