Bitcoin, Ethereum, Toncoin: Last Week’s Crypto Rally – Full Update and Outlook

In Brief

Bitcoin, Ethereum, and Toncoin rallied last week with BTC leading on ETF inflows, ETH showing quiet accumulation, and TON building real-world use cases, all while crypto markets reached key decision points.

Bitcoin (BTC)

If you were watching Bitcoin last week, you probably felt that familiar momentum start to build again. We saw a clean lift from around $85,000 up to $94,000 – and today, we’re holding just a hair above $94,300 after touching $94,451. Not bad for a week’s work, right?

BTC/USDT 4H Chart, Coinbase. Source: TradingView

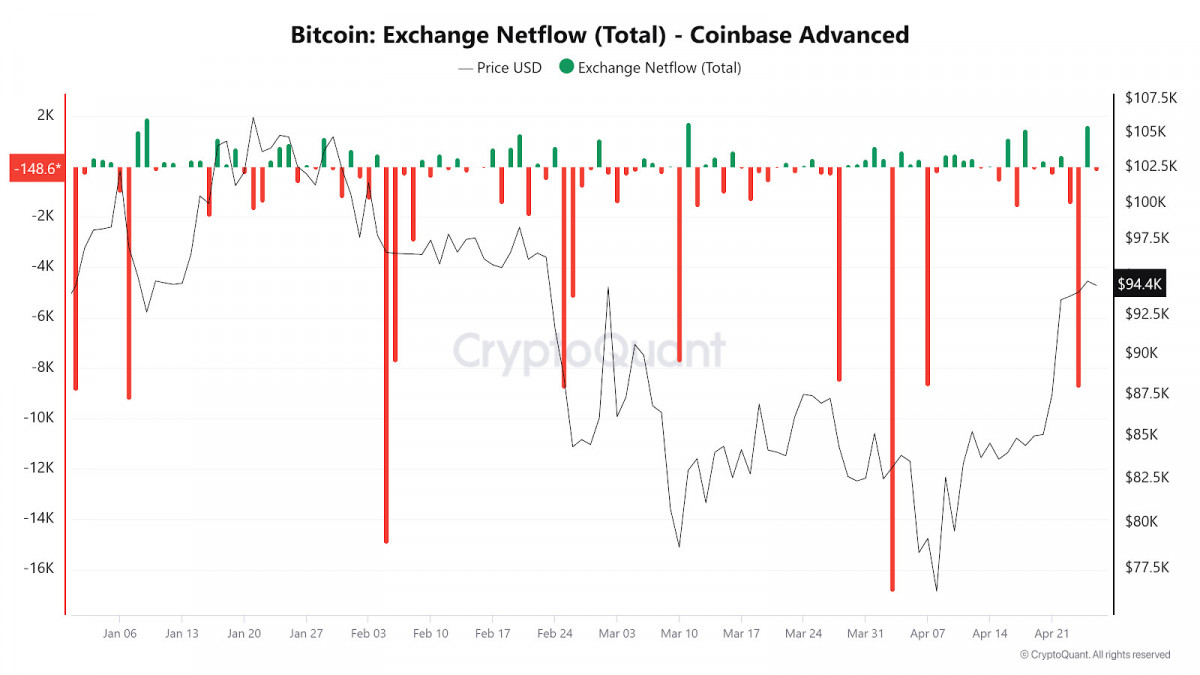

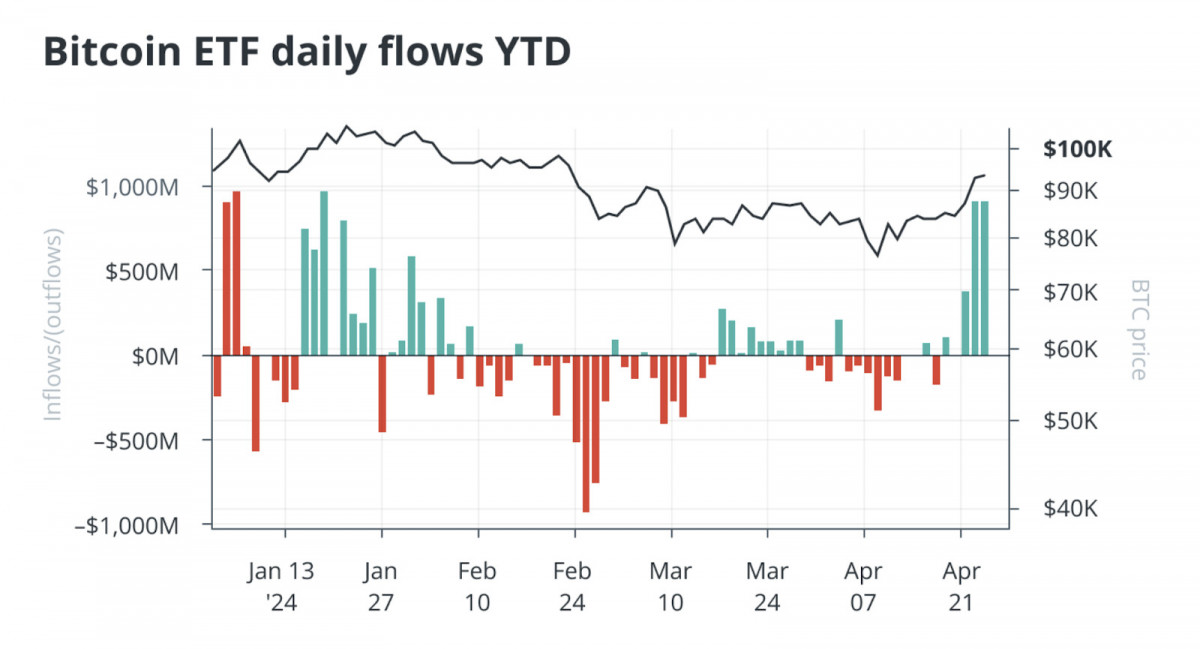

What’s more interesting, though, is how controlled the move has been. The ETF inflows flipped positive again – roughly $3 billion last week – and you can see how price responded. No frantic pumps, no blow-off spikes. Just steady pressure up.

Bitcoin exchange netflows on Coinbase. Source: CryptoQuant

It wasn’t just ETF flows doing the heavy lifting either. The macro backdrop quietly improved: Trump’s push for tariff rollbacks and promises of slashing federal taxes helped risk appetite across the board. Stocks caught a bid, the dollar weakened, and Bitcoin leaned into that momentum like it should in a reflationary setup.

Source: Bitcoin Magazine Pro

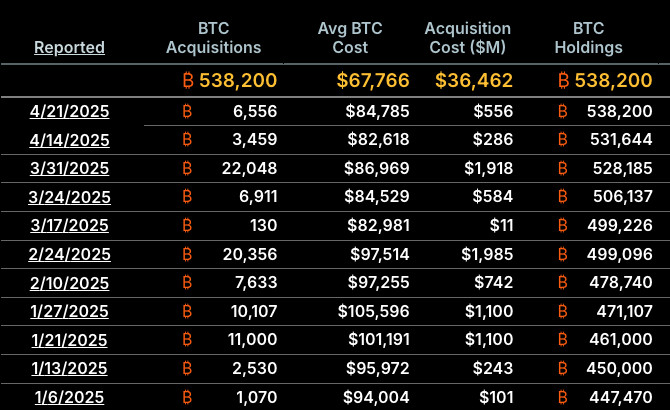

Meanwhile, sentiment inside the crypto market itself firmed up. Spot Bitcoin ETFs logged their strongest weekly inflows in over three months. Institutional buying wasn’t just ticking up – it looked aggressive. Strategy’s fresh $555 million Bitcoin buy didn’t hurt either, signaling that large treasury allocators are still hungry for exposure even at elevated levels.

