Securing Tomorrow: Central Banks Forge Pathways to Future-Proof Cyber Defense with Gen AI Innovations

In Brief

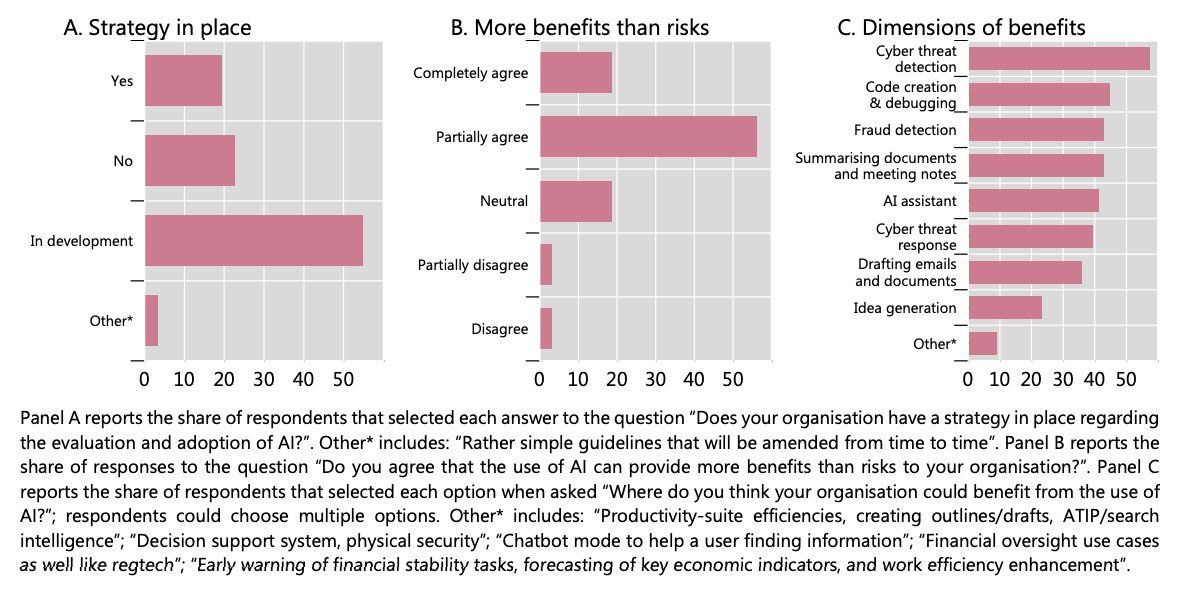

A poll by GCRG shows that 26% of central banks plan to incorporate Gen AI, with 55% still in the planning stages due to uncertainty about its use and potential benefits.

The financial industry is under serious danger from the increased complexity and frequency of cyberattacks, with central banks being particularly vulnerable because of their crucial role in protecting sensitive data and financial infrastructure. The emergence of ChatGPT and other generative artificial intelligence (gen AI) models has presented central banks with new cybersecurity options as well as difficulties.

Current Status of Gen AI Adoption

According to a recent poll by the Global Cyber Resilience Group (GCRG) in January 2024, 26% of central banks expect to incorporate such technology over the next year or two, while 71% of central banks are currently employing such AI techniques. Even with this high rate of acceptance, only 19% of these organizations have a clear plan in place for integrating Gen AI, with the bulk (55%) still in the planning stages. This careful strategy is a result of the unknowns around the best use of genetically altered intelligence and the dangers and rewards that go along with it.

Photo: Adoption of gen AI in central banking, BIS

Numerous general artificial intelligence (gen AI) applications used by central banks are highlighted in the report, such as fraud detection, cyber threat identification, and the automation of repetitive administrative chores. These apps allow central banks to commit greater funds to key protection projects while simultaneously improving operational efficiency. The integration process is intricate, though, and calls for thorough preparation as well as a sizable investment in both human and technological resources.

Benefits of Gen AI as Seen by Others

Central banks understand that artificial intelligence (AI) has a big impact on improving cybersecurity. According to the poll, 57% of participants said that the main advantage of gen AI is the ability to identify cyber threats. This feature makes it possible to identify possible dangers by analyzing huge datasets that would be impossible to handle using more conventional techniques.

