Rising Wave of High-Stakes Crypto Thefts Reveals Critical Flaws in Security and Undermines Investor Confidence

In Brief

The $36 million theft of Ethereum coins by a prominent crypto venture capital firm highlights ongoing digital asset market risks and threatens to undermine the crypto ecosystem’s trust foundation.

The recent $36 million theft, which targeted a well-known crypto venture capital firm, is a sobering reminder of the ongoing risks in the digital asset market. The theft of wrapped Ethereum coins is not an isolated instance; rather, it is part of a rising trend that threatens to destroy the fundamental elements of the crypto ecosystem’s foundation of trust.

The Intricacies of a Serious Theft

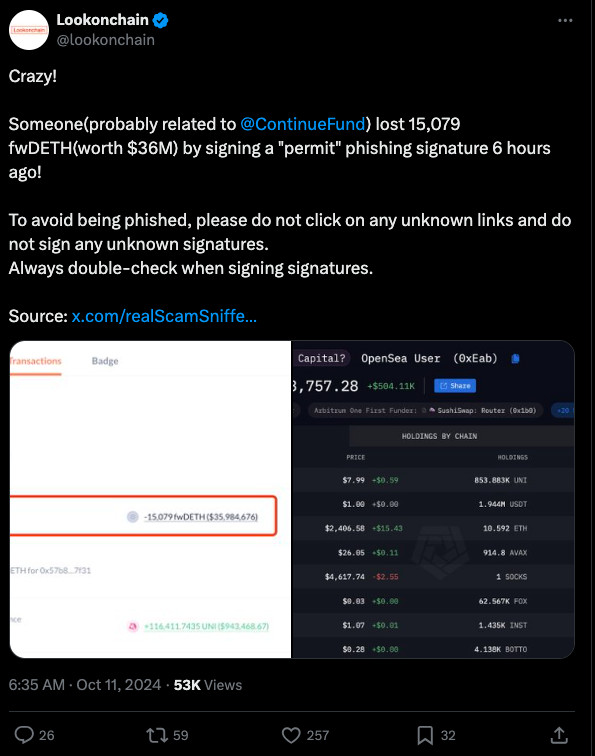

The announcement of a highly skilled phishing assault that caused the loss of 15,079 fwDETH tokens—worth $36 million at the time of the theft—shook the cryptocurrency community on October 11. The victim, an organization connected to Continue Capital, was duped by a fraudulent operation that took advantage of a standard blockchain transaction signature technique.

The feature that allowed customers to accept transactions without physically touching their assets was meant to streamline operations, but the attackers took advantage of this by using a counterfeit “permit” signature. In this instance, the bad actors made use of this process to deceive the victim into unintentionally approving the money transfer. The attack’s shocking speed and accuracy caused the fwDETH market to temporarily but significantly fall as the stolen tokens were sold and quickly transferred to an address under the control of the hackers.

This theft had far-reaching consequences that went well beyond only the immediate victim. A huge quantity of fwDETH was liquidated suddenly, which shocked the decentralized finance (DeFi) community. Collateral harm occurred to protocols like PAC Finance and Orbit Finance that depended on fwDETH liquidity as the token’s price fell by more than 95% before making a partial recovery.

This domino effect demonstrates how the DeFi industry is intertwined, with a single point of failure having the potential to have far-reaching effects on several platforms and countless investors. The episode is a frightening reminder of how easily liquidity pools may be manipulated and how market manipulation can occur when significant thefts occur.

A Predation Pattern

The $36 million theft is a part of a troubling trend in the cryptocurrency industry, not an isolated incident. The industry has been beset by similar attacks, with a number of high-profile examples emerging in recent months. Another investor was duped by a phishing scam in September, losing $32.4 million in spWETH tokens that were connected to the Spark network. A much larger loss occurred in August when a cryptocurrency whale was tricked out of $55.4 million worth of Dai stablecoins.

