What’s Been Up and Down in Crypto: Past Week’s Bitcoin, Ethereum, Toincoin Market & Price Analysis

In Brief

In this article, we’ll examine the prices of three cryptocurrencies over the past week: Bitcoin, Ethereum, and Toncoin.

Bitcoin News & Macro

Last week was quite the rollercoaster for Bitcoin, thanks to a few heavyweight moves. Kicking things off, the German government dumped 900 Bitcoins, putting a bit of a drag on the price. Then the ghost of Mt. Gox resurfaced, announcing a plan to pay out Bitcoin to old creditors, which had everyone bracing for a possible price plunge.

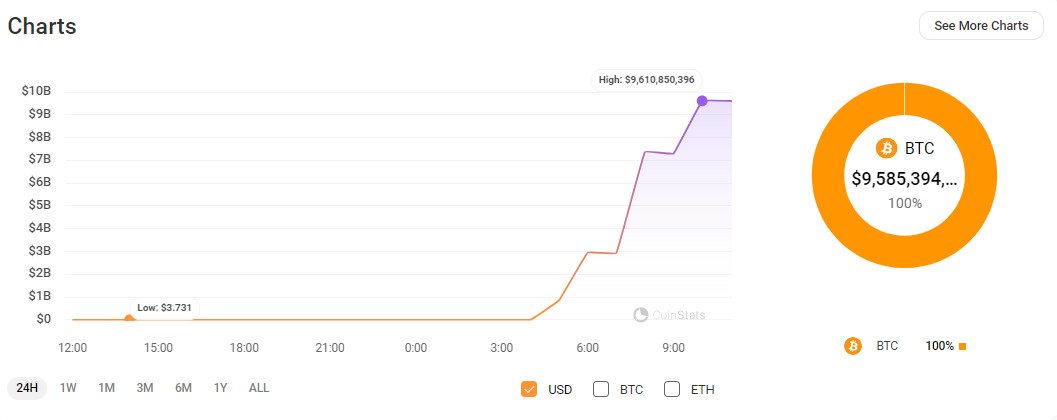

Holdings on the Mt. Gox wallet “1Jbez” Source: CoinStats

Market watchers were biting their nails as the price dipped in response, showing just how jittery investors are about any new flood of coins hitting the scene. However, some pros think this might not be such a big deal after all. For one, IG Markets analyst Tony Sycamore reassures us it won’t be all doom and gloom, seeing as we’ve known about these payouts for ages.

