QCP Capital Notes Surge In November $75,000 Call Options Buying Activity, While Market Remains Cautious

In Brief

QCP Capital notes the market’s cautious sentiment, as evidenced by sideways price movement over the weekend and a reduction in leveraged perpetual contract positions.

Singapore-based cryptocurrency trading firm QCP Capital released a new market analysis indicating that Kamala Harris and Donald Trump are in a close contest, as the odds on Polymarket have aligned more closely with current poll estimates. While Polymarket odds still favor Trump at 55%, this figure has dropped from 66% just a week earlier.

Additionally, the market’s cautious sentiment is reflected in the sideways price movement over the weekend and the reduction in leveraged perpetual contract positions, which fell from $30 billion to $26 billion across exchanges. QCP Capital suggests this may be a period of calm before a potential breakout from the prolonged range, possibly leading to new all-time highs.

The options market has also experienced a surge in buying activity, particularly for $75,000 call options set to expire at the end of November, which has been notable since last Friday. As the election date approaches, the number of related options positions is increasing, with implied volatility exceeding 87 on Friday, while actual volatility remains around 40.

Analysts expect spot prices to fluctuate within this range until the election results become clearer this week. A victory for Donald Trump could lead to a swift price increase, while a win for Kamala Harris may result in the opposite effect.

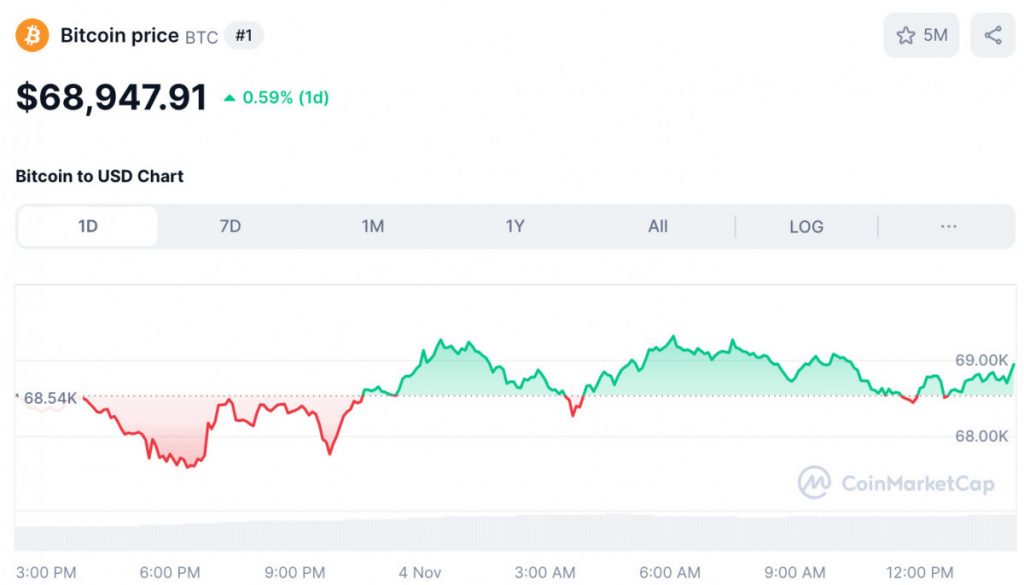

Bitcoin Trades Below $69,000, While Overall Crypto Market Faces Decline

As of this writing, Bitcoin is trading at $68,947, reflecting a 0.59% increase over the last 24 hours. The cryptocurrency reached an intraday low of $67,574 and a high of $69,324. Bitcoin’s market capitalization stands at $1.36 trillion, with its market dominance increasing by 1.37% from yesterday to 60.49%. This upward movement corresponds with considerable weekly inflows of $2.22 billion into spot Bitcoin exchange-traded funds (ETFs), according to data from SoSoValue.

In contrast, the global cryptocurrency market capitalization has experienced a decline of 1.83%, dropping to $2.25 trillion. However, the total cryptocurrency market volume has seen a substantial increase of 25.50%, rising to $72.44 billion today, as reported by CoinMarketCap.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.