Strategy’s $70T Vision: The Race To Accumulate Half Of All Bitcoin By 2045

In Brief

By 2045, Bitcoin Treasury Companies are projected to hold half of all BTC, driving a $280 trillion market as institutional capital shifts from fiat to Bitcoin in search of long-term value preservation.

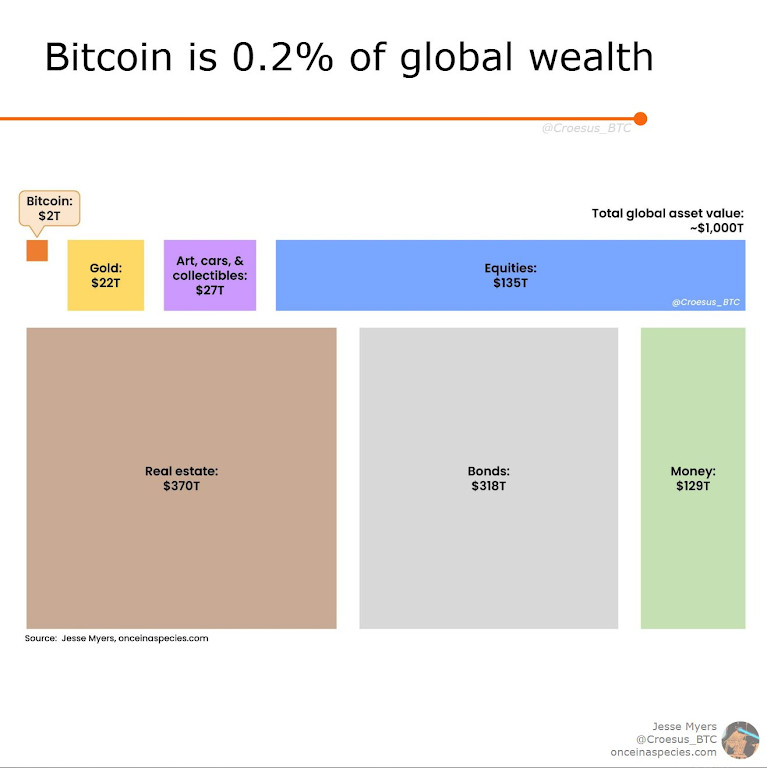

In a world with over $1,000 trillion in total asset value — including bonds, stocks, real estate, and gold — Bitcoin remains a tiny player. Today, it represents just 0.2% of all global wealth. But this is changing fast.

As Jesse Myers (Moon Inc.’s head of Bitcoin strategy) highlights, the landscape is shifting. A new class of companies is emerging: Bitcoin Treasury Companies. These are public businesses whose main mission is to buy and hold Bitcoin as their central strategy. Their goal? To control a massive share of the BTC supply and deliver strong Bitcoin-based returns to their investors.

