Weekly Crypto Highlights: Bitcoin Struggles, Ethereum Gains, and Toncoin’s Stability

In Brief

The weekly crypto highlights report covers Bitcoin’s struggles with a significant price drop to $64,000 and market pressures, Ethereum’s gains following SEC news, and Toncoin’s stability despite market volatility, detailing price analyses, macroeconomic factors, and institutional moves in the blockchain sector.

Bitcoin News & Macro

Bitcoin took a dive to $64,000, hitting a new 1-month low and having traders on the edge. Despite significant buying from large investors – seen from exchange reserves dropping to a three-year low – the market remains tense without signs of a swift rebound. This is exacerbated by a 2.8% price drop triggered by whales as Bitcoin approached $66,500, deepening the bearish sentiment and intensifying struggles to maintain the $64,000 threshold.

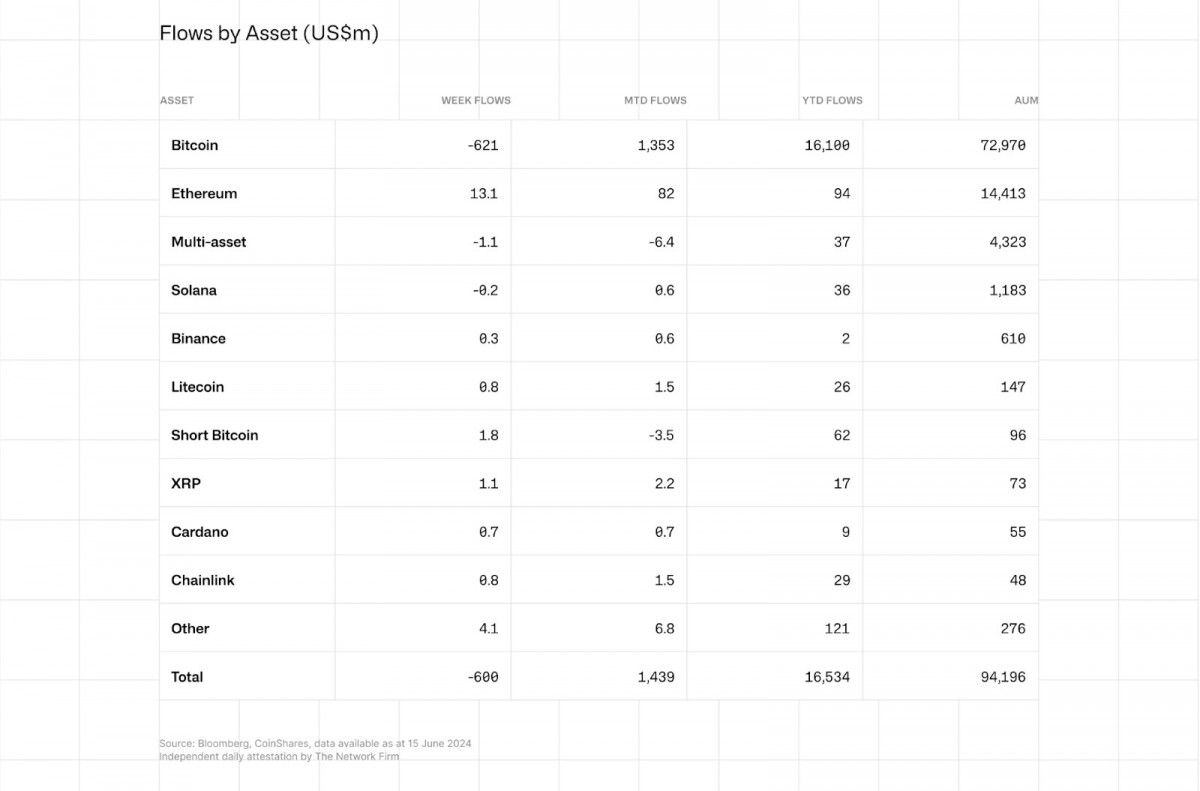

The gloomy market mood is fueled by the Federal Reserve’s tough stance and large-scale withdrawals from U.S.-based Bitcoin ETFs, which saw a staggering $600 million exodus on June 14 – the heftiest outflow since March.

A breakdown of inflows/outflows by digital asset. Source: CoinShares Weekly Fund Flows Report

This financial flight adds considerable pressure on Bitcoin’s value, especially as the Fed’s inclination towards higher interest rates makes riskier assets like Bitcoin less appealing. Despite Bitcoin outperforming the S&P 500 by over three times in 2024, this advantage hasn’t staved off a selling frenzy.

Source: Michael Saylor (X/Twitter)

Amidst the downturn, actions such as MicroStrategy’s $800 million note offering to purchase more Bitcoin suggest that some market participants view the lower prices as prime buying opportunities.