Strategy’s Bitcoin acquisitions in 2025 so far. Source: Strategy

Even international flows gave a little tailwind: firms like Metaplanet and several Hong Kong players kept stacking BTC at pace, adding to the narrative that sovereign and corporate demand outside the U.S. is quietly building.

Source: Simon Gerovich

That said, we’re now seeing the first signs that buyers might be getting a little winded. Price action has flattened out over the past two days, and the RSI, which had been pressing near the overbought zone, is starting to drift lower. If you’re long, it’s not a panic signal – but it is something to respect. The easy money on this leg seems to be made.

BTC/USDT 4H Chart, Coinbase. Source: TradingView

A clean break above $95,000 could re-ignite the rally toward six figures, no question. But if Bitcoin starts slipping under $93,000–92,500, that would signal that the pause is becoming a deeper pullback. Which way are the odds leaning? Right now, it’s basically at a decision point – and it’s taking its sweet time making up its mind.

Ethereum (ETH)

Ethereum tracked alongside Bitcoin last week, but not with the same conviction. It rose from roughly $1,580 to today’s $1,804, tagging a local high at $1,809. Decent, sure – but it’s pretty clear ETH isn’t leading this market right now.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

If you’ve been watching the ETH/BTC pair, you’ll know exactly what I mean. Ethereum has been underperforming Bitcoin for weeks, and that trend hasn’t flipped yet. Even now, while ETH/USD looks healthy enough on its own, it’s not pushing harder than Bitcoin.

Still, there are a few things under the surface worth paying attention to.

