Weekly Crypto Overview: Past Week’s Bitcoin, Ethereum, and Toncoin Analysis

In Brief

The article provides a comprehensive analysis of the past week in cryptocurrency, highlighting significant inflows into Bitcoin and Ethereum, technical price movements, and major market influences, along with Toncoin’s performance and institutional interest.

Bitcoin News & Macro

Let’s dig into what’s been going on with Bitcoin over the past week. Bitcoin and Ether led the charge with a whopping $17.8 billion in crypto inflows, marking the fifth-largest week of inflows ever.

Source: CoinShares

This influx helped Bitcoin claw back above the $60,000 mark, signaling strong investor interest. However, analysts are still playing it cautious, pointing to the macro environment as a critical influence on Bitcoin’s future moves.

Source: Dune

US Bitcoin miners are HODLing, betting on price hikes, while BlackRock’s asset management hit a staggering $10 trillion AUM, thanks to booming ETF inflows. This kind of institutional confidence is giving Bitcoin a solid support base.

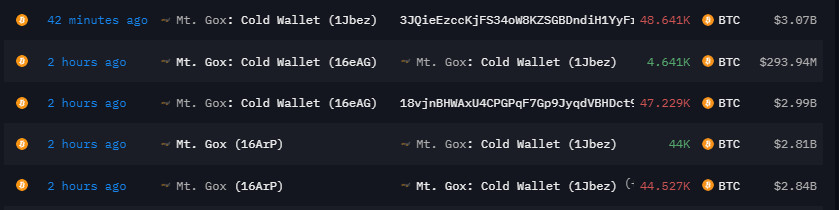

Source: Arkham Intelligence

The market got a jolt from Mt. Gox news, with $9 billion in BTC shifting from cold wallets, sparking initial sell-off fears. Yet, Bitcoin showed resilience, bouncing back above $65,000 as traders brushed off the potential threat.

Now, rumblings from Mainland China’s ongoing crackdown put some negative pressure on the market. Despite this, bullish vibes persisted, with BlackRock’s CEO backtracking on past skepticism about digital gold.

And, of course, there’s the elections. Speculations about a Trump victory in the upcoming US presidential race have been the talk of the town. Many see this scenario as a boon for Bitcoin, with Trump being openly and vocally pro-crypto. With Biden recently stepping down, who knows – maybe that’s not at all unlikely? Keep in mind, however, that politicians have been known to say all kinds of things prior to their elections.

BTC Price Analysis

With that in mind, let’s look at the technicals. On the daily chart, Bitcoin broke out of its consolidation phase, rallying from $54,000 to $69,000 – a 24% surge within the blue-highlighted week. This move points to bullish momentum dominating the week.

Source: TradingView

Key support at $54,000 halted declines, sparking a powerful rebound. Breaking through resistance near $63,000, Bitcoin accelerated upward. The 20-day and 50-day EMAs on the daily chart converged, with the price soaring above both, signaling a shift from bearish to bullish sentiment.

Source: TradingView

On the 4-hour chart, the rally is even more dynamic. Post-$63,000 breakout, Bitcoin formed a steep upward channel with higher highs and lows. The 50-EMA has acted as support during pullbacks while the RSI, though occasionally overbought, pointed at a strong bullish spirit.

Thus, the $67,000 level, initially a resistance, is now supported, with Bitcoin consolidating just above it. The rejection from $69,000 suggests some profit-taking, but consolidation at $67,000 shows buyers still in control.

So, Bitcoin’s breach of key resistance levels, strong EMA support, and bullish RSI indicators point to a promising outlook. Holding support around $67,000 and breaking past $69,000 could lead to new highs, while dips below may signal consolidation or minor corrections.

Ethereum News & Macro

So, this past week, Ethereum had quite a journey, much like Bitcoin. The excitement about the upcoming Ethereum ETFs has also electrified the market.

Source: Bybit

Institutions are placing big bets on Ether, which has helped push its price past $3,300. It’s been one of the largest weekly inflows we’ve seen recently, which says a lot about the growing interest.

That said, while the trend is mostly positive, some analysts are advising caution. The initial excitement around the ETFs might die down, which could lead to some price corrections. But overall, the mood is still pretty upbeat. Many believe Ether could even outshine Bitcoin once these ETFs are launched. The SEC’s preliminary approval for several Ethereum ETF issuers has definitely helped boost this optimism.