Miners hold the smallest amount of Bitcoin since February 2010. Source: IntoTheBlock

Additionally, with Bitcoin miners holding the least amount of Bitcoin since 2010, a potential supply squeeze could be on the horizon, further influencing the market dynamics.

High-profile transactions are also causing turbulence in the already volatile market. Notable movements include Michael Dell’s massive $2.1 billion Bitcoin sale and the Winklevoss twins’ significant political donation, both injecting short-term volatility. Despite the tumultuous price landscape, political figures seem increasingly intertwined with cryptocurrency, signaling an escalation rather than a retreat from crypto engagements.

BTC Price Analysis

This past week’s look at Bitcoin’s charts spells out a textbook sell-off, with prices dipping through what used to be solid support. Here’s a quick rundown of what’s been happening:

BTC/USD 1D Chart, Coinbase. Source: TradingView

The daily chart caught Bitcoin in a tough spot, slipping under a support line that had previously held up for weeks. We saw a tumble from highs around $66,000 down to nearly $62,000, marked by a bunch of long red candles. Both the 20-day and 50-day EMAs crossed in a way that screams trouble for Bitcoin bulls, hinting this dip might stick around unless we see a strong bullish bounce back.

BTC/USD 4H Chart, Coinbase. Source: TradingView

Zooming into the 4-hour chart, this drop gets a closer look. The 50-EMA has turned into a ceiling that Bitcoin just can’t crack right now, making every rebound effort a short-lived story.

The Relative Strength Index on this tighter timeframe dipped below 30, signaling an oversold market. But don’t get too hopeful – without a strong push from buyers, these low RSI readings just underline the heft of the sell-off.

That former support (dashed line we’ve been watching) has been a battleground for bulls, but now it’s a barrier on Bitcoin’s road to recovery. Trading volumes during this dip were notably hefty, suggesting that the drop had plenty of backing.

Traders should keep eyes peeled for any signs of the market steadying or price patterns that might signal a turnaround. But with those EMAs looming overhead on the daily chart, any uptick will have its work cut out for it.

To sum it up, it’s been a week of bears roaring through the Bitcoin market, with key indicators advising caution ahead.

Ethereum News & Macro

Ethereum also had a roller-coaster week. The SEC ending its investigation into Ethereum gave Ether’s price a welcome boost, pushing it past $3,500. This shot of optimism showed strong market support, but, like Bitcoin, which was struggling at $64,000, Ethereum couldn’t keep the momentum.