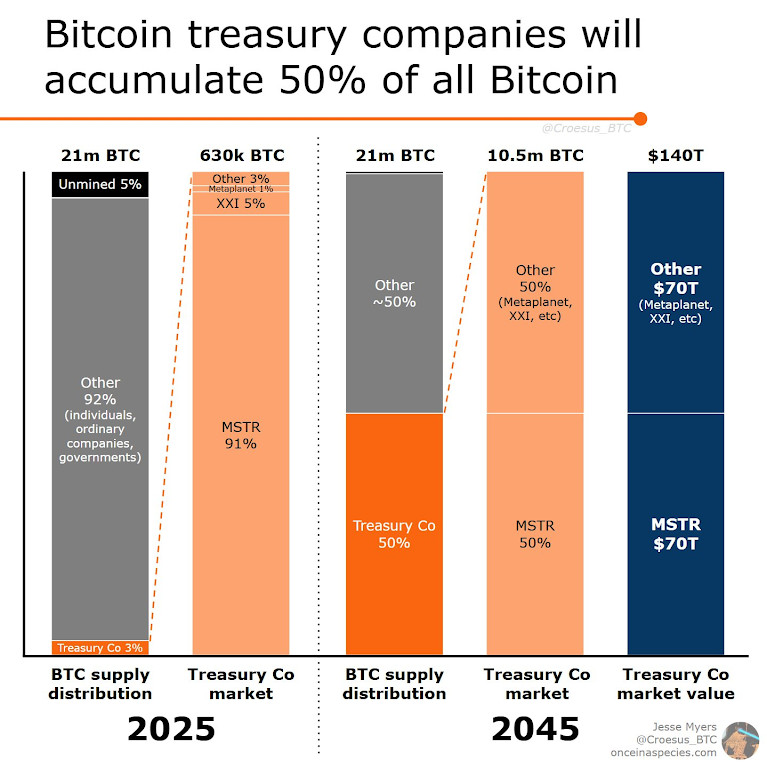

By 2045, these companies are expected to own 50% of all Bitcoin in existence — that’s 10.5 million BTC out of a maximum 21 million. One company, Strategy (formerly MicroStrategy), may end up holding 5 million BTC alone. If Bitcoin hits $13 million per coin, as forecasted, that would make Strategy worth over $70 trillion — more than any company in history.

This article breaks down the full picture: the mechanics behind the shift, the key players involved, market forecasts, technical price analysis, and what it all means for the future of Bitcoin.

Why Is Bitcoin Attracting Trillions in Capital?

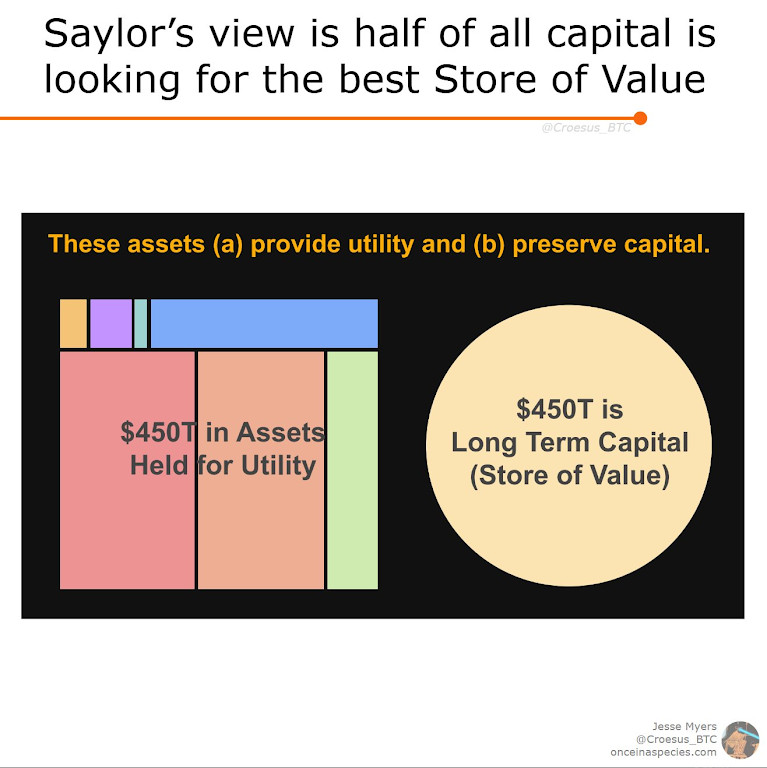

Michael Saylor, founder of Strategy, believes that half of all global capital is simply looking for the best place to protect wealth over time — known as a “store of value.” That’s roughly $450 trillion searching for safety.

According to Saylor, Bitcoin is the best store. It’s decentralized, has a fixed supply, and can’t be printed like money. It’s more scarce than gold and more portable than real estate.

Over the next two decades, capital that currently sits in fiat currencies, bonds, and even gold will gradually move into Bitcoin. But it won’t flow evenly. Most of it will be absorbed by companies purpose-built to buy and hold BTC. These Treasury Companies will become the main engines behind Bitcoin’s growth.