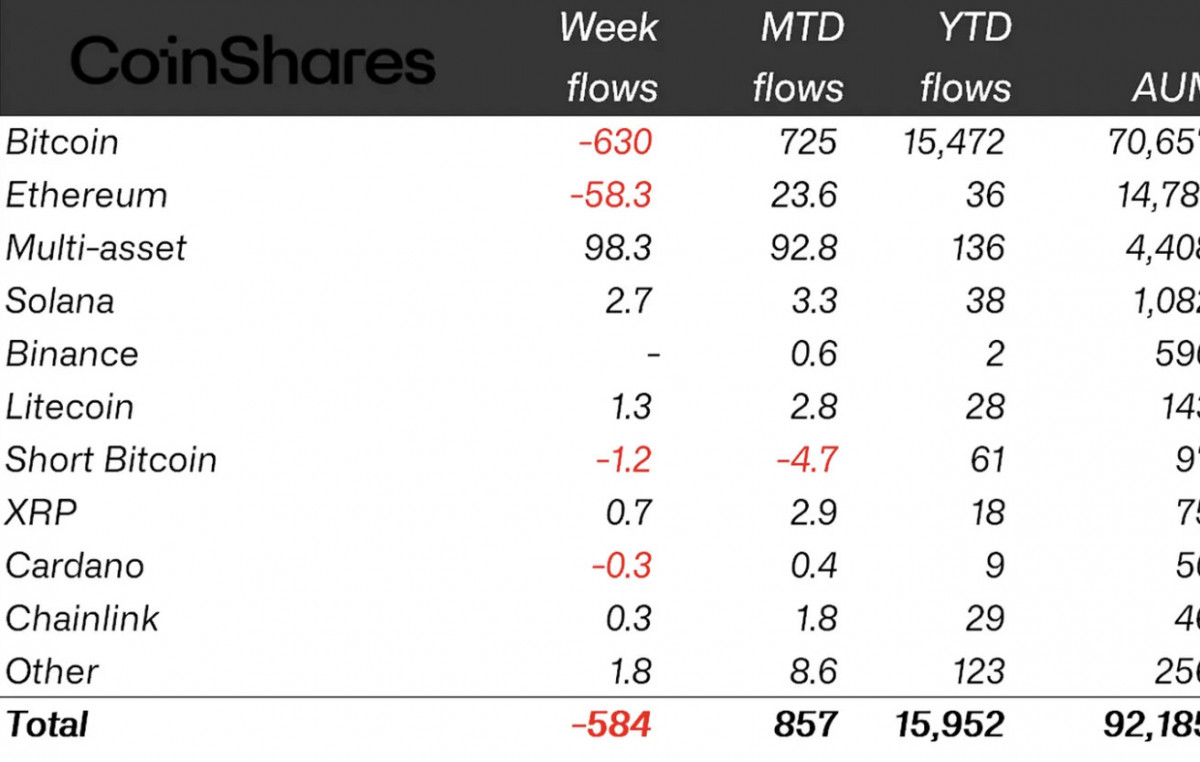

Source: CoinShares

There was a massive $584 million pullout from Bitcoin investment products, as shown in CoinShares’ “Digital Asset Fund Flows Weekly” report. Seems folks are scouting for safer spots amid the squalls of rising interest rates and global economic hurdles. These outflows are telling, especially in regions getting tossed by economic storms.

Yet, through it all, Bitcoin managed to hold its footing above $60,000. Still, it’s perched on the edge, sensitive to any shift in market moods. As we keep watching this unfold, expect more ups and downs, and keep your eyes peeled.

BTC Price Analysis

Over the past week, Bitcoin’s price action has been fairly range-bound, still marked by brisk rallies and sharp selloffs.

BTCUSD 1D Chart, Coinbase. Source: TradingView

On the daily chart, Bitcoin took a nosedive, breaking below the $64,000 support and hitting lows around $60,000. This drop was part of a larger bearish trend spurred by macroeconomic jitters and sour market sentiment. Both the 20-day EMA (blue line) and the 50-day EMA (orange line) sloping downwards highlight this persistent bearish vibe over the past weeks.

However, Bitcoin didn’t stay down for long, gaining a solid footing around the $60,000 mark. Buyers swooped in to defend this critical support, triggering a series of green candles — a sign of renewed buying pressure and a possible momentum shift.

BTCUSD 4H Chart, Coinbase. Source: TradingView

Zooming into the 4-hour chart reveals the finer details. After slipping below the support, Bitcoin bounced back, rallying toward the $63,000 resistance. This comeback was echoed by a rising RSI, moving out of oversold territory and hinting at a short-term bullish reversal. However, the $63,000 resistance held strong, pushing Bitcoin into a consolidation phase around this level.

Daily closes above $60,000 gave bulls a psychological edge, reinforcing the support. Meanwhile, the $63,000 resistance became a battleground, with sellers stepping in to curb gains.

Market players are seemingly building positions, gearing up for the next big move.

Ethereum News & Macro

Ethereum’s market also saw some big moves this week. The SEC dropped its investigation into Ether, labeling it a commodity instead of a security. This gave a quick boost to investor confidence, but not everyone is buying into the classification, leaving some doubts in the air.

Analysts aren’t too optimistic either. They warn that a spot ETH ETF might not spark the rally traders are hoping for. Futures markets premium metrics by Laevitas.ch suggest hitting $3,700 is a long shot, casting shadows over any short-term gains.

