Will Polygon’s zkEVM Pivot Be Game Changer of the Year Despite SEC Hurdles?

In Brief

ZK-rollups have emerged as one of the hottest topics in the blockchain space over the past year.

With Polygon launching its zkEVM in March, competition in the ZK-rollup landscape has been heating up.

Polygon’s advanced zkEVM technology holds immense potential if it’s able to overcome SEC hurdles.

Scalability and cost-effectiveness have been some of the biggest issues for Ethereum, which has grappled with transaction congestion, slow confirmations, and soaring fees. Thus, addressing the need for a scalable solution while maintaining decentralization principles has become a pressing challenge.

Enter ZK-Rollups — one of the buzziest topics in the blockchain space over the past year. Rollups are a pioneering Ethereum Layer 2 scaling solution that offloads transaction execution to a separate layer. This allows L1 Ethereum to focus on consensus and data availability. By compressing multiple transactions into a single batch and transmitting them to L1, gas fees associated with execution are significantly reduced, making transactions much cheaper than regular Ethereum transactions. Rollups typically handle off-chain calculations and state storage while retaining data for each on-chain transaction, enabling the transfer of a group of L2 transactions to L1 in a single transaction with proof of validity.

The benefits of ZK-Rollups extend beyond scalability; they provide enhanced privacy and reduced transaction costs. With Zero-knowledge Proofs (ZKP), transaction validity can be verified without exposing sensitive information, ensuring participant privacy. Additionally, offloading computational work to ZK-Rollup operators alleviates blockchain congestion and lowers fees, making blockchain technology more accessible and economically viable globally.

For developers, this technology allows them to create dApps with unprecedented efficiency. However, like any technological breakthrough, ZK Rollups also come with their own set of challenges. For instance, ensuring the security and trustworthiness of ZK Rollup operators, balancing on-chain and off-chain operations, and addressing potential vulnerabilities require careful scrutiny.

ZK-Rollup Ecosystem

As Cryptomeria Capital’s ZK-Rollup Report highlights, numerous companies within the ZK-Rollup ecosystem are actively building their own ZK-Rollup solutions, each tailored with distinct architectural designs and a range of features. They include zkSync, Starknet, Polygon, Scroll, Intmax and more.

zkSync

One of the most reputable projects in the ZK-Rollup landscape, zkSync is the brainchild of Matter Labs, which first introduced the solution in 2019. The project runs on zk-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge), which plays an important role in the functionality of ZK-Rollups.

ZK-Rollups leverage zk-SNARKs to compress and bundle multiple transactions off-chain, generating succinct proofs that can be verified on the main blockchain. By using zk-SNARKs, ZK-Rollups provide a way to validate the correctness of off-chain computations without revealing the specific transaction details, ensuring privacy and security.

Its architecture consists of:

- zkEVM: EVM-compatible ZK-rollup engine, the only solution with L1 protection and support for Solidity smart contracts

- zkPorter: a standalone data availability system with two orders of magnitude more scalability than storage packages

- ZkSync main storage contract: The operator captures blocks, provides zkProof, which is confirmed by the Verifier contract, and handles withdrawals (executes blocks)

- Verifier: implements the logic of zkProof verification

- Upgrade Gatekeeper: The contract that implements the upgrade mechanism for Governance, Verifier and ZkSync.

- Governance: stores a list of block makers, NFT factories and white-listed tokens

- Full Nodes: zkEVM bytecode pre-execution environment, filters out explicitly invalid transactions, executes transactions in the mempool and generates blocks.

- Provers: obtain proofs for blocks and generate ZK-proofs, parallel proof generation is possible.

- Interactor: a tool to connect to ETH L1, calculate commission, ZKP generation costs and gas prices in L1.

What makes zkSync a leader in the Rollup landscape is its 99% compatibility with EVM and the number of prominent blockchain projects that run on it including Chainlink, SushiSwap, Uniswap, Aave, Argent, 1inch, and Gnosis. Its ecosystem consists of 223 projects across DeFi, infrastructure, payments, public goods, social, gateways/CEX, bridges, games, DAO, NFT, governance, privacy, digital ID and more.