Strategy’s Bold Plan: $70 Trillion and 5 Million BTC

As of May 2025, Strategy owns 580,250 BTC. It has spent around $40.6 billion to build this position. Just days ago, it purchased another 4,020 BTC at $106,237 per coin, pushing its average holding price to $69,979.

This isn’t a short-term bet. Strategy’s roadmap stretches to 2045, where it aims to own 5 million BTC. At a forecasted Bitcoin price of $13 million, that holding would be worth over $70 trillion — turning Strategy into the most valuable company in history.

Current forecasts show:

- By 2025: Treasury companies will hold 3% of all BTC (around 630,000 coins). Strategy will control over 90% of that;

- By 2045: Treasury companies will hold 50% of BTC — split between Strategy (5M BTC) and others like Metaplanet and XXI;

- The total value of these holdings could reach $140 trillion.

This accumulation model is aggressive, but it’s backed by powerful tools that only public companies have access to.

How Treasury Companies Convert Capital Into BTC?

Strategy does more than simply hold Bitcoin — it creates direct capital flow into BTC.

Here’s how it works: Strategy launches financial products like STRK and STRF, which offer high yields (8% and 10%) to bond investors who are hungry for better returns. This borrowed capital is then used to buy more BTC.

Think of Strategy as a machine. On one side, it pulls in dollars from traditional markets. On the other, it pushes those dollars into Bitcoin. The company becomes a bridge between fiat investors and digital assets. And because it’s public, it can raise funds on a scale that individuals cannot.

This method allows treasury companies to build BTC positions quickly, while also giving investors exposure to Bitcoin with added yield.

Why Treasury Companies Have a Big Advantage?

Bitcoin Treasury Companies have three key strengths:

- Access to public markets. They can raise billions through bonds, equity, and financial products;

- Freedom to build strategies. They can design tools and methods to match what the market wants;

- A clear mission. Their shareholders expect them to grow BTC holdings and returns through smart risk-taking.

This mix of capital, flexibility, and mandate makes them unstoppable BTC acquirers. Over time, they are set to outcompete retail buyers, governments, and even traditional institutions.

The Capital Rotation Has Already Begun

From 2023 to 2025, capital has been shifting from fiat-based assets like bonds and money into hard assets like gold and Bitcoin.

- Bitcoin grew by +114%;

- Gold rose by +29%;

- Bonds dropped by -3%;

- Fiat money fell by -2%.

This isn’t theory — it’s happening. Investors are leaving old safe havens and looking for better places to park long-term capital. With $318 trillion in global bond markets, even a small shift toward BTC could drive massive price increases.

And the companies best positioned to catch this wave are BTC Treasury Companies.

