The Growing Use of Cryptocurrency by Extremist Groups in Europe Is Raising Concerns Among Security Experts and Regulators

In Brief

Cryptocurrencies are being used by terrorist organizations in Europe, raising concerns due to their decentralized and pseudonymous features, causing international regulatory scrutiny.

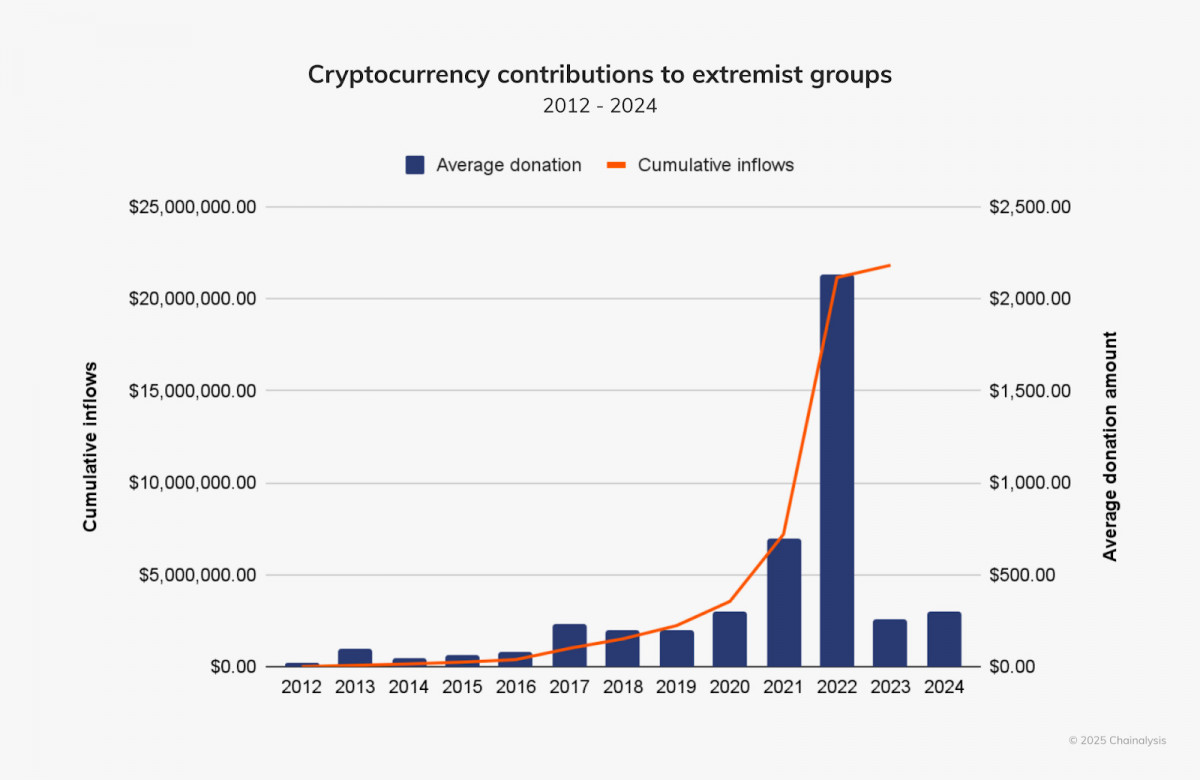

According to a recent investigation, terrorist organizations’ use of cryptocurrencies is causing increasing worry throughout Europe. These organizations are using blockchain-based assets’ decentralized and pseudonymous features to fund their activities without the help of established financial institutions. Due to the sharp increase in the amount and severity of crypto donations to extremist groups, Europe has become an essential focus for comprehending this trend as regulatory scrutiny increases internationally.

Cryptocurrency as a Lifeline for Finances

For extremist organizations cut out of conventional finance channels, cryptocurrency has emerged as a compelling substitute. The act of “debanking”—which involves taking away access to banking institutions and payment processors—has forced these organizations to look for other ways to raise money. For example, a U.S.-based white supremacist organization garnered over $40,000 in cryptocurrency donations after their accounts with conventional financial institutions were closed.