Other alleged advantages include fraud detection, which makes use of AI’s capacity to identify odd patterns suggestive of fraudulent activity, and code generation and debugging, which expedite the construction of safe software systems.

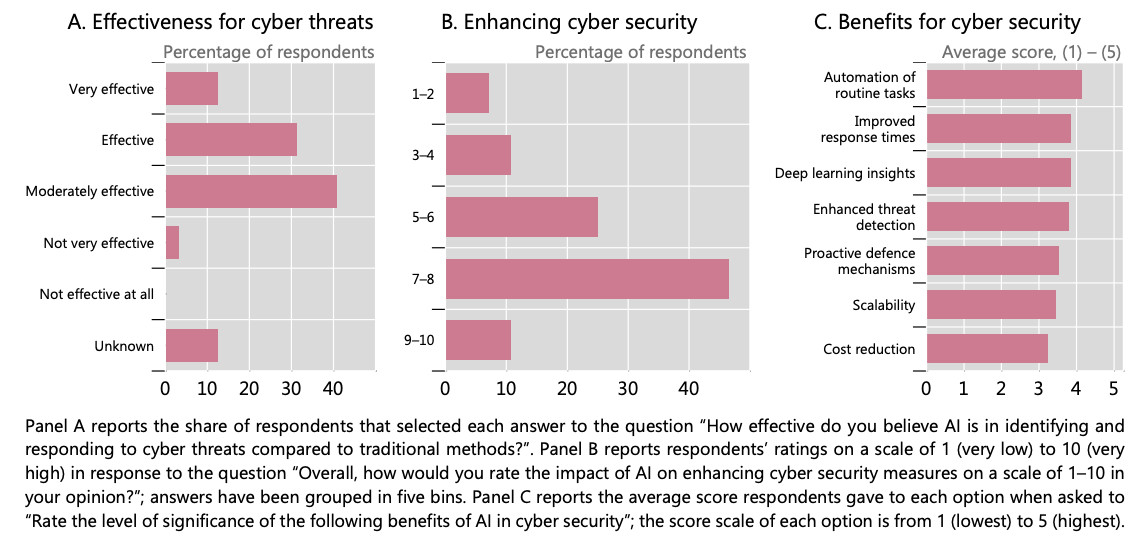

Photo: Effectiveness of gen AI for defense against cyber threats, BIS

Furthermore, gen AI can improve operational efficiency by automating repetitive processes like email composition and document summarization. Central banks may alleviate the workload on their cybersecurity teams by automating these procedures. It frees them up to concentrate on more intricate and crucial areas of their security measures.

Possibilities to Improve Cybersecurity

There are several ways that central banks might strengthen their cybersecurity with the help of Gen AI. Cyber risk management has always made use of traditional machine learning methods; however, gen AI can further augment these skills.

Compared to conventional techniques, Gen AI can recognize and address cyber threats more rapidly and precisely. Gen AI frees up cybersecurity professionals to work on more important projects by automating time-consuming duties. Gen AI makes it possible for central banks to go from reactive to proactive threat management, allowing them to identify and eliminate risks before they become real. Furthermore, by using machine learning algorithms that adapt to every new threat, generation AI may help maintain the ongoing improvement of cybersecurity defenses.