A drop in the premium of 2-month ETH futures, Source: Laevitas.ch

Adding insult to injury, Mechanism Capital’s Andrew Kang came out with a stark warning: without a solid economic plan, Ethereum could drop 30% after the ETF launch.

Andrew Kang’s (@rewkang) Tweet on the grim prospect of ETH Spot ETF approval

Andrew argues that Ethereum gains have already been at their peak, and for further upside, the ecosystem’s entire economics needs to be improved.

What’s more, Ethereum transaction fees (along with those of Bitcoin) have hit a seven-month low. While lower fees might attract more users, they also signal a drop in activity.

A decline in Ethereum fees report by Layer2Insider

On the bright side, Ethereum’s ecosystem is buzzing with innovation. New decentralized networks and asset restaking options are still emerging as we speak, unlocking new growth potential despite all risks and uncertainties.

ETH Price Analysis

Ethereum’s price action over the past week, captured within the blue box, has been a mix of consolidation and slight rebounds.

ETHUSD 1D Chart, Coinbase. Source: TradingView

On the daily chart, Ethereum has struggled to maintain a clear directional bias. After a series of selloffs, the price found support around the $3,400 level, where buyers stepped in to prevent further declines. This support level has been critical in the past few weeks, acting as a floor where the price bounces back. The 20-day EMA (blue line) and the 50-day EMA (orange line) are almost parallel, indicating a period of consolidation rather than a strong trend in either direction.

The past week’s action saw Ethereum trying to break above the $3,500 resistance level but failing to sustain above it. This level has acted as a ceiling, capping gains and causing the price to retreat each time it approaches.

ETHUSD 4H Chart, Coinbase. Source: TradingView

On the 4-hourly, ETH tested the support around $3,320, after which it rallied towards the $3,500 resistance. The rally was mirrored by a rise in the RSI, which climbed out of the oversold territory, suggesting increased buying pressure. However, the resistance around $3,500 held strong, causing the price to consolidate again. The 50-EMA on the 4-hour chart has acted as a dynamic resistance, curving downward and reflecting the overall bearish sentiment in the shorter timeframe.

Toncoin News & Macro

Toncoin once again has got some regulator love over the past week, while still being rocked by market waves. The major boost came from Kazakhstan’s approval for trading on licensed crypto exchanges. Needless to say, this is a big yes to Toncoin’s credibility and expanding trading opportunities.

The TON Foundation grabbed headlines by transferring 30 million TON (about $230 million) to Telegram. Such robust backing is likely to give Toncoin’s price a strong push.

However, the ecosystem faced a setback due to phishing attacks, with analyst SlowMist highlighting vulnerabilities in Telegram’s system, having short-term traders on the edge.

On a brighter note, Telegram launched a $20 million fund to support the TON ecosystem, aiming to drive development and adoption, further integrating Toncoin into the crypto landscape.

TON Price Analysis

Toncoin’s (TON) price action over the past week also shows a consolidation phase with minor fluctuations around recent key levels. Just like with BTC and ETH, we’re seeing a tug-of-war between bulls and bears without a decisive winner.

TONUSDT 1D Chart, ByBit. Source: TradingView

On the daily chart, TON has been oscillating between $7.45 support and $7.70 resistance. The 20-day EMA (blue line) just above the price hints at mild bearish sentiment, while the upward-trending 50-day EMA (orange line) suggests potential long-term bullishness. This convergence of EMAs indicates market indecision, with neither side gaining control.

Within this range, we’ve seen a few small rallies and pullbacks. Attempts to breach the $7.70 resistance faced selling pressure, pushing prices down. Conversely, the $7.45 support has held strong, attracting buyers and maintaining the consolidation.

BTCUSD 4H Chart, ByBit. Source: TradingView

On the 4-hour chart, TON tested the $7.45 support, then briefly rallied towards the $7.70 resistance. This move saw the RSI climb from oversold to neutral, suggesting a shift in short-term momentum. However, strong resistance around $7.70 led to a sideways crawl around $7.65.

As always, traders should keep their eyes peeled and their pockets protected.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.