The Next Era of DeFi: Scale, Liquidity, and Institutional Trust

In Brief

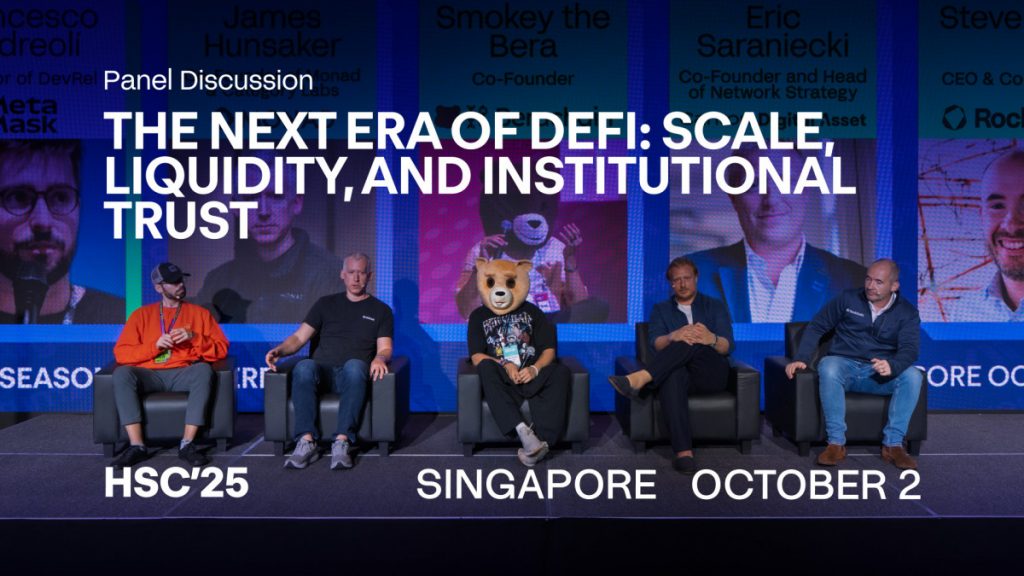

Web3 ecosystem leaders discussed DeFi maturity and its nearing maturity at The Next Era of DeFi: Scale, Liquidity, and Institutional Trust.

At the intersection of performance, regulation, and liquidity, decentralized finance is entering its next major inflection point. On stage at The Next Era of DeFi: Scale, Liquidity, and Institutional Trust, leaders from some of Web3’s most influential ecosystems sat down to explore what maturity in DeFi actually looks like — and how close we are to getting there.

Institutions Aren’t Coming — They’re Already Here

The conversation opened with a sentiment that echoed throughout the room: the institutional wave has arrived.

Steve Pack, CEO of RockSolid, described a sharp shift in how traditional players approach the space.

“People used to say, the institutions are coming. They’re here,” he said. “But they’re not DeFi experts — they’re experts in public markets, regulation, and compliance. They need simplicity.”

RockSolid’s newly launched “liquid vault” platform aims to deliver exactly that — single-click access to curated DeFi strategies, reducing the complexity of navigating dozens of protocols and chains. “Institutions don’t want a list of 17 protocols to deploy to,” Pack added. “They want one clean interface.”

Rebuilding Market Structure for Scale

For Eric Saraniecki, Co-founder of Canton Network, the challenge goes deeper than user experience. It’s structural.

“Market structure in crypto is fundamentally broken — not because anyone made a bad decision, but because TradFi rejected us for 15 years,” he argued. “We ended up vertically integrating everything: the exchange, the custodian, the clearinghouse. That’s not sustainable if we want real scale.”

Saraniecki’s vision of institutional DeFi requires separation of concerns — rebuilding the architecture so custody, clearing, and trading exist as distinct layers, not bundled under one roof. “That’s how we get from billions to trillions,” he said.

The Compliance and Risk Gap

Smokey the Bera, Co-founder of Berachain, pointed to compliance and risk modeling as the core obstacles to institutional adoption.