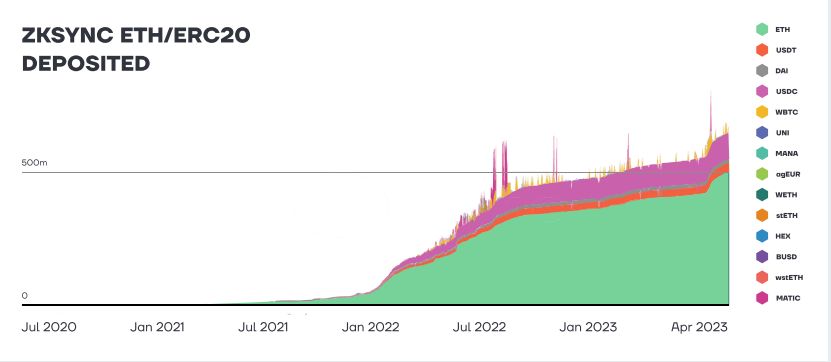

ERC-20 tokens being deposited into zkSync have also been steadily increasing over the past year.

zkSync has raised a total of $258 million from investors including Andreessen Horowitz, Placeholder, Dragonfly, 1kx, Blockchain.com, Crypto.com, Consensys, ByBit, OKEx, Alchemy, CoFalent, Blockchain Capital, Dragonfly, LightSpeed Venture Partners, Variant and many more.

StarkNet

Developed in 2019 by Starkware, StarkNet runs on ZK-STARK proofs (Scalable, Transparent ARgument of Knowledge) or (STARK Validity Proofs) technology. STARKs are cryptographic proofs that guarantee the integrity of computations by utilizing advanced cryptography. With polylogarithmic verification complexity and proof size, as well as quasilinear proof complexity, STARKs provide efficient verification processes and offer robust security against quantum attacks by relying on minimal assumptions.

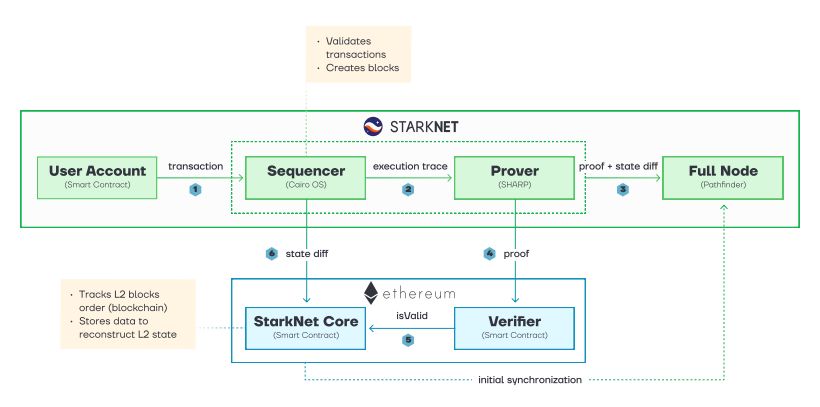

StarkNet launched its testnet bridge, StarGate Alpha, in April 2022. User accounts on StarkNet are implemented as smart contracts. What sets StarkNet apart from other EVM L2 solutions is that it uses the native high-performance Cairo. Transactions on StarkNet are not directly stored in a chain. Instead, only the changes to the system resulting from those transactions are recorded on the underlying Layer 1 (L1) blockchain. StarkNet employs a system of recursive proofs, generating proofs that effectively reduce the size of the overall proofs required for verification.

Its architecture runs on Full Nodes (for accounting transactions and storing network backups), Verifier (smart contract in Ethereum), and centralized services like Sequencer and Prover. However, Permissionless Sequencer and Prover are part of the project’s roadmap.

StarkNet’s architecture consists of:

- Sequencer, an off-chain server that receives, organizes, verifies, and combines all transactions into blocks.

- Prover, which creates a cryptographic proof and confirms the integrity of the computation performed by the sequencer.

- StarkNet core contract, which receives validated state roots from the Sequencer and allows users to read L2-L1 messages and sends L1-L2 messages.

- GPS statement verifier: Starkware SHARP verifier is shared by StarkNet, Sorare, Immutable X and rhino.fi. It receives STARK proofs from the proofer, which testifies the integrity of the execution trace of these four platforms.

- Memory Page Fact Registry, one of the many contracts used by the SHARP verifier, which logs all the necessary data in the chain, such as the state differences of the StarkNet contracts.

Besides StarkNet, Starkware also provides StarkEx, a separate L2 scalability engine allows developers to create something similar to a rollup for dApps. Since launching mainnet in 2020, StarkEx has been used by DyDx, Immutable, Sorare, Venus Protocol, Myria, Reddio, and Deversif.

