Visa Exposes the Veil Over 90% of Stablecoin Transactions: Unveiling the Bot-Driven Reality

In Brief

Visa has revealed that 90% of stablecoin transactions are fraudulent, indicating bots and large-scale traders rather than genuine user activity, raising doubts about the mainstream adoption of stablecoins.

In a startling revelation, Visa has reported that over 90% of stablecoin transaction volumes do not stem from genuine user activity but rather from bots and large-scale traders. This finding, in collaboration with blockchain data firm Allium Labs, has sent shockwaves through the crypto industry, casting doubt on the mainstream adoption narrative surrounding stablecoins.

In the context of blockchain and decentralised finance (DeFi), what is a “real” transaction? According to Visa’s analysis, most stablecoin transactions are not caused by regular consumers using these virtual currencies for transactions or money transfers but rather by automated procedures and skilled trading firms.

To put things in perspective, stablecoins are digital currencies that are intended to keep their value constant. They are frequently linked to fiat currencies like the US dollar. By providing a reliable means of exchange and safe haven inside the erratic cryptocurrency markets, they want to close the gap that exists between traditional finance and cryptocurrencies.

The Stablecoin Landscape

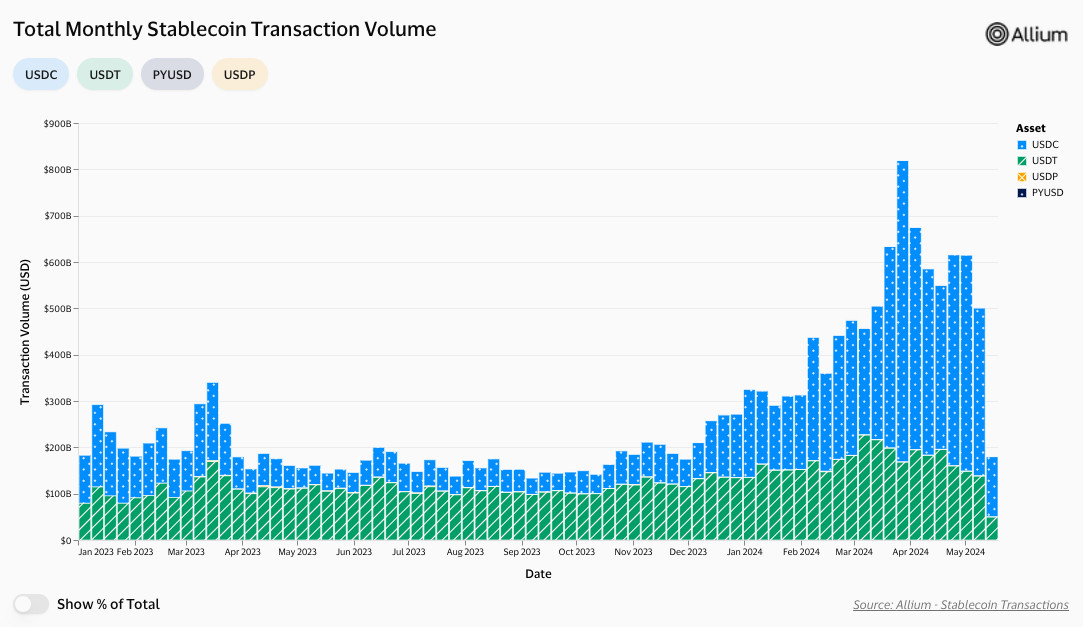

As of now, the stablecoin market boasts a substantial market capitalisation of around $160 billion, with Tether (USDT) and USD Coin (USDC) dominating the space, accounting for over 90% of the market share. These digital assets have gained traction among traders, investors, and DeFi platforms for their stability and ease of use in facilitating transactions and providing liquidity.

Visa’s report reveals a stark reality: amidst the staggering $2.2 trillion in stablecoin transactions documented in April 2024, a significant portion lacked the hallmark of genuine user engagement. According to the findings, a mere $149 billion could be traced back to what the report classifies as “organic payments activity.”

Photo: Visa

The Role of Bots and Automated Processes

The intrinsic characteristics of smart contracts and ledger technology play a major role in the enormous amount of bot-driven transactions. In contrast with conventional finance, where trusted middlemen originate and approve actions, those on the blockchain are carried out by autonomous code, frequently prompted by outside events or automated processes known as “bots.”