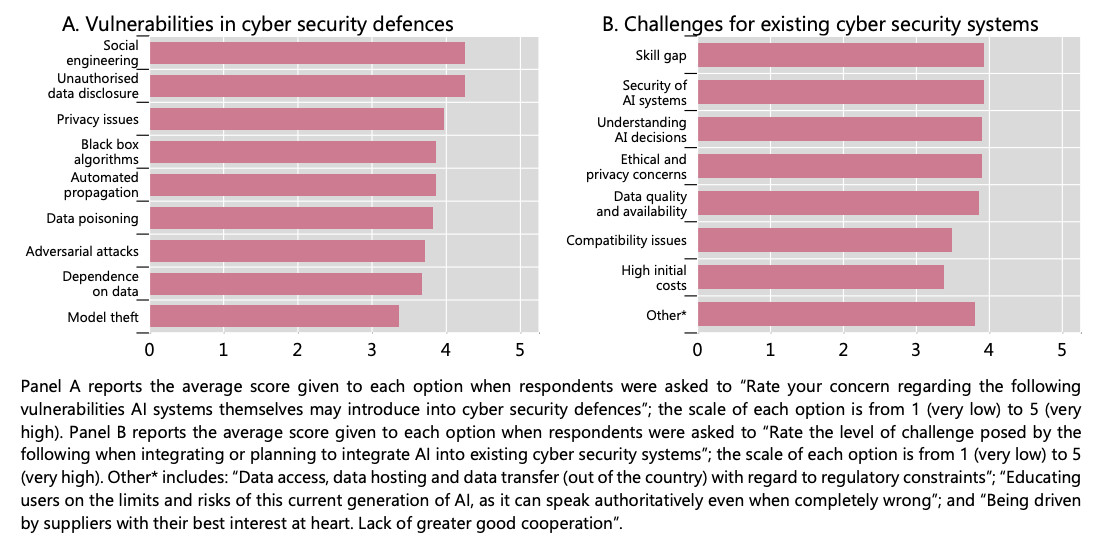

Risks and Difficulties with Further Adoption of Gen AI

Gen AI has several risks and challenges in addition to its benefits. Sensitive data disclosure without authorization and the emergence of new cybersecurity vulnerabilities like social engineering and zero-day attacks are two possible outcomes. This is particularly troublesome when AI systems are trained on large datasets that contain sensitive data. A major barrier to effective deployment and management is the shortage of personnel with knowledge of AI and cybersecurity techniques.

Photo: Risks and challenges posed by AI adoption for cyber security, BIS

Central banks must fund training programs to develop a staff that can handle the complexity of AI-driven cybersecurity. Modern AI systems must be constantly updated and monitored in order to combat new threats since they are dynamic. This calls for a large investment of cash as well as human capital. If these issues are not resolved, significant disruptions and security breaches may occur.

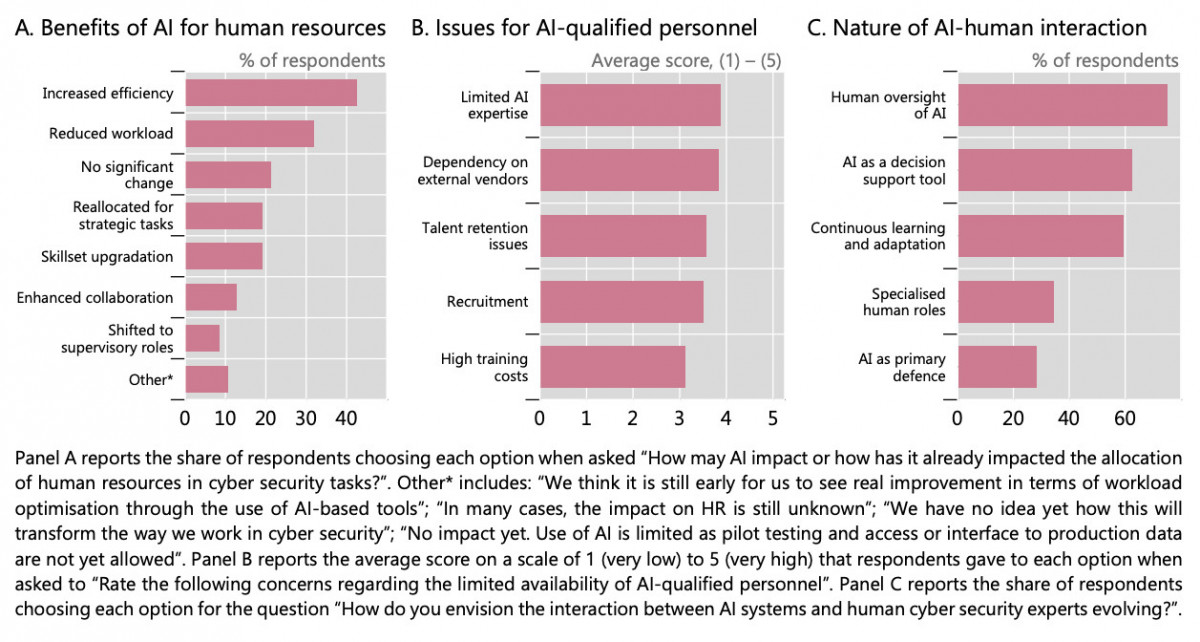

IT and Human Capital Investment

The report emphasizes how crucial it is to spend money on human resources and IT infrastructure in order to fully utilize the advantages of gen AI. Cloud-based gen AI applications are being used by central banks, although with limitations to reduce risks. This entails putting strong security measures in place to safeguard cloud environments and making sure that any data kept there is protected and safe.

