Unveiling the Future Potential of AMM Models in Derivatives Trading Through Equation

In Brief

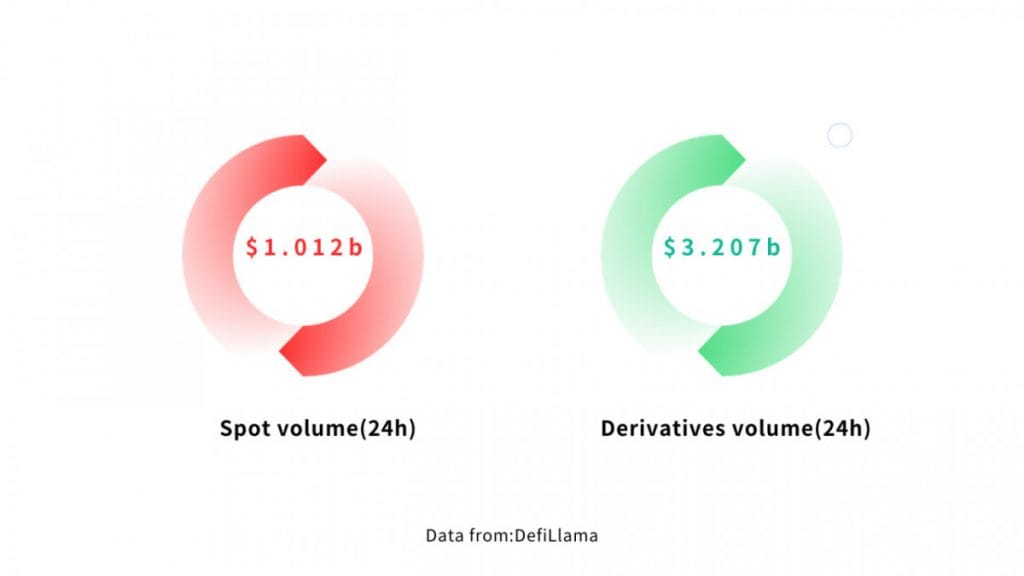

Derivatives trading has become an indispensable part of the crypto landscape. The perpetual contracts market share significantly increased within the derivatives market even on-chain.

Market Overview

Derivatives trading has become an indispensable part of the crypto landscape. The perpetual contracts market share significantly increased within the derivatives market even on-chain.

The development of on-chain derivatives trading protocols has been going in two main directions. One follows the traditional Centralized Exchange (CEX) order book model, where the orders are stored on a centralized server, faces challenges in balancing decentralization with trading experience. The other, represented by the GLP fund pool model, with GMX as a leading example, operates as a lending model where liquidity providers (LPs) lend funds for user positions allowing the users to make a profit as opposed to LPs losing money. While this model provides a straightforward trading experience, it has notable drawbacks. The size of a trader’s open position is limited by the LPs’ pool of funds, rather than a real perpetual contract, where the open position limit depends only on the counterparty; therefore there is a high risk of loss for the LPs when the market is one-sided.

Here, we introduce a novel derivatives trading protocol that inherits the same advantages of decentralization, efficiency, and transparency as the spot AMM and is perfectly suited for the price discovery function in the perpetual contract product field, which greatly improves the capital utilization.

Equation Introduction

Equation is a decentralized perpetual contract protocol based on Arbitrum, audited by the third-party firm ABDK. Leveraging its innovative Balanced Rate Market Maker (BRMM) model, Equation allows traders to establish larger and unrestricted positions at up to 200x leverage while benefiting from lower liquidation risks (MMR = 0.25%). At the same time, liquidity providers can also enhance capital efficiency by using leverage on Equation.

