Origins of Value: An Easy-to-Use Approach for Understanding Tokens Value

In Brief

This time, we’ll explore the value of tokens in the Web3 industry, focusing on their role in capturing coordination value from the tokenized system.

Tokens are multipurpose digital assets that power thousands of protocols, including blockchains, dApps, DAOs, infrastructure, social, gaming, and other projects. This leads to the questions of why tokens have value and how to build a framework for understanding them in the ever-growing Web3 industry.

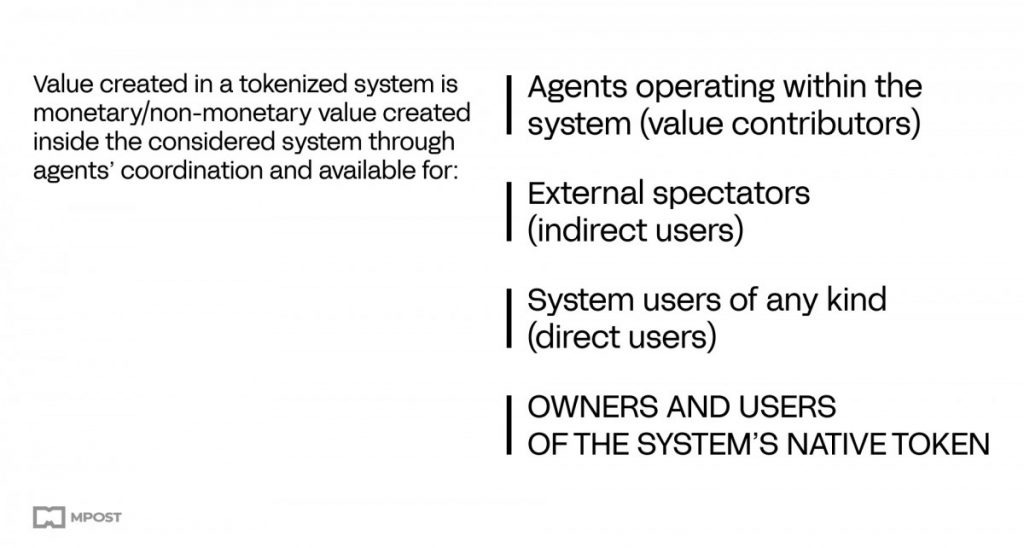

In the first article of this series, we explored the concept of the demand side in token models and coordination value in tokenized systems. In a nutshell, value in decentralized protocols is created by coordinating the various agents involved in its operation and use. A properly designed token captures some of this value while contributing to sustainable protocol operation.

The next question that needs to be covered is how the token captures coordination value from the tokenized system.

Token is the Key to Capturing Coordinational Value

The “Token is the Key” is a simple analogy that allows us to explore this complex question.

Note that owners/users of the native token are often both value contributors and direct users.

A share of the value created is available to the native token’s owners and users. The main question is how this happens: how does the token receive (capture) a share of the value created in the system?

The token is an asset that provides its owner with utility functions. It uniquely allows access to a valuable resource in the system, which de facto shares ecosystem value with the token holder.

I defined these basic utility functions as providing access to such resources as Origins of Value. The formal definition is presented below:

The Origin of Value is a system policy applied to a token (or a token function) that allows a token holder to share the system’s value.

Describing the Value-Capturing of a Hypothetical DEX Token Using Origins of Value

Liquidity pool creators, liquidity providers, and traders create a DEX value. Swap fees collected (protocol fees) and the protocol treasury represent this value in monetary terms. Non-monetary representations include brand value, user loyalty, and the DEX’s influence on the Defi ecosystem.

If the native DEX shares protocol fees with token holders, it becomes a value-capturing tool because a portion of the DEX value created is shared directly with token holders.

Suppose the native DEX token provides an option to manage the DEX’s resources, such as the allocation of funds, rewards, and protocol variables (fees). In this case, the governance value is shared with the DEX token holders via the ability to influence allocation decisions. However, the governance value is much more complicated for valuation than the protocol fee sharing.

Not all Origins of Value provide positive value to the token holder. Some expose the token holder to risk or require action to activate other utility functions. For example, it is necessary to stake ETH (with a risk of slashing) and run a node (a conditional action requirement) to participate in block production and receive Ethereum validator rewards.

