What Changed In June 2025: New Validator Rules, Cross-Chain Upgrades, And Governance Drama

In Brief

June saw steady but meaningful progress across several blockchain projects, with key upgrades enhancing cross-chain functionality, user accessibility, governance challenges revealing leadership tensions, and validator improvements.

You know those months where nothing huge happens, but stuff still shifts just enough to feel like it might matter later? This June was kind of like that. A few major upgrades went through; some chains cleaned up loose ends. A couple others kicked off problems they probably didn’t mean to. There wasn’t one big narrative, but if you looked at validator updates, cross-chain tweaks, and some real governance drama – you start to see where things are going.

Here’s what stuck out to us.

Celestia Gets Serious About Being the Internet’s “Data Layer”

If you’ve been following Celestia at all, you probably know them as the people banging the “modular blockchain” drum – basically, they want to be the go-to source of cheap and reliable data for other chains. But until now, a lot of that was more roadmap than reality.

That’s why their Lotus v4 upgrade this June actually caught our eye. Two things happened that make this more than a minor version bump:

- Cross-chain Interop Finally Gets Real – They baked the Hyperlane protocol directly into the network. Practically speaking, this means Celestia data (and its TIA token) can now move between different chains without kludgy workarounds. If you’re a rollup developer using Celestia to post your transactions, or you’re a staker wanting to put TIA to work across ecosystems, that’s a big step toward treating Celestia like proper internet plumbing rather than a side project.

- Reward Economics Tweak – They also trimmed block reward inflation by about one-third and tightened up the rules around claiming those rewards. Now you only earn if your TIA stays locked up properly – if you yank it early, you forfeit that epoch’s cut. It’s a small but meaningful nudge to discourage “lazy” staking behavior and encourage long-term participation.

If you ask us, that’s the kind of under-the-radar stuff that actually moves the needle for users and validators. Celestia isn’t becoming flashy overnight, but it’s clearly maturing. Think less “hype cycle,” more “here’s a smoother data layer for rollups that don’t want to reinvent the wheel.” Will that make rollups and their builders jump on board? Time will tell. But this upgrade feels like one of those steps that needed to happen sooner or later for them to stay competitive.

Base Goes Retail

We’ve all heard the grand vision for Layer-2s like Base: cheap, fast Ethereum transactions, a playground for dApps, all that jazz. But what actually brings a rollup to life? The answer is: real people using it – not just airdrop hunters and devs testing contracts.

That’s where Base’s June move comes in. Coinbase – which, let’s remember, built Base in the first place – quietly wired decentralized exchanges right into its own mobile app. Practically speaking, if you’re a regular Coinbase user, you can now swap tokens that live on Base – think all those DeFi and meme coins – without ever leaving the comfy blue-and-white interface. Yup, no more gas math, and no more MetaMask errors.

And yes, Coinbase still takes its small cut. But they also cover the Base gas fees for you. That’s a huge step toward making on-chain activity feel as painless as buying on a CEX.

Why does this matter? Because most people don’t care what “Layer-2” even means – they care that their swaps go through and don’t drain their ETH. Base has already been one of the faster-growing rollups; this could pour even more retail liquidity into its dApps and deepen its DeFi scene.

And let’s not kid ourselves – this also gives Coinbase a nice funnel into all that DEX action they’d otherwise lose to Uniswap or Aerodrome directly. Overall, it’s a smart bit of vertical integration that could make Base stickier long-term. Will it make Base the go-to rollup overnight? Probably not. But it’s one of the few “infra plays” this year that actually connects a new Layer-2 to mainstream users – and that’s a rare thing in this space.

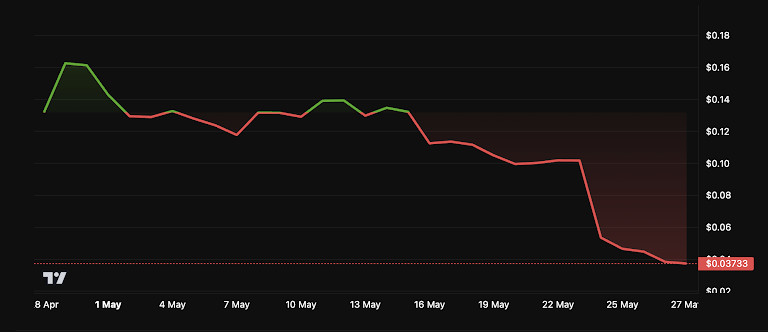

Aleph Zero’s Governance Blow-Up – and What’s Left of the Vision

Aleph Zero has always sold itself as a privacy-focused, next-gen Layer-1 with serious academic chops – zero-knowledge proofs under the hood, slick tech papers, all that good stuff. But June 2025 showed that even the most polished tech can’t paper over messy human stuff.

That’s because co-founder Adam Gągol went public with his resignation, airing some pretty harsh critiques of the Aleph Zero Foundation’s transparency and treasury management. Within days, the AZERO token tanked to all-time lows, proving that even loyal communities spook easily when the people in charge look like they’re fighting.

And then came the twist: Gągol announced “Common,” a fork of the project promising a cleaner, more transparent restart – and teasing an airdrop for existing AZERO holders (except the Foundation). In other words, we’re looking at a classic blockchain split driven by governance and trust, not some technical disagreement.

What’s at stake? On one level, it’s a cautionary tale – even promising tech can implode if leadership falls apart. On another, it raises questions about who will continue building on the original Aleph Zero and what happens to all those privacy apps they kept talking about.

If you ask us, this is one of those inflection points that will either galvanize the community into sorting itself out – or leave Aleph Zero as a cautionary bullet point in someone’s governance deck. The tech might still be promising, but as this June showed us, code isn’t the only thing that matters.

Starknet Gets Serious About Validators

While a lot of Ethereum Layer-2s are still figuring out who even runs them, Starknet’s been inching toward real decentralization. Its big June 2025 move was launching Staking v2 on mainnet – a set of validator upgrades that sound dry at first, but matter if you care who’s actually keeping the network honest.

Here’s the gist: validators now have to prove they’re actually present – by signing off on randomly selected blocks during each epoch – if they want their rewards. Miss your attestation? You and your delegators take a hit. Plus, they can’t randomly jack up their commission rates overnight anymore; there’s a new system that locks fees in up to a year at a time.

That might sound like boring protocol housekeeping, but it’s what Layer-2s need if they want to grow up and stop looking like glorified single-operator sidechains. It’s also better for delegators: you actually know what fees you’re paying and can trust that your validator is doing its job – or losing money if they don’t.

Is this going to send TVL skyrocketing tomorrow? Probably not. But it’s one of those updates that can make or break long-term trust. If you ask us, that’s what differentiates a network that’s serious about sticking around from one that just pays lip service to “decentralization” and hopes no one looks too closely.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.