These bots perform a number of tasks for the DeFi ecosystem, including market making, stablecoin arbitrage, liquidity provision, and transaction fee optimisation. They also carry out intricate financial procedures. The ensuing on-chain transactions could not match conventional settlement procedures despite the fact that these activities are essential to the continued growth of the DeFi industry.

For instance, a developer could create a bot program to perform stablecoin arbitrage across multiple decentralised exchanges (DEXs), capitalising on temporary price discrepancies. Similarly, liquidity providers might employ bots to adjust their positions and maintain desired exposure levels automatically.

The Paradigm Shift: Redefining “Real” Transactions

The topic of what defines a “real” transaction in the context of blockchain and DeFi has been rekindled by Visa’s results. Payments are often associated with direct human engagement in traditional banking. However, the blockchain execution model provides an innovation in which transactions are started and carried out by autonomous code.

This paradigm’s proponents contend that automation is a key component of blockchain, opening the door to complex banking services and improving productivity. They argue that we should applaud the emergence of bot-initiated transactions as evidence that blockchains are becoming a strong foundation for automated money transfers.

Consider, for example, a future in which autonomous smart contract execution, started by bots, facilitates daily mortgage refinancing through the use of flash loans or quick, uncollateralised crypto loans. This degree of automation has the potential to save operating costs and provide financial services with never-before-seen accessibility.

The Mainstream Adoption Narrative

Visa’s report has also cast doubt on the narrative surrounding stablecoins’ potential for mainstream adoption as a payment method. Compared to the $150 trillion global payments industry, the report suggests that stablecoins are far from achieving widespread adoption as a payment option among everyday consumers and businesses.

Conversely, some industry analysts hold the view that stablecoins are merely in their nascent stage and could potentially garner widespread adoption in the future. Pranav Sood, the general manager at Airwallex, emphasised the importance of prioritising the enhancement of existing infrastructure in the short and mid-term, stating that “ensuring the optimal functionality of current payment systems should be our primary focus.”

Regulatory Implications

The revelation of bot-driven stablecoin transactions could also have implications for regulatory efforts surrounding these digital assets. Policymakers and financial authorities have been grappling with the challenge of establishing a clear regulatory framework for stablecoins, which have emerged as a critical component of the crypto ecosystem.

Some analysts argue that the dominance of bot-initiated transactions underscores the need for robust monitoring and oversight mechanisms to ensure transparency and accountability within the stablecoin market. Others contend that excessive regulation could stifle innovation and hinder the growth of this nascent industry.

The Path Forward

As the stablecoin market continues to evolve, the industry must confront the complexities surrounding bot-driven transactions and their implications for mainstream adoption. Addressing this challenge will require a multifaceted approach involving:

Improved data analytics and monitoring: To gain a comprehensive understanding of the stablecoin market, more refined data analytics tools are needed to differentiate between bot-initiated and genuine user transactions accurately.

Education and awareness: Efforts should be made to educate the public, policymakers, and industry stakeholders about the unique execution model of blockchain technology and the role of automation in facilitating efficient and secure transactions.

Regulatory clarity: Policymakers should strive to establish a balanced regulatory framework that fosters innovation while ensuring transparency, consumer protection, and market integrity within the stablecoin ecosystem.

Collaboration and innovation: Continued collaboration between traditional financial institutions, fintech companies, and blockchain developers is crucial to bridge the gap between legacy systems and emerging technologies, enabling the development of innovative solutions that leverage the strengths of both worlds.

What to Expect?

Visa’s revelation that over 90% of stablecoin transaction volumes are linked to bots and large traders has sparked a crucial dialogue within the crypto industry. While some may view this as a cause for concern, others argue that it represents a paradigm shift in how we perceive and understand financial transactions in the blockchain era.

As the industry grapples with this conundrum, it becomes increasingly clear that a one-size-fits-all approach is inadequate. Embracing the unique characteristics of blockchain technology, while addressing legitimate concerns around transparency and accountability, will be crucial for unlocking the full potential of stablecoins and fostering their mainstream adoption.

Ultimately, the stablecoin bot conundrum serves as a microcosm of the broader challenges and opportunities presented by the integration of traditional finance and decentralised technologies. By navigating these complexities with an open mind and a commitment to innovation, the industry can pave the way for a more inclusive, efficient, and resilient financial system.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.