Top 15 Crypto Staking Platforms in 2023

Crypto staking platforms have become increasingly popular in recent years as a way for investors to earn rewards while holding their cryptocurrency. Staking involves holding a certain amount of cryptocurrency in a wallet or on a platform to support the operations of a blockchain network and in return, receiving a reward in the form of additional cryptocurrency. Think of it like earning interest on saving your cash in the bank. With the rise of DeFi and the increasing adoption of blockchain technology, crypto staking has become a popular investment option for many people.

Why do people stake crypto?

There are several reasons why people use crypto staking platforms, with the most obvious being the potential to earn passive income. Staking rewards can be a source of income for long-term cryptocurrency holders who are not planning to part with their coins anytime soon. It is a low-effort method of making a buck since it does not require actively trading or investing in other assets. Additionally, staking can be a way to support the network and increase its security by becoming validators for the network, which can be a benefit for those who are committed to the long-term success of a particular blockchain project.

The difference between staking and lending

Many crypto exchanges and wallets of certain cryptocurrencies offer rewards generated via lending or on-chain staking. When lending, you deposit your crypto into a platform’s lending pool, which others then borrow at a fixed or variable rate. The platform draws a commission for facilitating the lending while paying you the remaining yield.

With staking, on the other hand, your assets are locked up in a smart contract that is governed by the network’s proof-of-stake consensus. Your crypto is used to secure the network, confirm transactions, and generate new blocks, and a fraction of the newly generated coins are then paid out to you. Be aware that many staking platforms charge a fee or commission for their services.

Considerations when choosing a crypto staking platform

Whether you’re staking or lending, especially on crypto exchanges, you should be aware that your funds are not in self-custody. When deciding on a crypto staking platform to use, it’s important to research the platform’s reputation and security measures to ensure that your funds are safe. Additionally, look for platforms with a clear and transparent staking process, including information about fees, rewards, and the process for withdrawing funds. It’s also important to consider the types of cryptocurrencies supported by the platform, as well as the potential rewards for staking each one.

In this listicle, we will explore some of the top crypto staking platforms on the market today, highlighting their features and benefits, as well as potential drawbacks or considerations to keep in mind. By providing an overview of some of the best options available, we hope to help investors make informed decisions about where to stake their cryptocurrency and potentially earn rewards.

Top 15 crypto staking platforms

AllNodes

AllNodes is an all-in-one node hosting and staking platform that allows users to easily stake 71 cryptocurrencies, including Bitcoin, Ethereum, Polygon, and other popular coins. The platform provides users with a simple and intuitive interface for managing their staked tokens and running a node on the network.

The platform has a value of over $2 billion across more than 34,000 hosted nodes. It supports staking from hardware wallets and offers competitive staking rewards ranging from 3-35%, depending on the token.

Pros:

- Supports a wide range of coins for staking

- Competitive staking rewards

- Simple and intuitive interface making it easy for novice users to participate in staking

Cons:

- No mobile app, which may be inconvenient for some users who prefer to manage their staked tokens on the go

Everstake

A decentralized staking provider founded in 2018, Everstake uses enterprise-level hardware to run over 8,000 nodes for over 70 blockchain networks, including Solana, Cosmos, Tezos, Polygon, and Cardano. The platform creates liquid staking products like Eversol. Everstake has over 625,000 unique users with $6.2 billion assets staked.

Pros:

- Supports a wide range of cryptocurrencies

- Competitive staking rewards range from 5%-49%, depending on the token

- User-friendly interface and management tools

Cons:

- Higher staking fees compared to some other platforms

- No mobile app available for managing staked tokens

Stakefish

Stakefish offers users the ability to stake their tokens and earn rewards while helping to secure a variety of blockchain networks. The platform operates validators for over 20 different protocols, including Ethereum, Cosmos, and Polkadot, among others.

The platform has been operating validators since 2018 and has established itself as one of the largest and most trusted validators in the crypto ecosystem. It supports over $1 billion worth of assets staked by both institutional and retail investors. Stakefish claims that its globally distributed team ensures 24-hour coverage of its validator nodes, giving users peace of mind.

Pros:

- Competitive staking rewards range from 5%-62%, depending on the token

- Offers staking for more than 20 different blockchain networks

Cons:

- Limited information available about its security measures

- No mobile app available

Lido

Lido is a decentralized staking platform that enables users to earn staking rewards on their Ethereum holdings. The platform allows users to stake their ETH, SOL, and MATIC tokens through a smart contract, which is then managed by a pool of validators.

