The Future Of Bitcoin: Investment, Mining, And Environmental Impact – 2025 Outlook

In Brief

Bitcoin enters Q3 2025 with rising momentum. Stimulus-driven macro shifts, political realignment, mining industrialization, and ESG scrutiny converge to reshape BTC’s market, meaning, and value trajectory.

Bitcoin’s role in 2025 can’t be reduced to price charts. It’s no longer a speculative experiment or contrarian hedge. It’s now a gravitational force pulling in capital, ideology, infrastructure, and environmental discourse. This year, Bitcoin is shaped not just by what it does, but by what it symbolizes.

As of July 11, 2025, BTC trades at $117,877 — up over 85% YTD. But behind the price action lies a deeper structure: a mix of macroeconomic pressure, political signaling, technical momentum, and institutional repositioning. The Bitcoin ecosystem is becoming more complex and professional — but also more vulnerable. What once moved on the fringes of finance is now increasingly driven by its core.

Political Risk and the Bitcoin Narrative in 2025

Bitcoin’s recent momentum reflects not only risk appetite and halving cycles, but also growing influence from state behavior.

A New Fiscal Era: The “Big Beautiful Bill”

On July 4th, Donald Trump — now re-elected and gearing up for his second major policy term — announced a sweeping fiscal stimulus initiative unofficially dubbed the “Big Beautiful Bill.” While the official outline spans infrastructure, defense, and tax restructuring, the central issue isn’t the content — it’s the scale of deficit financing.

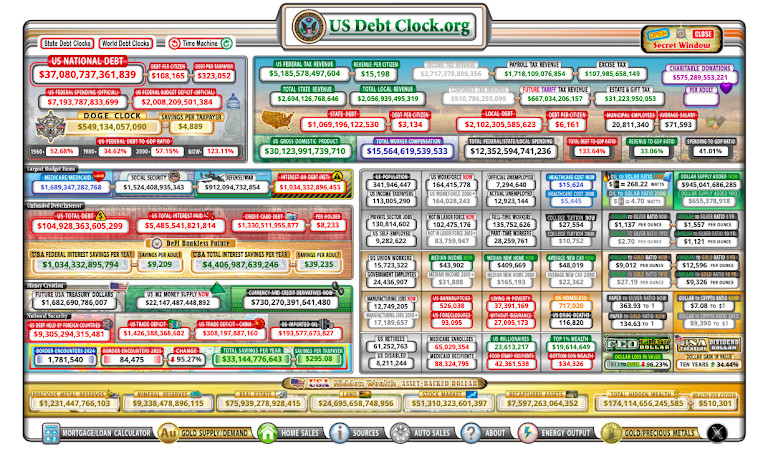

U.S. national debt is now projected to exceed $40 trillion by Q4 2025, up from $34 trillion just a year earlier. Treasury issuance is ramping up sharply. Real yields continue to drift downward, shaped by implicit monetary accommodation and political incentives to suppress the cost of capital.

This level of borrowing is unprecedented. It marks a structural shift in how the United States approaches debt issuance and capital markets.

Capital allocators are starting to treat this shift not as a passing anomaly, but as a reflection of deeper concerns. Confidence in fiat currencies is increasingly seen as inseparable from the stability of the political systems behind them. Bitcoin, under these conditions, reclaims its role as a strategic hedge against both inflation and institutional decay.

This context is not a replay of 2020. That was reactive debt expansion in response to a global health crisis. In 2025, the expansion is deliberate — an act of economic doctrine. And markets are responding accordingly, positioning into scarce, decentralized alternatives like Bitcoin as political risk bleeds into monetary credibility.

Elon Musk and the America Party: Bitcoin as Symbol

The second major political catalyst came on July 5, when Elon Musk declared the formation of a new political entity: the America Party. In a tweet seen by over 45 million users within 24 hours, Musk said:

When asked whether Bitcoin would be a part of the party’s economic policy, Musk’s response was unequivocal:

This wasn’t just another crypto endorsement. It cemented Bitcoin as a wedge issue: a vehicle for opposition, rebellion, or decentralization — depending on perspective.

In combining fiscal volatility with ideological realignment, the U.S. has inadvertently reintroduced Bitcoin into the political bloodstream. This time, not as a fringe tool, but as a narrative anchor for libertarian identity and post-fiat economics.

For markets, the implications are clear: BTC isn’t merely a commodity. It’s now a proxy for political trust — or its absence.

