This Week In Crypto: BTC Stable, ETH Shows Signs Of Life, TON Lags The Pack

In Brief

This past week in crypto felt calm but coiled, with Bitcoin and Ethereum consolidating in tight ranges while showing subtle signs of strength, and Toncoin lagging despite major ecosystem developments.

Sometimes the market feels too calm. Not in a boring way, but in that quiet, coiled kind of way where nothing’s exploding, yet nothing’s slipping either. You get tight ranges, small reactions to big news, and just enough movement to keep everyone guessing. That’s pretty much what this past week looked like. And when you dig into the charts and the headlines, a few patterns start to stand out. Let’s get into it.

Bitcoin (BTC)

Bitcoin didn’t move much this week on the surface – mostly stuck between ~$93K and ~$97K. But that doesn’t mean nothing happened. When GDP data came in weaker than expected, we saw a quick dip under $93K. It didn’t last though – buyers showed up, price recovered, and BTC settled right back into the same tight range.

BTC/USDT 4H Chart, Coinbase. Source: TradingView

If you’re watching the 4h chart, the structure’s been clean. Price respected the 50-period SMA all week. It bounced off that level more than once and never really lost it. RSI briefly dropped into the low 40s, but turned back up fast – not what you’d expect if sellers were in control. It’s the kind of slow buildup you often get before a bigger move.

So what’s keeping it supported? ETF inflows are still steady, and there’s been a shift in rate cut expectations – especially after the soft JOLTS data and labor numbers. For now, that’s helping to hold the floor.

US Consumer Confidence (left) vs. Total non-farm US job openings (right). Source: TradingView/Cointelegraph

Two narratives also gave Bitcoin some lift. First, U.S. national security voices – including people linked to the CIA – openly discussed Bitcoin in a geopolitical context (Controversial, sure, but nevertheless notable).

Podcast host and investor Anthony Pompliano (left) and Deputy CIA director Michael Ellis (right). Source: Anthony Pompliano

Second, Michael Saylor’s firm hinted at another round of BTC purchases after earnings. Nothing surprising, but it reinforces the idea that big players are still accumulating.

Technically, ~$95K looks like a pressure point right now. Price keeps returning there, but hasn’t broken through yet.

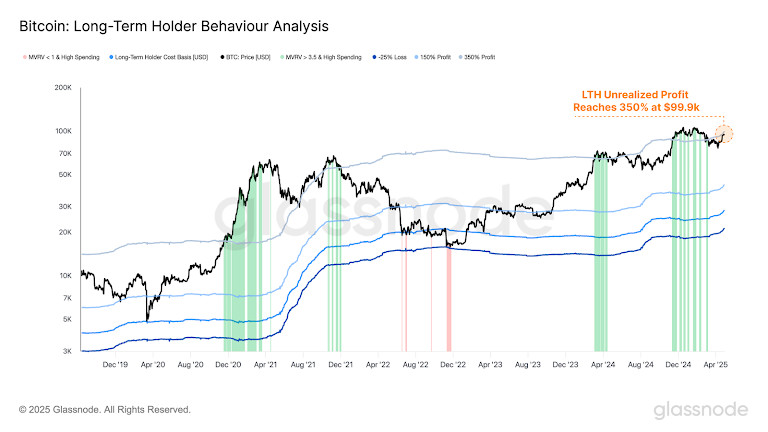

Souce: Glassnode

And despite unrealized profits sitting around 350% (per Glassnode’s recent report) historically where people start thinking about taking gains – we’re not seeing real selling pressure. And so far, it’s still a wait-and-see type of setup.

Ethereum (ETH)

ETH didn’t move much this week – but that’s exactly what made it interesting. Price held between roughly $1,770 and $1,870 on the 4h chart, forming a tight, sideways range. It kept riding the 50-period SMA, and unlike BTC, never convincingly dipped below it. That kind of relative stability doesn’t make headlines, but technically, it’s telling. RSI spent most of the week drifting in the low-to-mid 50s – not bullish, not bearish either. And sometimes, that’s the signal.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

What stands out is that ETH didn’t fall behind. For weeks, it’s been lagging BTC – both in price action and in sentiment. But now the ETH/BTC pair is showing signs of bottoming, and we’re starting to hear “undervalued” again in analyst notes. It’s not hype – it’s the structure. We’ve got a flattening RSI, clean support holds, and a chart that’s been coiling for weeks. The longer it coils without breaking down, the more fuel it builds.

Meanwhile, the fundamentals quietly improved. The Pectra upgrade is now on the calendar (set for May 7). Developers proposed new ERC standards focused on multichain compatibility. And Vitalik popped up again, pushing for simpler Ethereum design that’s easier to build on.