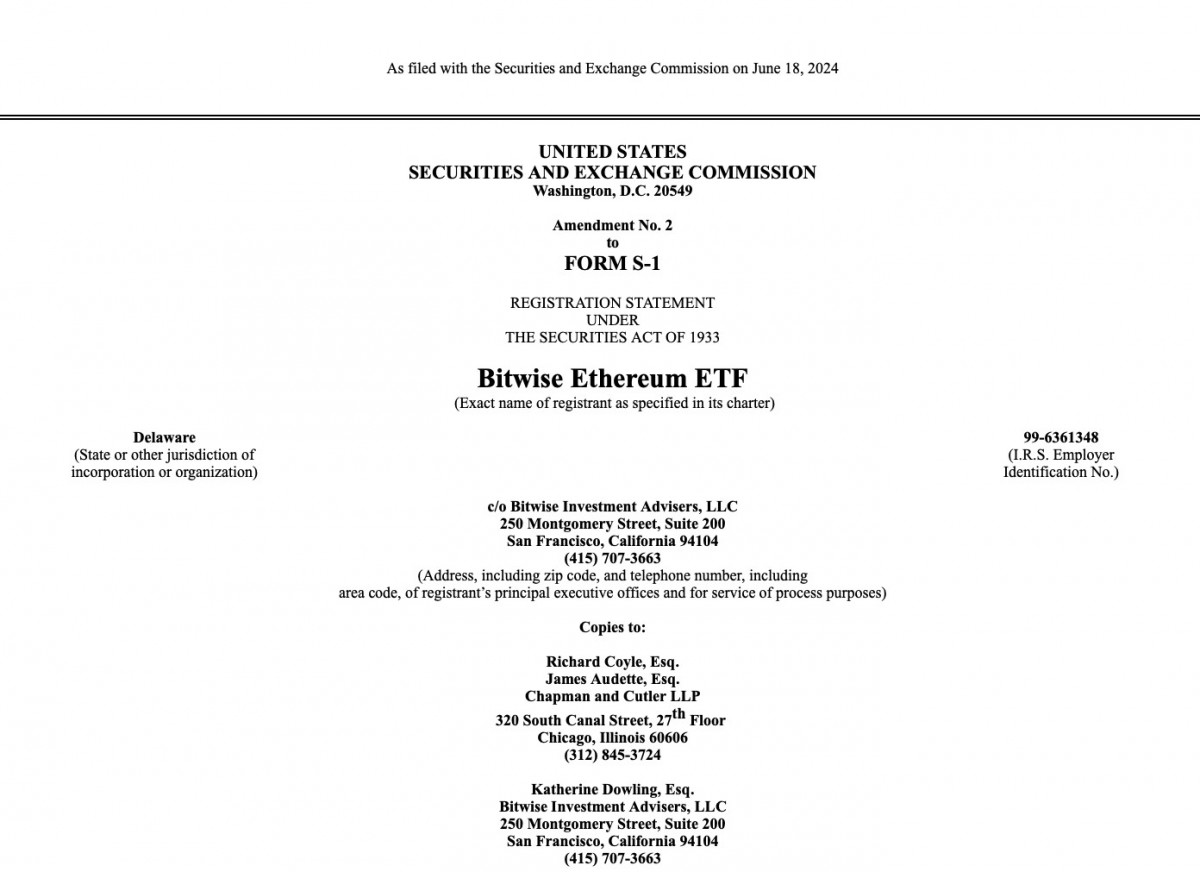

Adding to the excitement, Bitwise updated its Ethereum ETF filing with Pantera, which is planning to invest up to $100 million. Together with MicroStrategy’s $800 million note Bitcoin offering, this points to yet-unwavering institutional interest.

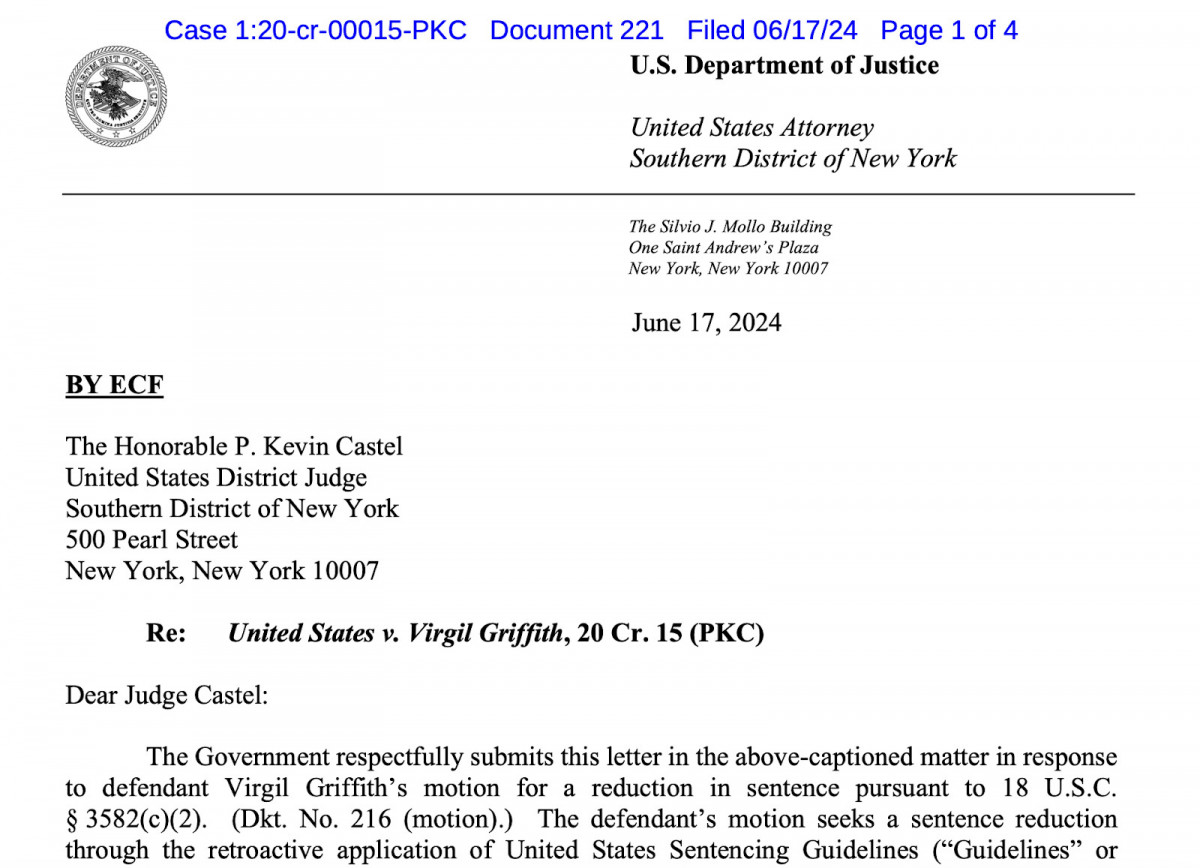

June 17 filing opposing Virgil Griffith’s motion for a sentence reduction. Source: PACER

However, not all the news was good last week. U.S. prosecutors opposed reducing the sentence for an Ethereum dev Virgil Griffith, reminding us that ongoing legal risks are still looming, making traders expectedly cautious.