Market Forecast: BTC Price Scenarios and Technical Signals

Bitcoin’s surge toward $110K is no longer speculative noise. It’s a structured move — and traders are watching it closely. Several independent analysts now align around key bullish scenarios, but they also warn: this isn’t a guaranteed breakout. It’s a volatile staircase.

Analyst Predictions and Price Targets

Multiple crypto macro analysts are converging around a mid-term bullish thesis. Among the most referenced in the current cycle:

- @cas_abbe: Known for applying Wyckoff-based models, he recently charted Bitcoin in the middle of a “power-of-three” formation. This structure implies a three-phase breakout, currently in its expansion phase.

His projected move: $135K–$150K by mid-Q4, contingent on a weekly close above $110K.

- @JavonTM1: A pattern-based trader who identified an inverse head-and-shoulders breakout forming over a 6-month chart window.

According to his model, confirmation at $111K–$112K would trigger an upward cascade targeting $140K as a first stop, then retesting ATH territory.

Both analysts stress that technicals must sync with macro liquidity. In 2021, retail momentum did the heavy lifting. In 2025, it’s ETF flows and institutional demand that determine thrust.

RSI, MACD and Price Structure

Beyond price targets, market structure is showing fundamental bullish health — albeit cautiously.

- RSI (Relative Strength Index):

- RSI reads 73.36 on the daily chart — signaling an overbought condition. This level reflects strong demand, but also calls for caution, as historically, readings above 70 often precede short-term pullbacks.

- MACD (Moving Average Convergence Divergence):

- The MACD line sits at 2,174, well above the signal line (1,237), confirming a strong momentum phase. The crossover happened in late June, signaling a potential continuation of the rally.

- Volume Profile:

- On-chain and exchange data show heavy accumulation between $94,000 and $99,000, primarily by institutional actors. This zone is now acting as a solid technical and psychological floor. Liquidity is deep, retracements have been shallow, and volatility is narrowing.

This doesn’t guarantee a parabolic move — but it creates a structural floor that gives technical traders confidence to position toward $125K–$135K.

Probabilistic Scenarios

The bullish outlook depends on confirmation:

- A confirmed breakout and close above $118,000 opens the path to $125K–$135K. This zone is now the key magnet for bullish positioning.

- However, failure to hold above $112K could trigger a short-term correction back toward $98K–$100K, where buy-side liquidity remains robust.

- $150K is possible in 2025, but contingent on two variables:

- Sustained ETF inflows, which remain above $300M daily.

- Political tailwinds, particularly related to deficit spending and Bitcoin-positive regulatory narratives.

In short, Bitcoin is climbing — not exploding. And the next few weeks will test whether conviction can withstand policy volatility and institutional pacing.

Institutional and Strategic Investment Behavior

Bitcoin is no longer primarily driven by retail investors. In 2025, ETFs, family offices, sovereign funds, and corporate treasuries are absorbing available supply faster than exchanges can rotate it—reshaping supply dynamics and market behavior.

ETF and Treasury Dynamics

Since the launch of U.S. spot Bitcoin ETFs in January 2024, institutional demand has surged:

- ETF holdings now total approximately 1.234 million BTC, up from about 660,000 BTC in February 2024—a gain of +86% in 16 months.

- These holdings represent roughly 5.9% of Bitcoin’s fixed supply, given U.S. ETFs currently control ~1.25 million BTC.

- In early July, U.S. spot ETFs recorded over $1.04 billion in net inflows in just three days, equivalent to ~9,700 BTC.

- BlackRock’s IBIT ETF holds ~700,000 BTC, about 62% of Satoshi’s stash, and is on pace to reach 1.2M BTC by May 2026, adding ~40K BTC/month

Corporate treasuries are also accumulating:

- In Q2 2025, publicly listed companies increased Bitcoin holdings by approximately 131,000 BTC, an 18% quarter-over-quarter rise.

- Among them, Tesla holds 11,509 BTC, valued at ~$1.26 billion as of early July 2025.

- MicroStrategy (now Strategy) continues its accumulation strategy, holding around 597,325 BTC, purchased for roughly $42.4 billion—currently worth ~$64.7 billion.

On-Chain Supply Impact

Institutional inflows are reshaping on‑chain metrics, showing clear trends toward long-term accumulation:

- Exchange reserves have declined for 12 consecutive weeks, indicating reduced selling pressure and increased withdrawals to cold storage. This brings exchange-held BTC to roughly 2.898 million BTC (~14.6% of supply) — one of the lowest levels since 2018.