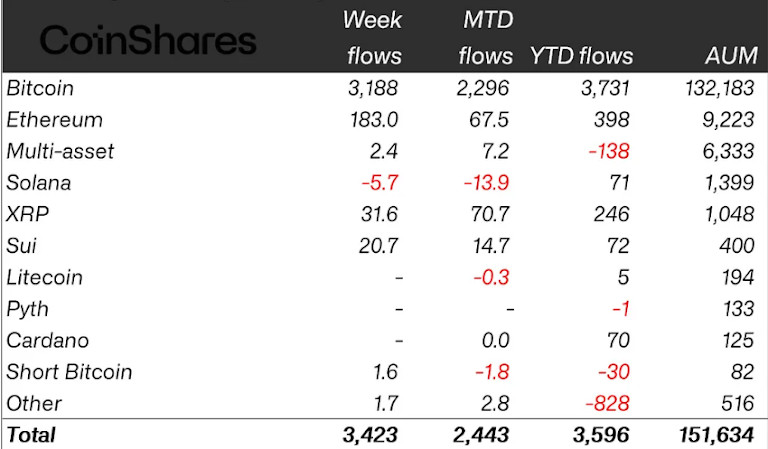

We’re also starting to see Ethereum show up in places it’s been missing from lately. ETP flows, for instance – those have started to include more ETH exposure again. It’s not a wave, but the tilt is noticeable. A few institutional funds that had backed off earlier in the cycle are now quietly reallocating back into ETH. Nothing dramatic, but enough to suggest the sentiment is shifting under the surface.

Flows by asset (in millions of US dollars). Source: CoinShares

And that shift matters. Because this wasn’t a breakout week – ETH didn’t rip through resistance or lead the charge. But it also didn’t roll over. If the current range ends up breaking higher, we might look back at this stretch as the point where Ethereum stopped trailing and started stabilizing. Sure, it’s not leading yet. But on the chart, at least, it’s no longer lagging behind.

Toncoin (TON)

Meanwhile, TON has been drifting – not to say collapsing, but clearly underperforming. The 4h chart shows a clean rejection from the $3.40 a rea and a steady decline back to the lower bound of its recent range, around $3.05. What’s key here is that the 50-period SMA flipped to resistance midweek, and the RSI hasn’t recovered – it’s been sliding under 50 for days, now touching 36. That suggests sellers remain in control, even if the pace is slow. There’s no capitulation, but also no sign of buyers stepping in with conviction.

TON/USD 4H Chart. Source: TradingView

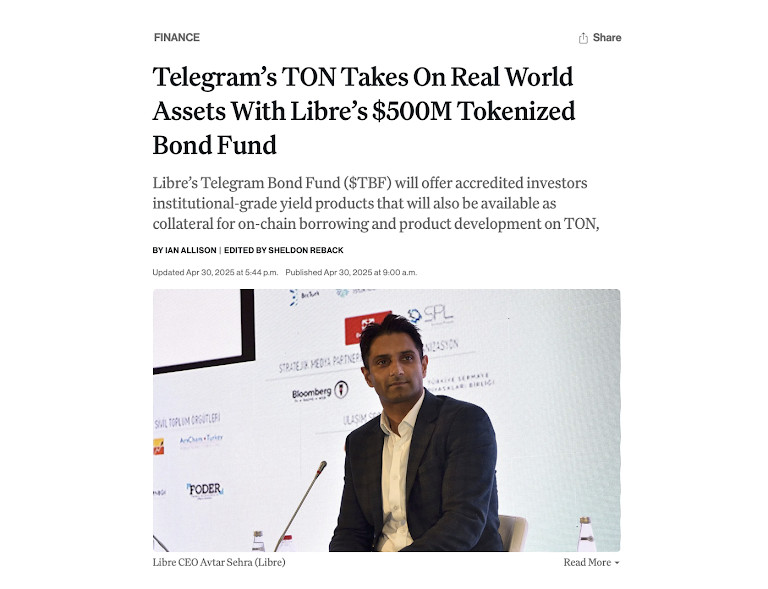

What makes this underperformance more interesting is how much fundamental news dropped this week. For one, Libre announced a $500M tokenized bond fund on TON – and that’s not small talk. It means real-world assets (RWAs), linked to Telegram itself, are starting to live on this chain.

Source: CoinDesk

At the same time, Broxus rolled out TON Factory, a scaling platform claiming up to 35K transactions per second – which signals serious L2 infrastructure ambitions. There’s also the Ethena integration: sUSDe and USDe stablecoins are being woven into Telegram’s ecosystem, right alongside TON.

Source: The Block

Believe it or not, the price hasn’t responded to those news yet. And that tells us a few things. First, this week’s developments are still mostly infrastructural. They don’t affect token velocity or demand immediately – they’re rather setup steps. Second, TON still isn’t part of the ETF/macro narrative driving BTC and ETH. So while fundamentals are improving, there doesn’t seem to be any spillover bid.

That doesn’t mean the updates don’t matter. They actually reinforce the long-term case: if Telegram continues to double down on TON-native infrastructure and stablecoins, that positions the network as a consumer-facing crypto layer. But for now, that’s a positioning story – not a price driver. Until flows catch up or the chart shows a reversal (say, reclaiming the 50 SMA or RSI breaking back above 50), TON will remain a laggard, technically speaking.

So How Does the Market Feel Right Now?

It feels like crypto’s getting ready to move – not exploding, but shifting its weight forward. BTC’s compressing under $97K, ETH’s finding its footing, and TON’s trying to hold on despite the drag. For now, the charts say: stay alert, stay patient. The pressure’s building – and if it releases, it won’t be quiet.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.