The platform offers a number of benefits, including the ability to stake any amount of ETH, high staking rewards, and no minimum staking period. Additionally, Lido’s staked ETH tokens are liquid and can be traded at any time. A total of more than 291,000 stakers have staked over 10 million tokens on the platform, with more than $500,000 worth of rewards paid out.

Pros:

- Allows users to stake any amount of ETH

- Staking rewards from 4-6%

- Liquid staked ETH tokens can be traded at any time

Cons:

- Limited to staking only ETH, MATIC, SOL

SpoolFi

Spool is composable and permissionless DeFi middleware that connects Capital Aggregators with DeFi Yield Generators to dynamically, automatically, and efficiently allocate funds and ensure optimized yields for custom strategies managed by DAO-curated Risk Models.

The platform offers an infrastructure solution to create and invest using “Smart Vaults” to manage risks. Users can create custom Smart Vaults tailored to their specific risk appetite. Once assets are deposited into a Smart Vault, Spool automatically manages and rebalances investments across various DeFi protocols, so users don’t have to worry about paying any gas fees. Users can also earn a performance fee when others invest in your Smart Vault.

Pros:

- Risk-managed approach to yield farming

- Users can create custom Smart Vaults tailored to their specific risk appetite

- The auto-rebalancing feature across various DeFi protocols ensures that users don’t have to pay any gas fees

Cons:

- The performance fee charged to Smart Vault Creators may discourage some users from creating their own custom Smart Vaults

MyCointainer

MyCointainer is a staking platform that supports over 100 cryptocurrencies. The platform offers secure and reliable node hosting services, as well as competitive staking rewards of over 14% APY for users.

The platform provides a user-friendly interface and a range of tools for managing staked tokens and tracking rewards. The platform also offers a number of other services, including a marketplace for buying and selling cryptocurrencies, crypto mining, and cashback on shopping from over 2300 global retailers.

Pros:

- No lockup period for over 100 supported staking assets

- Claims to offer daily rewards and minimal fees

- Mobile app for users to manage their staking activities

Con:

- No concrete information on staking fee/commission

Stader

Stader is a multichain liquid staking platform that allows users to access their assets while earning staking rewards. Unlike the proof-of-stake system, where user funds are locked up for a period of time, liquid staking stores funds in DeFi escrow accounts so that users can access their tokens whenever they want, making their funds liquid. This enables users to use their staked tokens as collateral for other financial transactions, such as lending, borrowing, and trading, to generate multiple revenue streams.

The platform supports nine networks, including Ethereum, Fanton, BNB, Polygon, Near, and more.

Pros:

- Increased liquidity and flexibility.

- Retain control over your assets while still being able to use them for other purposes

- Potential for higher returns as staked tokens can be used for other financial transactions that generate additional passive income.

Cons:

- May be more complex and difficult to use than traditional staking platforms, as liquid staking involves additional financial transactions and collateralization

- Regulatory uncertainty of liquid staking may lead to legal and regulatory risks for users and providers of liquid staking services

Stakely

A decentralized staking provider built on the Ethereum network, Stakely is a non-custodial platform that supports close to 40 tokens, including ETH, FTM, DOT, and more. The platform offers staking APY ranging from 5-43%, depending on the token. It charges a 5% commission to cover the costs of maintaining its infrastructure. It has a total value of more than $612,000 locked and more than 38,000 users staking across 34 networks.

A percentage of the fees earned each month goes towards the Stakely Insurance Program, which provides insurance for delegators in case Stakely’s validators are affected by a slash incident. Slashing occurs when a validator displays harmful behavior like downtime or poor performance, resulting in a penalty of having their bonded tokens slashed, meaning that those tokens will be lost.

Pros:

- Staking insurance ensures that assets are secure

- Low commission fees

- Non-custodial platform. Users don’t have to transfer funds to the platform’s validator

Cons:

- Limited variety of supported cryptocurrencies.

