This Week’s Top Deals, Major Investments in AI, IT, Web3, and Crypto (03-07.06)

In Brief

Web3 investment deals show growth in blockchain projects, with Avail’s $75 million Series A, DWF Labs’ $5 million boost for Milady Meme Coin, and Tether’s $18.75 million funding for XREX Group.

This week’s investment deals in the Web3 space have seen significant financial backing for innovative blockchain projects, highlighting the sector’s continued growth and potential. Key investments include Avail’s $75 million Series A, DWF Labs’ $5 million boost for Milady Meme Coin, and Tether’s $18.75 million funding for XREX Group to improve financial inclusion and cross-border payments.

Avail Secures $75 Million Series A to Fuel Development of Web3

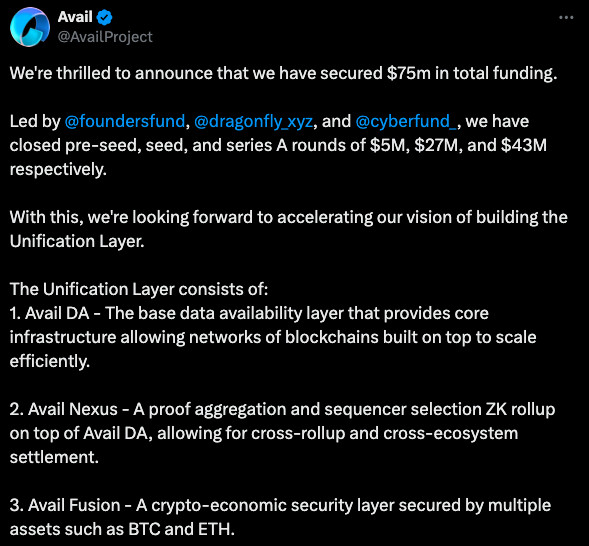

The blockchain technology startup Avail has completed a $75 million Series A fundraising round. With their Unification Layer technology stack, Avail will be able to address issues with compatibility and scaled data availability in the Web3 industry as a result of the investment. The Unification Layer facilitates the scalability and easy interoperability of modular blockchains by combining data availability, aggregation, and common security.

Photo: Avail

With the additional funding, the business intends to expand its Nexus interchange layer and Fusion Security layer development as well as cultivate collaborations throughout the Web3 ecosystem. With $75 million in investment, the goal is to lay a solid basis for upcoming blockchain ventures.

DWF Labs Pours $5 Million into Milady Meme Coin

DWF Labs, a Web3 investment business and worldwide creator of digital asset markets has invested $5 million in Milady Meme Coin (LADYS). Within the LADYS and meme ecosystem, the funding will allow LADYS to open up more doors for growth, cooperation, and community involvement. In addition, DWF Labs will offer ecosystem support and strategic direction, enabling LADYS to dominate the meme currency market and embody the values of memetic power and internet love.

Tether Funds XREX Group with $18.75 Million

Tether has declared a $18.75 million investment in the blockchain-enabled financial company XREX Group, which is completely regulated. The National Development Fund of the Taiwanese Government, SBI Holdings, and others are the sources of funding.

The investment seeks to increase cross-border payment efficiency in emerging areas, expand financial inclusion, and provide novel financial solutions. To introduce XAU1, a USD-pegged unitized stablecoin over-reserved using Tether Gold, XREX and the Unitas Foundation are partnering.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.