Galaxy dumps Ether, but not all of it. Source: Arkham

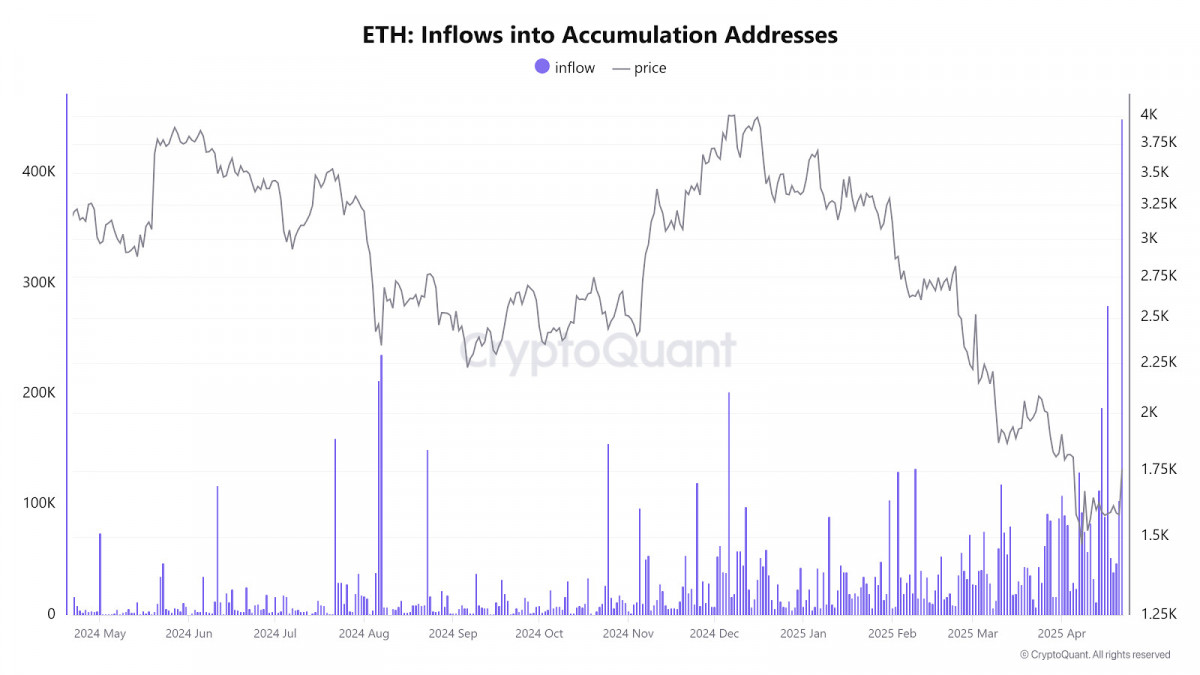

Exchange balances for ETH are dropping again – a classic sign of accumulation. And just last week, accumulation addresses pulled in over 449,000 ETH in a single day. That’s a serious number. It doesn’t guarantee an immediate breakout, but when big wallets start growing like that, it usually means someone’s positioning for something down the line.

Ethereum inflows into accumulation addresses. Source: CryptoQuant

On the development side, Ethereum isn’t exactly sleeping either. Validators signed off on testing a 4x gas limit increase ahead of the upcoming Fusaka hard fork. If that sticks, Ethereum’s base layer could soon handle a lot more transactions – a critical move as competition from faster L2s and alt-L1s heats up.

Mantle’s mETH yields 3.78%. Source: DeFILlama

Meanwhile, institutions haven’t lost interest ither. Securitize and Mantle launched a new fund last week that specifically includes ETH, along with BTC and SOL. It’s a reminder that even if traders are chasing faster returns elsewhere, Ethereum still holds a seat at the table for bigger money.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

Technically, ETH is sitting in a narrow band between $1,780 and $1,825. A clean breakout above $1,850 could open things up for a stronger run – but if Bitcoin stumbles, ETH probably won’t be spared. For now, it’s still very much in Bitcoin’s orbit.

Toncoin (TON)

If you looked away from Bitcoin and Ethereum for a second last week, you might have caught what was brewing over in Toncoin – and if you didn’t, it’s probably worth revisiting.

TON/USDT 4H Chart. Source: TradingView

The news flow stayed busy through the week. For one, MyTonWallet announced plans to roll out bank cards. It’s a small headline for now – but if it actually happens, it could make it easier for everyday users to bridge between crypto and real-world spending. It’s one more piece of infrastructure that could quietly push Toncoin from “speculative token” territory into something a little more usable.

Leadership changes also caught some attention. The TON Foundation appointed Maximilian Krain, a co-founder of MoonPay, as their new CEO. Leadership changes don’t move price charts overnight – but they can shape the tone and strategy for months to come. MoonPay built a reputation for connecting traditional payments with crypto access. Could Krain bring some of that same pragmatism to TON? Whatever the outcome, it’s something worth watching.

Source: Coindesk

Technically, Toncoin’s structure looks clean. It climbed from about $2.85 last week to around $3.2455 today, after briefly touching $3.25. Not a vertical moonshot – but steady, credible strength. The RSI never overheated, and price held well above the 50-period moving average throughout the move.

If Bitcoin stays stable or keeps grinding higher, Toncoin looks like it has room to stretch toward $3.50 or $3.70 without too much friction. But – and it’s worth repeating – if Bitcoin stumbles, history says TON will likely feel some of that pressure too. It’s still tethered to the broader market currents, no matter how strong its fundamentals are getting.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.