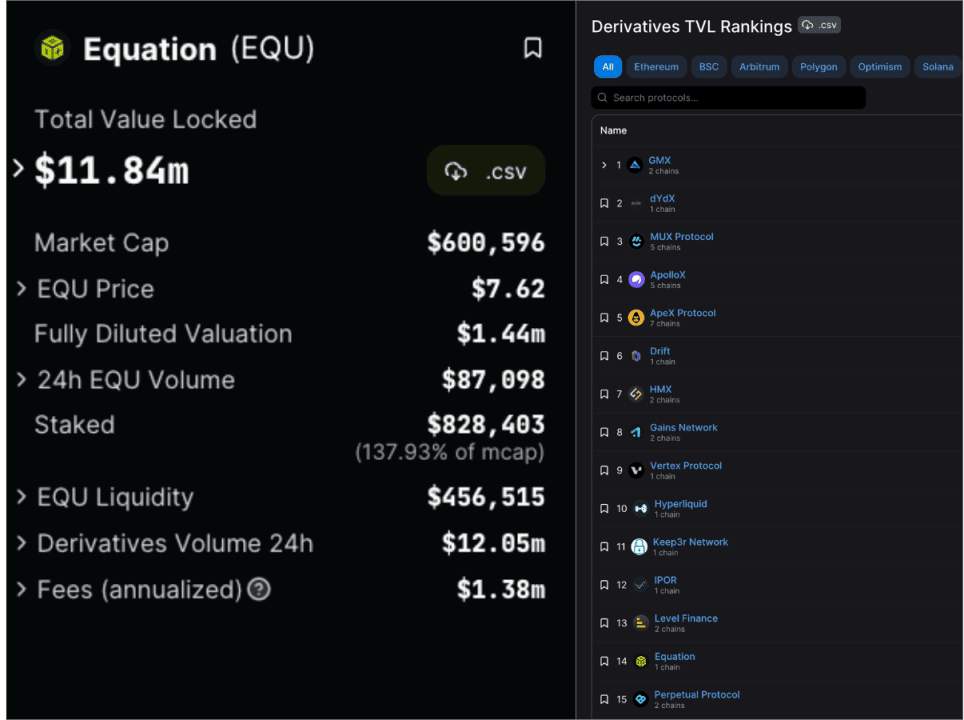

Equation officially launched on the Arbitrum mainnet on October 28, 2023. According to DefiLlama data on the day of writing, Equation ranks 13th among 162 on-chain derivatives exchanges.

Mechanism Advantages

The BRMM (Balanced Rate Market Maker) concept draws inspiration from the AMM (Automated Market Maker) mechanism in the spot market, with a key difference. It calculates the liquidity pool’s balance rate based on the temporary positions held by liquidity providers. This rate is then used to calculate the contract price premium relative to the index price. BRMM can then find price discovery. The BRMM model has a clear advantage. Similarly to perpetual contracts on CEX, who are relying solely on counterparty size, the user position sizes are not limited by liquidity. The liquidity provided by LPs only serves as temporary counterparty positions, allowing the users to benefit from temporary position risks.

The benefits of these mechanisms attracted many users to Equation, especially after the Mainnet launch. According to Equation’s official website, on the 24st day of the Mainnet operation, Equation protocol’s leveraged liquidity amounted to $596,584,794, with a perpetual contract trading volume of $296 million and an open contract volume of $76,183,194.

Fair Launch and Burning Mechanism

EQU is Equation’s native token. EQU has a maximum supply of 10 million tokens, generated entirely through position mining, liquidity mining, and referral mining. All of these mechanisms reward the community members of Equation. As of writing, Arbiscan shows that 224,877 EQU have been mined, and EQU is currently only available for trade on Uniswap, now at $11.88.

EQU is differentiating itself from competitors in terms of the token allocation. Equation allocates 50% of tokens through Position Mining to traders. LPs will capture more trading fees thanks to our increased capital efficiency through leverage. Equation offers two staking modes for EQU: EQU/ETH LP NFT staking and Solo-asset EQU staking. These two mining modes require different lock-up periods. As we speak, 159,872 EQU are in staking. Token staking indicates the confidence in the project’s development, correlating positively with the holder’s time and positive perception on the project.

Equation DAO has adopted a proposal to burn off a proportionate amount of unused EQUs based on the length of the EQU lock-up period, a strategic move designed to potentially increase the value of EQU holders’ holdings and to encourage and reward them for their long-term investment in the ecosystem.

Conclusion

Clearly excelling in the decentralized perpetual contract field, Equation outperforms its DEX competitors. Factors such as trading costs, position limits, liquidity pool depth, and maintenance margin rates directly influence positively the trading experience for traders. Equation, through measures such as funding rates, fee discounts, and position mining, provides traders with a more cost-effective trading service.

For liquidity providers, a DEX’s capital efficiency is very important and Equation offers the possibility to LPs to leverage to obtain more trading fees and token (EQU) shares with less capital.

With all these positive impacts, BRMM successfully addresses the challenges of low capital efficiency and poor trading experience exhibited by AMM models in the application of perpetual contract products. The future looks promising for Equation who has the potential to dominate the entire decentralized perpetual contract market.

About Equation

Equation is a decentralized perpetual contract protocol built on Arbitrum, audited by third-party auditor ABDK. With its innovative BRMM model, Equation allows traders to take larger and unlimited positions with up to 200x leverage at a lower risk of blowout (MMR = 0.25%). At the same time liquidity providers are able to use leverage at Equation to improve capital efficiency. As one of the DeFi protocols advocating for a return to Fair Start, Equation is showing the world in action how the power of community-driven innovation can shape the future of decentralized finance. It prioritizes security and transparency and aims to provide traders with a reliable and secure environment for trading perpetual contracts. Please visit the official website https://equation.org to learn more.

Media Contact

Company: EquationDAO

Contact: Equation Media Team

Email: [email protected]

Website: https://www.equation.org/

Twitter: https://twitter.com/EquationDAO

Medium: https://medium.com/@EquationDAO

EQU is tracked on

DefiLIama: https://defillama.com/protocol/equation

CoinMarketCap: https://coinmarketcap.com/currencies/equation/

Coingecko: https://www.coingecko.com/en/coins/equation

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.