BlackRock and Big Banks Are Actively Buying up Cryptocurrencies

In Brief

In the crypto sphere, financial giants like BlackRock and U.S. banks are covertly amassing digital assets. Meanwhile, top exchanges face SEC scrutiny. This perplexing dance of regulation, power, and capital sparks questions about the overarching strategy in the crypto world.

As the dust continues to swirl around the world of cryptocurrencies, a captivating narrative is slowly emerging from the shadows. Power players on the global financial stage like BlackRock and major U.S. banks, traditionally hesitant about digital assets, are now allegedly buying up cryptocurrencies in record amounts.

Meanwhile, well-established cryptocurrency exchanges, such as Binance and Coinbase, have found themselves under the uncomfortable scrutiny of regulators. Paradoxically, halfway around the globe, Hong Kong is pushing traditional banking giants to open their arms to crypto clients. This intricate dance of power, regulation, and capital begs the question: Are we witnessing a strategic masterstroke designed to control the new digital financial frontier, or is this merely a chaotic reaction to the disruptive force of cryptocurrencies?

Let’s take a deep dive into this labyrinth of high finance and digital assets.

The Gensler Dystopia: A Disillusioned Crypto World

Contrary to previous expectations, the leadership of Gary Gensler, the SEC Chairman, is now viewed with growing suspicion and dismay. Despite his history as an MIT professor, where he lectured on blockchain and crypto, Gensler’s reign at the SEC has seen him morph from a supposed advocate to a proverbial harbinger of hardship for the crypto world. Instead of the expected regulatory understanding, his tenure has ushered in an era of draconian oversight and relentless crackdowns on crypto exchanges. His perceived betrayal and the discord between his background and his actions have left many stakeholders disillusioned and increasingly resentful.

The Shadowy Dance of the Financial Giants: BlackRock and Big US Banks

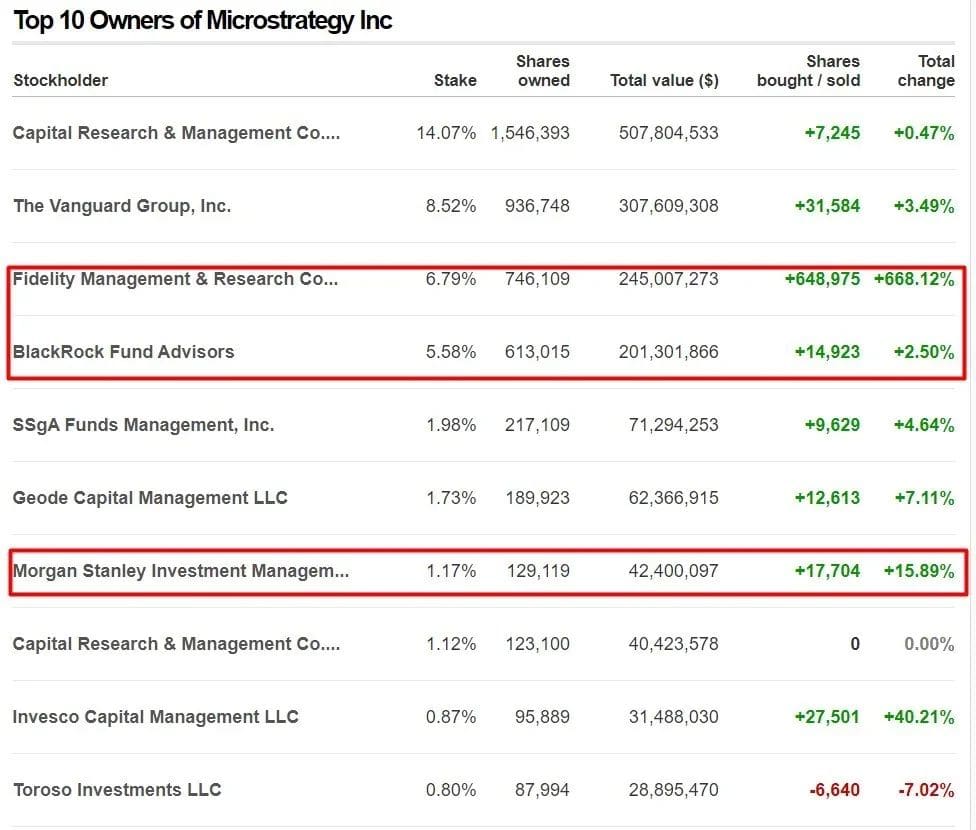

Meanwhile, large US banks and other financial entities are not just sitting idle. Many, including BlackRock and Fidelity, have been quietly accumulating Bitcoin and other cryptocurrencies, often under the guise of purchasing shares of companies heavily invested in cryptocurrencies like MicroStrategy. This has led to some accusing these financial giants of hypocrisy, decrying Bitcoin publicly while clandestinely buying it.