The use of cryptocurrencies is consistent with a larger pattern of growing financial exclusion for organizations promoting extreme beliefs. Since its inception, cryptocurrencies have made it very easy for these groups to raise, store, and move money. Tracking is made possible by the blockchain’s transparency, but privacy-focused technology like private wallet services and privacy currencies pose increasing difficulties for law enforcement.

Photo: Chainalysis

Changes in Regional Patterns

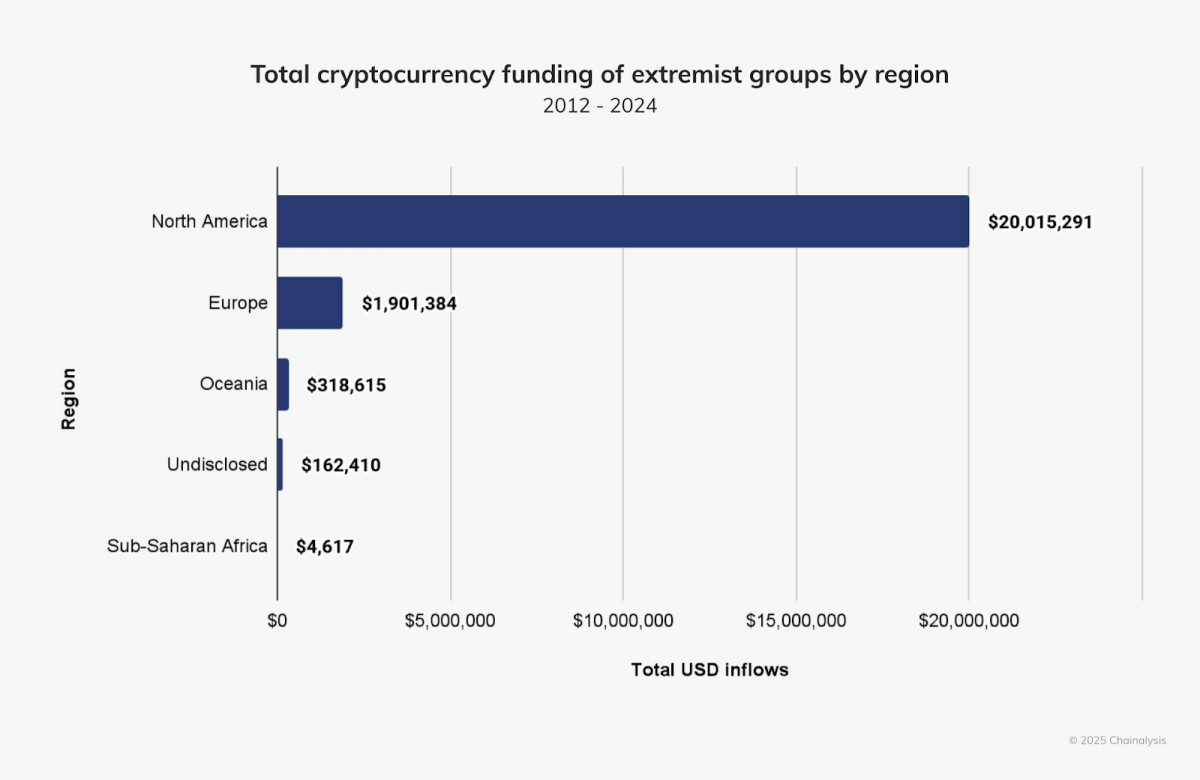

Cryptocurrency financing for extremists has previously been dominated by North America, but Europe is seeing the most expansion in this area. Europe’s portion of crypto inflows to extremist organizations increased to about 50% of the worldwide total between 2022 and 2024. This pattern highlights the rise in the number of groups in the area spreading nationalist, anti-Semitic, and white supremacist ideologies.

Photo: Chainalysis

In order to rally support, these organizations frequently take advantage of divisive political environments, election cycles, and contentious policy discussions. For example, contribution spikes were seen in a number of ideological categories during the 2024 European elections, indicating that political events were strategically used to boost fundraising efforts. As a result of increasing donor intensity, average donation sizes rose for nationalist and Holocaust denial groups in particular.