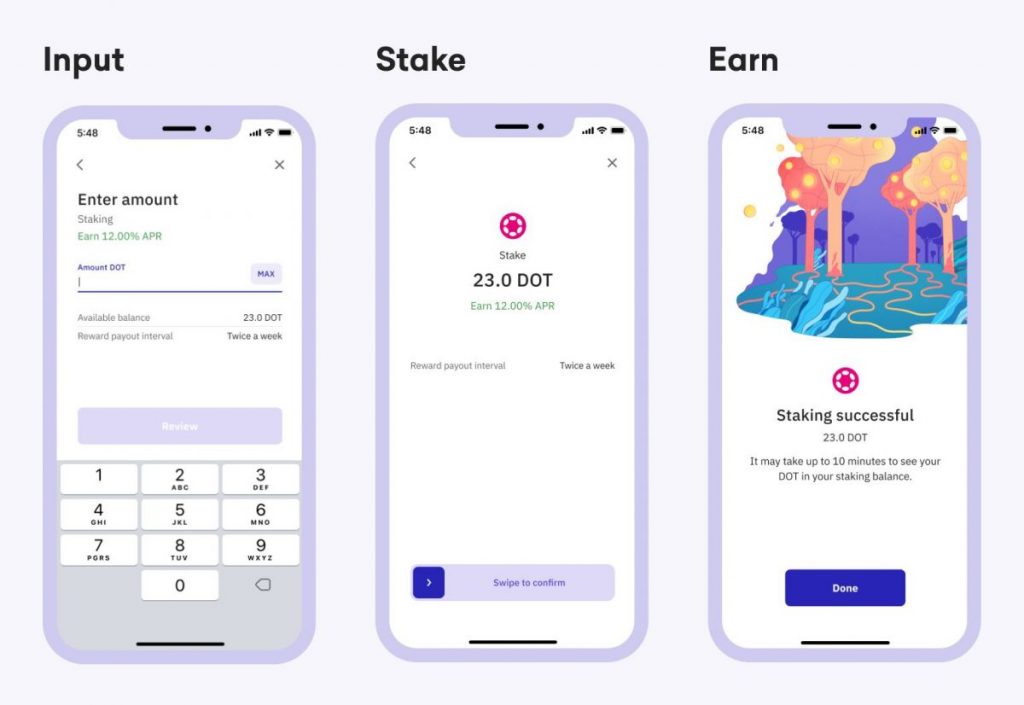

Ledger Live

Ledger Live is a crypto wallet and staking app that allows users to securely store and manage their digital assets, as well as stake their cryptocurrencies to earn rewards. The platform supports several major cryptocurrencies, including Bitcoin, Ethereum, and Tezos. With Ledger Live, users can easily stake their assets with just a few clicks and benefit from attractive yields. The platform also offers advanced security features, such as multi-signature support and hardware wallet integration, ensuring the safety and privacy of users’ assets.

Pros:

- Over 400 cryptocurrencies supported

- Hardware wallet integration for added security

- Option to earn staking rewards while maintaining control of private keys

Cons:

- No staking reward information for each token

- May require some technical knowledge for staking from a hardware wallet

Aave v2 Ethereum

Aave is a decentralized finance (DeFi) platform that offers staking services through its Aave Protocol. Users can earn rewards by staking their AAVE tokens or other supported assets, such as ETH and DAI. Staking rewards are distributed in AAVE tokens and can be claimed anytime. Prior to unstaking, users must start the cooldown period of 10 days, followed by a two-day window where they can unstake. If they miss that window, they would have to restart the cooldown process.

Users can also lend assets to earn interest on them and borrow assets with a stable or variable interest rate.

Pros:

- Staking feature is integrated with its lending and borrowing platform, so stakers can earn interest on their staked assets while also earning staking rewards

Con:s

- Low staking rewards compared to other platforms

- Only supports staking for a limited number of assets

Ankr

Ankr is a blockchain infrastructure platform that offers delegated and liquid staking services for several cryptocurrencies, including ETH, BNB, and DOT. Users can stake their coins through Ankr’s one-click node hosting service, which allows them to earn rewards while Ankr manages the technical aspects of running a node. Additionally, the platform also offers a DeFi staking dashboard that enables users to monitor their staking activity and rewards.

Pros:

- Competitive APY of up to 16%, depending on a token

Cons:

- Limited number of supported tokens

- Some assets require a 14-day notice period for withdrawal

Binance

Besides being a crypto exchange, Binance also offers staking services for a large variety of coins, including ETH, BNB, USDT, and many more. Users can stake their coins through the exchange and earn rewards that are distributed on a weekly or monthly basis.