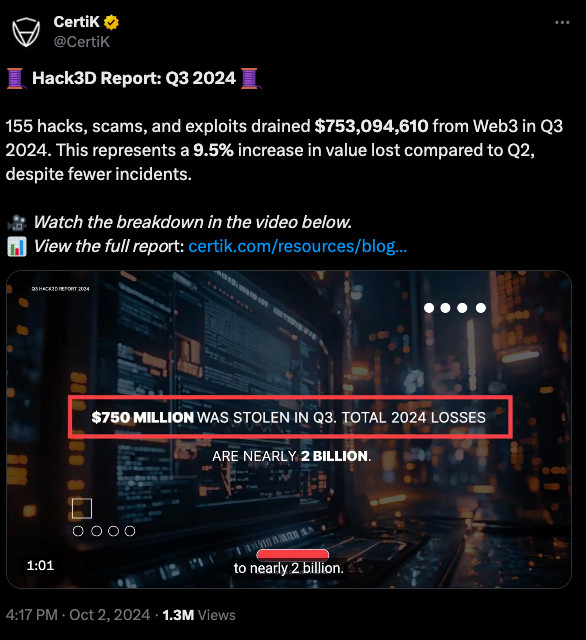

The security situation in the crypto space is depicted in a negative light by these instances. Phishing assaults accounted for $127 million of the damages that exceeded $753 million in the third quarter of 2024 alone, according to cybersecurity firm CertiK. The ongoing nature of these assaults and their evolution indicate that hackers are modifying their tactics to take advantage of the special weaknesses in blockchain technology and human psychology.

A deep grasp of both human behavior and the intricacies of digital transactions sits at the core of these assaults. In the cryptocurrency industry, phishing attempts frequently take advantage of the conflict between the necessity for strong security measures and the need for speedy, seamless transactions. Since blockchain activities are sometimes opaque, the employment of fake websites, fraudulent smart contracts, and social engineering techniques prey on users’ confidence.

The effectiveness of these attacks also highlights a more widespread problem in the crypto world, which is a lack of knowledge and understanding of security best practices. Even people in charge of sizable assets might not be entirely aware of the ramifications of the transactions they allow or the possible dangers connected to different signature techniques.

Institutional Vulnerabilities Exposed

This most recent hack targets a venture capital firm, which begs the issue of what security protocols institutional actors in the cryptocurrency field are using. Considering that they frequently oversee sizable portfolios, these organizations become appealing targets for fraudsters. The episode shows that even among investors who are thought to be intelligent, there is a need for improved security processes and due diligence.

The hack also highlights how blockchain technology’s openness has two drawbacks. The blockchain’s public nature makes it possible to track downheld money, but it also gives hackers access to vital details about possible high-value targets. Because of this openness and the irreversible nature of blockchain transactions, hackers with audacity and ambition have the ideal storm.

Regulatory Implications and the Call for Action

Regulatory agencies are probably going to be more interested in the recurrent issue of widespread phishing assaults in the cryptocurrency field. More strict monitoring and security standards for cryptocurrency companies, particularly those handling substantial assets on behalf of investors, could be brought about by this episode.

However, the global reach of cryptocurrencies poses problems for established regulatory frameworks. Collaboration between cybersecurity specialists, industry participants, and regulatory bodies from many countries is necessary for any successful solution.

Technological Solutions and Their Limitations

Numerous technical solutions have been put forth and put into practice in response to the rising threat posed by phishing assaults. Users and organizations may improve their security posture using a variety of technologies at their disposal, including hardware wallets, multi-factor authentication, and improved signature techniques.

The ongoing success of assaults, however, indicates that technology is not enough to solve the issue. Even the most advanced security measures are frequently circumvented by human mistakes and social engineering, which continue to be serious weaknesses.

The constant struggle against phishing attempts brings to light the precarious equilibrium between security and innovation in the cryptocurrency space. With new financial instruments and protocols appearing on a regular basis, the sector is always evolving, which increases the attack surface for possible exploitation.

The difficulty for developers and platform providers is to retain strong security protocols while designing user-friendly interfaces and simplified operations. The long-term sustainability and widespread acceptance of cryptocurrencies and blockchain technology depend on this delicate balance.

Those who follow the crypto space are aware of the irony of the situation. Blockchain technology, which is frequently hailed as a solution to trust problems in financial institutions, is currently dealing with a trust crisis brought on by these security lapses.

Following well-publicized assaults, confidence will need to be restored and maintained, and this will need coordinated efforts from all parties involved in the cryptocurrency ecosystem. This entails developing a culture of continual security protocol development, enforcing more stringent auditing procedures, and improving openness surrounding security policies.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.