StarkNet also has plans to implement Layer 3 (L3) solutions that can be built on top of its L2, allowing it to scale further.

StarkWare has raised a total of more than $270 million from Sequoia Capital, Paradigm, Ethereum Foundation, Pantera Capital, Alameda Research, Three Arrows Capital, Founders Fund and others. The company has also secured major partnerships with Consensys, Nethermind, OpenZeppelin, Infura, Ledger, Alchemy, Arcane Assets, and OSS Capital.

In comparison to zkSync, StarkNet has a lower total amount of ETH deposits and a lower total number of deposit addresses, per data from Dune Analytics. According to Nansen, over 500,000 wallets have bridged to Starknet from Ethereum, depositing over $65M on the network.

Scroll

Launched on the Goerli testnet in Februayr, Scroll is an innovative ZK-SNARK rollup that prioritizes compatibility with the Ethereum Virtual Machine (EVM), facilitating a smooth transition for current applications from Layer 1 (L1). With close collaboration with the Ethereum Foundation and positive feedback from influential figures like founder Vitalik Buterin, Scroll is actively developing the zkEVM virtual machine. The project has gained significant traction within the Asian Ethereum community, particularly in Vietnam.

A key component of Scroll’s architecture is Scroll Node, which creates L2 blocks with user transactions. It commits the transactions to the Ethereum mainnet, therefore reducing communication between L1 and L2.

Other components of Scroll’s architecture include the Roller Network, which creates validity proof for execution trace and sends it back to the Coordinator. To speed up proof generation, multiple Rollers can work in tandem to generate proofs for different blocks simultaneously. Rollers also generate zkEVM validity proofs using microchips to reduce the proving time and associated costs.

Scroll has raised a total of $80 million at a valuation of $1.2 billion, making it a unicorn. Projects in its ecosystem span NFT/gaming, wallets, DeFi, infrastructure/tools, including SushiSwap, The Graph, AAVE and more.

Polygon

Although known mostly as an Ethereum scaling solution, Polygon started making a pivot into zkEVM last July when it released part of the source code and roadmap for zkEVM. But its ZK ambitions can be traced back to 2021 when it allocated $1 billion to focus on ZK-Rollup research.

The $1 billion was allocated to objectives such as:

- Acquiring exceptional ZK projects and assembling talented teams

- Designing and developing innovative ZK-based solutions.

- Attracting top experts in the field to join the program.

- Providing financial support for research, partnerships, and other related activities.

In March this year, the Polygon zkEVM launched in beta on the mainnet and shortly after, Polygon unveiled version 2.0 of the protocol, which aims to allow developers to build on it using the Polygon zkEVM technology.

Besides the zkEVM, other ZK solutions such as Polygon Miden, Polygon Hermez and Polygon Zero are being developed within the Polygon ecosystem.

Polygon Hermez emerged in Mar 2021 as an early decentralized ZK-Rollup solution on Ethereum, claiming to be the first implementation of the Ethereum zkASM virtual machine (zkEVM), although other projects, like Scroll, were also working on their own zkEVM implementations at the time. To address the challenge of computational power for generating ZK-proofs, Proof of Efficiency (PoE), a consensus algorithm, was proposed.

Polygon zkEVM leverages the technology stack of Polygon Hermez and offers EVM compatibility with ZK storage packages. This integration positions zkEVM as a highly EVM-compatible solution within Polygon’s product suite.

Compared to zkSync, StarkNet, and Scroll, Polygon zkEVM boasts the most sophisticated architecture and transaction lifecycle organization, incorporating recursive STARK technology. It supports both ZK-SNARK and ZK-STARK, and its zkProver tool provides builders for both STARK-proof and SNARK-proof. Currently, Polygon zkEVM is operational on the Ethereum Mainnet and Goerli Testnet.

Polygon’s architecture comprises:

- The Consensus Contract (PolygonZkEVM.Xol), deployed on Layer 1 (L1), represents the current version of consensus in the Polygon zkEVM ecosystem. This version combines decentralized automated Proof of Donation (PoD) auctions from Polygon Hermez 1.0 with the participation of multiple coordinators. The purpose is to generate batches of rolled-up transactions from L1 to Layer 2 (L2). In a ZK-rollup, on-chain data is necessary, along with ZK-SNARK proofs for transaction validation and careful analysis of the Prover’s final statements.