It also offers flexible staking options that allow users to unstake their coins at any time without penalties. Additionally, Binance offers a staking calculator that enables users to estimate their potential rewards.

Pros:

- Offers a wide range of staking options for many different assets

- High staking rewards compared to other platforms

- Mobile app available for easy staking and monitoring

Cons:

- Binance is a centralized platform, which can be risky for stakers in case of a black swan event

- Some users may not feel comfortable trusting their assets to a centralized platform

- Binance has faced some security and regulatory issues in the past, although they have since taken steps to improve security measures

OKX

Like other popular crypto exchanges, OKX provides staking services to its users as an added value. Users can stake 80 cryptocurrencies on the platform, including Bitcoin, Ethereum, and a variety of altcoins. Staking on OKX is straightforward and can be done by simply depositing the cryptocurrency into the staking pool; that’s all you need to be rewarded in additional crypto. OKX also offers flexible staking so users can unstake anytime with no penalty.

Pros:

- Offers staking rewards for 80 cryptocurrencies, including lesser-known ones

- A variety of staking options, including flexible and fixed-term staking

- High APY for fixed-term staking

- No commission fee

Cons:

- The platform has faced security breaches in the past, raising concerns about the safety of user funds

- Some users have reported slow customer support response times

Coinbase

Coinbase is a well-known cryptocurrency exchange that also offers staking services. Users can stake 103 cryptocurrencies on the platform, including Ethereum, Cosmos, and Algorand, and earn up to 6% on crypto. Staking on Coinbase is user-friendly and can be done through the platform’s easy-to-use interface. The platform also offers a rewards calculator to help users estimate their potential earnings from staking. Additionally, Coinbase is insured against theft and hacking, providing an extra layer of security for users’ staked coins.

Pros:

- User-friendly interface that is accessible to both beginners and experienced traders

- A well-established and reputable company with a strong track record in the cryptocurrency industry

Cons:

- Coinbase charges a high staking fee, which can reduce the overall returns

- Does not offer staking rewards for some popular cryptocurrencies like Bitcoin

Kraken

Despite having to shut down staking for US users, Kraken still offers staking services to its users in other countries. Ethereum, Polkadot, and Cosmos are among its 18 supported cryptocurrencies for staking. Besides bonded staking, which offers a higher APY, Kraken also offers flexible staking, allowing users to choose how long they want to stake their coins. Additionally, Kraken provides users with access to detailed staking reports, enabling them to track their earnings and monitor their staking activity.

Pros:

- Instantly unstake with no penalties

- No fees for staking or unstaking

Cons:

- Kraken’s staking service is only available to certain regions, which may limit its accessibility to some users

Crypto staking platform cheat sheet

| Crypto staking platform | APY % | No. of cryptocurrencies supported | Pros & cons |

| AllNodes | 3 -35% | 71 | Pros: – Supports a wide range of coins for staking – Competitive staking rewards – Simple and intuitive interface Cons: – No mobile app |

| Everstake | 5 – 49% | 6 | Pros: – Competitive staking rewards – User-friendly interface and management tools Cons: – Relatively high staking fees – No mobile app |

| Stakefish | 5 – 62% | 22 | Pros: – Competitive staking rewards – Offers staking for over 20 different blockchain networks Cons: – Limited information on its security measures – No mobile app |

| Lido | 4 – 6% | 5 | Pros: – Allows users to stake any amount of ETH – Liquid staked ETH tokens can be traded at any time Cons: – Limited to staking only ETH, MATIC, SOL – No hardware security device support available |

| SpoolFi | 2 – 25% | USDC, USDT, DAI | Pros: – Risk-managed approach to yield farming – Custom Smart Vaults available – Auto-rebalancing feature across various DeFi protocols Cons: – Smart Vault Creators are charged a high performance fee |

| MyCointainer | 4 – 153% | ~ 100 | Pros: – No lockup period – Claims to offer daily rewards and minimal fees – Mobile app Cons: – No concrete information on staking fee/commission |

| Stader | 5 – 100% | 7 | Pros: – Increased liquidity and flexibility – Retain control over your assets – Potential for higher returns as staked tokens can be used for other financial transactions Cons: – complex and relatively difficult to use – Regulatory uncertainty of liquid staking may lead to legal and regulatory risks |