- Long‑term holders now control approximately 73% of circulating supply, with 14.46 million BTC held by investors who haven’t moved their coins in at least 155 days.

- Whale wallets (holding 1,000+ BTC) are in aggressive accumulation mode, showing renewed inflows and fewer outflows — a signal of institutional-scale holding rather than trading.

Bitcoin Mining: Efficiency, Expansion, and ESG Challenges

Bitcoin mining has evolved into an industrial-scale, geopolitically significant sector. Public firms are consolidating power, reshaping energy dynamics, and integrating with grid operators.

Post-Halving Consolidation

- The April 19, 2024 halving cut block rewards from 6.25 BTC to 3.125 BTC, subsequently forcing less efficient miners—particularly those in Kazakhstan, Russia, and Iran—to scale back by late 2024.

- As of mid-2025, the top 12 public mining firms control over 30% of global hashrate, up from 22% in early 2024, reflecting intense consolidation.

- The global hashrate reached approximately 780 EH/s in early 2025, a record high.

Industrial Energy Strategy

Major public miners now manage energy at scale and optimize operations via grid integration:

- CleanSpark, operating multiple U.S. sites, participates directly in demand‑response programs with the Tennessee Valley Authority, offering grid stability services.

- Riot Platforms reported $5.6 million in total power and demand‑response credits for June 2025—$3.8 million from power curtailment and $1.8 million through ERCOT’s 4CP program.

- Marathon Digital acquired a 114 MW wind farm in Texas and integrated it with mining operations behind the meter, signaling an energy-first growth model .

Miners are also deploying grid arbitrage strategies—shutting down or scaling back during peak demand to receive utility credits—shifting from technical efficiency to energy-market savvy.

Sustainability Metrics: Where the Ecological Debate Really Stands

Bitcoin’s annual energy consumption currently sits at approximately 132 TWh, based on the Cambridge Bitcoin Electricity Consumption Index (CBECI) as of June 2025. To put that in perspective, it consumes more power than Argentina or Poland—countries registering around 155–172 TWh/year.

Yet energy consumption alone fails to capture the full picture. According to a 2024 CoinShares report, between 52 % and 58 % of this energy now comes from renewable sources—including hydroelectric power (notably from Paraguay and Canada), U.S. wind and solar, and geothermal energy in Iceland and Kenya. Cambridge’s own CBECI methodology also highlights the increasing share of low-carbon energy inputs .

This shift is not academic—it has regulatory consequences. In the U.S., the Environmental Protection Agency now mandates quarterly energy audits for any mining facility over 5 MW, as outlined in its 2024 Smart Sectors guidance. In Texas, the grid operator ERCOT formally treats mining outfits as “controllable loads”, enabling them to participate in peak-demand mitigation programs. The EU’s MiCA framework introduced ESG classifications into crypto markets, encouraging transparency—even if Bitcoin-specific regulations remain under discussion.

Still, criticisms persist. A peer‑reviewed MIT study shows that even large public miners in the U.S. emit on average ~397 gCO₂/kWh—comparable to grid averages—calling into question any blanket claims of carbon neutrality. And due to inconsistent reporting standards, allegations of “greenwashing” continue, especially from facilities in jurisdictions with looser oversight .

So, while Bitcoin’s energy consumption remains large, the evolving energy mix and growing institutional oversight suggest a transition—albeit one still shadowed by data opacity and uneven regulation. For investors and policymakers alike, the question is no longer whether mining consumes energy. It’s how effectively it’s shifting toward sustainable practices without losing transparency.

What’s Next for Bitcoin in H2 2025

Bitcoin enters the second half of 2025 reinforced by structural strength—ETF inflows above $1 billion/week, 73% of supply controlled by long-term holders, and exchange reserves near multi-year lows. A confirmed floor at $110K and a breakout above $112K could propel BTC toward $125K–$135K by Q4, as projected by Cas Abbé and Javon Marks.

But the broader test lies in its ability to function as infrastructure, not merely speculation. Michael Saylor recently captured this in a post on X:

That distinction matters. As regulatory frameworks tighten—through EPA-mandated audits, ERCOT grid integration, and ESG benchmarks—Bitcoin must validate its neutrality, transparency, and resilience.

Its political alignment with new movements adds further exposure. Be it as a hedge, symbol, or asset, Bitcoin’s next trajectory depends on balancing decentralization with institutional legitimacy.

H2 2025 won’t be about whether Bitcoin can soar—it’s about whether it can sustain its role as a decentralized asset within a structured financial and regulatory environment.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.