The Token Utility Function

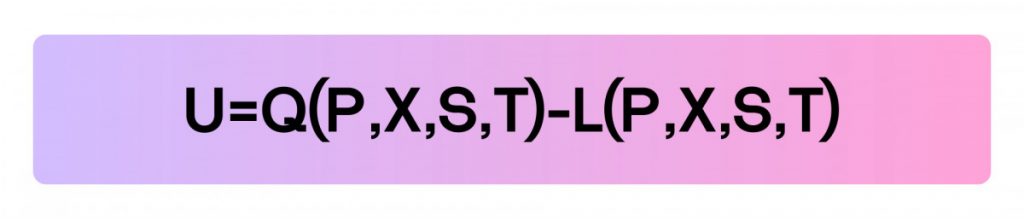

The token utility can be described as Positive utility minus the risks and expenses that the holder is required to face to activate Positive utility:

Where:

- U is the token value function

- Q is a Positive utility or gain for the token holder of holding the share of supply X at the token price P, given the blockchain state S during the time T

- L represents Risks and Expenses for the token holder to activate Positive utility (productively use the token) for holding a share of supply X at the token price P, given the blockchain state S during the time T

Risks and Expenses logic applied to the token utility is a cryptoeconomic requirement for successful coordination and value creation in decentralized systems.

The main example is the necessity to stake tokens somewhere exposed to a slashing risk (slashing occurs in case of a node’s misbehavior) and provide some active work to the protocol.

The List of Origins of Value With Examples

The list of elementary token functions – Origins of Value contains eight utility functions with examples of assets, containing particular Origin of Value in its design:

- Value transfer – the value is captured from involvement in transactions(settlements). This origin of value represents the intrinsic value gained from the ability to be involved in transactions as a medium for the value of other assets.

Examples: Bitcoin, Litecoin, Brave native token BAT (Basic Attention Token). - Future cashflow – the value is captured by receiving future income stream created as a result of protocol operation.

Examples: Sushiswap native token SUSHI (xSUSHI), Liquity protocol LQTY token. - Governance – the value is captured from a unique option to manage the distribution of limited resources. Examples of limited resources include protocol treasury management, rewards allocation, future developments, etc.

Examples: Compound COMP token, Uniswap UNI token, Optimism OP token, Curve CRV token. - Access – value is captured from access to some unique resource without compounding with any other utility. For example, access to a private community, information, or the ability to perform some actions or receive exclusive information.

Examples: NFT tickets, Soulbound tokens, and other NFTs offering exclusive access.

- Representation – the value is gained by representing a unit of another asset.

Examples: stablecoins, LP positions at DEXes, and any liquid staking tokens – LSTs (Liquid Staking Tokens), LRTs (Liquid Restaking Tokens). - Hedonic value/scarcity – the value captured due to ‘social contract’, popularity, or context, created around the protocol.

Examples: NFT digital art, POAPs, and in-game assets fall in this category. Memecoins also are an example. - Risk exposure (negative) – generalized loss/risk exposure acting as a requirement for successful coordination.

Examples: staking in a node for participating in consensus, vote-lock in governance. - Conditional action (negative) – is a necessity to perform actions as a requirement for successful coordination or value creation.

Examples: staking in a node to participate in consensus, vote-lock in governance. The voting process in governance is also referred to as a conditional action requirement since it is impossible to derive value from governance if the token holder never votes.

How to Use Origins of Value and What’s Next?

The Origins of Value concept can be used to understand token utility and value capture in a basic way. By studying any token, its functions can be broken down into elementary Origins of Value, promoting a deeper understanding of token models.

The DEX token example mentioned in this article includes Future Cashflow, Governance, and Conditional Action. Conditional Action refers to the need to participate in voting to capture value in governance.

It is important to mention that the sources of value can interact with each other and act as Value-Capturing Mechanisms. The next article will explore mechanisms, their classification, and operating principles.

Where Can You Study About Tokens?

For those interested in deepening their understanding of token value, I, the author, a Token Engineering Academy Fellowship Candidate, am conducting a Study Season Live Track titled “TE Value Capturing Fundamentals.” All are invited to the next session this June 3, from 16:00 to 17:30 UTC. Register to participate.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Ph.D., Head of Research in the PowerPool protocol, he's a researcher focused on the intersection of blockchain and economics. During his Web3 journey, Vasily has analyzed, designed, and prototyped tokenized economic systems and Defi products. He is an early member of the Token Engineering Community. Vasily's token engineering research focuses on value-creation and capturing processes in tokenized economic systems. This research led to the creation of the token classification framework, which is based on analyzing tokens' value origins and mechanisms of their manifestation. The results of this research formed the basis of the TE Value Capturing Fundamentals course for TE Academy and will be published in an academic journal.

More articles

Ph.D., Head of Research in the PowerPool protocol, he's a researcher focused on the intersection of blockchain and economics. During his Web3 journey, Vasily has analyzed, designed, and prototyped tokenized economic systems and Defi products. He is an early member of the Token Engineering Community. Vasily's token engineering research focuses on value-creation and capturing processes in tokenized economic systems. This research led to the creation of the token classification framework, which is based on analyzing tokens' value origins and mechanisms of their manifestation. The results of this research formed the basis of the TE Value Capturing Fundamentals course for TE Academy and will be published in an academic journal.