| Stakely | 5 – 43% | ~40 | Pros: – Staking insurance – Low commission fees – Non-custodial platform Cons: – Limited variety of supported cryptocurrencies – No information regarding commission fee |

| Ledger Live | n/a | > 400 | Pros: – Over 400 cryptocurrencies supported – Hardware wallet integration – Option to earn staking rewards while maintaining control of private keys Cons: – No staking reward information for each token – Staking from a hardware wallet may require some technical knowledge |

| Aave v2 Ethereum | Up to 14% | AAVE Token or Aave Balancer Pool Token (ABPT) | Pro: – Staking feature integrated with its lending and borrowing platform Con: – Low staking rewards – Supports staking for two tokens |

| Ankr | 3 – 16% | 80 | Pros: – Offers staking rewards for 80 cryptocurrencies – A variety of staking options, including flexible and fixed-term staking – High APY for fixed-term staking – No commission fee Cons: – The platform has faced security breaches – Slow customer support response time |

| Binance | Up to 104% | 60+ | Pros: – Offers a wide range of staking options – High staking rewards – Mobile app available Cons: – A centralized platform – Binance has faced some security and regulatory issues in the past |

| OKX | 0.1% – 56.8% | 78 | Pros: – Offers staking rewards for nearly 80 cryptocurrencies – A variety of staking options, including flexible and fixed-term staking – High APY for fixed-term staking. – No commission fee Cons: – The platform has faced security breaches in the past – Slow customer support response time |

| Coinbase | Up to 6% | 103 | Pros: – User-friendly interface – A well-established and reputable company Cons: – High staking fee – No staking rewards for some popular cryptos |

| Kraken | 1 – 24% | 18 | Pros: – Instantly unstake with no penalties – No fees for staking or unstaking Cons: – Service available in certain regions – Limited supported cryptocurrencies for staking |

FAQ

It can vary depending on the platform and the specific cryptocurrency. Generally, platforms will require users to stake a minimum amount of cryptocurrency in order to participate in staking. This amount can range from a few hundred dollars to several thousand, depending on the platform.

In many cases, the rewards are a percentage of the staked cryptocurrency, paid out in the form of additional cryptocurrency. The rewards can range from a few percent to 20% or more, depending on the platform and the cryptocurrency being staked.

However, a high yield offered by a staking platform may be unsustainable if the cryptocurrency price experiences a sharp decline, leading to a decrease in the value of the staked assets. As more investors flock to a high-yield staking platform, the platform may become oversaturated, leading to increased competition for staking rewards and potentially causing the yield to decrease over time.

Staking periods can range from a few days to several months or even years. Some platforms offer flexible staking periods, allowing users to withdraw their staked cryptocurrency at any time, while others require users to commit to a specific period of time.

It depends on the platform. It can be safe if the platform has strong security measures in place. When choosing a platform, it’s important to research its reputation, implemented security measures, and history of any security incidents or hacks. Additionally, it’s important to follow best practices for securing your cryptocurrency, such as using a hardware wallet and enabling two-factor authentication.

There is always a risk of losing cryptocurrency when staking on a platform. However, the risk can be minimized by choosing a reputable platform with strong security measures in place. Additionally, it’s important to consider the risks associated with the specific cryptocurrency being staked, such as market volatility or the risk of a hard fork.

Conclusion

Crypto staking platforms have made staking more accessible to a wider range of investors, allowing them to participate in network validation and earn rewards. However, it’s important to note that staking is not without risks. There is always a possibility of losing some or all of the staked cryptocurrency due to market fluctuations or other unforeseen events. Be especially wary of platforms that offer high yields that seem too good to be true, as it may be unsustainable if the cryptocurrency price experiences a sharp decline, leading to a decrease in the value of the staked assets. Before committing your funds, you should carefully research the platform and the price movement of the cryptocurrency you intend to stake.

Despite the risks, crypto staking platforms offer a compelling investment option for those who want to earn passive income. With the increasing adoption of blockchain technology and the growing interest in cryptocurrency investments, it’s likely that crypto staking will continue to gain popularity in the future. As the industry evolves, we can expect to see even more innovative staking solutions emerge, further democratizing access to this potentially lucrative investment option.

Read more:

- Top 30+ Crypto Gambling Websites in 2023

- Top 10 Crypto Journalists and Reporters in 2023

- 10+ Best AI Crypto Projects of 2023

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.