The Global Crypto Race: Can America Stay Ahead as Trump and Harris Tackle Digital Finance?

In Brief

The US presidential race between Trump and Harris could impact cryptocurrency regulation and usage, with both candidates potentially acknowledging the growing importance of cryptocurrency voters.

Digital assets are now a hot topic in politics due to the contest between former President Donald Trump and Vice President Kamala Harris. This might have an impact on how crypto is regulated and used in the US in the future.

Although Trump has been outspoken in his support of cryptocurrency, Harris has been more circumspect, which has left many in the business unsure of her attitude. Recent events, however, indicate that both candidates may be conscious of the rising significance of cryptocurrency voters and that Bitcoin’s upward trajectory may continue regardless of the election’s result.

The Crypto Voter Phenomenon

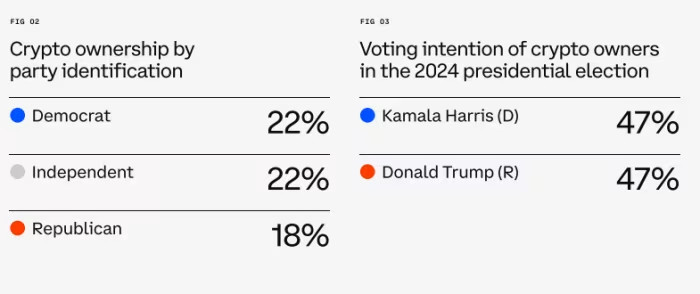

Recent HarrisX polling data, which Consensys released, shows an unexpected trend: a lot of voters now consider crypto policy to be important. Support for pro-crypto policies by a politician is significant to nearly half of those surveyed nationally. Similar percentages of Democratic and Republican voters share this viewpoint, indicating that it transcends party boundaries. The significance of pro-crypto policies increases to more than 80% among cryptocurrency owners and potential investors.

These figures show that cryptocurrency has moved from being a specialized interest to a widely discussed political topic. Based on 2020 voting totals, there are an estimated 30 million voting crypto owners in the US. Therefore, the crypto vote may have an important effect on a close election. Both Trump’s and Harris’ campaigns seem to be modifying their tactics to attract these people, indicating that they have recognized this.

Photo: Morning Consult

Trump’s Adoption of Crypto

With audacious pledges that have struck a chord with many in the sector, Donald Trump has positioned himself as a champion of the cryptocurrency business. Crypto users have taken great pleasure in his pledge to remove SEC Chairman Gary Gensler and establish a government reserve for Bitcoin. Trump has a nine percentage point lead in voter favor on this topic because to his pro-crypto messaging.

It’s important to note, though, that Trump has changed his position with regard to cryptocurrencies. Trump expressed doubts about the worth and possible hazards of Bitcoin and other cryptocurrencies when he was president. This shift in stance indicates that even legislators who were previously dubious about cryptocurrency are now realizing how important it is to discuss this topic.

Harris’s Changing Position

Although Vice President Harris’s opponent has been more outspoken about cryptocurrency than she has been, there are indications that her campaign is reconsidering its strategy. Harris’s position seems to be softening, despite the fact that the Biden administration’s apparent animosity towards digital assets first led many in the crypto industry to approach her with mistrust.

According to recent reports, officials from the sector have met with the Harris campaign to discuss crypto policy. Harris hasn’t used the term “crypto” in public yet, although she has used “digital assets” and “blockchain” in previous remarks.

This subtle change in rhetoric has not gone unnoticed by the crypto industry. The possibility that a Harris administration might be more receptive to collaborating with the industry than the present one is welcomed by many. Some, meanwhile, are still suspicious, citing the absence of specific legislative recommendations and the power of anti-crypto voices in the Democratic party.

The Opportunity for Bipartisanship

It’s interesting to note that polling data indicates that bipartisan collaboration may be possible in the field of crypto policy. When it comes to which party voters trust better to manage crypto policy, the votes are split fairly equally, with Republicans slightly ahead. Nonetheless, Democrats are significantly more trusted to create policy among cryptocurrency owners and most investors.

Both candidates have an opportunity because there isn’t a pronounced party difference on crypto-related topics. They may get supporters from all political persuasions if they take pro-crypto positions. According to the research, a sizable number of voters—with cryptocurrency owners being more inclined to do so—would contemplate switching parties to support a politician who supports cryptocurrencies.

Bitcoin’s Resilience

The outcome of the election might affect the cryptocurrency markets in the near term, but many industry observers think that Bitcoin will continue to rise in the long run, whoever wins in November. Regardless of the outcome of the election, Steven Lubka, head of Swan Bitcoin’s private customers and family offices, expressed optimism that Bitcoin will reach six-figure valuations by 2025.

Photo: CoinGecko

This optimism stems from a number of things. First off, Bitcoin has shown remarkably resilient in the face of political unpredictability and regulatory obstacles. Its success indicates that its core values are truly independent of the political environment, especially in times of official antagonism.

Second, a more stable and developed market has resulted from the growing institutionalization of Bitcoin, as seen by the recent US approval of spot Bitcoin ETFs. As a result of these developments, Bitcoin’s investor base has grown, and its connection with conventional financial institutions has intensified, possibly protecting it from transient political swings.

As a result, the worldwide macroeconomic patterns, including apprehensions about inflation and monetary policy, persistently stimulate curiosity in Bitcoin as a possible safeguard against financial instability. Whichever holds the White House, these variables are probably going to remain the same.

Global Competitiveness

The outcome of the US presidential election will also affect how America is seen in the world of cryptocurrency. Whether the United States leads or lags in this developing industry will be determined by the next administration, as other nations build their own digital currency projects and crypto rules.

Advocates of a more welcoming stance toward cryptocurrencies contend that adopting digital assets might support the United States’ efforts to preserve its financial hegemony in the face of threats from China and other nations. They argue that excessively restrictive rules may discourage innovation and talent from coming home, thus reducing the technical and economic competitiveness of the United States.

However, critics caution against the dangers of moving too rapidly, raising issues with consumer protection, financial stability, and the possible use of cryptocurrencies for illegal purposes. One of the main challenges facing the incoming government will be finding the ideal balance between innovation and regulation.

Co-founder of Crypto Valley Exchange James Davies highlights the worldwide scope of the cryptocurrency industry, pointing out that it hasn’t responded badly to significant events on either side of the political spectrum. According to him, the sector must “learn from traditional finance” by interacting with both political parties and creating a strong ecosystem that can prosper in a variety of regulatory settings.

Tyrone Ross, the founder and president of 401 Financial, shares this viewpoint, estimating that the outcome of the election would not significantly impact Bitcoin’s performance in the next 12 to 18 months. More important elements influencing Bitcoin’s future success, according to Ross, include its continued institutional acceptance, the possibility of interest rate reductions, and its maturation as an asset class.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.