Additionally, everyone agrees that although general-purpose AI can do regular cybersecurity jobs, human oversight is still necessary to guarantee moral results and ongoing AI system training. Hiring and training employees who are knowledgeable in both cybersecurity and AI technology must be a top priority for central banks.

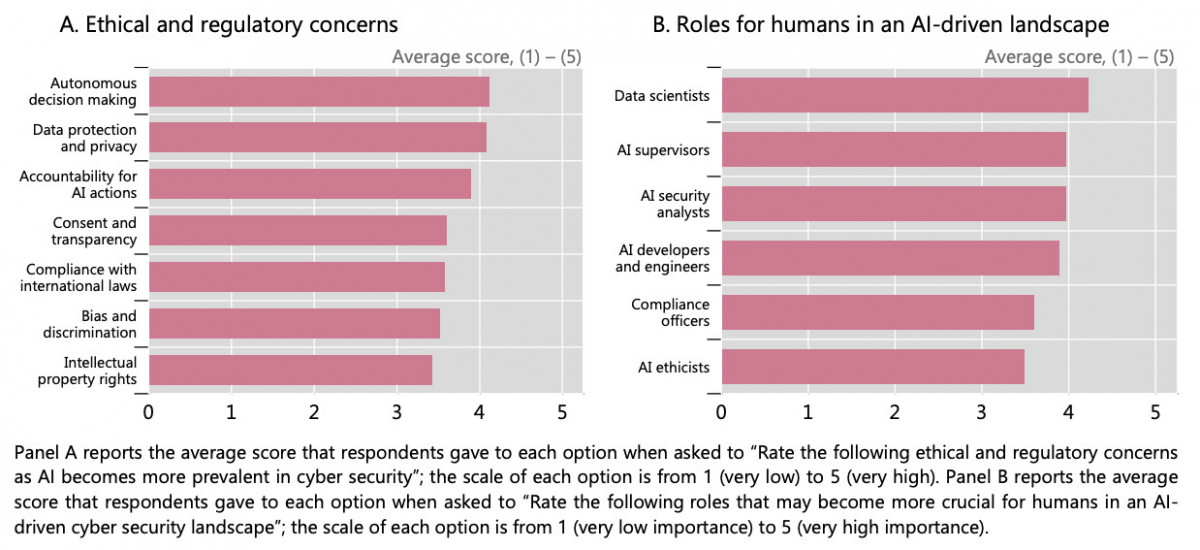

Photo: AI, cyber security and human capital of central banks, BIS

Staff must participate in ongoing education and training programs to stay current on the most recent developments in cybersecurity and artificial intelligence. By continuing to invest in human capital, central banks may successfully utilize artificial intelligence (AI) while reducing the related risks. Central banks can maintain strong cybersecurity defenses and remain ahead of emerging threats by cultivating a culture of constant learning and innovation.

Prospects for Gen AI in the Future

With a near-term adoption rate that is getting close to 100%, the future of generation AI in central banking is bright. However, resolving the difficulties and dangers posed by its use is necessary for the technology’s effective incorporation. Central banks can protect their operations from emerging cyber dangers and fully utilize the promise of artificial intelligence.

Furthermore, global collaboration and information exchange will be essential to the successful application of gen AI in cybersecurity. Global cybersecurity guidelines for the financial industry are already being worked toward by groups like the Financial Stability Board and the G7. In the age of artificial intelligence, better cooperation between central banks and regulatory agencies may result in a more unified and successful strategy for handling cyber hazards.

Photo: The future landscape of AI and cyber security, BIS

Central banks have a revolutionary potential to improve their cybersecurity protocols with the help of generative AI. Although there are many advantages to technology, there are also new concerns that need to be carefully considered. Central banks may better manage the challenges of implementing artificial intelligence (AI) and fortify their cybersecurity by employing strategic planning, ethical deliberation, and significant investments in human and technological resources.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.