The market strategies employed by these banking giants may not necessarily indicate a grand conspiracy, but the optics are indeed interesting, leading to an increasing number of individual investors suspecting that a manipulative game is afoot. There is an escalating belief that the institutions are trying to scare the ‘retail’ into selling their holdings while they accumulate.

While all this is happening, Binance and Coinbase, two of the world’s largest cryptocurrency exchanges, have been facing unprecedented regulatory scrutiny, particularly from the SEC. Some argue that this is a concerted attack on these platforms designed to destabilize the crypto market and create fear, uncertainty, and doubt.

EDX Markets vs Binance & Coinbase: The Regulatory Paradox

Adding fuel to the mystery are emerging reports and data on BlackRock and the large bank’s alleged crypto accumulation. Evidence indicates these institutions are indirectly purchasing considerable amounts of Bitcoin and other digital currencies through investment in firms like MicroStrategy, which holds significant Bitcoin amounts.

This narrative takes an unexpected turn with the introduction of EDX Markets (EDXM), a novel crypto exchange. Interestingly, while Binance and Coinbase grapple with regulatory hurdles, EDXM seems to be receiving regulatory approvals. Adding to this intrigue is Citadel Securities, renowned for its governmental ties, reportedly assuming a substantial stake in EDXM.

As these developments unfold, retail investors must stay informed and avoid succumbing to fear and uncertainty. This isn’t about an “us versus them” scenario, but establishing a balanced, secure financial system where both traditional banking and crypto-assets can flourish. In this volatile landscape, true wisdom lies in making informed decisions based on diligent research and prudent risk management, rather than on conspiracy theories. The crypto revolution signifies more than just wealth – it represents financial autonomy and freedom.

BlackRock’s Crypto ETF: A Game-Changer or a Masterstroke of Manipulation?

Lastly, rumors about BlackRock planning to launch a crypto ETF are making waves in the industry. Tying this with a leaked conversation from a BlackRock recruiter suggesting they have the government in their pocket, the likelihood of the ETF’s approval seems higher. If this turns out to be true, it signifies a whole new level of complexity in the game, demonstrating just how convoluted the world of cryptocurrencies has become.

According to an insider, BlackRock is reportedly on the verge of applying for a Bitcoin ETF (exchange-traded fund). The source disclosed BlackRock plans to use Coinbase Custody for the ETF and will rely on the crypto exchange’s spot market data for pricing. Coinbase has refrained from commenting on this matter.

Last year, BlackRock initiated collaborations with Coinbase to offer cryptocurrencies directly to institutional investors. However, it remains unclear whether the ETF will be spot- or futures-based.

In the past, the U.S. Securities and Exchange Commission (SEC) has declined all spot bitcoin ETF applications, although it has green-lit several bitcoin futures ETFs for trading.

In conclusion, the landscape of cryptocurrency is at a critical crossroads. As major players and governments around the world stake their claims, retail investors must navigate this ever-evolving maze with diligence and discernment.

Update:

In the video footage created by OMG News’ undercover reporter, BlackRock recruiter Serge Varlay tells about how the asset manager “buys” politicians and more. In the same period, BlackRock officially files for a spot in Bitcoin ETF, and digital asset marketplace EDX Markets goes live. Both events take place following the United States Securities and Exchange Commission going after cryptocurrency exchanges Binance and Coinbase.

Read more:

- BlackRock mentions Energy Web; EWT price goes up to $4.47

- BlackRock and Coinbase are bringing bitcoin to Aladdin. Now what?

- Discover the Power of Bitcoin ETFs: How Investors Can Reap Rewards in 2023 and Beyond

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.