Top Prediction Market Platforms To Use In 2026

In Brief

Prediction markets are moving mainstream, evolving from niche crypto and academic tools into widely accessible platforms that let users trade real-world event outcomes like stocks, bridging finance, pop culture, and forecasting.

Prediction markets are going mainstream. They were once a niche corner of crypto and academic forecasting, but the apps are now getting real traction thanks to better design, simplified trading, and by becoming part of pop culture: from South Park to NFL markets on Robinhood.

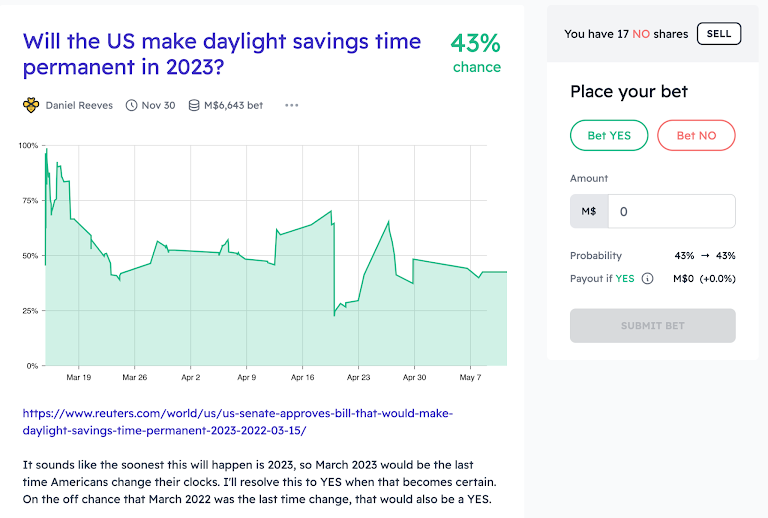

Unlike sportsbooks, prediction markets let users buy and sell “Yes” or “No” contracts on real-world events, basically like a stock market for future outcomes. The price of each contract reflects the collective belief that something will (or won’t) happen.

This article breaks down the best prediction market apps of 2026, from traditional platforms like Kalshi to blockchain-based tools like Polymarket. We’ll explain how they work, where they’re legal, and which app is best for your goals.

What Is a Prediction Market App?

Prediction market apps let you trade contracts on future events. Each market asks a simple question: “Will X happen by Y date?”

You buy a YES or NO contract. The price reflects probability: a YES contract priced at 34¢ implies a 34% chance of that outcome. If you’re right, you get $1. If you’re wrong, you get $0.

The magic is in the market. Prices move up and down as users trade. Unlike sportsbooks (which lock in odds when you place a bet), prediction markets are dynamic and crowd-driven, like a stock exchange.

Example:

- Market: Will the Cowboys win the Super Bowl?;

- You buy YES at 0.20 ($20);

- If they win: you get $100;

- If not: you lose your $20;

- Or sell early if odds shift in your favor.

Best Prediction Market Apps: 2026 Rankings

| App | Best For | Bonus | Payout Speed | Fees | Notable Feature |

| Kalshi | Overall Experience | $10 Bonus | 4 Days | Low | Predictive Insights Tool |

| Polymarket | Crypto-native Prediction | None | 24 Hours | Zero Fee | Runs on USDC via Polygon |

| Robinhood | Beginners & Stock Traders | $200 Stock | 24 Hours | $0.01 Fee | Familiar UI + NFL markets |

| Crypto.com | Altcoin Integration | $50 Crypto | 1 Hour | Low | 350+ tokens supported |

These platforms have different audiences. Kalshi is built for U.S. traders who want clean UX and reliable regulation. Polymarket is the king of crypto-native prediction: fast, cheap, and open to anyone with a wallet. Robinhood’s new entry is tailored for sports fans and investors used to app-based trading.