However, there’s always that lingering concern about potential regulatory hurdles, especially with the SEC asking for final submissions from issuers.

ETH Price Analysis

So, Bitcoin’s resilience in bouncing back has provided a positive backdrop for Ethereum’s growth. But for now, ETH’s movement suggests an accumulation phase, with traders building positions in anticipation of a breakout. Let’s look at that in detail.

Source: TradingView

On the daily chart (blue box), Ethereum rallied from around $2,800 to the $3,500 resistance zone, reflecting the broader crypto market’s bullish sentiment. The 20-day and 50-day EMAs are converging, hinting at a potential trend reversal if ETH holds above these levels. A breakout above $3,000 signaled a momentum shift, but resistance at $3,500 caused a slight pullback, with traders taking profits in this range.

Source: TradingView

On the 4-hour chart, after testing support at $3,000, ETH saw a strong rally driven by buying interest, with RSI moving from oversold to neutral. However, resistance of nearly $3,500 led to consolidation. Closes above $3,000 have reinforced bullish confidence, while failures to breach $3,500 have limited upward movement, mirroring Bitcoin’s volatility.

The balance between $3,000 support and $3,500 resistance, along with EMA trends, indicates a market in contemplation, poised for a significant move.

Toncoin News & Macro

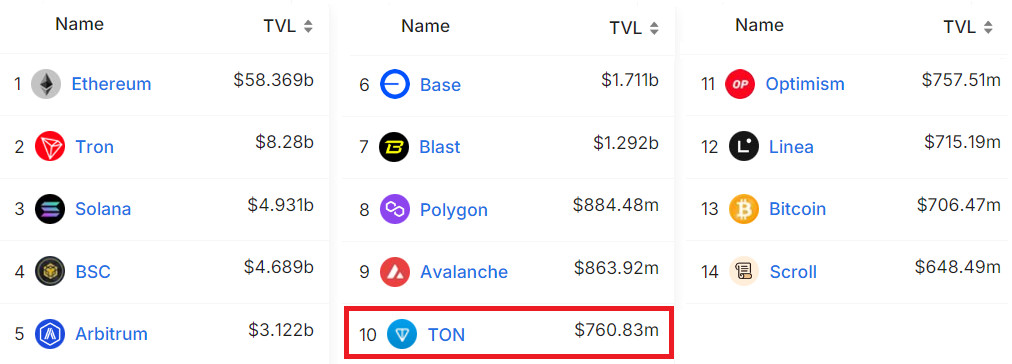

Toncoin’s developments have been full of buzz about integrations while still echoing the moods prevalent in Bitcoin and Ethereum. With the TON Network’s TVL skyrocketing past $760 million, investor interest has surged, pushing Toncoin into the spotlight.

Source: DefiLlama

Now, the real for Toncoin is that Coinbase International has decided to list futures on TON – talk about majors diving headfirst into crypto.

However, it hasn’t been all smooth sailing. The recent WazirX hack, resulting in a $235 million loss, has raised serious security concerns across crypto exchanges.

Yet, just like Bitcoin’s bounce back, Toncoin has shown remarkable resilience. Let’s look at just how that happened.

TON Price Analysis

Toncoin (TON) had a classic tug-of-war week between bulls and bears, oscillating between key support at $7.10 and resistance around $7.50, as shown in the blue box.

Source: TradingView

On the daily chart, TON fluctuated within this range. The 20-day EMA slightly above the price indicates lingering bearish sentiment, while the 50-day EMA below suggests a potential bullish trend in the longer term. This EMA convergence reflects market uncertainty, with no clear dominance by buyers or sellers.

Price movements saw rallies and pullbacks throughout the week. Attempts to break above $7.50 faced significant selling pressure, while $7.10 held firm as support. This interplay highlights TON’s consolidation phase.

Source: TradingView

On the 4-hour chart, after testing $7.10 support, TON rallied briefly towards $7.50, driven by renewed buying interest, with the RSI moving from oversold to neutral. However, resistance at $7.50 led to consolidation around $7.20.

No distinct chart patterns like triangles or flags formed, but the overall movement suggests an accumulation phase, with traders building positions in anticipation of a breakout.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.