Long-Term Forecast: $280 Trillion BTC Market by 2045

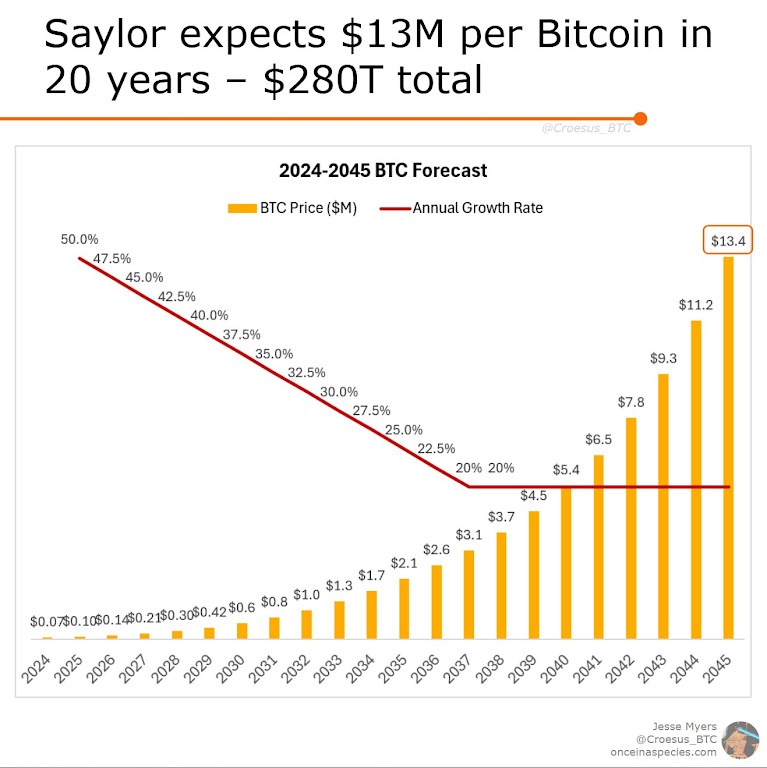

Michael Saylor expects Bitcoin to reach a total market cap of $280 trillion by 2045. That would be 7% of global wealth. Based on a fixed supply of 21 million BTC, this implies a price of $13.4 million per coin.

This growth will be powered by:

- A slow but steady shift of institutional capital into Bitcoin;

- A compounding BTC yield model used by Treasury Companies;

- The collapse of confidence in fiat currencies.

Between 2023 and 2025, Bitcoin is already outperforming Saylor’s predicted growth curve, growing at 120% annually (vs. the expected 29%).

Technical Analysis: BTC Momentum, RSI, and MACD Signals

Bitcoin’s price recently crossed the $108,000 mark, up 59% in the last year and 14% this month. But how strong is this trend — and can it continue?

RSI (Relative Strength Index) is currently at 68.79, which suggests Bitcoin is close to being “overbought.” Historically, levels above 70 often lead to short pullbacks. However, in strong bull markets, RSI can stay high for long periods without triggering major drops.

MACD (Moving Average Convergence Divergence) shows a strong bullish setup. The MACD line is well above the signal line. The histogram is growing. This means momentum is still on the side of the bulls. Volume is also increasing, adding strength to the move.

Price action shows BTC bouncing off higher lows and pushing through key resistance levels. If Bitcoin holds above $100K, the next target is $120K. But with RSI nearing overbought levels, a short consolidation period wouldn’t be surprising.

The overall trend remains clearly bullish — both technically and fundamentally.

Beyond Strategy: Other BTC Powerhouses

Strategy leads, but it’s not alone. Several major players are now building BTC treasuries at scale:

Metaplanet (public company modeling Strategy’s playbook) – Rapidly buying BTC, positioned to lead in Asia. Seen as a rising star in corporate Bitcoin strategy;

XXI Century Capital (private investment fund) – Treats Bitcoin as its core holding and a long-term protection against inflation. Focused on silent accumulation;

Block Inc. (financial services, Cash App) – Deep integration with BTC. Holds Bitcoin and enables user-level BTC adoption across products;

Tesla (electric vehicle company) – Holds BTC on its balance sheet. One of the first major S&P 500 companies to embrace Bitcoin;

Coinbase (crypto exchange) – Holds BTC directly and indirectly. Its infrastructure also enables large institutional purchases of Bitcoin.

Together, these firms represent the early phase of corporate Bitcoin accumulation — and likely won’t be the last.

What It All Means: Looking Ahead

The Bitcoin story is no longer about tech or speculation. It’s now about global capital, corporate structure, and long-term value.

BTC Treasury Companies are forming a new layer of financial infrastructure — one that’s built entirely around digital gold. They will hold half of all Bitcoin by 2045. Strategy alone could control 5 million coins. And with BTC forecasted to reach $13 million per coin, the stakes are enormous.

For investors, the message is clear. The rules are changing. Institutions are taking over BTC — not by force, but by incentives. And as they do, the supply gets tighter, the price rises, and Bitcoin becomes even more valuable.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.