Top Predictions Market Platforms of 2026

Kalshi

Kalshi is the only CFTC-regulated prediction market in the U.S., making it legal for Americans to trade real money on real-world events, from inflation rates to Taylor Swift ticket prices.

Use Case

Serious forecasters, hedge traders, political bettors

Key Features

Regulated, up to $25K per market, tight spreads

Example Markets

- Will the U.S. unemployment rate be above 4.0% in July?

- Will Republicans win the midterms?

Kalshi combines Wall Street structure with Reddit-level events. It’s the go-to for anyone wanting to legally forecast U.S. economic, political, or societal outcomes, with real stakes.

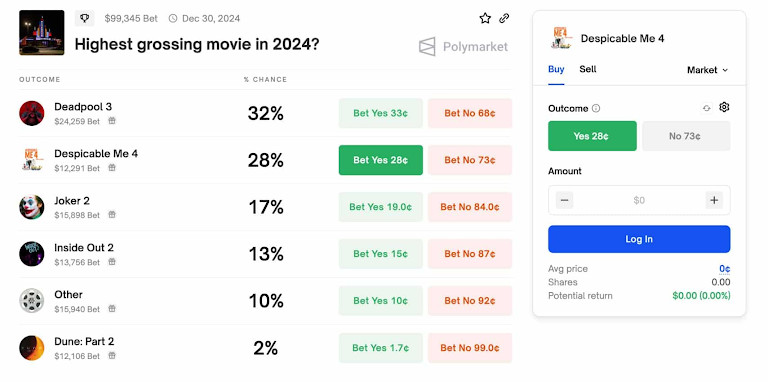

Polymarket

Polymarket is the largest on-chain prediction market, hosted on Polygon. It’s accessible globally and powered by USDC, letting anyone trade on real-world events with a DeFi twist.

Use Case

Crypto-savvy traders, DeFi fans

Key Features

Open liquidity pools, fast resolution, real-time trading

Example Markets

- Will Bitcoin hit $150K before 2026?

- Will Apple announce an AI chip in Q4?

Polymarket shines in speed, flexibility, and market diversity. From U.S. elections to UFO disclosures, Polymarket is where meme culture meets serious forecasting.

Manifold

Manifold is a play-money market that rewards accuracy and insight, not profit. It uses “Mana,” a fake currency, but attracts real thinkers: researchers, founders, and EA-aligned communities.

Use Case

Community insight, social forecasting, academic thought

Key Features

Free, API support, question creation, creator markets

Example Markets

- Will OpenAI release GPT-6 by year-end?

- Will China invade Taiwan by 2030?

Great for testing ideas, gauging vibes, and building forecasting literacy. Manifold also fuels broader ecosystems like Metaculus and PredictionBook.

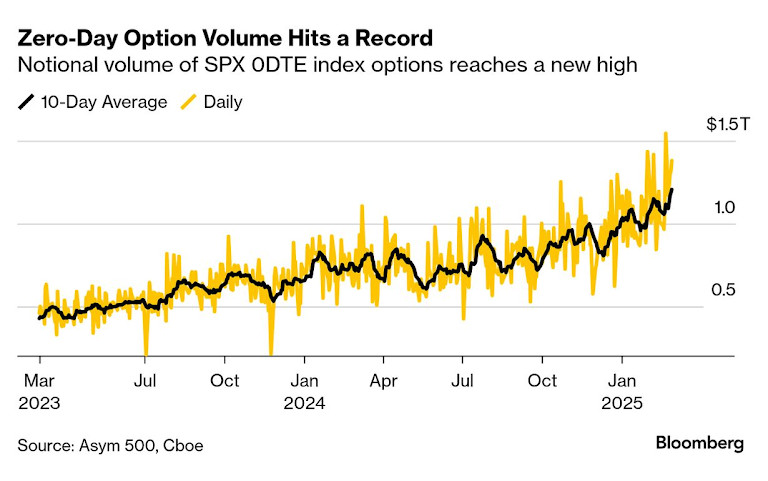

Robinhood 0DTE

Robinhood’s zero-day options (0DTE) let users bet on daily market movements like a prediction market, just without calling it that.