Of course, the future outlook depends on Ethereum breaking current resistance levels and sustaining growth – just like the hypothetical $90,000 breakout for Bitcoin.

Overall, Ethereum’s price is still tied to the broader market, including Bitcoin’s ups and downs. All factors combined are so far making it tough for ETH to stay above $3,500.

ETH Price Analysis

Ethereum’s 1-Day journey shows it slipping steadily beneath the weight of the bear market. No fancy flags or triangles this time – just a straightforward bumpy slide down the charts as sellers took the reins.

ETH/USD 1D Chart, Coinbase. Source: TradingView

Mirroring the mood in the Bitcoin camp, Ethereum also showed a breakup with its previous support levels. The 2-EMA interaction here adds layers to our story. Initially hugging the 20-EMA, ETH took a stumble and didn’t stop until it tripped below the 50-EMA. This bearish crossover, where the 20-EMA swooped under the 50-EMA, pretty much set the stage for a downward drama. The volume spike in ETH’s recent plunge ties the whole picture together, showing that this wasn’t a gentle slide but a determined push downwards.

ETH/USD 4H Chart, Coinbase. Source: TradingView

Zooming into the 4-Hourly, Ethereum’s saga doesn’t look much brighter. After failing to hold the 3,650 dashed support line, ETH nosedived, showing that bears were in full control. As it danced around the 50-EMA, each attempt to rise above was squashed, sending ETH down further. The RSI dipping near 30 whispers ‘oversold,’ but there’s no sign of any bullish muscle to punch back. Key resistance for ETH now lies at those daily EMA levels, which could serve as battlegrounds for any potential recoveries.

For traders, these are times to watch the EMAs for any sign of a bullish crossover or a calming of the RSI on the 4-hour chart to signal a potential ease-up on the selling pressure. As always, the trick will be in catching the right wave at the right time, should the tides turn favorable again.

Toncoin News & Macro

Toncoin’s week was also full of ups and downs. For one, Binance greenlit USDT transfers on the TON blockchain, cementing its institutional presence. Integrations like these are known to boost liquidity and cut transaction fees, so that’s something to cheer for Toincoin investors.

Source: Binance

What’s more, there’s a buzz about Toncoin’s unique approach to cross-chain swaps. This could set it apart and drive future growth, much like the hopeful predictions for Ethereum and Bitcoin.

However, economic pressures and liquidity problems are still rocking the whole crypto market, causing price swings in TON following other majors.

TON Price Analysis

TON’s price action, while echoing the bearish trend seen in BTC and ETH, shows subtle signs of holding ground better than its peers. Let’s slice into TON’s price moves over the past week.

TON/USD 1D Chart, ByBit. Source: TradingView

On the daily chart, TON showed a roller-coaster week, diving in and out of the bullish and bearish zones. After a steep climb early in the week, TON’s price pulled back sharply, shedding gains as it moved from peaks near $8.20 down to around $7.20. This drop reflects a similar sentiment seen in ETH and BTC, where rallies were quickly sold off.

Early in the week, TON danced around the 20-day EMA, signaling some buying interest, but this was short-lived as prices dipped below both the 20-EMA. TON’s price dipped below the 20-EMA mid-week, signaling a bearish shift, but unlike BTC and ETH, it hasn’t broken below the 50-EMA, suggesting a bit more resilience or possibly a slower reaction to broader market pressures.

TON/USD 4H Chart, ByBit. Source: TradingView

The 4-hour chart brings into focus the struggle around the 50-EMA, which acted like a ceiling, capping any bullish attempts to recover fully from the dips. Each push upwards was met with resistance, and the RSI lurking below the 50 mark most of the week indicates that the bears had the upper hand, much like what we saw with ETH. However, unlike ETH and BTC, TON’s RSI didn’t dip into severely oversold territories, which might suggest that selling pressure, while persistent, wasn’t as extreme. During the weekend, we saw a break above the 4-hourly 50-EMA, but that was also short-lived, as TON tumbled back below the EMA, not yet gaining a foothold.

In sum, unlike BTC and ETH, where we observed clear bearish crosses on their EMAs and stronger downtrends, TON managed to keep above its more significant 50-EMA on the daily chart, offering a sliver of hope for the bulls. A definitive break above the 20-EMA could be a sign to watch for potential bullish momentum build-up.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.