Fundraising Techniques and Ideological Motivators

In Europe, extremist organizations have changed how they raise money, crafting stories that appeal to particular donor groups. White nationalist organizations, for instance, frequently integrate economic and cultural issues with anti-immigration sentiments to win over adherents. Similarly, to increase their appeal, some organizations conflate pro-Russian or anti-Semitic sentiments with conspiracy discourse.

Their adoption of privacy precautions to avoid discovery is a noteworthy component of their fundraising method. These companies have come to favor privacy coins like Monero, which mask transaction information. Instead of posting wallet addresses openly, some have switched to sharing them privately, which makes them less visible to blockchain experts and authorities.

Instead of institutional patrons, private investors provide the majority of crypto funding for extremist organizations. These donors frequently endorse several causes, forming an ideological network. According to blockchain research, people are funding campaigns that support everything from white supremacist ideologies to Holocaust denial and more general conspiracy theories.

Generally speaking, individual donations are small, averaging a few hundred dollars each. However, as seen by the $8 million payment made to the far-right conspiracy website InfoWars in 2022, some occasions might inspire bigger donations. These kinds of episodes show how one-off occurrences can cause significant money inflows, which can distort yearly averages.

Regulation and Enforcement Difficulties

Cryptocurrency regulation of extremist funding poses special difficulties. Many of these organizations take advantage of jurisdictional discrepancies to function in a legal uncertainty. Some nations have strong anti-extremism legislation, while others have constitutional guarantees of free speech and association, which makes enforcement more difficult.

In the fight against illegal activities, centralized exchanges (CEXs), where cryptocurrencies are frequently exchanged for fiat money, are essential. Stricter Know-Your-Customer (KYC) procedures enable exchanges to identify and report questionable behavior more effectively. However, extremist organizations are able to take advantage of less secure platforms in some jurisdictions due to less strict regulatory settings.

Additionally, decentralized financial technologies that mask transaction origins, including as mixers and privacy coins, are being used by extremist groups more and more. Even though extremist organizations do not now employ these technologies extensively, their increasing awareness of them suggests that their sophistication may increase in the future.

Political Flashpoints and Extremist Funding

Extremist fundraising is frequently sparked by major political events in Europe, such as elections and changes in policy. Groups use these occasions to mobilize support from donors by portraying them as either emergencies that require quick action or successes to celebrate. For instance, nationalist organizations had notable increases in donations during French and UK election seasons, highlighting the link between financial activity and political developments.

The deliberate exploitation of political events by ideological groups to spread their message and raise funds is reflected in these spikes in the intensity of donations. Election-related fundraising campaigns frequently highlight urgency, appealing to supporters’ feelings and sense of purpose.

Another concerning development is the financial interconnectedness of extremist groups. On-chain analysis has revealed instances where organizations aligned with different ideologies share resources and support. For example, white nationalist organizations have been observed transferring funds to groups promoting Islamophobia or Holocaust denial.

This cross-pollination suggests a deliberate effort to strengthen networks and amplify influence. By aligning financially and ideologically, these groups can pool resources, expand their reach, and maintain operational resilience despite increasing scrutiny.

Policy Implications and Recommendations

A multifaceted strategy is needed to combat the increase in crypto donations to extremist organizations. Clear mechanisms for detecting and stopping the funding of extremism must be developed by regulators and law enforcement organizations. Since crypto transactions are international, global cooperation should be given top priority.

Enforcement is greatly aided by private sector entities, especially crypto exchanges. The abuse of cryptocurrencies for illegal purposes may be considerably reduced by fortifying KYC procedures and keeping an eye on transactions for warning signs. Furthermore, the number of possible donors may be decreased by informing the public about the dangers of supporting extreme causes.

Blockchain research is still a useful technique for monitoring and comprehending extremist organizations’ financial activity. By examining patterns of on-chain activity, analysts can uncover hidden connections, monitor evolving tactics, and provide actionable intelligence for policymakers and enforcement agencies.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.