XLink Releases Whitepaper, Revealing New Architecture for Bitcoin’s DeFi Integration

XLink, a protocol integrating BTC into the growing decentralized finance (DeFi) economy, recently announced the release of its whitepaper detailing a completely unique approach to the blockchain’s interoperability with other ecosystems.

The protocol seeks to mitigate some of the most pressing bottlenecks hampering Bitcoin-based DeFi’s growth — more popularly known as BTCFi — using its propriety framework called “Bitcoin-Centric Chain Abstraction.”

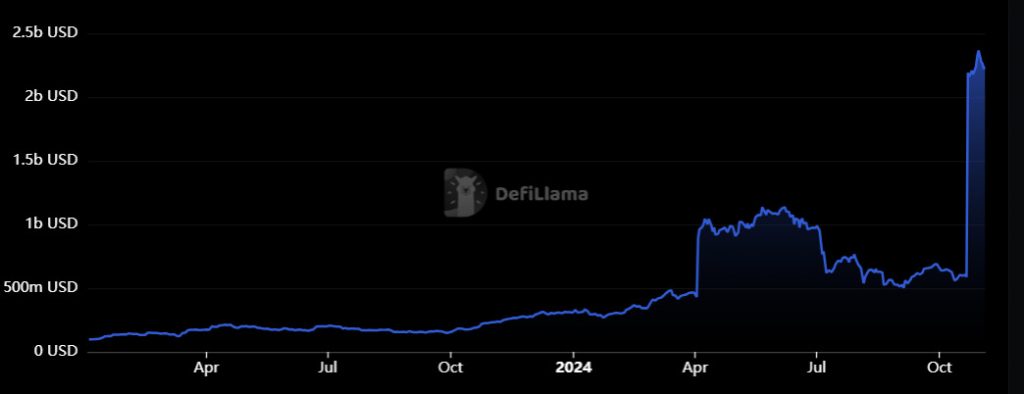

As things stand, BTC’s fledgling economy has a total value locked (TVL) of $2.23 billion — over 22 times what it was during January 2023.

Total funds locked across various BTC protocols (source: Defillama)

The whitepaper outlines XLink‘s evolution from a simple cross-chain bridge within the Bitcoin-DeFi platform ALEX to overcoming some of the digital asset’s limitations (such as its limited smart contract capabilities).

What is ‘Bitcoin-Centric Chain Abstraction?’

XLink’s core innovation stems from its Bitcoin-Centric Chain Abstraction framework, which allows BTC holders to interact with different networks using only their Bitcoin wallets — thus bypassing the need to manage multiple storage solutions or possess extensive knowledge of crypto-related jargon.

Technically speaking, the abstraction layer is supported by an Intent-Based Routing Engine, which automatically translates user intentions into executable workflows across different networks.

Rather than requiring users to understand the complexities of cross-chain transactions, the system allows them to specify their desired outcomes, with the protocol handling all technical implementation details automatically.

Technical architecture and security measures

According to the whitepaper, XLink’s revamped digital architecture brings forth a host of notable security features, including a ‘Direct Event Validation’ mechanism that differs from traditional bridging solutions.

Instead of relying on external validators, the protocol validates Bitcoin events within its own framework, potentially reducing the risk of errors and external manipulations that can occur in conventional systems.

The protocol’s security infrastructure is further strengthened by institutional-grade Multi-Party Computation (MPC) wallets. Developed in partnership with established custody technology providers Cobo and Fireblocks, they require multiple signatures for transaction approvals, adding an additional layer of security for users’ assets.

Additionally, disaster recovery solutions have also been provided through a partnership with Coincover, addressing concerns related to untimely outages or operational disruptions.

Lastly, to maintain a high level of decentralization and security, XLink has deployed a validator network that combines both signing and non-signing validators. This hybrid approach establishes a two-layer security model that prevents any sort of network takeover attempts while also encouraging community participation when it comes to bolstering network security.

Exploring XLink’s governance operations

XLink’s operations are currently being overseen by XLinkDAO, a decentralized autonomous organization (DAO) ensuring non-localized governance (via distributed stakeholder participation).

Their long-term collaboration with ALEX Lab Foundation has facilitated the integration of the Bitcoin Oracle — a cross-chain messaging and consensus layer that enables secure communication between off-chain computation engines on Bitcoin — into their respective digital frameworks.

For institutional users, XLink has positioned itself as a bridge facilitating seamless participation in the Bitcoin economy. The protocol’s infrastructure specifically caters to the needs of family offices, pension funds, and high-net-worth individuals seeking secure exposure to BTCFi.

Strategic Partnerships and Technology Integration

Earlier this month, XLink announced that it had worked with NEAR Protocol to leverage its propriety ‘Chain Signatures’ technology, enabling smart contracts to execute transactions across multiple blockchains while simultaneously enhancing the platform’s throughput and confirmation rates.

Not only that, the NEAR Protocol integration also improves the efficiency of XLink’s aforementioned Bitcoin Oracle while also signaling a shift from traditional “lock-and-mint” mechanisms to more efficient account-based routing for cross-chain asset transfers.

As a result, users can have a more streamlined experience, particularly when it comes to interacting with L2 smart contracts (since all they have to do is use a Bitcoin wallet for managing their transactions).

Finally, XLink’s integration with prominent ecosystems, including Stacks and Core Chain, aims to create a more cohesive DeFi landscape where users can leverage the strengths of multiple networks while maintaining Bitcoin as their primary asset.

Looking ahead, it will be interesting to see how BTCFi continues to mature and how XLink’s Bitcoin-Centric Chain Abstraction paves the way for future blockchain interoperability solutions. Interesting times ahead!

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.