Use Case

Day traders, degens, Wall Street retail

Key Features

Real-time options, intuitive UX, same-day expiry

Example Markets

- Will TSLA close above $850 today?

- Will the S&P 500 drop by 2% before 4PM?

While not branded as forecasting, Robinhood 0DTE offers some of the most liquid, high-stakes yes/no markets available, just in TradFi clothing.

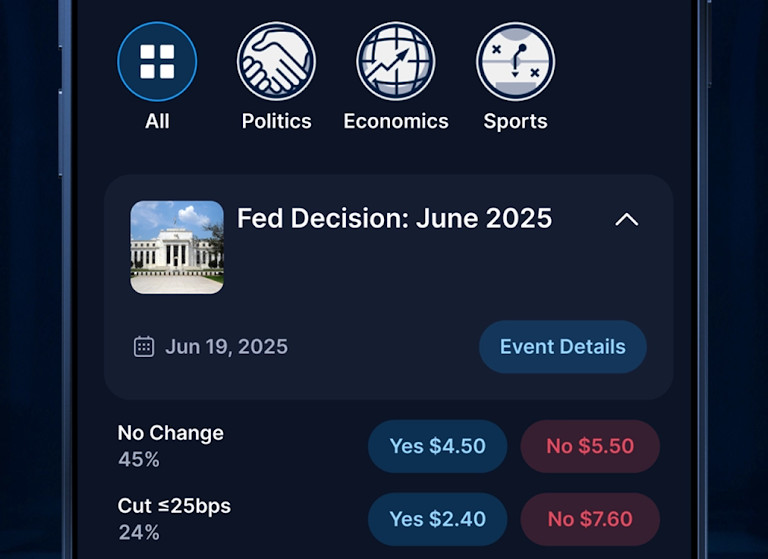

Crypto.com Predictions

Crypto.com quietly added a “Predictions” tab where users bet on upcoming crypto outcomes. It’s simple, slick, and designed for mobile-first audiences.

Use Case

Beginners, casual crypto holders, sportsbook-style bettors

Key Features

Fixed odds, weekly events, bonuses

Example Markets

- Will ETH outperform SOL this week?

- Will BTC hit $150K by month’s end?

Perfect for onboarding newbies into prediction culture without throwing them into a DEX or options terminal.

Hedgehog Markets

Built on Solana, Hedgehog offers DeFi-native binary prediction trading, often with deep liquidity and under-the-radar institutional flows.

Use Case

Crypto traders, DeFi whales, Solana ecosystem

Key Features

On-chain transparency, leveraged positions, fast resolution

Example Markets

- Will US CPI print above 3.5%?

- Will Notcoin flip PEPE in market cap?

It’s fast, composable, and deeply embedded in the Solana landscape. More aggressive and customizable than Polymarket for power users.

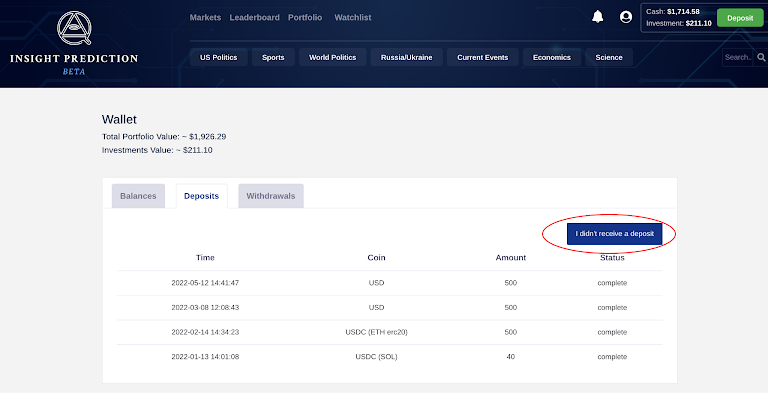

Insight Prediction

Insight is a hybrid: not fully DeFi, not TradFi. It offers cash-based prediction markets across global topics. Legal gray area, but growing fast.