“Institutions look at underwriting risk completely differently,” he noted. “Right now, on-chain models for risk are either incomplete or underdeveloped. We take a lot for granted — things like multisig key distribution or bridge exposure — that traditional finance simply won’t overlook.”

He revealed that emerging players like Turtle Club are already building standardized institutional risk frameworks to help large LPs evaluate protocols consistently. “That’s how we move from Wild West to Wall Street,” he said.

For Retail, It’s Still About Simplicity

The discussion then shifted from institutional to retail adoption. The consensus: DeFi still isn’t easy enough.

Pack didn’t mince words: “Telling users to interact with 17 protocols isn’t mainstream. Even the best tools are still too complicated.”

James Hunsaker, Co-founder of Monad, took it further. “When Luna’s Anchor offered 20% on stables, retail flocked in — not because they loved DeFi, but because the experience felt like a better bank,” he said. “The problem was they didn’t know where the yield came from.”

Today, Hunsaker argued, the yields are more sustainable — and the UX needs to catch up. “People should be able to sign in with Apple ID, press two buttons, and earn — without realizing there’s a blockchain underneath,” he said.

MetaMask’s Francesco Andreolí agreed, noting how even MetaMask has started merging swap and bridge features into a unified interface. “People don’t know the difference,” he said. “They just want it to work.”

The Trade-Offs: Decentralization vs. Performance

When the topic turned to decentralization, Saraniecki delivered one of the panel’s most provocative takes:

“I don’t think the average retail participant gives a damn about decentralization or scalability trade-offs,” he said. “What they want is trust and clarity. We lack a shared language for risk — TradFi has it, we don’t.”

He criticized crypto’s “reinvention of language,” arguing that jargon like “looping” or “yield farming” obscures what users are really doing. “In TradFi, you’d just say shorting volatility or taking leverage,” he said. “We need to grow up and speak the language of the world we want to win.”

Pack added that RockSolid’s own launch tested those trade-offs firsthand. “A fully decentralized vault would mean everything’s on-chain and voted on,” he said. “It’s possible — but you move slow and lose APR. Sometimes, speed wins.”

Smokey agreed that the space is shifting away from “performative decentralization.” “Institutions and users both want reliability, not ideology,” he said. “It’s okay to have trust assumptions — as long as you’re transparent about them.”

Fragmentation and the Path to Convergence

With dozens of new L2s, L3s, and stablecoins emerging weekly, the panel tackled the growing liquidity fragmentation problem.

Saraniecki summed it up bluntly: “Congratulations — we’ve invented hyper-fragmented money.” He predicted a future where only two or three chains and stablecoins dominate, much like the Internet or the US dollar as universal networks.

Smokey saw the fragmentation as a necessary evil: “It’s innovation in disguise. Short-term pain for long-term progress.”

Hunsaker agreed — but warned of inefficiencies. “We’ve got DEXs and lending markets all doing the same thing with minor tweaks,” he said. “The winners will be the ones who know exactly what role they play in the ecosystem — and design capital flow accordingly.”

What’s Next: Trillions in TVL and Tokenized Everything

As the panel wrapped, each speaker shared what excites them most about the next six months.

For RockSolid’s Pack, it’s the explosion of on-chain innovation. “These new DeFi Access Tokens are giving people a window into innovation in a language they understand,” he said.

Canton’s Saraniecki predicted a monumental growth curve: “People will be shocked by how fast we get to trillions in TVL once large-scale institutions go live. They’re already here — and very active.”

Berachain’s Smokey looked to “spicy tokenization” — tokenizing unconventional assets like royalties and cash flows. “It’s time to go beyond T-bills,” he said.

Monad’s Hunsaker emphasized the rise of privacy-preserving systems and zero-knowledge proofs. “We’ll see models where users get convenience and privacy — not one or the other,” he said.

And for MetaMask’s Andreolí, the next wave will blend AI and DeFi. “We’re entering the age of agentic systems — trustless, autonomous agents that can execute finance on our behalf,” he said.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.