- Verifier, a smart contract that verifies any ZK-SNARK cryptographic proof for every transaction in the batch. It verifies the correctness of a proof, ensuring a valid state transition.

- zkNode

- RPC mode – It updates network data from Sequencer’s batches broadcast and verifies by Consensus Contract validated info. It also interacts with L1 and synchronizes the local L2 State every two seconds.

- Sequencers – Node mode runners that aggregate transaction requests into batches and submit them to the Consensus Contract. The sequencers are then rewarded with MATIC fees for successfully processing valid batches.

- AggregatorX – Nodes that are responsible for validating transaction batches and generating proofs to ensure their validity. They receive transaction data from the Sequencer and submit proofs that verify the accuracy of state transitions during computation. Once all the necessary computations are completed, aggregators transmit the outputs of the Prover to PolygonZkEVM.sol, which verifies the correctness of the ZK-proofs.

- zkEVM Bridge – The solution offers smart contracts for L1-L2 deposits, withdrawals, and transactions across different L2 networks. It ensures data availability for validation by utilizing optimized Merkle Trees with cost-effective Keccak hash functions. Additionally, it generates wrapped tokens when new tokens are added to the zkEVM network, potentially resulting in faster transactions. Furthermore, detailed token metadata is included in the Merkle Trees’ leaves to enhance the security of every transfer.

While the Polygon zkEVM ecosystem is not as established as zkSync’s or StarkNet’s, major projects including Lens, Balancer, QuickSwap, Uniswap, Aave, Covalent HQ, game projects Midnight Society and Oath of Peak as well as infrastructure providers like ANKR, Alchemy, Sequence and The Graph are reportedly launching in the Polygon zkEVM Mainnet beta.

Polygon’s zkEVM potential

Even though Polygon’s zkEVM is in its nascent stages, it already has a more advanced architecture than Scroll’s. Polygon has raised a total funding amount of $451.5 million — larger than the amounts zkSync and StarkWare have raised.

However, MATIC has been struggling to regain value amidst the bear market. To make matters worse, its value has plummeted by almost 40% since February after being deemed a security by the SEC last month. Amidst the current buzz surrounding ZK solutions in the blockchain space, Polygon is considering the launch of a dedicated token to support their zkEVM aspirations, according to a source familiar with the matter.

“There is a lot of buzz around ZK. Multiple solutions claim to be running their mainnet environments, and it seems ZK summer is just around the corner. However, upon closer inspection, we find that most of these networks have implemented most of the basic features but are still not fully production-ready,”

said Edi Sinovčić, founder & CEO of SpaceShard, a full-cycle blockchain development company focusing on Zero-Knowledge Proof technology within the Starkware ecosystem.

Polygon’s centralized nature and regulatory hurdles

Polygon came under fire in January for its centralized nature despite claiming to be decentralized. The network completed a hard fork with only 13 validator teams despite its initial plan of having 100 validators and infrastructure providers participate in the process.

Back then, Justin Bons, the founder & CIO of CyberCapital, tweeted that “Polygon in its current state is insecure & centralized.” In response, Polygon co-founder Mihailo Blejic clarified Polygon’s use of multi-sig to increase security, and that the team is working on removing them.

1/9 The usage of multisigs has been addressed many times. Mainly for the sake of newcomers, let's cover the key points once again.

— Mihailo Bjelic (@MihailoBjelic) February 14, 2022

TL;DR: Multisigs are used to increase security, not to decrease it. Polygon is responsibly using them, and we are working towards removing them. https://t.co/vSlSQUaRmX

Polygon’s intention of launching a separate token remains unconfirmed at this point as the company still faces the hurdle of battling with the SEC in regard to MATIC being categorised as a security last month. Following that, Polygon chief policy officer, Rebecca Rettig, hit back at the SEC, saying, “The new proposed rule isn’t only harmful for DeFi – it threatens the very existence of permissionless blockchain networks in the U.S.”

In the past year, Polygon has secured several partnerships with global brands including Reddit, Meta, Google Cloud, and Starbucks, just to name a few. This allowed the blockchain scaling platform to build a reputation as a preferred solution for building and scaling dApps on Ethereum.

With that said, the success of Polygon’s zkEVM solution hinges on its ability to navigate the regulatory challenges, particularly its ongoing battle with the SEC. Overcoming these obstacles is critical as Polygon’s advanced zkEVM technology holds immense potential, making the outcome pivotal for the company’s future prospects.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.