Use Case

Politics followers, global bettors, risk-tolerant users

Key Features

Real money, global access, topic diversity

Example Markets

- Will Kamala run for president again?

- Will Ethereum switch to L2-centric roadmap in 2025?

Less regulated than Kalshi, more real than Manifold, and often faster-moving on news.

Metaculus

Metaculus is a quantitative forecasting platform often used by policy wonks, scientists, and EA thinkers to predict long-term global trends.

Use Case

Climate science, geopolitics, AI risk

Key Features

Calibration scoring, thousands of users, ensemble forecasts

Example Markets

- Will fusion power reach 10MW sustained output by 2030?

- Will there be a synthetic virus pandemic by 2035?

It’s not for quick profits, but if you want the most robust collective foresight on existential topics, this is it.

Which Prediction Market Should You Use in 2026?

If you’re just getting into prediction markets, the options can be overwhelming. Each platform is designed for a different type of user, whether you’re here to profit, to forecast, or just to explore.

Kalshi is the best choice if you’re in the U.S. and want to trade real money on regulated markets. It’s backed by the CFTC and offers high-quality markets on inflation, elections, interest rates, and more. If you want to treat prediction markets like a serious investment tool, start here.

Polymarket is ideal for crypto-savvy users who want fast markets on global events, from presidential debates to celebrity trials. It’s decentralized and fast-moving, with high volume and lots of meme energy. If you already use MetaMask or are deep in Web3, this one’s for you.

Manifold is the most fun and community-driven. You don’t bet real money (you use “Mana,” a play currency) but you still get access to thousands of clever, high-signal markets. It’s perfect for learning, experimenting, and seeing what the crowd really thinks about everything from politics to AI timelines.

Metaculus leans more academic. It’s built for long-term forecasting, things like “Will AGI arrive by 2030?” or “Will China invade Taiwan by 2027?” It scores you based on calibration and Brier accuracy, so if you’re here to build your forecasting skill (not just win bets), it’s a great place to grow.

Insight Prediction and Hedgehog serve the more experimental crowd. They let you bet real money (though often in legal gray zones) and offer more niche or edgy markets. Great for degens and power users, but less beginner-friendly.

Robinhood’s 0DTE options and apps like Kalshi’s mobile interface are also pushing prediction-style experiences into mainstream finance. You might already be participating in prediction-style thinking without realizing it.

What’s Next for Prediction Markets?

Prediction markets are no longer just a curiosity. They’re becoming infrastructure for journalism, governance, trading, and even science.

In the coming years, we’ll likely see mainstream platforms like Bloomberg, The New York Times, or FiveThirtyEight integrating prediction market data alongside polls and expert opinions. Instead of quoting “70% of economists,” headlines might read: “Market puts 42% chance on Fed hike next month.”

We’re also entering a phase where governments may begin experimenting with markets as policy tools. Imagine allocating budgets based on forecast accuracy, or using decentralized signals to detect geopolitical risks faster than traditional intelligence.

On the tech side, the biggest innovation could be AI-assisted forecasting. Manifold already lets users auto-generate markets with GPT. Soon, large language models could summarize top markets, spot inconsistencies, or even generate high-signal questions the crowd hasn’t thought of yet.

Meanwhile, legal clarity is inching forward, especially in the U.S. where Kalshi’s fight with regulators is forcing a long-overdue conversation about what counts as a “contract of difference” versus a useful public tool.

The big takeaway: prediction markets are evolving from hobbyist side-projects into real-world signal engines. And in a world drowning in opinions, the ability to price truth might be one of the most valuable tools we build.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.